Nordroden/iStock via Getty Images

We’re nearing the end of the Q4 Earnings Season for the Gold Juniors Index (GDXJ), and as usual, the best is rarely saved for last. The most recent company to release its results was Pure Gold Mining (OTCPK:LRTNF), which reported a massive miss on H2 production guidance, and has entered the year with a more bloated share count. Unfortunately, with the company still not free-cash-flow positive and carrying significant debt, more share dilution looks likely, especially with the lukewarm H1 2022 guidance. While Pure Gold trades at an enterprise value typically reserved for a developer, not a producer, I continue to see the stock as cheap for a reason.

All figures are in United States Dollars at a 0.80 to 1.0 Canadian Dollar to US Dollar exchange rate unless otherwise noted.

Pure Gold Operations (Company Presentation)

Pure Gold Mining released its Q4 and FY2021 results last week, reporting Q4 production of ~7,600 ounces, a massive miss vs. the H2 2021 guidance that was provided, and a meaningful decline on a sequential basis. This weak quarter was unable to push annual production above the 30,000-ounce mark, with annual production coming in at just ~26,900 ounces, below the low end of the company’s H2 2021 guidance of 27,000 to 32,000 ounces. Not surprisingly, the market didn’t love the report, nor did it like that more share dilution might be on the way. Let’s take a closer look below:

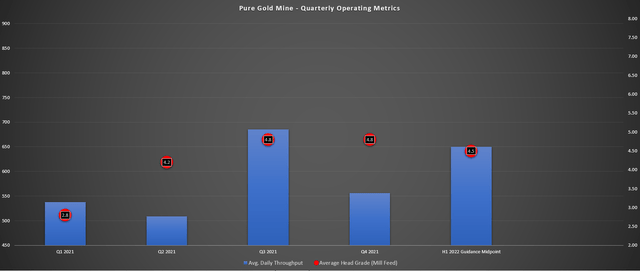

Pure Gold – Quarterly Operating Metrics (Company Filings, Author’s Chart)

As shown in the chart above, mill throughput actually decreased sequentially in Q4, dipping back below 52,000 tonnes after a meaningful improvement with ~61,500 tonnes processed in Q4. This was not helped by flat head grades in the period of 4.8 grams per tonne gold. These metrics were well below the guidance provided during the Q4 announcement of a mine leadership change when previous CEO Darin Labrenz provided a Q4 guidance midpoint of 650 tonnes per day of production at a head grade of 5.5 – 6.5 grams per tonne gold.

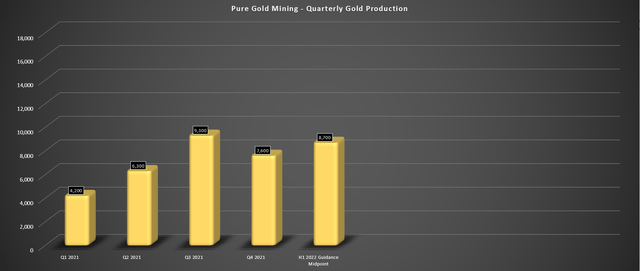

Pure Gold – Quarterly Gold Production (Company Filings, Author’s Chart)

The good news is that the mill has proven that it can operate at more than 800 tonnes per day, and upgrades are planned for the gravity circuit to improve recovery rates above the expected 95% recovery rate. Unfortunately, it’s the mining side of the operation the bottleneck, which has led to having to blend low-grade material and stockpiles, impacting the feed grade. As noted by Pure Gold, mined tonnes and gold grade have been lower than forecasted on average due to shortages of high-grade ore at various times. The cause of this issue is development delays, insufficient scheduling flexibility, insufficient geological information available for stopes, equipment downtime, and strategic misalignments.

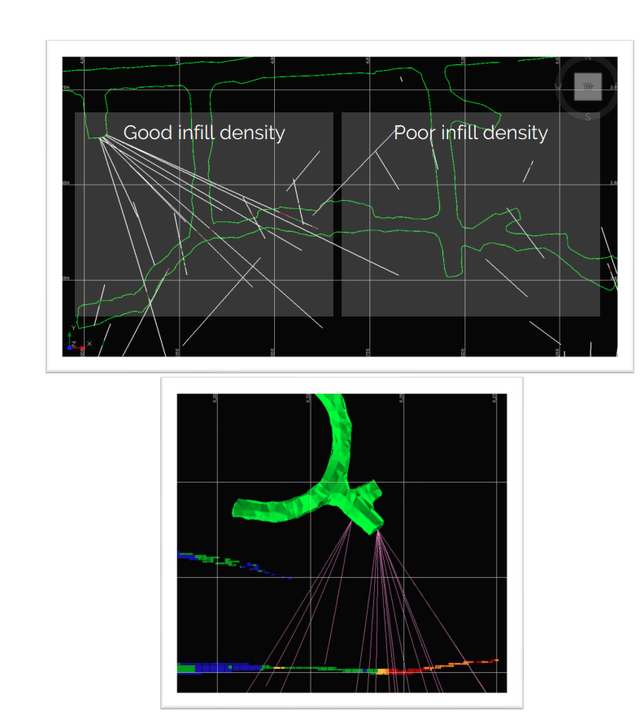

With a new CEO in place and a new Chief Operating Officer and General Manager, the company appears confident that it can turn things around. During the Q4 release, Pure Gold shared that it is seeing early signs of progress in the December results, and a geologic confidence-based model has been implemented to standardize decision-making and improve mining scheduling/planning. Meanwhile, the company has increased its definition drilling program to provide mine planners with better information to improve stope designs and scheduling flexibility.

The strategy of a meaningful increase in definition drilling worked well for Pretium (PVG) under Jacques Perron, which was able to turn things around under his new leadership. However, Pure Gold and Pretium are two different situations. This is because while Pretium was seeing a large variance in grades sequentially, which led to volatile quarterly results, it was free-cash-flow positive and was successfully paying down its debt. In Pure Gold’s case, it’s nowhere near being free-cash-flow positive, and with this being a much smaller operation (~90,000 ounces vs. ~350,000 ounces), there’s much less margin for error.

Pure Gold – Infill Drilling (Company Presentation)

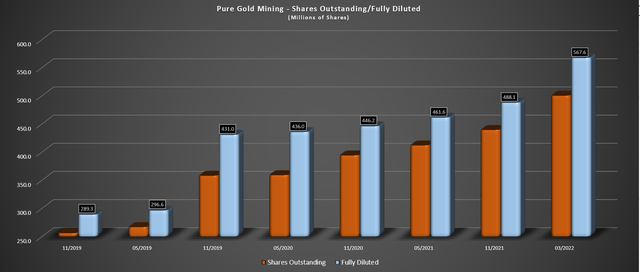

This is a step in the right direction, but it’s bizarre that it’s taken a year to get to this point, and considerable damage has been inflicted already. The evidence is a share count that’s increased ~32% from November 2019 levels due to meaningful share dilution at new 52-week lows. The massive increase in the share count means lower free cash flow per share, lower reserves per share, and lower net asset value per share. In addition, there’s now a considerable warrant overhang at higher prices. So, even if this is a short-term issue, it has long-term consequences.

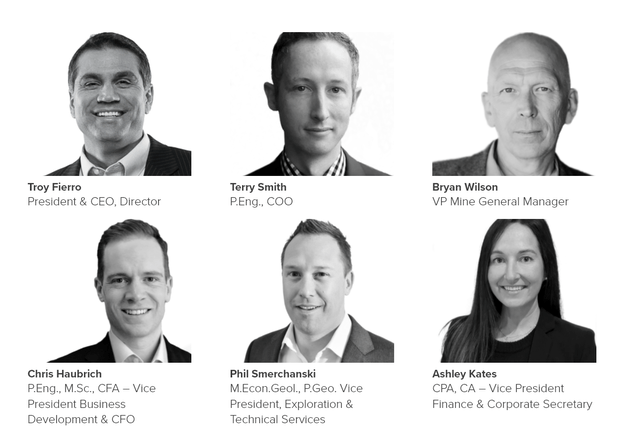

Pure Gold Management Team (Company Website)

Fortunately, the new team appears confident and is focused on walking before they run. They’ve also offered up more achievable guidance figures. This is a breath of fresh air vs. the previous team which was great at marketing and discussing the upside case but probably should have spent more time getting this mine to a position of operating at least remotely close to the initial mine plan. Having said that, the key will be successful execution. Let’s take a look at the financial results:

Financial Results & Share Structure

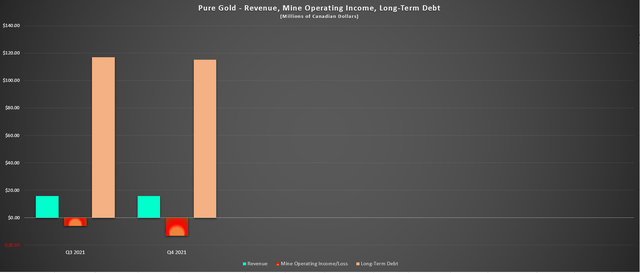

Moving to the financial results, it’s no surprise that the results have been ugly, with annual revenue of just C$56.6 million [US$45.3 million]. This led to a net loss of C$34.9 million [US$27.9 million], with a mine operating loss of C$13.2 million [US$10.5 million] in Q4. This has not helped with debt reduction or improving the balance sheet, with long-term debt sitting just above $90 million at year-end and a cash balance of just ~$5 million.

Based on H1 2022 guidance of ~17,500 ounces at the midpoint or ~650 tonnes per day at 4.5 grams per tonne gold, progress will come at a snail’s pace. In fact, grades are forecasted to be lower than H2 2021 levels based on an average head grade of 4.0 to 5.0 grams per tonne gold. So, even if the company does manage to secure financing and meet its goals, this should still be another sub-50,000-ounce year from a production standpoint.

Pure Gold – Revenue, Mine Operating Income, Long-Term Debt (Company Filings, Author’s Chart)

The most disappointing part about this lukewarm H1 2022 guidance is the fact that Pure Gold will not be benefiting much from the much higher gold price than if it was operating at similar levels to the mine plan at ~20,000 ounces per quarter. The bigger issue, though, is that Pure Gold will not generate positive free cash flow at these production rates, and it’s in dire need of cash flow sitting given that it must service its debt and have a minimum $12 million cash balance requirement. As the company warned in its recent corporate update, the company will require $40 million in external capital and will not be providing cost guidance until June 2022.

“At the date of this MD&A, the Company’s cash balance is approximately $6 million. The Company expects it will need to seek additional financing in the next 30 days to fund operations and to service the interest on its debt. In December 2021, and further amended in January 2022, the Company signed a second amendment to its Credit Facility, to defer certain working capital covenants as well as to include a temporary reduction of a minimum cash balance requirement, and deferral of the completion test from December 31, 2021 to June 30, 2022.

– Pure Gold Company Filings

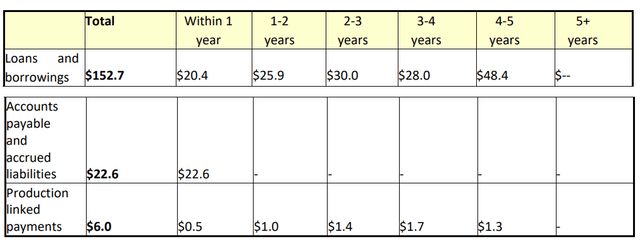

Contractual Obligations Outstanding (Company Filings)

So, while other producers are building up their balance sheets to fund growth, share buybacks, and potentially increase their dividends to stand out among their peer group, Pure Gold is in a position of weakness, to say the least. This is the worst position to be in when it comes to needing to raise additional capital and suggests that if we do see additional share dilution, it isn’t likely to be at favorable prices.

Valuation

Following the steady stream of share dilution we’ve seen, Pure Gold now has ~501 million shares outstanding and ~568 million shares on a fully diluted basis. Based on a share price of US$0.30, this translates to a fully diluted market cap of US$170 million. After adding in net debt, the company’s enterprise value is closer to ~$280 million. Some investors might argue that this is a very cheap valuation for a Tier-1 producer. However, two areas of uncertainty make it difficult to value the company.

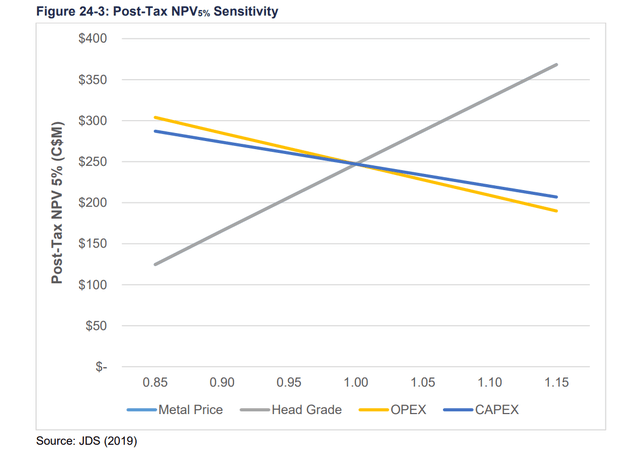

Post-Tax NPV (5%) Sensitivity (2019 Technical Report)

The first is that although Pure Gold trades at less than 0.65 NPV (5%) if we assume an After-Tax NPV (5%) of ~$450 million ($1,750/oz gold price) and the 2019 study parameters, the study is dated. I discussed this in my previous article, noting that the 2019 study used assumptions that I believed to be far too ambitious. The updated life-of-mine plan scheduled to be released in Q4 of this year will show much higher operating costs (2019 study: $787/oz) due to inflationary pressures (fuel, consumables, labor, materials), so I would not be relying on this figure.

Pure Gold – Shares Outstanding/Fully Diluted (Company Filings, Author’s Chart)

The second issue, which is a major one, is that there’s no way to rely on the current share count when it comes to calculating Pure Gold’s enterprise value. This is because the company continues to dilute shareholders at a torrid pace, as evidenced by the chart above. While the initial share dilution was excusable (2019 bought deal), given that an equity raise was required to fund mine construction, we’ve seen considerable dilution since Q4 2019. As shown above, the fully diluted share count has increased from ~431 million shares in late 2019 to ~568 million shares most recently. Worse, as warned, more share dilution is likely on the way.

As the company stated in its most recent news release, $40 million in external funding would be needed over the next six months to get the company to a position of being free cash flow positive at the corporate level. A portion of this funding will be to satisfy its covenants which require a minimum cash balance of ~$12 million, with additional capital required to pay its current debt obligations. Even if the company manages to find a way to raise $30 million of this $50 million without an equity raise, a $20 million equity raise would still translate to incremental share dilution of ~67 million shares at current prices.

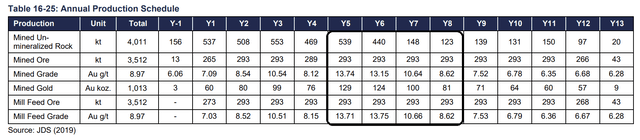

Mine Production Schedule – 8 Zone (2019 Technical Report)

Given this uncertainty about the ultimate share count and whether the company will get adequate funding, it’s already hard to justify catching a falling knife here. If we add that it’s hard to give any value to resources outside the mine plan when the company is nowhere near being free-cash-flow positive, this puts a dent in the upside case.

Finally, while the bonanza-grade 8 Zone has been dangled like a carrot in front of investors, the company is still years away from this zone, which was expected to be mined in years 5 through 8. There’s nothing the market likes less than uncertainty and risk of default, and with Pure Gold no longer in a position of strength, it certainly doesn’t put much confidence in favorable terms if it has to sell shares to raise additional capital. Given this bleak outlook, I continue to see several better ways to play the sector.

Pure Gold Operations (Company Presentation)

Occasionally, I will catch falling knives in the producer space and buy into steep downtrends, but in these cases, I believe it’s best to focus on companies with four key attributes:

- extremely high confidence that the management team can deliver

- extremely high confidence in the ore body and mine plan

- high confidence in a stable or declining share count

- more than one operation so that risk is not magnified

These attributes made buying Agnico Eagle (AEM) at $48.00 per share and Newmont (NEM) at $54.00 a piece of cake. This is because both companies have solid track records, multiple operations, are using very conservative gold prices for their multiple mine plans, and they had strong balance sheets. This meant that they were likely to buy back any shares the market would throw at them, not raise capital at unfavorable prices.

Unfortunately, there isn’t even one of these attributes present when it comes to Pure Gold. The reason is that the management team hasn’t had a chance to prove themselves, the operations have not reconciled well with the mine plan, (even if this is the fault of previous management), there’s zero confidence in a stable/declining share count, and Pure Gold is a single-asset producer. So, not only is averaging down a dangerous proposition, since it’s throwing good money after bad but even starting a new position is very difficult to justify. This is especially true when several producers are buying back shares, and paying out generous dividends.

Pure Gold Mine (Company Presentation)

While a turnaround is possible and blood is certainly in the streets after an 80% plus decline, I remain Neutral for the reasons discussed. This doesn’t mean that Pure Gold can’t bounce since even the worst stocks rarely decline in a straight line. Having said that, sharp bounces are likely to be sold into, given that many investors that parked money here will be anxious to get out at a less devastating loss after what’s been a slow-motion train wreck. Given that Pure Gold remains a high-risk, high-reward bet, and that is purely gambling, not investing, I continue to favor established producers with attractive growth profiles like Alamos Gold (AGI).

Be the first to comment