SDI Productions/E+ via Getty Images

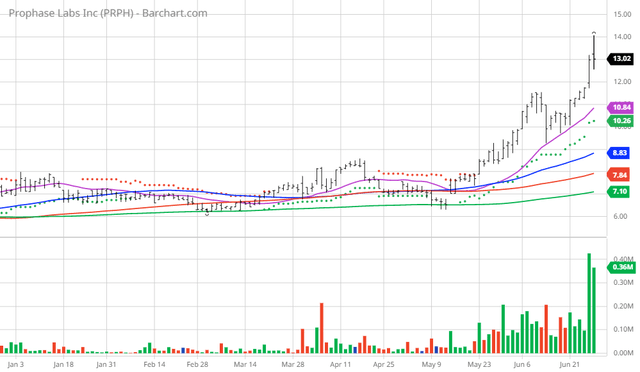

The Chart of the Day belongs to the healthcare company ProPhase Labs (PRPH). I found the stock by sorting Barchart’s Top Stocks to Own list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 5/23 the stock gained 52.42%.

ProPhase Labs, Inc. engages in the research, development, manufacture, distribution, marketing, and sale of over the counter (OTC) consumer healthcare products and dietary supplements in the United States. The company operates in two segments, Diagnostic Services and Consumer Products. It offers a range of OTC dietary supplements, including Legendz XL for male sexual health; and Triple Edge XL, an energy and stamina booster. The company also provides contract manufacturing services, such as product development, pre-commercialization, production, warehousing, and distribution; SARS-CoV-2 (COVID-19) and COVID-19 viral mutation polymerase chain reaction tests through saliva and nasal swab methods; and other respiratory pathogen panel molecular testing services, as well as personal genomics products and services. It serves national chain drug, internet-based, and various regional retailers. The company was formerly known as The Quigley Corporation. ProPhase Labs, Inc. was founded in 1989 and is headquartered in Garden City, New York.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals but increasing

- 152.50+ Weighted Alpha

- 93.44% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 27.18% in the last month

- Relative Strength Index 53.07%

- Technical support level at 12.07

- Recently traded at $13.23 with 50-day moving average of 8.83

Fundamental factors:

- Market Cap $201 million

- P/E 15.53

- Revenue expected to grow 15.00% this year

- Earnings estimated to increase 53.60% this year

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts give 1 strong buy and 1 buy opinions on the stock

- Analysts have price targets as high as 14.50

- The individual investors following the stock on Seeking Alpha voted 6 to 0 for the stock to beat the market

- 1,650 investors are monitoring the stock on Seeking Alpha

Be the first to comment