narong sutinkham/iStock via Getty Images

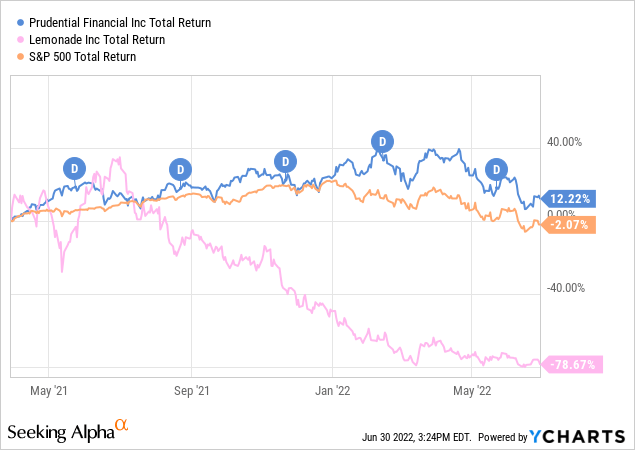

Those of you who followed our advice from March 2021 article: Lemonade Makes A Sour Offering For Investors, Go With Prudential Instead would have made over 90%, most of it coming from Lemonade (NYSE:LMND) share price decline.

However, just being long Prudential Financial (NYSE:PRU) has brought investors 12% return, as the company outperformed S&P 500 by 14%.

In our today’s article, we look again at Prudential Financial Inc. and Lemonade as a Pair Trade.

Prudential is a Renowned Insurance Giant with Proven Dividend Record

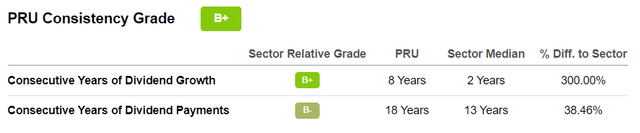

Prudential Financial Inc. has been around for 147 years and has a long history of generating and returning profits to shareholders.

Prudential Financial, Inc. has three major pillars: two of which are insurance divisions: International Businesses and U.S. Businesses. The third pillar is Prudential Global Investment Management (PGIM).

In 2022 the company is expected to generate $53.4bn in revenues and $11.52 in EPS. Company’s management stated during 1Q22 earnings call that higher interest rates will be positive for Prudential after the transitory period and “are good for Prudential overall”.

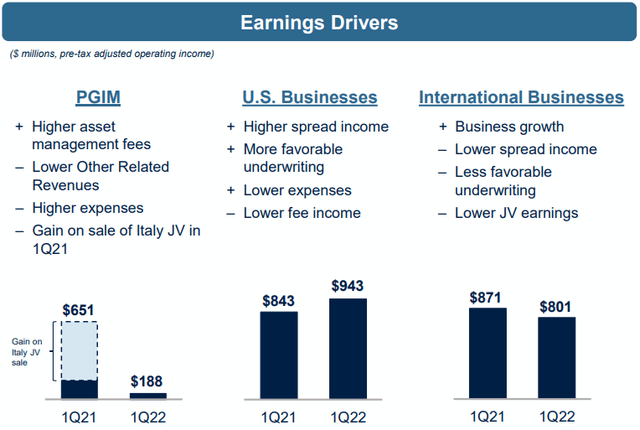

The bulk of earnings at Prudential is generated by the insurance businesses. The earnings of U.S. Businesses went up by 12% in 1Q22, among other things benefiting from variable investment income and rising interest rates. With the interest rated poised to continue to go up, this could be favorable for future earnings generation. On its earnings call, the company also noted that the COVID-19 mortality is on decline, which results in lower expenses.

International Businesses saw their earnings fall 8% compared to 1Q21. This is the business segment where Prudential invests in growth through M&A transactions. The company currently has $4bn from divestitures, which is plans to use for future M&A transactions or to return to shareholders.

PGIM division saw a significant funds outflow in the quarter, as mutual fund investors exit fixed income products due to rising interest rates and inflation. During the earnings call, Rob Falzon, Prudential Vice Chairman, noted that rising interest rates can continue to have negative impact on fixed income products, however, when the rates stabilize, it would be positive for PGIM business.

Risks to Business Model

As we have stated above, International Businesses’ earnings declined y-o-y and the objective to improve earnings contribution from growth businesses to over 30% was not achieved. It remains to be seen if the management succeeds in spurring growth through M&A activity.

According to Prudential’s management, inflation could be a negative for long term care business, where the premiums are set, but the expenses may rise due to inflation. However, the risk is currently estimated as manageable.

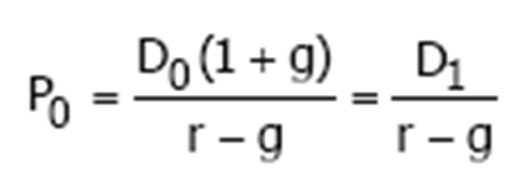

Valuing Prudential Financial Inc. using DDM

For us valuing Prudential Financial using the Dividend Discount Model (DDM) is about defining the lowest estimated fair value per share based on company’s cash flows to shareholders. In 1Q22 the company repurchased shares for almost as much as it paid in dividends ($375m vs. $462m), which translated in almost $1/share in share repurchases. However, share repurchases, unlike dividends, are not sticky and cannot be counted upon in the future.

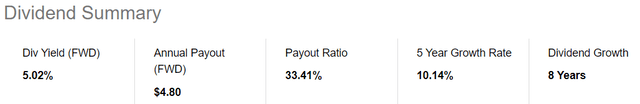

Prudential Financial Inc. currently has a payout ratio of just 33%, signaling that the company could afford paying higher dividends, however, prefers to pay additional capital back to shareholders using share buybacks. Current dividend yield is 5.02%.

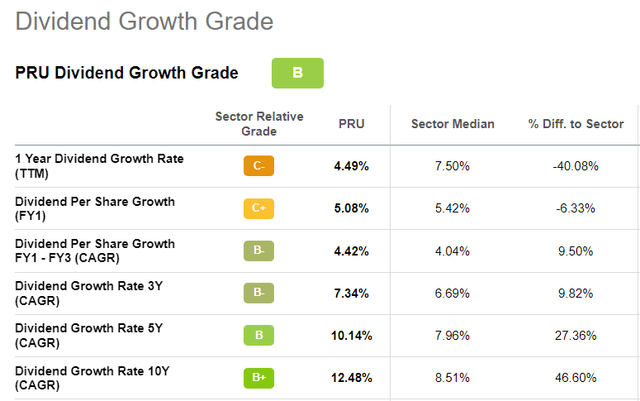

In order to calculate the fair share value using DDM, we use future dividend estimates, long-term growth rate and required rate of return. Prudential is expected to pay $4.81 per share in dividends in 2022, which constitutes 4.6% growth y-o-y and $5.11 in 2023 (6.2% growth). As you can see from the chart below, historically, Prudential has been growing its dividends at even higher rate.

Given high historical growth and low payout ratio, we keep our assumption of a long-term dividend growth rate at 6%.

To come up with a required rate return (R) for PRU, we start by using risk free rate of 2.98%, adding equity risk premium (5.17%) times PRU’s Beta (1.48x). This would result in a required rate of return of 10.6%.

Wikipedia

Assumptions:

D1 = $5.11 (expected dividends in 2023)

g = 6% (long-term dividend growth rate, compare it to 10% historical 5Y CARG)

r = 10.6% (required rate of return – Author’s pick)

Result for Price: $5.11/(10.6%-6%) = $111 per share, 15% upside to the current share price.

Sensitivity: Adding $1 in share repurchases to DDM valuation would increase the payout ratio by 9% to 42% and the estimated fair share value by almost $22 to $133/share.

Therefore, based on DDM, PRU shares are currently undervalued.

Lemonade is a Newcomer in Insurance Business

In contrast to Prudential Financial Inc. Lemonade is a new entrant to the insurance industry. The company was founded in 2015 and went public in July 2020. The company offers renters, homeowners, life, pet, and car insurances. It differentiates itself from other insurance companies by relying on artificial intelligence and behavioral economics. Delighting its customers is at the core of Lemonade’s strategy. Customers can close insurance contracts by chatting with a chatbot AI Maya, file claims by chatting with another chatbot – AI Jim and receive settlements to their claims within seconds.

Lemonade’s philosophy is that satisfied customers would spur further growth, generating more revenues for Lemonade (what the company calls Grow With Customers strategy) and enabling Lemonade to use its customer data to learn and optimize its machine learning algorithm (Win With Technology strategy).

At Lemonade, the company keeps 20%-25% of the money received from customers to pay its cost and generate return to shareholders while using the remaining 70%-75% to reinsure and pay the claims. Lemonade is a Public Benefit Corporation and directs unused premiums to nonprofit organizations selected by customers.

Lemonade’s 1Q22 Results and FY22 Guidance

Lemonade generated $44m in revenue in 1Q22, up 89% y-o-y, however, its expenses also almost doubled from $55m in 1Q21 to almost $93m in 1Q22, driven mostly by marketing expenses and employee-related expenses.

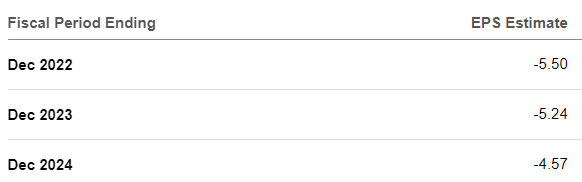

For the FY2022 Lemonade’s guidance is $205m-$208m in revenues, while the market expects the company to produce negative EPS of $5.5/share. This cash-burning trend is expected to continue for the next several years, for which analysts estimates are available.

As of March 31, 2022, Lemonade’s book value per share amounted to $14.8/share, demonstrating how the company lost $10/share in book value since the time of our previous article in March 2021.

Lemonade’s Risks

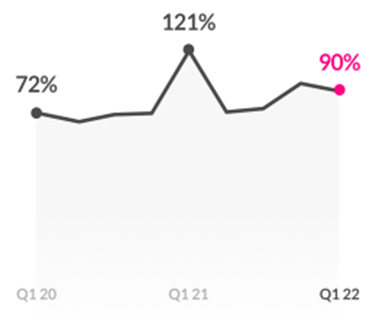

Gross Loss Ratio: One of the troubling signs at Lemonade is its high gross loss ratio of 90% in 1Q22. Gross loss ratio is calculated by dividing paid insurance claims and expenses by total earned premiums.

Lemonade’s Gross Loss Ratio

Lemonade 1Q22 Shareholder Letter

When the ratio is approaching 100%, the company is not making any money on its insurance products. Lemonade’s objective is to achieve long-term loss ratio of 75%. The company indicated that the loss ratio is a lagging indicator and that the business Lemonade generated in 1Q22, would have gross loss ratio below 75%. This is a KPI for investors to watch.

Regulated industry: as Lemonade states in its SEC filings, the company is subject to extensive insurance industry regulations. The regulations cover how the products could or could not be structured and offered, what information from clients can be used and for which purposes as well as various reporting requirements to name a few. Complying with those requirements may slow down Lemonade’s ability to develop new innovative products, while failure to comply may result in charges or necessitate remedial actions.

Lemonade’s Valuation

Lemonade is still expected to burn $5/share per year in the years to come.

Seeking Alpha

At the current rate, the company has three years until it runs out of equity and will need to raise additional capital.

The calculation of a fair value per share using different valuation models is based on discounting positive cash flows to investors. However, in case of Lemonade, it’s difficult to foresee if the company ever becomes profitable and therefore come up with a fair value per share.

Lemonade’s Upside Potential

It looks like the market still sees some potential in Lemonade, as the shares are trading at a premium to its book value. Such potential can materialize from extraordinary growth.

Lemonade has been growing its revenues at a strong double-digit pace in the past years. Given the digital nature of its business and the core of its strategy of delighting customers, Lemonade may experience an explosion of its customer base and revenues, respectively. Since at Lemonade the products are sold and the claims are settled via AI technology, involving virtually no human touch, Lemonade technically is capable of explosive revenue growth. In that case, revenues would outpace the expenses and the company would turn profitable, implying a higher valuation of its shares. However, currently we see no indication of the company achieving this inflection point any time in the future.

Another factor, which could trigger an increase in LMND share price is a short squeeze. According to Seeking Alpha, currently almost 30% of LMND’s stock is sold short. Should short investors rush to cover their positions at the same time, it could result in a steep short-term share price increase.

Relative Valuation of PRU and LMND

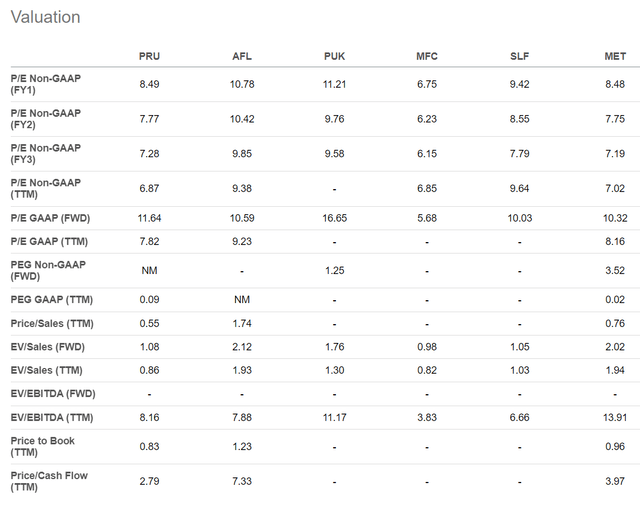

PRU is currently trading at 8.5x 2022 P/E, which is lower compared to its peers (AFL, MET trading in 9x-11x range). Thus, the relative valuation also implies 5%-25% upside potential for PRU. Prudential has also one of the lowest Price/Sales and Price/Book ratios among its peers, all suggesting that the stock is undervalued.

The fair share value of $111 suggested by the DDM would translate into 9.6x P/E ratio.

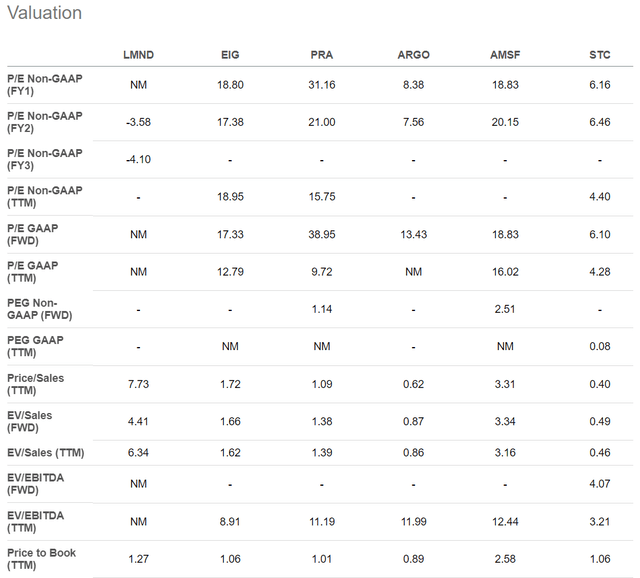

In case of Lemonade, only multiples involving Sales and Book value as denominator could be used, as the company does not generate any profits. LMND shares trade at a significant premium compared to its peers, e.g. Price/Sales ratio of 7.7x is 5x higher than the average of 1.4x for Lemonade peers. In our view this suggests further downside potential for the stock.

The same goes for Price/Book value. Most Lemonade peers trade around its book value, while LMND trades at 27% premium, which in our view is not justified and could indicate at least 27% downside for the stock or estimated fair value at $13/share. Therefore, we remain bearish on the stock.

Conclusion

We believe Prudential is currently attractively valued with only 8.5x forward P/E. According to the management, the company is well-positioned to withstand economic headwinds such as rising interest rates and inflation. Prudential is currently trading below its book value and also below the minimal fair value per share as estimated using the Dividend Discount Model. We believe the shares are worth at least $111, which translates into 15% upside potential to the current share price.

As for Lemonade, despite LMND’s steep share price decline in the past year, we still believe the shares are overvalued, as the company has not demonstrated a viable path to profitability. We don’t see why LMND shares should trade at a premium to its book value, when its peers are trading around its book value. In our view this implies at least 27% potential downside to the current LMND share price with an estimated fair value of $13/share.

Be the first to comment