piranka/E+ via Getty Images

This old adage still holds true: buy when the rest of the market is fearful. The question of what to buy is very important, however. During the current choppy markets, I’ve been leaning way more into value-oriented tech stocks that are still showing tremendous fundamental performance while still having enough valuation “rope” to rally in a rebound.

Look no further than Pure Storage (NYSE:PSTG) for a software stock that checks off all these boxes. For many years, Pure Storage has been written off as a commoditized technology vendor, but in recent quarters, as the company has been beefing up its software offerings and converting into a purely high-margin, recurring-revenue service provider, it’s high time that the market revised its assessment of Pure Storage.

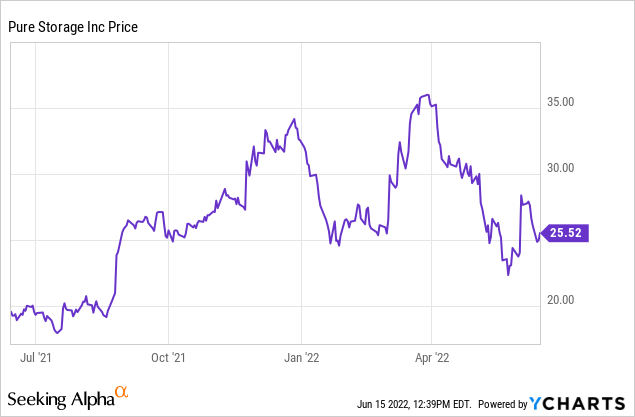

Year to date, shares of Pure Storage are down ~20% – in line with the broader market but beating many fellow growth software stocks that have seen much steeper declines. In my view, Pure Storage is a great candidate to continue beating the market through the rest of this year.

Given the dual combination of Pure Storage’s A) accelerating fundamental performance, and B) the decline in its share price since the start of the year, I’m raising my view of Pure Storage to strong buy. To me, Pure Storage continues to represent a “guilt free” investment – there’s so much valuation cushion in this stock that it’s difficult to see Pure Storage as not having already reached the bottom.

For investors who are newer to this stock, here’s a full rundown of the reasons to be bullish on Pure Storage:

- Shifting into a subscription/services play, which will help drive multiples appreciation for Pure Storage. In Q1, Pure Storage grew subscription services at a 35% y/y pace. This kind of revenue stream is just what Wall Street prizes: a recurring, high-margin stream of revenue from repeat customers. Yet in spite of this, the market’s valuation of Pure Storage still treats it like a commodity hardware play, even if its pro forma gross margin now resembles most SaaS stocks in the high 60s/low 70s.

- Industry recognition. Pure Storage has been named a leader in storage for eight consecutive years by Gartner, the most influential software industry ranking system. Customers choose Pure Storage for the combination of its broad platform, its modern cloud-first approach, and simplicity for installation, and an un-intimidating pay-as-you-go pricing model.

- Huge TAM. Pure Storage estimates its TAM at $60+ billion, which means its current ~$2.5 billion revenue run rate is only ~4% penetrated into this overall market.

- Pay-for-consumption is a win-win for both Pure Storage and its customers. Pure-as-a-Service is priced based on usage, generally priced on a GiB/month basis. Outside of relatively low minimum commitments, this is a benefit for new customers because they can start out with Pure Storage for select workloads only, reducing the barriers to entry. For Pure Storage, it’s an advantage because, over time, these customers can expand to become major clients.

- Enterprise focus is growing. More to the point above, more than 50% of Pure Storage’s revenue is now coming from enterprise clients, and the top 10 customers spend more than $100 million annually.

- Cash flow. Pure Storage is delivering huge cash flow, but with FCF margins in the mid-single digits versus a low-teens pro forma operating margin, there’s still plenty of room for expansion.

An ultra-cheap valuation, which seems completely disconnected from the strengths listed above, remains the chief reason to be optimistic on Pure Storage’s upside prospects. At current share prices near $25, Pure Storage trades at a market cap of $7.61 billion. After netting off the $1.29 billion of cash and $572.8 million of debt on Pure Storage’s most recent balance sheet, the company’s resulting enterprise value is $6.90 billion.

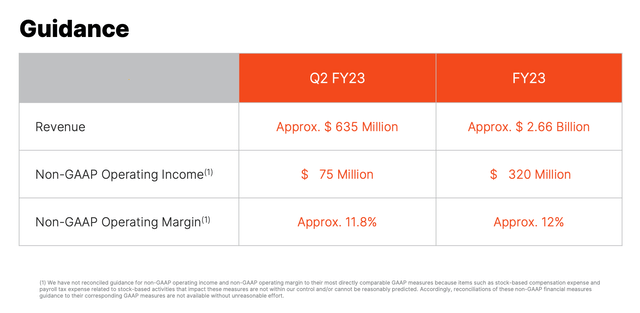

Meanwhile, for the current fiscal year FY23 (which for Pure Storage is the year ending in January 2023), the company has guided to $2.66 billion in revenue, representing 22% y/y growth and above its prior outlook of $2.60 billion (note that there is plenty of conservatism here: Pure Storage’s revenue growth in Q1, even after excluding pulled-in deal closings, was 36% y/y on an adjusted basis).

Pure Storage outlook (Pure Storage Q1 earnings presentation)

Nevertheless, at this guidance estimate, Pure Storage trades at just 2.6x EV/FY23 revenue – which is an unheard-of discount for a company with ~30% y/y baseline revenue growth on top of ~70% pro forma gross margins. Even in this environment, where tech multiples are deflating, Pure Storage can still be considered a bargain basement discount.

Stay long here and take advantage of recent downside momentum to buy.

Q1 download

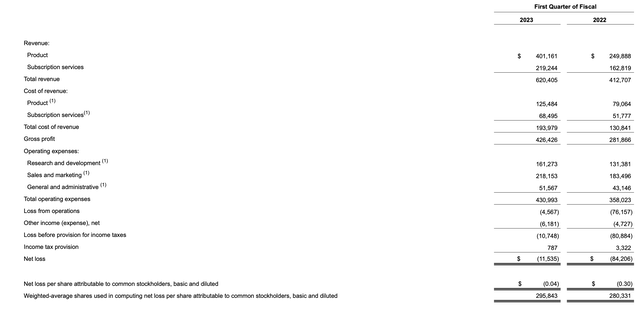

Let’s now cover Pure Storage’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Pure Storage Q1 results (Pure Storage Q1 earnings presentation)

Pure Storage’s revenue increased at a staggering 50% y/y pace to $620.4 million in the quarter, beating Wall Street’s expectations of just $521.7 million (+26% y/y) by a huge margin.

Now, a portion of this beat was timing. Some further details on this from CFO Kevan Krysler’s prepared remarks on the Q1 earnings call:

Total revenue for the quarter was exceptional, growing over 50% to over $620 million. Approximately $60 million of our product revenue upside this quarter was with several of our larger enterprise customers in the U.S. that we had originally forecasted to close in the second half of our fiscal year.

Our customers were pleased we were able to deliver our solutions against the earlier schedule, which is a testament to the agility and resilience of our technology and supply chain. Revenue growth when excluding these transactions was still a very strong 36%. Revenue in the U.S. grew 57% and international revenue grew 33% year-over-year. Subscription services revenue grew approximately 35% year-over-year and represented approximately 35% of total revenue.”

We’ll emphasize that the 36% y/y “adjusted” revenue growth rate, excluding the timing impact of the pulled-in deals, is well ahead of the ~20% growth rate that Pure Storage has forecasted for the year. Note as well that the company cited its efforts to minimize supply-chain constraints that have crippled other companies, which additionally contributed to strong results in the quarter.

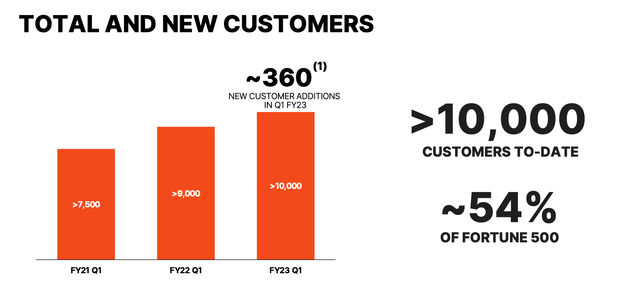

In additional good news: the company signed up 360 net-new customers in the first quarter, boosting its customer base by ~11% y/y. Management noted that the resumption of sales travel has driven a boost in new signups. Pure Storage also grew its ARR base by 29% y/y to $900 million.

Pure Storage customer growth (Pure Storage Q1 earnings presentation)

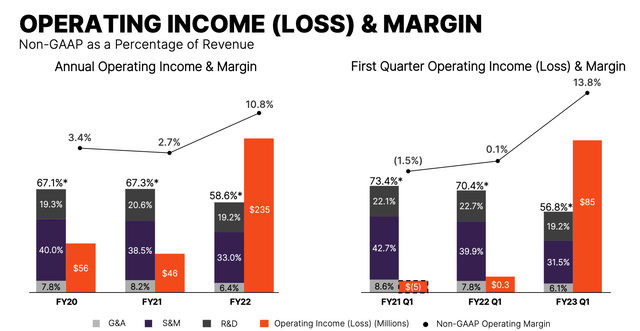

Pure Storage also excelled on profitability. In Q1, pro forma operating margins soared to 13.8%, up from essentially breakeven in the year-ago quarter. Pro forma gross margins also jumped by 10bps to 70.6% (again, similarly matching the profile of a software company), while reductions in sales and marketing spend as a percentage of revenue provided the majority of the remainder of the operating income boost.

Pure Storage operating margin (Pure Storage Q1 earnings presentation)

Key takeaways

Despite a flailing share price and valuation, Pure Storage continues to deliver top-notch results. Though it requires patience, I continue to hold to the belief that the market will eventually view and value as a software company, especially as its “land and expand” thesis plays out and its margins rise. Buy more here if you haven’t already.

Be the first to comment