Mystockimages/iStock via Getty Images

Introduction

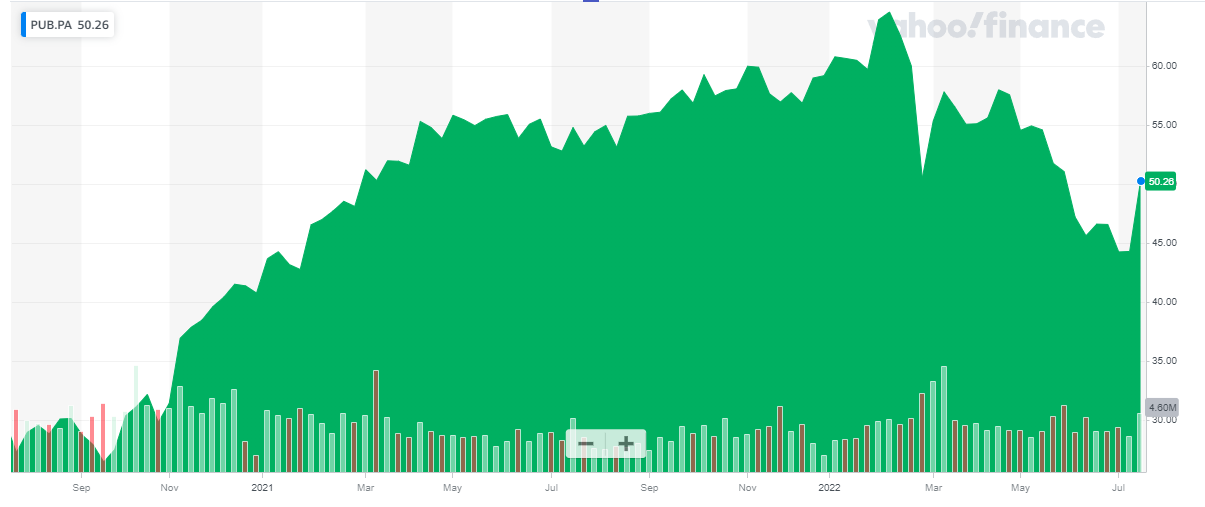

Publicis (OTCQX:PUBGY) (OTCQX:PGPEF) has surprised me in 2021 with a free cash flow result of in excess of 1.2B EUR in its first post-COVID year. Unfortunately the COVID crisis wasn’t fully digested before a new crisis erupted and as an European communications and advertising firm, Publicis is bound to feel an impact from the war in Ukraine. Since my previous article I wrote some put options on Publicis, but they either all expired or will expire out of the money so the fresh set of half-year results is a good moment to have another look at the company from an investment perspective

Yahoo Finance

As a reminder, one share of PUBGY represents 0.25 shares of Publicis. I will discuss the results of Publicis in EUR as the main listing of the company is on Euronext Paris where it’s trading with PUB as its ticker symbol. The average daily volume in Paris exceeds 700,000 shares per day so it makes sense to refer to the primary listing. Investors interested in trading PUBGY should divide the per-share results by four to end up with the results per PUBGY share.

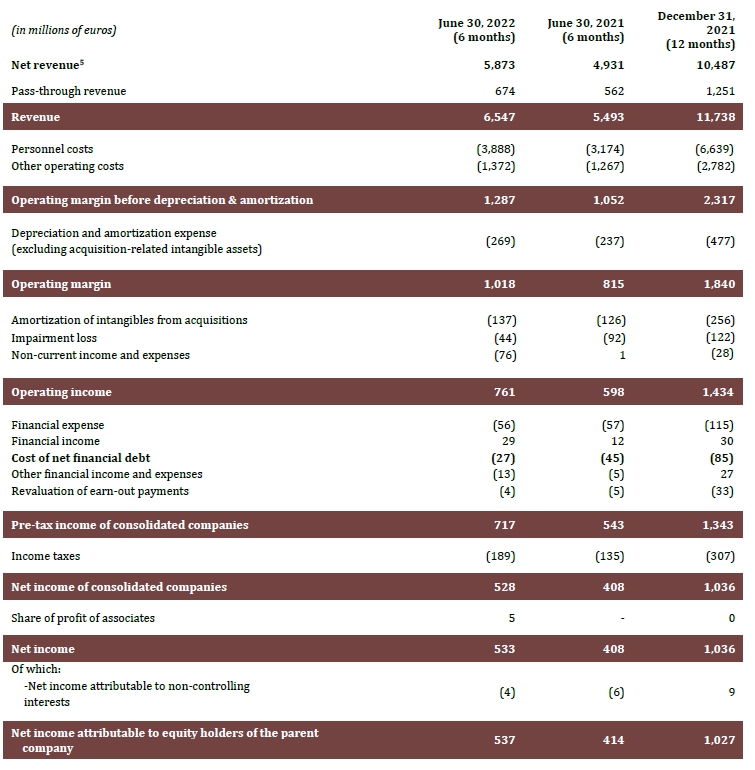

The results are in, and the result in the first semester remained very strong

Publicis performed very well in the first half of the year. Its revenue increased by almost 20% to 6.55B EUR while the operating income increased by a similar percentage, up 22% to 1.29B EUR.

Publicis Investor Relations

That’s important because most of the other expenses are relatively fixed in nature. The depreciation and amortization expenses increased but the net cost of the financial debt decreased and as you can see above, the pre-tax income increased from 543M EUR to 717M EUR, an increase of approximately 32%.

After deducting the income taxes and adding back the income from associates and the loss attributable to non-controlling interests, the net income attributable to the shareholders of Publicis was 537M EUR and based on the average share count of 250M shares, the EPS was 2.15 EUR per share.

Publicis also released the ‘headline diluted EPS’. That’s the EPS on a diluted basis but excluding the impairment charges and the amortization of acquisition-related intangibles. Adjusting the result for these elements, the EPS was actually 2.88 EUR per share which is excellent.

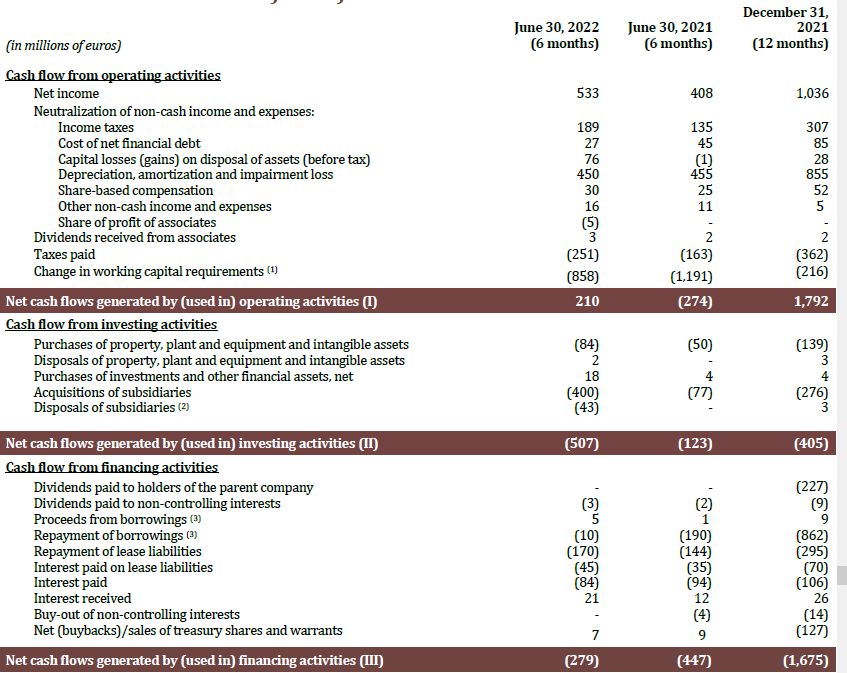

Another way to look through these impairment charges and non-cash amortization expenses is by studying the cash flow statement. The reported operating cash flow was quite disappointing at 210M EUR but as you can see below, this clearly is related to the 858M EUR investment in the working capital position while the company also paid about 62M EUR in taxes that weren’t owed based on the H1 results (251M EUR paid while only 189M EUR was due).

Publicis Investor Relations

We should also deduct the 63M EUR in net interest payments as well as the 215M EUR in lease related payments (170M EUR in lease liability payments and 45M EUR in interest paid on lease liabilities). The adjusted operating cash flow was 852M EUR.

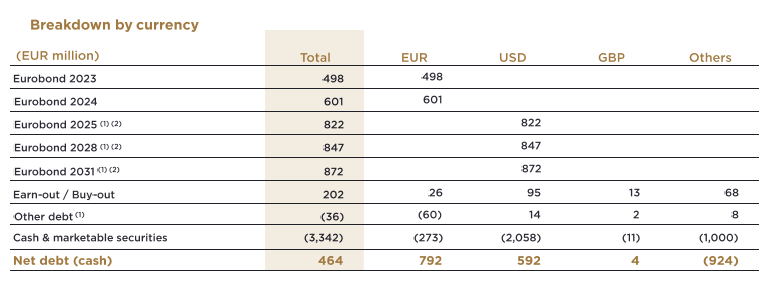

With a total capex of just 84M EUR, the half-year free cash flow result was 768M EUR for an FCFPS of 3.07 EUR per share. An excellent result and although the net debt didn’t decrease (239M EUR in net financial debt excluding lease liabilities as of the end of June versus a net cash position of 29M EUR as of the end of last year) that’s not a reason to be worried due to the working capital build-up. The company uses a net financial debt level of 464M EUR as it includes the future cash payments related to previously agreed-upon acquisitions with final buyout payments.

Publicis Investor Relations

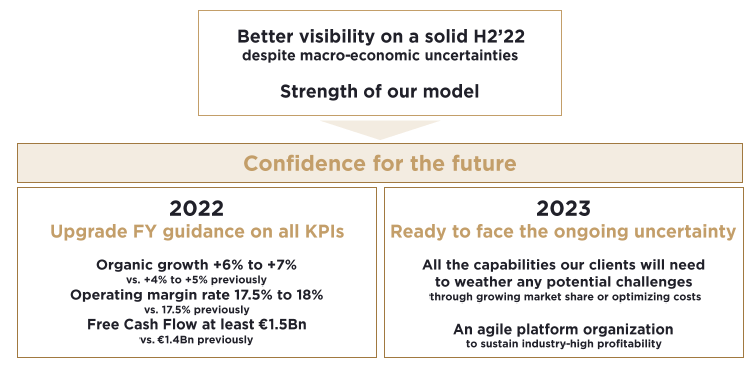

A guidance increase was the logical result

A very strong set of results in the first half of the year, and this allowed Publicis to hike its full-year outlook on all accounts. The company has now hiked its organic revenue growth rate from 4-5% to 6-7%. Additionally, it has also increased the metric that’s the most important for my investment decisions: the free cash flow result.

Publicis is now aiming to generate a free cash flow result of at least 1.5B EUR (compared to the previous guidance of 1.4B EUR) which would work out to be 6 EUR per share. Also keep in mind Publicis includes the tax payments on an as-is basis (which explains why its H1 FCF came in at 708M EUR which is lower than my number, mainly due to the difference between taxes owed and taxes paid).

Publicis Investor Relations

The full-year free cash flow upgrade doesn’t really come as a surprise. This is what I wrote in my April article on Publicis:

Publicis is now guiding for a full-year free cash flow result of 1.4B EUR. I think it may actually be able to do better than that

It’s still too early to discuss 2023 and the visibility for next year just isn’t there so it will be interesting to see if we can get some more color on the 2023 expectations later this year.

Investment thesis

Despite the recent ex-dividend date which saw a 2.40 EUR dividend being detached from the shares, Publicis’ share price is already trading above 50 EUR again. Not entirely unreasonable given the strong performance in the first half of the year and the recent guidance increase. I was a bit scared for the fallout from the Ukrainian war but Publicis’ guidance seems to indicate I was too worried about this risk. Although this doesn’t mean much when it comes to the visibility for 2023 and beyond, it does mean Publicis will end this year with a very strong balance sheet which will compensate for any potential visibility issues.

I still have one put option I wrote a while ago and will now likely expire out of the money. I will very likely continue to write put options as long as the increased volatility levels keep the option premiums high. I am impressed with Publicis’ H1 EPS and adjusted EPS and perhaps even more so with the free cash flow result. Despite the recent share price increase, Publicis is still trading at a 12% FCF yield based on the company’s official projections for 2022.

Be the first to comment