jkitan

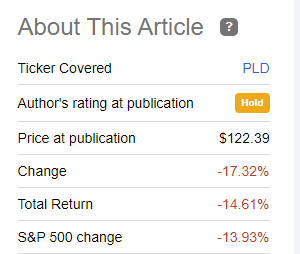

When we last covered Prologis Inc. (NYSE:PLD), we gave it a “meh” as the valuation was just too rich for our taste. We hesitated to put an outright “sell”, as the strong fundamentals balanced the rich valuation. Specifically, we identified one major risk factor that could send this hurtling down.

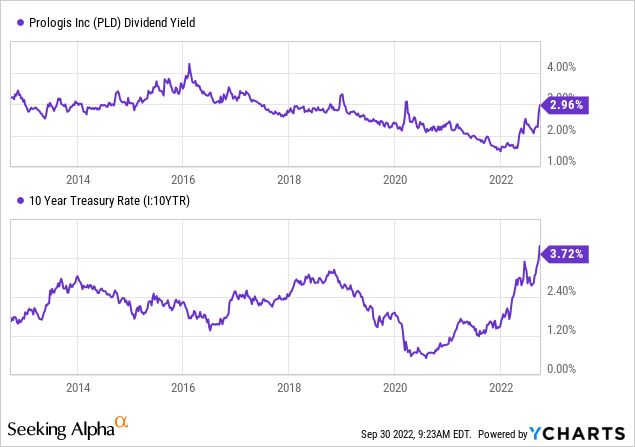

The first of those is valuation compression. The last few years have marked a steady valuation expansion and if that reverses investors can have a difficult time. Currently, PLD yields just 31 basis points over the 10-year Treasury.

If we run into a scenario where the 10-year yields rise 100 basis points and investors also demand 150 basis points in dividend yield over the 10-year rate, we could see big price declines for the REIT. While 180 basis points over the 10-year yield may sound high, do note that we have reached those levels, five times in the last decade. What might make this episode more painful is if it’s accompanied by rising rates.

Source: What Could Derail The Exceptional Returns

Our forecast for higher rates generally got giggles and no one believed that the Federal Reserve could or would, raise interest rates. Despite flying higher from that point, the risk did play out and the stock is 17% lower than what it was 15 months ago.

Seeking Alpha

We examine the recent results and see if we can give this an upgrade.

Q2-2022

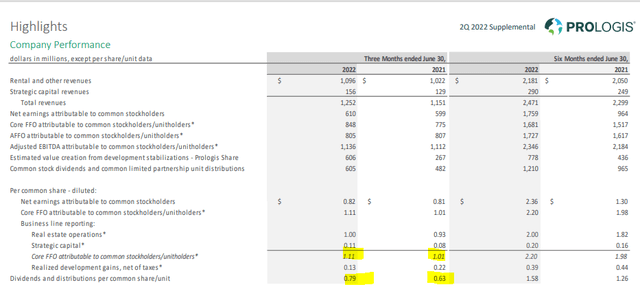

Last quarter’s results were quite strong and core funds from operations (FFO) increased by 10% year over year.

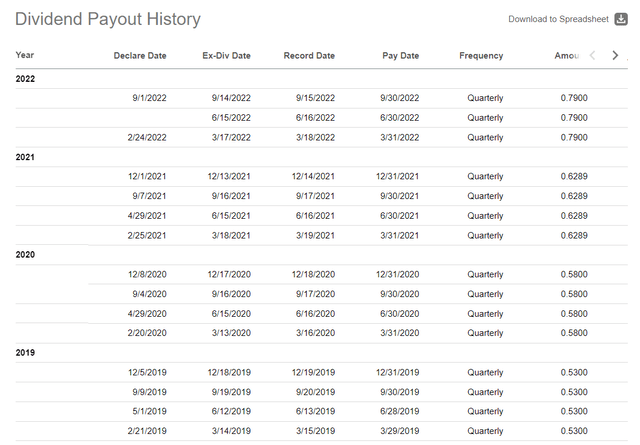

Prologis increased its dividend at the beginning of 2022 and the recent annual jumps have been spectacular.

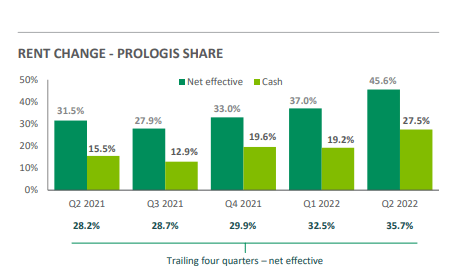

The secret to those jumps has been the ‘net effective” and the “cash” rent changes. Q2-2022 saw this cash rent actually move up by 27.5%.

Seeking Alpha

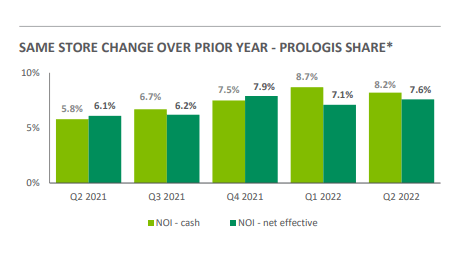

Those are rather spectacular numbers and shows the tightness in the industrial space market. The trailing 4 quarter net effective numbers were quite strong as well, coming in at 35.7%. While those numbers were hard to find any fault with, keep in mind that Prologis is a property giant with leases on its properties. That means that rent changes on expiring leases tend to move up overall numbers slowly. This is reflected in the same store net operating income (NOI) numbers.

Prologis Q2-2022 Presentation

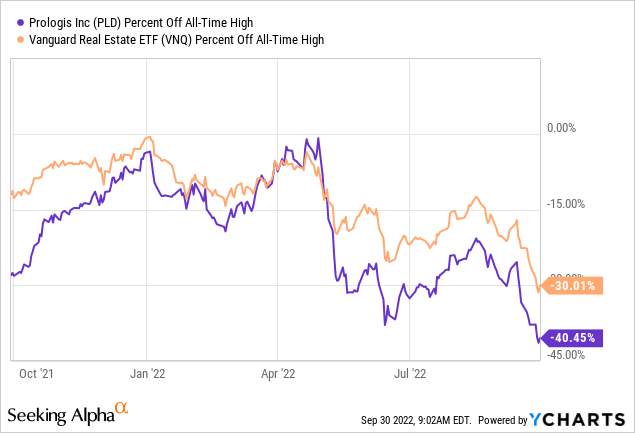

7-8% NOI growth is nothing to scoff at but you can see how that number trails the two forms of rent given. Overall, the recent results have been strong and consistent and there was nothing there that remotely dictated the chart below.

Outlook

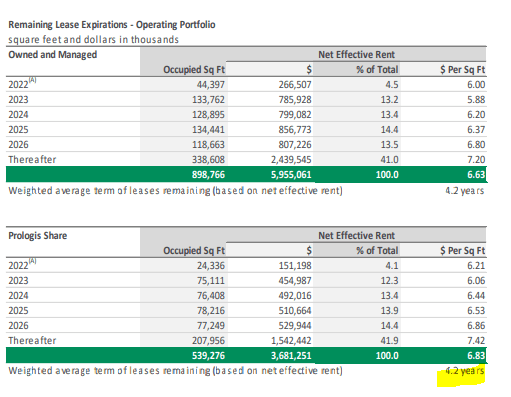

Prologis has very short-term leases and that means that those cash rent spreads will flow very quickly through the entire portfolio.

Prologis Q2-2022 Presentation

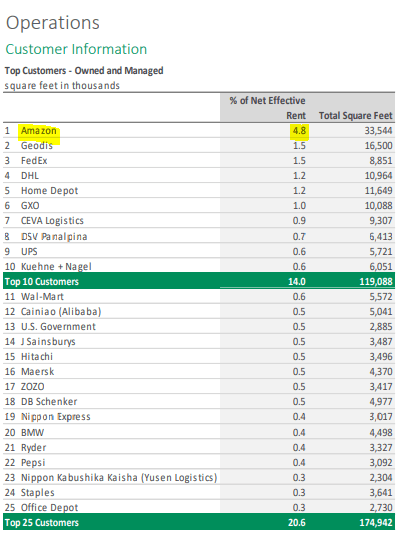

Of course, the underlying assumption there is that the market remains strong enough for this pass through. On that front, the news about the economy in general and from Amazon Inc. (AMZN) in particular, has riled investor nerves. AMZN acknowledged that the “if we build it, they will come” strategy has not exactly panned out and it was aiming to sublet 10-30 million square feet of industrial space. It was also looking to renegotiate rents where feasible with landlords. Like most other industrial REITs, AMZN is a key customer for Prologis.

Prologis Q2-2022 Presentation

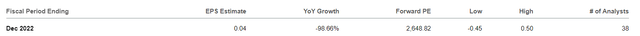

AMZN is obviously feeling the heat as earnings are set to collapse by a shade under 99% and all the dreams of this powerhouse growing into its valuation have gotten squashed.

The company likely has some clout here with landlords and yes there may the occasional space that it might be able to force rents lower. Subletting might drive some minor pressure on overall rents in a few markets. That said, with close to 98% overall occupancy and a Class A portfolio, we don’t see this a material factor that one should worry about in relation to Prologis.

If there was a factor that investors should worry about, it is the risk-free rate. That valuation compression and a demand for higher yield is in play for Prologis and we don’t think it is done. In 2016, Prologis bottomed at a 4% plus dividend yield and back then the 10 Year Treasury rate was just 2.6%.

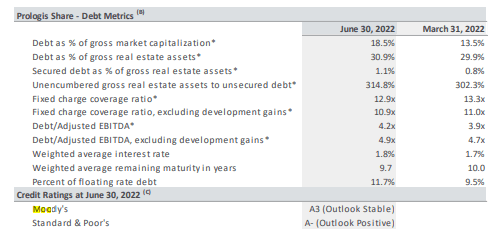

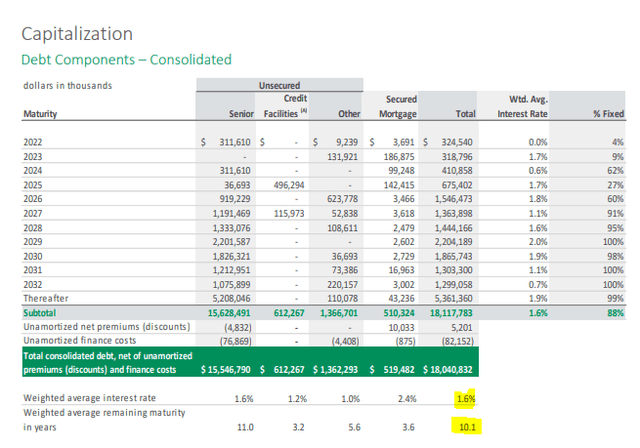

Prologis is delivering faster rent growth today but both 1 and 10 Year Treasury rates are in the 4% zone. We think at a minimum, we will see this 4% dividend yield once more. Now, this could happen in 1-2 years as Prologis rapidly raises the dividend to the $4.00 mark. Prologis could deliver positive total returns from here in that scenario. Consensus NAV estimates are also around $135 and it is very rare to see Prologis trade at this deep of a NAV discount. The company also has a rather exceptional balance sheet. Moody’s (MCO) and Standard & Poor’s can find nothing wrong with the company and only about 12% of the debt is floating rate.

Prologis Q2-2022 Presentation

The weighted average interest rate is exceptionally low and the weighted maturity of the consolidated portfolio is near 10 years.

Our point here is that if there was one company designed to withstand a full-scale front assault of the Federal reserve, it is Prologis.

Valuation & Verdict

Prologis has pulled back to about 20X core FFO. That is certainly cheap compared to the nosebleed levels seen at the beginning of 2022 where it was close to twice this number. But let’s not forget the example above, where Prologis yielded 4% in 2016 and traded at just 16X core FFO. NAV estimates also rely on rather low cap rates, at it remains to be seen how well these hold up in the face of higher interest rates. A good chunk (10-15%) of core FFO also comes from development and disposition gains, something that may prove difficult in the near future.

The company is one of the best in the space though, and they have taken full advantage of the period of ultra-low interest rates. So far there has been a zero pullback in the tone and it continues to deliver from strength to strength. We think it has visibility to deliver here but believe the “risk-off” but our predicted valuation compression has a little bit more to go. We think it can trade at 16-17X Core FFO multiples in the near future and are maintaining the Hold rating. We are on the lookout to sell covered calls or cash secured puts as we are getting quite close to an attractive buy point.

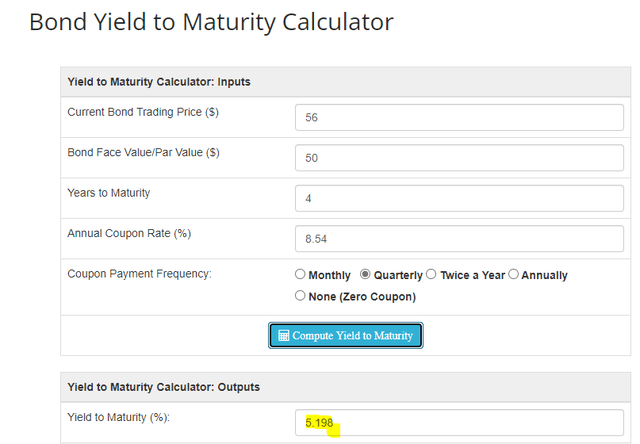

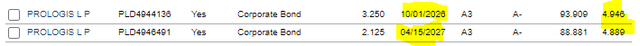

The other publicly traded security Prologis, Inc. 8.54% PFD SR Q (OTCQB:PLDGP) has a low return standpoint as its yield to call in October 2026, (which appears guaranteed) is about 5.2%.

This actually does beat its bonds and that might be something for consideration for investors looking for a low-risk bond.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment