anyaberkut

My Thesis On PubMatic

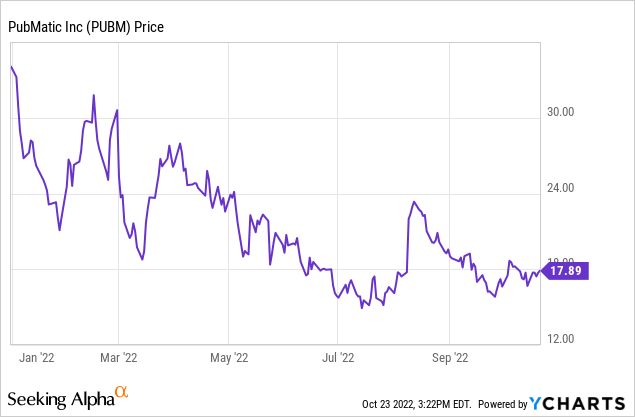

Although a recession is bad for all businesses, those that are still profitable, growing, and have a strong balance sheet are attractive candidates for medium to long-term recovery. When the market eventually catches up, these stocks will have already taken off. And PubMatic (NASDAQ:PUBM) falls into this category. This, and some other reasons that are mentioned below, is why I am bullish on PubMatic and I rate it as a BUY.

Business Model

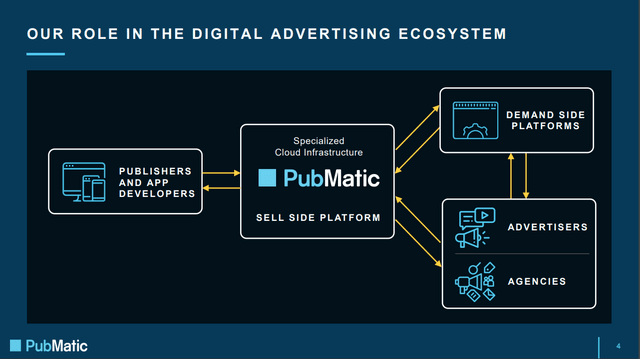

PubMatic is active on the supplier side of the digital advertising industry. That is where internet content creators have space for advertisers to fill in. This is where PubMatic steps in, assisting these advertisers not only in locating businesses to advertise with on their platform but also in maximizing their income. PubMatic generates revenue by taking a cut of the value of each advertising impression.

Real-Time Bidding Program (RTB)

In order to understand how PubMatic works, you will have to first understand how real-time bidding works. Real-time bidding (RTB) is the process of purchasing and selling advertisements in an instant auction in real time on a per-impression basis. The winning ad (with the highest bid) is displayed to the user when many advertisers compete for a single impression of a publisher’s inventory at any one time. You can think of it like a live auction for ad space. This way, advertisers can use precise targeting and concentrate on the inventory that is most pertinent to their needs. This results in higher eCPMs and therefore a higher ROI.

PubMatic – Financials

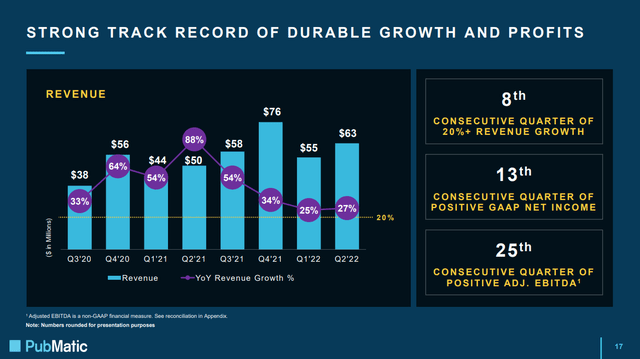

Something to note about PubMatic is that although its stock price has almost halved since the beginning of the year, the company grows its top-line revenue at tremendous levels (>25%) exceeding analysts’ expectations every single quarter.

The company currently has a P/E ratio of 18.66 which is a bit higher than the sector’s median of 14.70 but is justified if you factor in the fact that the company has a bright future both from a top and bottom-line perspective. This argument is also supported by the company’s PEG, which stands at 0.3, compared to its sector’s median of 0.45 (50% higher). Additionally, not only the company’s EV/S is as low as 2.81 but also analysts project a revenue growth rate of about 20% for the next 3 years and they see EPS reaching $1.81. If the company manages to earn $1.81 per share by 2025, and applying to that a P/E ratio of 18, making the stock worth $33, you could double your money in the next three years.

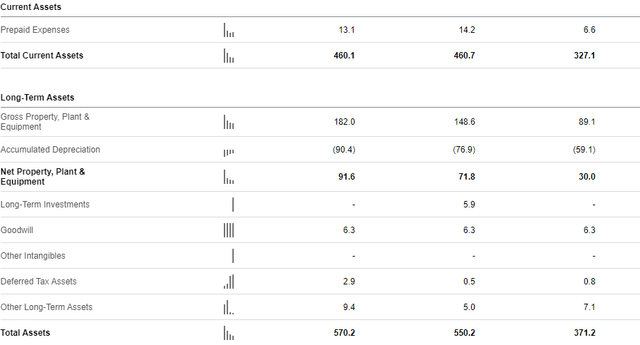

Balance Sheet

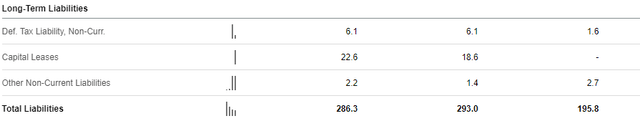

As shown in the company’s balance sheet, the company is almost debt free. This is quite reassuring, especially in a high-rate environment such as the one we are currently in, as:

- The company is not in danger of going bankrupt at least in the short term.

- The company has much fewer expenses and can thus either reinvest more back in itself to grow at a faster pace or retain the remaining earnings as cash (asset) and wait for the right time to invest it.

Talking about assets, PubMatic’s total assets are valued at $570 million, with $460 million of these being current assets such as accounts receivable and short-term investments.

With no debt, a strong asset position, stable growth, and a low PE and PS, I would not be surprised if the company’s stock quintupled (5x) in the future and especially when big money starts buying it.

PubMatic’s Moats

1. Switching Cost

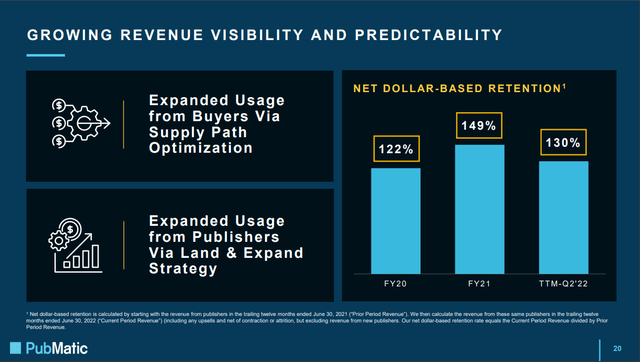

It takes time, effort, and money to transfer platforms once an advertiser is set up on PubMatic’s platform. Due to this, the company’s net dollar retention has exceeded 120% since going public in 2020, a fantastic result.

2. Low-Cost Production

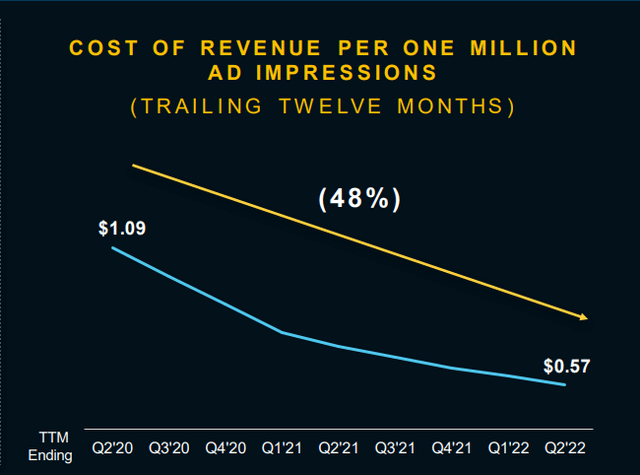

PubMatic has chosen to build all its servers throughout the world and run its programming on its own server. That has a high-cost upfront but once they get economies of scale, the cost per ad impression falls precipitously. This is something that the company’s competitors such as Magnite, Inc. (MGNI) cannot do and that gives PubMatic a comparative advantage.

3. Common Interest

The main reason that I believe PubMatic and the service that it offers (RTB) will take over the classic digital advertising (the service companies like Meta (META) and Alphabet (GOOG) offer) is that when businesses choose to advertise with the latest there is a conflict of interest between these businesses and the ad provider company.

In the case of PubMatic, as mentioned before, the company generates revenue by taking a cut of the value of each advertising impression. This implies that in order for the company to make more money, its customers have to make more money as well. Thus the company has an intrinsic motive to offer its clients the best services attainable and aim for the most practical outcomes.

But when it comes to classic advertising the story is a bit different. These companies make more money when they promote the ads more intensively, no matter how much the advertiser is going to yield. So it is in their favor to show ads even to people that are probably not going to convert just to make more money.

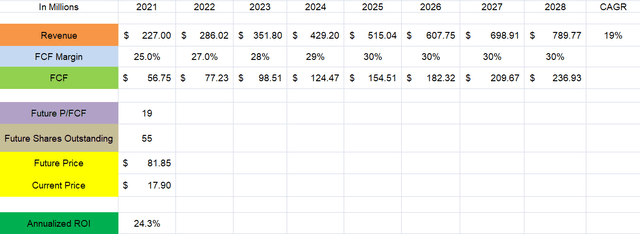

PubMatic – Valuation

If the company’s management accomplishes to perform well for the next 6 years and hit its targets, I believe it would be more than rational to expect a CAGR of 19%, especially when the digital advertising market is expected to grow at a CAGR of 14.3% reaching $354.90 billion in 2026. By doing so, the business would reach a revenue level of roughly $790 million in 2028. Add to that a FCF margin of 30%, which is reasonable, although it is a bit higher than the one that the company currently has, as the company benefits from economies of scale and a P/FCF of 19 and you have a future price of $81.85 in 2028.

Considering everything, I anticipate PubMatic shares to generate an annualized ROI of 24.3% through 2028, which is significantly higher than the 10% that the market has yielded on average.

Risks

As PubMatic is currently losing to Magnite (the largest sell-side provider in the market) in terms of yearly revenue, competition is its top issue. Magnite is also growing at a rapid pace and that worries many of PubMatic’s shareholders as they don’t know which of the two companies is going to survive and give its investors the highest ROI in the long term.

That said, I do believe that PubMatic looks a lot stronger in a few ways.

- Profitability: Although Magnite generates more revenue it has a net loss margin of 18% in contrast to PubMatic’s profit margin of 22%.

- Valuation: PubMatic has an EV/EBITDA of 10.34 compared to Magnite’s of 13.84

Conclusion

As it seems a period of recession is only getting started. Bearing that in mind, I believe that $15 was not the bottom. The problem is that we can never know for sure where the bottom is. This is why I believe that the best investing strategy is to find stocks that you like and buy them at prices where you feel confident.

If PubMatic can continue to perform as well as it has in the past, I think it will be able to produce long-term growth at the current price especially when we see some indications of a macroeconomic recovery.

Summing up, I love both the company and the valuation and I rate this stock as a BUY.

Be the first to comment