ismagilov/iStock via Getty Images

In order to understand the current macroeconomic environment, we have to contend with, it is important to grasp how we got here in the first place. This is especially true for newer market participants, who may not have the appropriate historical perspective to put things into proper context. So let’s take a step back and reflect on what’s been happening over the past 10-15 years from a high-level point of view.

Many will recall the financial crisis of 2008/09, during which excessively loose monetary conditions coupled with extravagant leverage on the part of commercial banks – among other factors – contributed to a massive real estate bubble, the bursting of which nearly brought both the global financial system and the world economy to its knees. This paved the way for an increasing level of intervention by central banks, that predictably always use a good crisis as an opportunity to expand their mandate and add new tools to their arsenal.

A few years later in 2012, ‘whatever it takes’ is the now-infamous phrase that Mario Draghi formulated, which heralded the unconventional policies that were to come in order to save the eurozone and the euro from its worst debt crisis yet. These included the heresy of taking nominal interest rates into negative territory, as well as more than doubling the ECB’s balance sheet as a % of GDP in the following decade.

More recently, ever since the start of the COVID pandemic in early 2020, ‘whatever it costs’ has been the new motto in numerous countries, as evidenced by unrestrained fiscal spending, mounting debts, and yet more monetary expansion.

We’ve long expressed our concerns about such irresponsible monetary and fiscal policies. Recall that in our 2020 Review of the current investment landscape, we yet again lamented i.) the unsustainable accumulation of debts, ii.) the debasement of fiat currencies and the prospects for inflation, and iii.) the growing disconnect between the fundamental health of the world economy and financial markets.

By the time we sat down to write our 2021 review at the start of this year, inflation in the U.S. had increased to levels unseen in decades. So they finally did it! After years of fighting a rate of inflation that they deemed to be too low, central banks have managed to more than quadruple it from 0-2% to approx. 8% currently in a very short space of time. All it took was a reckless expansion of the money supply, and for some of that money to find its way into the real economy through COVID-related fiscal policies. Of course, the start of an armed conflict in Ukraine and the impact this has had on commodity prices has also played a part. But contrary to the prevalent narrative, it is not the only factor. It is not even the main factor. Suffice it to say that inflation was well on the move prior to February of this year.

To state the obvious, such a high level of inflation is a big issue. Not only is it way too high in absolute terms, it is also ludicrously high relative to current interest rates. As a result, in the U.S. and Europe, real interest rates are deeply negative, and at an all-time low.

To combat this inflation, central banks need to normalize monetary policy, in other words raise interest rates and shrink their balance sheets. Doing so necessarily implies that public finances also need to be redressed, as central banks have increasingly been footing the bill for government deficit spending. So both tighter monetary and fiscal policies going forward. And clearly, the ‘magic’ of the alchemy of money works both ways: whatever stimulus is provided by monetary expansion, inevitably reverses during periods of monetary contraction.

So we can and should expect real economic growth to slow down in the coming quarters. And we can also anticipate that tighter monetary conditions may create some level of stress in parts of the financial system. Such expectations are supported by looking at the evolution of macroeconomic indicators and asset prices year-to-date (ytd). Growth projections for 2022 have been downgraded meaningfully, and business and consumer confidence have been on the decline. Asset prices have also been volatile, and reflect increasingly less favorable economic and investment prospects.

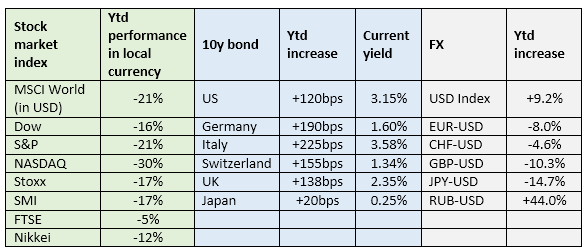

As shown in the table below, stocks have fallen quite precipitously, with U.S. equities and technology companies leading the way. Other geographies might appear to have fared slightly better, but much of that outperformance is due to their weakening currency relative to the USD.

Bond yields have also been on the move, with bond prices falling meaningfully, as can be expected given the sharp increase in inflation. As a result, yields have risen considerably, and spreads (e.g., Germany vs. Italy) have also widened to reflect the relative financial strength of various countries in the face of higher financing costs. At the same time, yield curves have mostly flattened, and in the case of the U.S. is close to inversion, which typically signals expectations of a short-term economic slowdown, as well as potentially lower inflation and interest rates down the line.

Finally, foreign exchange rates have also been extremely volatile, and broadly reflect the choices that various countries have made (or delayed) in dealing with re-surging inflation. Those that have been more proactive have seen their currency do relatively better. For instance, the U.S. has already increased interest rates 3 times this year, from 0.25% to 1.75%, and more rate hikes are expected as early as this month. The Fed is also expected to start shrinking its balance sheet imminently (we’ll believe it when we see it). As a result, the USD has strengthened considerably so far this year. Similarly, Switzerland has taken a small but decisive step in moving away from negative interest rates, by increasing interest rates for the first time in 15 years. Only 25 basis points (bps) to go to 0%! As expected, its currency has done alright. On the other hand, countries that have persisted in or fallen deeper into their follies of monetary experimentation have seen their currency pay the price of their actions. In Europe, the ECB has yet to start raising interest rates from -0.5% (with inflation at 8%, maybe a 25bps increase in July, or is that seen as too aggressive?). Its balance sheet is not expected to start shrinking any time soon, with new tools being implements to combat widening spreads, or so-called ‘fragmentation’. As a result, the Euro has lost 8% relative to the dollar, just so far this year. Worst still, Japan continues to try to implement yield curve control, despite clearly emerging out of mild deflation. And in order to defend its ceiling of 0.25% on the 10y bond yield, which speculators have started to attack, the Bank of Japan is buying an increasing amount of government debt. As a result, its currency has declined a shocking 15% vs the USD just ytd. And finally, in our last commentary we briefly mentioned the sanctions being imposed on Russia as a result of the conflict in Ukraine, and the manner in which that prompted Russia to take a first step towards a commodity-backed currency. We can see that thus far, this has indeed shored up its currency, with the rubble up nearly 45% vs the USD this year, albeit from a fairly low base. We’ll continue to watch this space closely.

Google finance, World Gov Bonds

We’ll finish this commentary with a number of foregone conclusions, which we discussed at length in our last review. Modern economic thinking might ask: isn’t inflation the miracle cure for over indebtedness? Why should we even try and combat it? But we know this reasoning to be flawed. Inflation, if left unchecked, can easily spiral out of control, which it arguably already has. This is mainly the result of prices and wages creating a positive feedback loop, as well as due to the human psychology of inflation expectations. Moreover, inflation clearly has more costs and dangers than benefits, as we’ve explained in the past. This is especially true, when it starts to meaningfully impair the already modest purchasing power of lower- and middle-incomes, which ultimately degenerates into social and political unrest.

So inflation does need to be tackled, and its rate must be brought back down before long, otherwise the likelihood of social upheaval will increase significantly. And the conventional way to get inflation back under control is to tighten monetary and fiscal policy, which is typically a painful adjustment.

Will central banks go through with it? They will of course try to run the middle course, of reigning in on inflation, all the while hoping to manage a ‘soft landing’ of the economy, in other words an inescapably doomed undertaking. But if the going gets really tough, we can of course expect central banks to pivot back to easing financial conditions, as they almost always do. Some of them, at least, will have given themselves a little bit more leeway than others. Importantly, will a pivot back to easing work this time, as it has without failure for so many decades? We’re not so sure. Because unlike in the past, we now clearly have an inflation problem. So a pivot back to monetary easing in these conditions might very well be the final straw for many of this current cohort of fiat currencies. We shall see.

For us as stewards of our savings and investment capital, we’re always focused on trying to strike the right balance between making sure we don’t lose money and making sure we don’t miss out on opportunities to make money. We do this predominantly by selecting specific assets (typically focusing on high-quality companies that we can own at reasonable prices), as well as making moderate adjustments in our overall positioning, more defensively or offensively depending on the investment environment. For some time now, we’ve advocated for a balanced yet decidedly defensive positioning. This continues to be the case today, even though we are starting to see individual investment opportunities arise, which may lead to incremental capital deployments in the months to come.

Be the first to comment