Pepgooner/iStock via Getty Images

At the last financial conference, Qorvo, Inc. (NASDAQ:QRVO) reported in-line results for the quarter while lowering expectations through the September quarter by $250 million. Primarily, issues in China are driving management’s caution. Other factors such as possible slowing world economies add in. Qorvo is quivering from excess inventory issues and possibly slowing demand. Dodging the quivers might be in order for investors. But, has the story changed? Let’s shake off a little of the cold and head inside.

The Last Quarter Results

For the March quarter, Qorvo reported revenue at $1.17 billion slightly above the guidance mid-point. A summary of other key measures follows:

- Mobile revenue equaled $835 million.

- Infrastructure and Defense (IDP) grew double-digits to $300 million year-over-year.

- Gross margins were 52%.

- Earnings equaled $3.12.

- The company used $325 million to purchase shares considerably more than the $295 million in free cash flow. (The company still has approximately $1 billion in cash).

- Inventory was at the high end of their target being $725 million.

- Guided $1 billion for the June quarter at slightly lower gross margins of 50%.

The important announcement came with a management comment that it was expecting a loss of $250 million revenue from lower 5G phone sales. The loss was spread between the June and September quarters. At the March quarter, the issue was component shortages. That changed heading through the quarter with increased uncertainty from war and growth concerns. Inventory builds especially in China with Vivo, OPPO, Xiaomi, will delay any revenue turnaround. Management’s view in May expects weakness to be temporary with no change in the long-term business model.

For the 1st half of 2022, Robert Bruggeworth, Qorvo’s CEO, noted at the J.P. Morgan conference, about China markets, “I think if anybody’s following units that are sold in China, January was almost 30 million, then it dropped into the upper 20s to the mid-20s to low 20s over the last few months and that’s what’s really transpiring in there.” China is down approximately 30%.

At the same conference, management expressed its view for long-term overall growth with this description, “30% of our revenue growing double-digits, with the core smartphone RF business growing probably in the mid-to-high single digits combined hitting the overall company growth rate at a 10% to 15%.”

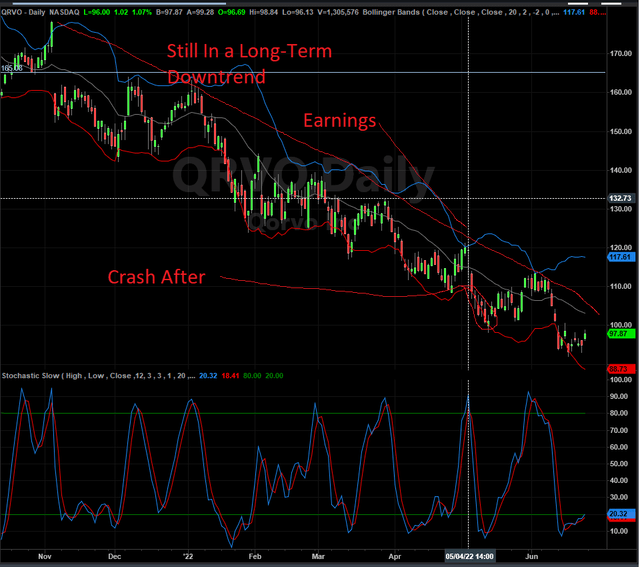

Market Reaction(s)

The market wasn’t happy with the results, selling off hard the next day after the earnings report. Using TradeStation Securities software, we include a day bar chart of Qorvo.

But, It’s Not Without Content & New Product Growth

Management made its direction clear concerning several content and unit growth initiatives beginning in the September quarter, including Samsung flagship plus mid-tier, Honor, a spinoff of Huawei, and multi-year growth opportunities within IDP. Other products in initial stages included products from its new [p]ower business with our programmable power, Active-Semi, along with the Silicon Carbide for power conversion. Other growth includes its diagnostics business for diseases.

Management also added depth with comments concerning new wins and content growth without predicting overall revenue growth. At the J.P. Morgan’s 50th Annual Global Technology Conference held on May 23rd, management offered depth into its new content wins at Samsung. “The breadth of products that are now in their phones run from envelope trackers to average power trackers, to antenna tuners, to switches, to integrated PA modules to WiFi, so very diverse products.” Management stated, “Of note, Qorvo more than doubled revenue year-over-year at Samsung with growth across multiple product categories.”

Honor’s mid-tier products are beginning to re-enter the markets of which management expects growth, significant unit growth, for the next 12-18 months.

More detail regarding newly added power business includes:

- First, it is clearly defined by the complexity required for the applications.

- For this key metric, RDS, Qorvo is the most efficient.

- Its size is about half compared to other competitive devices.

- Targeting markets needing efficiency (Niche, not bulk).

- No mention of the SAM except it seems large enough to justify the purchase cost.

Progress with its ultra-wideband technology continues being adapted in package from multiple upcoming smartphone models. Ultra-wideband, a technology for measuring accurate distances, is the best fit when integrating SoC, RF front-end and software.

Qorvo isn’t short of growth paths; it is about unit volumes, particularly in today’s macro environment.

A Logical Discussion with an Unknown Answer

Speaking concerning possible weakness from struggling economies, management at J. P. Morgan said (emphasis added):

“So we’re not sure what the consumer is going to do. Another thing is, in China, the latest phone is a status symbol. Well, if you’re not going out and you’re not eating out and laying your phone down on tables and things, are they going to buy new phones? Those are unknown for us. But what we do know is our design activity continues. . . . .All I can tell you is that the relationships with our customers only continue to get stronger and the opportunities for us continue to get bigger. But the number of units we’ll just have to wait and see.”

For us, this is a truly honest answer leaving both the possibility for negative or positive consequence. When consumers face pinches, alternatives present themselves; they can forgo more expensive activities and invest in modestly costing purchases such as new home entertainment or mobile devices. No one yet knows this answer.

With Qorvo’s stock price hammered so badly and in free fall, investors need to show patience. The market still predicts significant risk. But, positive positioning still exists. From an article dated June 21st, entitled, Mizuho Sees Qualcomm, Qorvo, Skyworks Well Positioned For Global 5G Ramps Amid Odds, Mizuho analyst Vijay Rakesh reiterated Buy on Qorvo but cut the price target to $110. “He believed QRVO could see headwinds from a softer China handset market, supply chain challenges, and increasing competition.” With regard to those headwinds in answering a question about competition with Qualcomm (QCOM) at Morgan, Bruggeworth answered (emphasis added):

“Yes, I think the easiest way to say it is our dollar content on many of Qualcomm’s platforms as the same as it’s on MediaTek or SLSI. So that doesn’t mean we get it all, but my point is, yes, they’ve made some progress in RF. But again, most of their RF content is our largest customer for millimeter wave. . . . So we feel that we’ve got a strong portfolio, and we’ve done quite well. We have not lost share [to] Qualcomm in China, if that’s the question.”

With the semiconductors still in free fall, we place a hold on the stock. For investors interested in buying, a good time might be after the next earnings if the stock should turn north on strength regardless of the report. Otherwise, we would be on the sidelines. But, the quivers will stop at some point, opening the door for an unusually positive investment.

Be the first to comment