Thomas Barwick

Summary

I recommend a buy rating on PropertyGuru Group (NYSE:NYSE:PGRU). It is worth $7.32, representing 24% upside from the date of writing. This opportunity exists as the market does not believe PGRU can hit their FY25e guidance and also because of the weak macro environment (e.g., rising rates). I believe the market is wrong, and PGRU can hit guidance based on the several industry tailwinds it enjoys and the structural levers it has that could expand TAM and drive monetization rates.

Company overview

PGRU is Southeast Asia’s leading Property Technology (PropTech) company. It’s a conduit between those looking to buy and sell homes. Its services include an online real estate marketplace that connects buyers, sellers, renters, and landlords. It also has a mortgage brokerage and a data-providing company that serves consumers, real estate agents, software developers, and financial institutions.

The marketplace is PGRU’s main profit driver where it offers a web-based real estate classifieds listing portal. Property owners and renters can use the website to look for rental units and new construction, while real estate agents and builders can use it to advertise their wares.

PGRU makes money from the following sources: annual subscription fees from real estate agents in Singapore, Malaysia, Thailand, and Indonesia; listing fees in Vietnam; fees for optional features and add-ons in all markets; digital advertising fees from developers; and the sale of SAAS for process automation solutions.

TAM with strong secular tailwinds

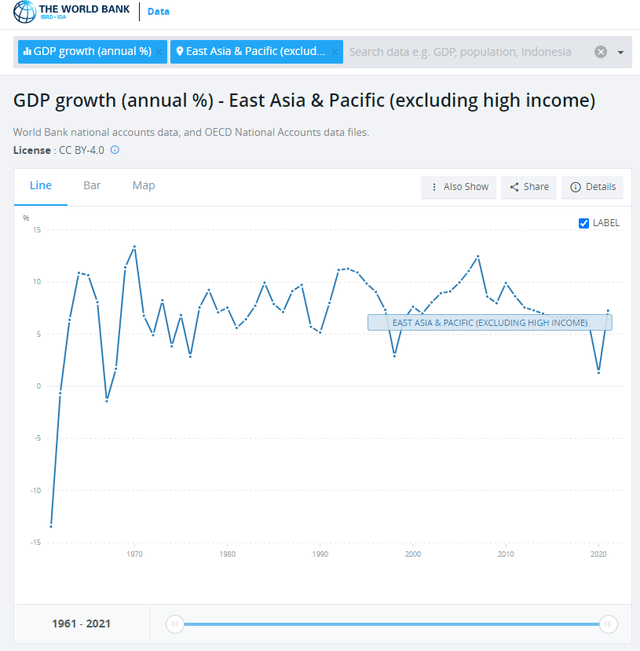

PGRU’s core markets include Singapore, Vietnam, Malaysia, Thailand, and Indonesia, all of which combined have a population of 478 million and an economy worth $2.5 trillion as of CY20 based on World bank’s data. There is a large current addressable market for PGRU to continue penetrating and selling more services in, as the region is experiencing high GDP growth in addition to having a large current GDP.

World Bank

The growth of the real estate market in the region is anticipated to be bolstered by a number of secular tailwinds. The most important is the proliferation of internet access, especially via mobile devices. As of today, it is estimated that 63% of the global population have access to the internet, with the highest penetration seen in the developed markets (>90%), while Southeast Asia has relatively lower penetration rates (excluding Malaysia and Singapore). The disparity, however, is predicted to shrink (source 1, 2) as the demand for internet service grows. Widespread use of the internet is important because it makes it possible to use many digital tools that help businesses be more productive and efficient.

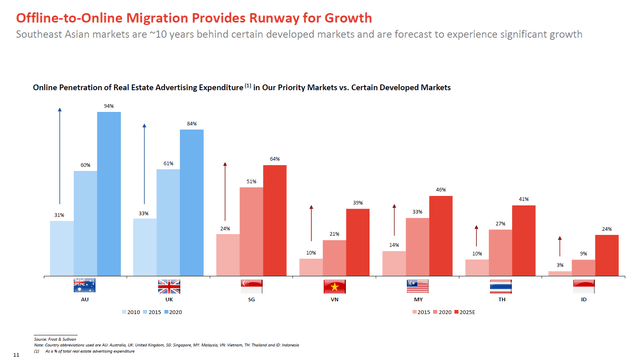

One example of a digital tool that has boosted the efficacy of the real estate market is the property portal. Developed markets have provided us with real-world examples of successful adoption. Such websites include Zillow (ZG) in the United States, Rightmove in the United Kingdom, and asrealestate.com.au in Australia. These real estate websites have replaced more traditional forms of advertising, such as newspapers and magazines. I think we will see a similar pattern emerge in Southeast Asia as merchants there try to close the information gap and boost productivity. Even though online advertising for real estate in Southeast Asian markets is just getting started, a similar trend is likely to grow over time.

PGRU Jan 22 Investor Day

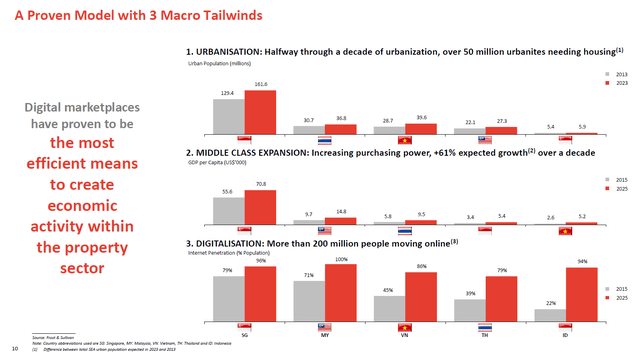

The next industry growth tailwind is urbanization. Again, we know that urban population growth drives housing demand in developed markets. While urbanization is already high in developed markets, ~85% in Australia, the United Kingdom, and the United States based on PRGU F-4), it is not the case in Southeast Asia (except Singapore). Urbanization rates are much lower, ranging from 20% to 53%, but are expected to rise (source 1, 2) in the coming years. Increases in individual or household wealth (due to the economic growth) would result in a demand for a higher standard of living (i.e., moving from rural areas to urban cities). This shift implies an increase in housing demand and the need for buyers and sellers to find each other more efficiently.

PGRU Jan 22 Investor Day

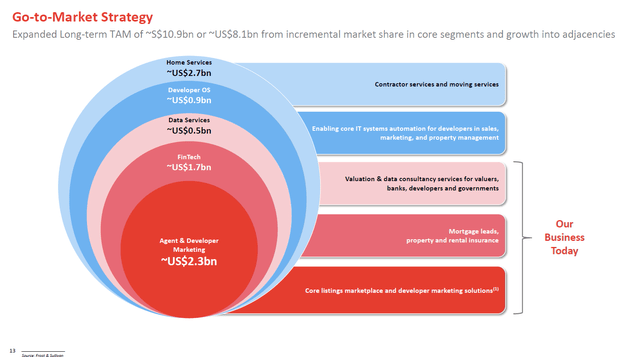

As previously stated, the combination of rising internet adoption and urbanization bodes well for PGRU to continue growing and capitalizing on this tailwind. Aside from industry tailwinds, PGRU can increase its TAM and monetization through structural levers. For example, PGRU could diversify its revenue streams by providing other services such as mortgage and insurance brokerage, anonymous property data to third parties, renovation assistance, and so on. The overall goal is to broaden the TAM and reach as many consumer touchpoints as possible, increasing PGRU’s ability to monetize and grow revenues. The total TAM indicated by PGRU is $8.1 billion, and I believe there is a clear path to it penetrating all of them.

PGRU Jan 22 Investor Day

Market leader with strong top-of-mind share and network effects

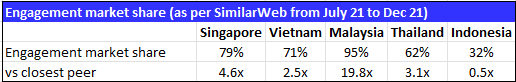

Amazon’s (AMZN) success in online retailing in the United States and Just Eat Takeaway (OTCPK:JTKWY) in the Netherlands and Germany illustrates the winner-take-all dynamics inherent in marketplace businesses. To succeed in a marketplace business, the most important thing is to be at the top of your customers’ minds, so it’s crucial to promote strong levels of interaction and recognition of your brand. In Singapore, Vietnam, Malaysia, and Thailand, PGRU digital property marketplaces command the lion’s share of the engagement market.

Normad Capital

Google Analytics data shows that between July and December of 2021, 82% of all traffic to PGRU’s platforms came from organic traffic (PGRU F-4). This shows that the company’s brands are well-known and trusted in the Southeast Asian real estate market.

The second most important fact about marketplace restaurants to keep in mind is that the dominant players typically have powerful network effects, making it hard for the minor players to grow to a competitive size. Because of the positive feedback loop created by the high volume of buyers and sellers on its online marketplace, PGRU is able to expand its operations and strengthen its market position as a result of network effects. For example, in developed markets like Australia and the United Kingdom, for example, the online property advertising industry has consolidated into two or three major companies that share a significant majority of online property advertising revenue, so this trend is in line with what Frost & Sullivan has observed.

Nature of the business model ensures resiliency through property cycles

Due to their annual subscription model, PGRU is protected from market downturns, and during weak property market periods, agents are likely to spend more on discretionary products like exposure boosters in an effort to increase the visibility of their listings. This is not a deal breaker, but I do think investors will appreciate the resilience in the event of a downturn.

Valuation

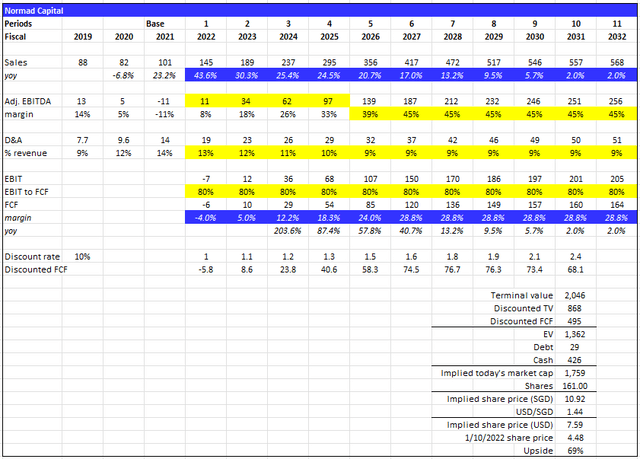

At the current stock price of USD4.48 and 161.2 million shares, the market cap is ~$722 million. I believe PGRU is worth USD7.59 representing 69% upside from the date of writing. I believe PGRU will make $557 million in sales and $251 million in EBITDA in FY31. This will be driven by high sales growth in the mid-terms based on management’s guidance and margin expansion.

Assumptions:

- Sales: to grow according to management’s guidance, which was reaffirmed in 2Q22 earnings, until FY25e and slowly decline to 2% (long-term inflation rate), supported by continuous penetration in the emerging markets and expansion of TAM

- Adj. EBITDA: to follow management’s guidance until FY25e and progress to Zillow’s long-term guidance of 45% adj. EBITDA margins given both of them have similar business model

- Valuation: Terminal growth rate of 2% (long-term inflation rate)

- Discount rate of 10%. This is a debatable figure for investors, but I personally require a 10% return per year

Normad Capital

Risk

Competitive market given the vast number of opportunities for growth

Considering the lucrative nature of the markets in which PGRU operates, new entrants will likely emerge regularly with the goal of overtaking PGRU and seizing its market share, since for most marketplace businesses, the market leader takes all. In addition to competing with traditional media for a share of advertisers’ total marketing budgets, PGRU runs the risk of delayed adoption. The level of inertia required to change consumer habits, for instance, means that Southeast Asia’s current attempt to implement a digital property agency business model may fail or take longer to implement than anticipated.

Low market presence in growth markets

PGRU has had a presence in both Thailand and Indonesia since 2011. Neither market, however, accounted for more than 8% of sales in FY21. Indonesia is home to close to 40% of Southeast Asia’s population and has the biggest market opportunity in the region. Because of this, I find the market’s small contribution to revenue to be a bit worrying because it shows that PGRU isn’t very good at capturing and growing market share.

Exposure to emerging markets’ forex

PGRU’s earnings are denominated in the currencies of the markets in which it participates. PGRU’s profitability and other financial results may be affected by currency exchange rate movements due to the fact that its product prices vary across markets and the company reports its performance in SGD. An increase in the value of the dollar means that the currencies of emerging markets will weaken against it, which is bad news for PGRU.

Conclusion

PGRU is undervalued at its current share price as of the date of this writing. The business is set to enjoy multiple industry tailwinds and has structural levers it can pull to expand its TAM and monetization rate. The market clearly does not give credit to management guidance given how the share price has performed, but the recent reaffirmation of FY22 guidance tells me that management is confident, and I believe they can hit their FY25e guidance.

Be the first to comment