gorodenkoff/iStock via Getty Images

Main Thesis / Background

The purpose of this article is to evaluate the PIMCO Corporate & Income Opportunity Fund (NYSE:PTY) as an investment option at its current market price. The fund’s objective is “to seek high current income, with capital preservation and capital appreciation as a secondary objective”.

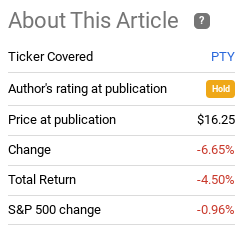

I cover PTY with regularity, with my last review being in mid-December. At that point, I was very hesitant to declare this fund a buy. I saw some risks for fixed-income as a whole, and PTY’s premium price continued to pose a challenge for justifying new positions. Looking back, this outlook was pretty spot-on, with PTY seeing some broad weakness over the past quarter:

Fund’s Performance Since Prior Review (Seeking Alpha)

As we are about to start the second quarter, I thought I should take another look at PTY to see if changing my position is warranted. After review, I continue to see a lot of positives. The fund has recently gotten some bullish momentum, the underlying assets seem to offer some value, and income metrics remain strong. All of these factors suggest a buy case.

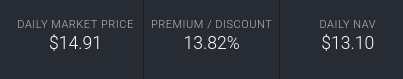

However, the primary negative is the fund trading at a premium nearing 14%. At this level, it is difficult for me to advocate buying this CEF, or any other for that matter. While I see enough positives to limit the downside potential, the premium caps the upside. The fund’s NAV has been on the decline this year, and the market price remains quite expensive. While I recognize a move higher is very realistic for this fund, the premium that must be paid to benefit from it makes me reluctant to place a “buy” rating on this option.

Let’s Start With Some Positives

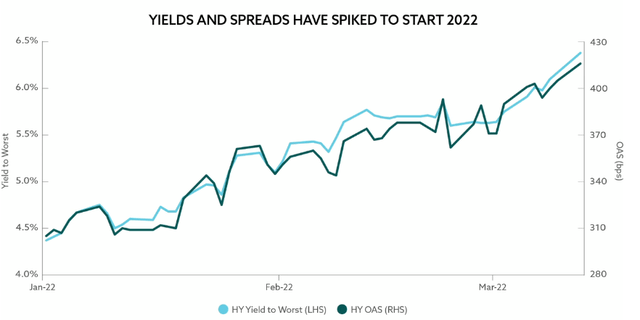

To start, I want to bring up a few attributes on why I like high-yield credit. This extends to PTY, along with numerous other CEFs. On the surface, high yield in particular looks interesting to me because it has been selling off hard. This opens up a reasonable contrarian play. Investors have been fleeing high yield credit broadly, and that has widened credit spreads significantly. This means investors who buy now are getting a much higher level of income to take on this risk:

High Yield Spreads (PPM America)

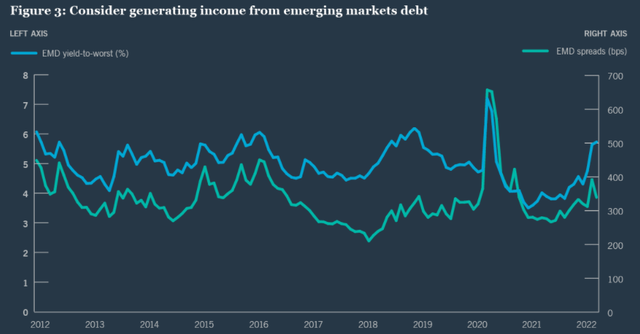

Importantly, this trend is relevant for emerging market debt as well, which often moves in a similar fashion to domestic high yield credit sectors:

Emerging Market Debt Spreads (Nuveen)

Now, these are not automatic buy signals. In fairness, I do personally view widening spreads and yields as a reason to buy the sector. But one has to consider their own personal risk tolerance and outlook. Perhaps spreads are widening because of significant underlying problems or forward risks. This could mean the market is selling off for valid reasons, and it is subjective whether current levels are attractive buys. To me, I see a clouded global macro-backdrop, but I think there is enough strength heading in to Q2 that make me confident we are not going to see widespread defaults across the market. This firms up my opinion that selecting these options now has merit.

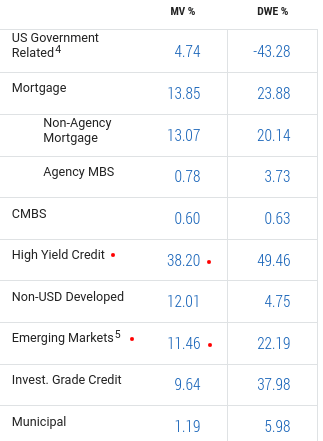

To tie this back to PTY, readers should recognize both high yield and emerging market credit combine to make up a significant amount of PTY. In fact, when combined together, these two sectors make up half of total fund assets:

PTY Exposure (PIMCO)

My takeaway is there is opportunity here. While macro-risks on a global level, such as the conflict in Ukraine remain a headwind for high yield credit, investors appear to be adequately compensated for these risks. When I see spreads push outside the short-term trading range, that suggests it is time to buy, in my view. While I have my concerns around PTY in isolation, which I will get to later in the review, I do tend to favor high yield and EM debt at this moment.

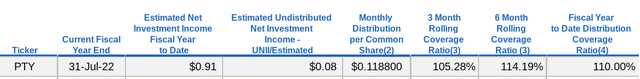

Income Metrics Remain Strong

A second positive attribute for PTY concerns the fund’s distribution. I mentioned in my last review how I saw PTY as offering a more sustainable yield, on the backdrop of its distribution cut last year. Fortunately, since then, income metrics have been strong and the income stream has been consistent. Further, the fund’s most recent UNII metrics suggest there is no cause for alarm. This is a continuation of the trend I mentioned in my last article:

Ultimately, there is a lot to like here. PTY’s coverage ratios are all over 100%, and its UNII balance remains in positive territory. Suffice to say this is an attribute that supports owning this fund for the income.

Housing Debt Also Well Supported

My next point looks at mortgage debt. While I would reiterate that high yield and foreign debt make up the bulk of PTY’s exposure, the fund still has almost 14% of its holding related to mortgages. This is an area that I view quite positively. The housing market remains very firm, prices are soaring, and lending standards have come a long way over the past decade. While affordability is a macro-concern, that is less of a concern for current homeowners, especially those that have been in their homes for at least a year. The reason being that prices have risen so fast, most homeowners are sitting with positive equity in their homes.

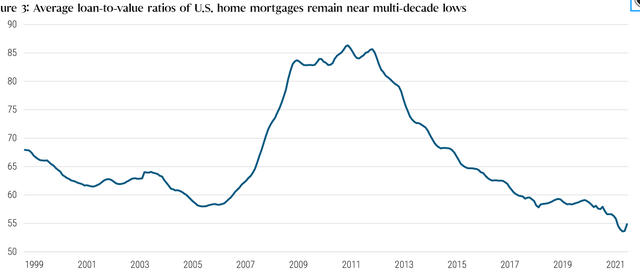

Furthermore, the combination of rising prices along with most borrowers putting reasonable amounts down on their home at the time of purchase has led to a significant deleveraging in this sector. Simply, households owe less on their properties, relative to their loan balances, then at any time over the past two decades, as shown below:

Average Loan To Value (U.S.) (PIMCO)

In sum, the housing market remains on solid footing, and this supports the underlying debt that represents it. Overall, I see its inclusion in PTY as a tailwind, even if the exposure is relatively limited compared to other sectors.

What Are The Risks? Inflation Is One

Now that I have discussed what I like about PTY, I want to dig in to some of the risks. The first is interest rate risk, driven by excessive inflation readings over the past year. This is important because it has chiefly been responsible for the decline in bond/credit products since the end of last year. Inflation has been forcing investors to shed fixed-income debt, whether it is domestic, international, high yield, IG, corporate, mortgage, municipal, or any other. With the exception of floating rate debt (whose interest rates re-set higher as rates climb), the bond market has been under tremendous pressure in 2022 so far.

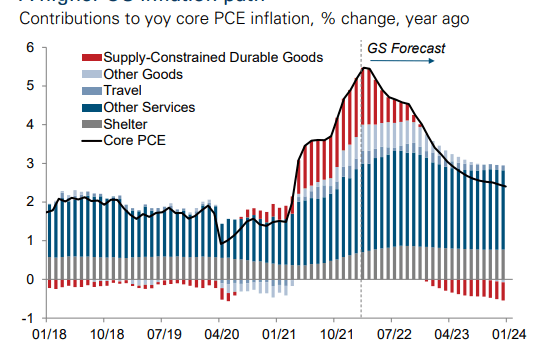

So, how does this impact PTY? Personally, I think the worst has mostly passed. Inflation remains red hot, that is true, but bond and credit prices have sold off substantially on this backdrop. I see price increases as likely to ease somewhat in the second half of the year. In fact, current forecasts suggest by the summer we will start to see inflation decline consistently, which is what everyone is likely hoping for:

Inflation Forecast (Goldman Sachs)

With this in mind, I see PTY as having some upside potential – if it turns out to be the case. There is lies the rub. While inflation story may moderate and PTY may benefit, we have to recognize that inflation remains a major sore spot for the global credit market. If inflation remains at current levels, or even moves higher, then PTY is going to struggle as it has been in 2022. Rising inflation pressures central banks to raise interest rates, and that in turn pressures current bond prices. Undoubtedly this is why PTY has seen its NAV drop this calendar year:

| NAV on 1/3/22 | NAV on 3/29/22 | YTD Change |

| $14.20 | $13.10/share | (8%) |

Source: PIMCO

This is a key fundamental investors need to keep an eye on throughout 2022, whether they are investing in PTY or any other credit fund.

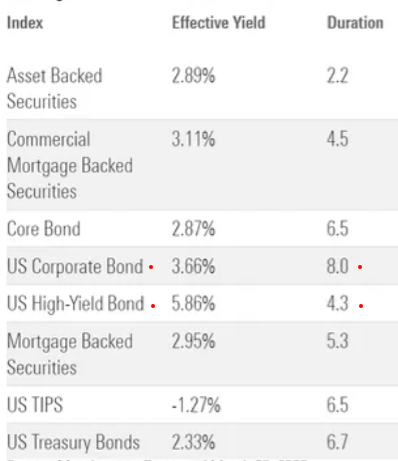

Of course, there is a silver lining here. One of the reasons I like high yield in particular is because I see interest rate risk as paramount to credit risk right now. On the backdrop of a strong 2021, corporate balance sheets have been fortified and defaults have been minimal. This makes moving down in credit quality a reasonable move, especially for the higher income stream it produces. Beyond that, investment grade credit, will very safe credit-wise, is extremely sensitive to rising interest rates. In fact, duration levels in IG credit are much higher than high yield, on average, as shown below:

Asset Classes – Yield & Duration (Moody’s)

What I am getting at here is that if an investor wants fixed-income exposure right now, the risk is truly inherent in the IG space, not high yield. Of course, credit risk is greater in the high yield realm, but it is interest rate risk, not credit risk, that is the concern right now. With IG offering less income with much greater interest rate sensitivity, pushing the credit envelope is the strategy that makes sense for the time being. Yet, we must also balance this reality out with the fact that if inflation continues to roar higher and central banks have to get more hawkish, both sectors are likely to decline as a result.

Debt From Ukraine, Venezuela, and Argentina? No Thanks

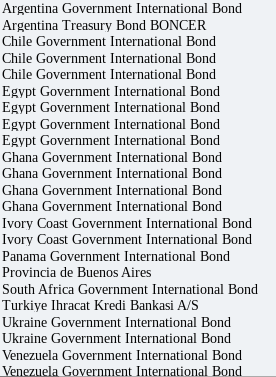

I mentioned earlier in this review how PTY has some EM exposure and that I view that asset class favorably. However, not all EM is created equally. Fortunately, PTY does not have much direct Russian sovereign exposure, which was a misconception that hit the market a few weeks ago on the backdrop of a report from Bloomberg overstating (in my opinion) the impact on PIMCO’s balance sheet. However, PTY in particular does have some sovereign holdings from Ukraine – which is a challenging spot right now. In addition, the fund holds sovereign debt from Argentina and Venezuela, two areas I am likely to avoid for the foreseeable future:

PTY EM Exposure (PIMCO)

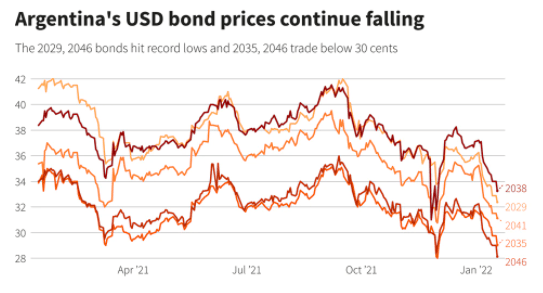

I personally see more value in Asian EM debt, and perhaps Eastern Europe in normalized times (definitely not now). As a reminder on why South American debt can be troubling, we don’t have to look back very far. After Argentina struck a tentative deal with the IMF earlier this year, the market was not impressed. Bonds from Argentina fell below $.30 on the dollar, and continue to showcase their incredible volatility:

Argentina Bond Prices (Reuters)

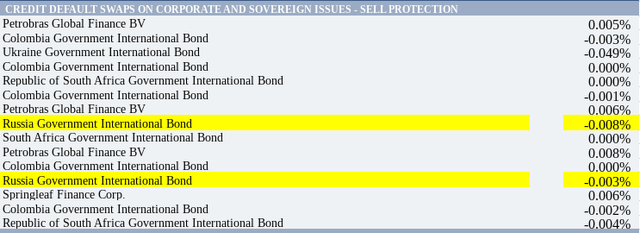

In addition, while PTY does not own sovereign Russian debt, it does hold some credit default swaps on bonds backed by Russia. This is where the risk comes in – if these bonds default PIMCO is going to have to shell out cash to the investors who bought protection against it. These swaps act as a kind of insurance, and right now it is getting more likely that insurance is going to be paid. This means PIMCO will have to pay out more than it probably collected in premiums for the swaps – a negative for the fund. Fortunately, the exposure for PTY is quite minimal, with only two small contracts on the books:

My take on all this is quite mixed. PTY does not have a ton of “scary” exposure, but there are some line items on the books I don’t see a lot of value in. Fortunately, the positions are quite small, but sometimes small positions can have a big impact. Whether there is value in buying here is subjective, but paying a big premium for these types of assets – which is the focus of my next paragraph – is a big point of concern for me.

The Premium Is Stubbornly High

My last point for PTY is a short, but important, one. As my readers know, I harp on the big premiums for PIMCO CEFs – I have been doing this for years. There are plenty of times when I find value, but it is difficult to do so (for me) in the double-digit range. Yes, many followers and writers of PIMCO CEFs disagree. But if we look back at historical performance for most of these funds, we see that buying when they are very expensive is simply not a winning play. In the short-term, perhaps, but over time, the performance just doesn’t justify it.

This brings me to the current price for PTY – at a premium nearing 14%. In fact, as I write this, PTY is having a strong trading day, so it will probably end March by surpassing that 14% level:

Premium Price (PIMCO)

I have made my position clear in past reviews on this point, so I won’t rehash the same arguments again in great detail. Simply, this is an expensive price to pay for a fund – even if all the other attributes lined up well. With some areas giving me pause, it is an easy decision for me to pass on this CEF for now. Plenty of others will disagree, I am sure of that. Many do not seem to mind premiums inherently, others likely have an outlook that PTY will revert back to its former glory of 30-40% premium levels. Whether that will happen is anyone’s guess, so it all depends on one’s comfort level. To me, the risk just isn’t worth it.

Bottom-line

PTY has seen a nice bounce in the past few weeks but I would hesitate before getting too optimistic. On the bright side, the high yield, EM, and mortgage debt sectors that the fund is long all have positive attributes. Further, income metrics are strong and the premium is about 2% smaller than where it stood in December. All these could warrant a buy rating. However, some of the underlying holdings concern me, and the bigger picture is that a 14% premium is quite pricey, even if it is “lower” than it used to be. When I add all this up, I continue to believe a modest or “hold” rating remains the most appropriate outlook. As a result, I continue to advocate readers approach new positions in PTY selectively at this time.

Be the first to comment