Evgenii Mitroshin/iStock via Getty Images

Crude oil prices have been slumping over the last month. The front month August ’22 contract peaked at June 9th at $121.50 and it is currently trading at $104.50.

The ProShares Ultra Bloomberg Crude Oil (NYSEARCA:UCO) has performed even worse as it is leveraged 2X to the price of crude oil. The UCO trading instrument has fallen from $55 to $43 in less than a month.

Despite the recent plunge, the bullish oil thesis is still intact and speculators can use the UCO to take advantage of the situation.

Understanding the UCO

Before we get in to some recent bullish developments for crude oil, it is important to fully understand the ProShares Ultra Bloomberg Crude Oil UCO instrument.

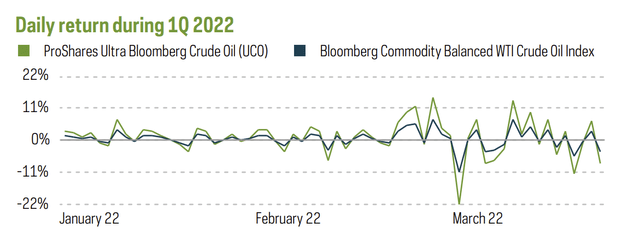

First of all, UCO does not perfectly track the price of crude oil. Instead, it is made up of three equally weighted crude oil contracts: June ’22, December ’22 and June ’23. Only one third of the contracts roll each month. The other contracts are rolled in March and September. Thus, there is going to be some tracking error as the fund uses some long dated crude oil futures contracts.

You can see how well UCO tracks the Bloomberg Commodity Balanced WTI Crude Oil Index in the chart above. Given crude oil’s volatility this year, UCO has adequately tracked the index.

Secondly, it is important to emphasize that UCO is a highly leveraged security. The fund is designed to offer a speculator 2X leverage to the price of the index.

For speculators that are uncomfortable using crude oil futures yet comfortable with the risks of leverage, UCO is a suitable option. The expense ratio is 0.95% in line with most commodity tracking funds.

Oil Supplies Remain Low

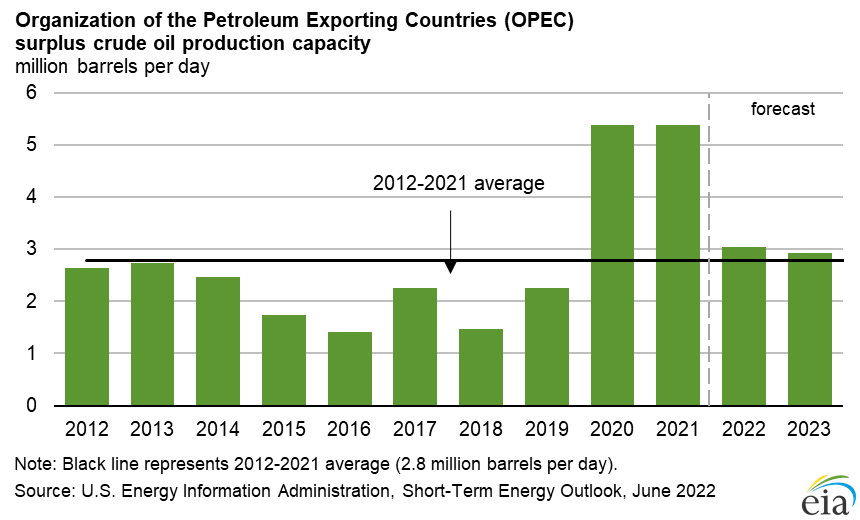

The main reason for my bullish oil thesis is that I do not see any meaningful increases to supply. OPEC+ production is currently at 29.2 million barrels per day. Production is up 3.1 million barrels over 2021. However, supply is still 0.6 million barrels lower than 2020.

EIA

U.S. production is still 0.6 million barrels per day less than pre-pandemic production. Despite the surging prices, it has been extremely difficult for the major oil producers to meaningfully increase production.

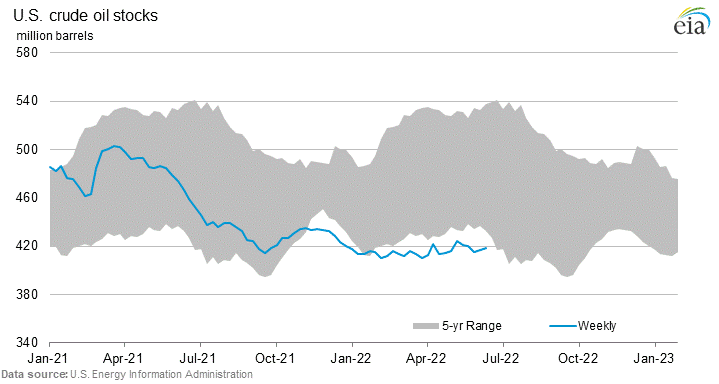

U.S. crude oil supplies remain woefully undersupplied.

EIA

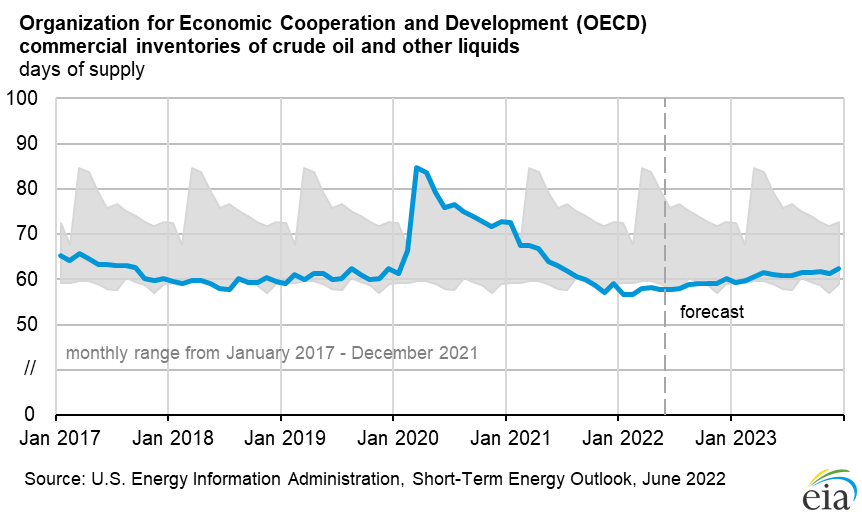

Similarly, global inventories of crude oil are exceptionally tight.

EIA

Despite the fact that crude oil prices have surged over the last 18 months, there has been little supply response. I think this is indicative of tight supplies in the short to medium term.

Buffett Buys More Oil and Gas Stocks

Warren Buffett is arguably the greatest value investor over the last fifty years. Interestingly, Buffett has recently been scooping up shares of oil and gas stocks. With the S&P down 22% year to date, most market commentators thought that Buffett would swoop in on some sectors of the market that have been battered such some consumer discretionary stocks. In actuality, the only major purchases that Buffett made during the market turmoil of 2022 have been oil and gas stocks.

According to Berkshire Hathaway’s (BRK.B) latest 13F filing, Buffett has bought $26 Billion of Chevron (CVX) and $13 Billion of Occidental Petroleum (OXY). Berkshire now owns 24% of the outstanding shares of OXY and 8% of the outstanding shares of CVX. Both Chevron and Occidental are now top 6 holdings in the Berkshire portfolio. Clearly, Buffett still sees some value in the energy sector even though energy stocks have vastly outperformed the broader markets over the last year.

Bear Case For Oil

The bear case for oil is that a recession will cause demand destruction or that OPEC+ will increase supply over the coming months.

Today, the American Petroleum Institute released the weekly crude oil draw figures. The API reported a build of 5.6 million barrels while analysts predicted a draw of 1.4 million barrels. However, since 2021, U.S. crude inventories have fallen by over 68 million barrels. It should be noted that the Biden White House has plans to release 90 million barrels of oil from the Strategic Petroleum Reserve between now and August. The White House is desperately trying to lower the price of gasoline as it is such a hot button topic in an election year.

The bear thesis is that the U.S. economy is teetering on the brink of recession. Almost every investment bank is now forecasting a recession for late 2022 or 2023. Yesterday, Nomura put out a research note that they now expect a recession in late 2022. In the Nomura research note, the economists stated: “With rapidly slowing growth momentum and a Fed committed to restoring price stability, we believe a mild recession starting in Q4 is now more likely than not.”

On Wednesday, Fed Chairman Jay Powell even noted that recession risks are rising amid rate hikes. In testimony to the Senate Banking Committee, Powell said, “I don’t see the likelihood of a recession as particularly elevated right now.” However, he tempered that statement by noting that “no one is good at forecasting recessions very far out.”

The risks of recession are rising and speculators are worried about demand destruction. Many speculators are scarred from 2008 where crude oil prices fell 68% in a matter of months as a deep recession stunted demand.

Conclusion

The recent slump in crude oil prices are most likely due to recession fears mixed with some leveraged speculators being washed out of the market. I think that the supply situation is far more important than any downside risks to demand. It is difficult for the world oil producers to meaningfully increase supply in the next 12-18 months.

I think there is a low risk entry point between $90-100 based on long term supply fundamentals. This equates to a good entry point in the $35-40 for the UCO trading vehicle.

Be the first to comment