Teamjackson

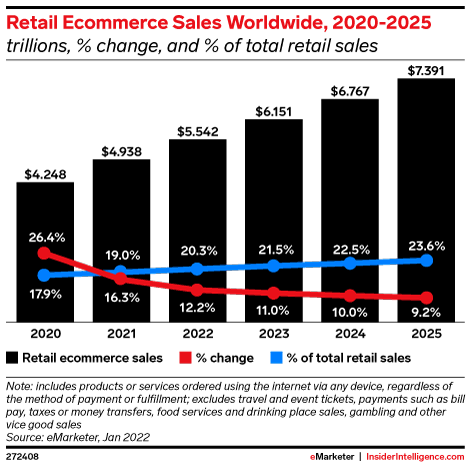

Global Ecommerce sales are forecasted to be worth a staggering $5.5 trillion globally in 2022. The trend of online shopping accelerated (26% growth) during 2020 and is forecasted to continue to grow by an ~10% CAGR, reaching over $7 trillion by 2025. Also, Online Sales now make up over 20% of total retail sales, and this is forecasted to reach ~24% by 2025.

Ecommerce Sales (EMarketer)

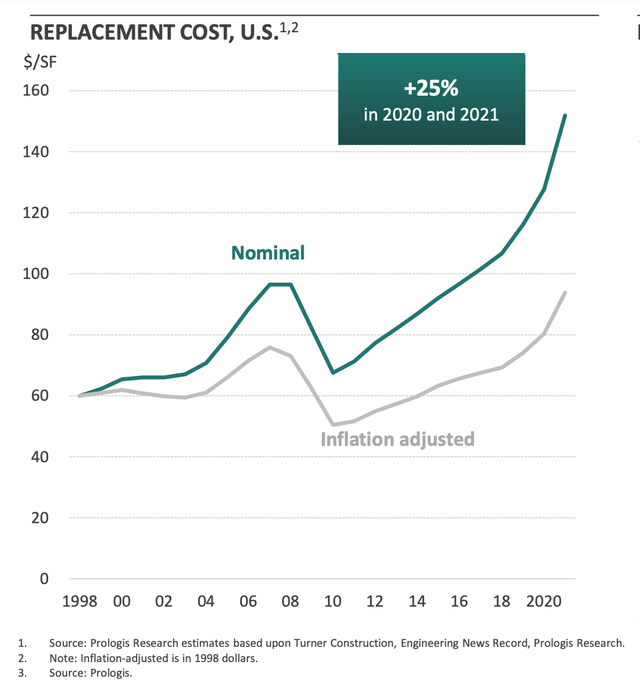

In addition, rising material and labor Inflation means replacement costs for warehouses are 25% higher. This means existing players in the industry have a significant barrier to entry.

Warehouse Replacement Costs (Prologis)

Prologis, Inc. (NYSE:PLD) is the largest industrial REIT in the world and a perfect way to play the two aforementioned trends. They have a ginormous 1 billion square foot of warehouses and distribution centers across 19 countries. With an envious list of tenants that includes the largest Amazon (AMZN), followed by Home Depot (HD) and FedEx (FDX), this real estate investment trust (“REIT”) is truly the “backbone of the logistics industry.”

The share price has recently nosedived by ~27% since the highs in April 2022. This was caused by a few reasons, the first being a sector slowdown caused by Recession forecasts. The second was PLD’s planned acquisition of Duke Realty (DRE) which spooked Wall Street analysts due to the high valuation agreed. Either way, this decline in share price has created a rare opportunity where the stock is undervalued relative to its Net Asset Value.

Let’s dive into further details of the acquisition, Business Model, Financials and Valuation to see why this stock “delivers.”

What Is Duke Realty?

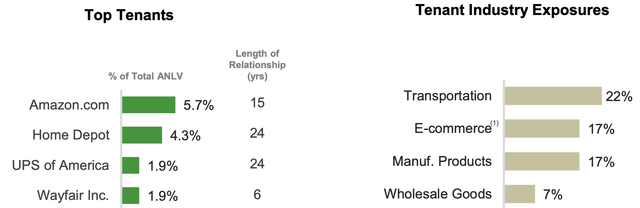

Duke Realty is a REIT that specializes in Industrial Logistics properties. It owns over 160 million square feet of warehouses and distribution centers across 19 U.S. markets. The company has an envious list of stable blue chip tenants similar to Prologis. These include Amazon which makes up 5.7% of annualized Net Lease Value (ANLV), followed by Home Depot (4.3%), UPS (1.9%), Wayfair (1.9%) and even Federal Government Agencies (0.7%). This diverse and elite list of tenants has a 98% occupancy rate, which is great to see and offers likely cash flow stability for investors.

Duke Realty (Investor Presentation 2022)

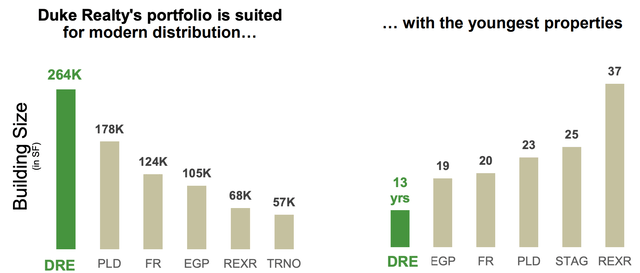

Diving deeper into the details, we can see the REIT has some of the largest and youngest properties relative to industry peers, with an average property age of just 13 years old.

Duke Realty (Investor presentation 2022)

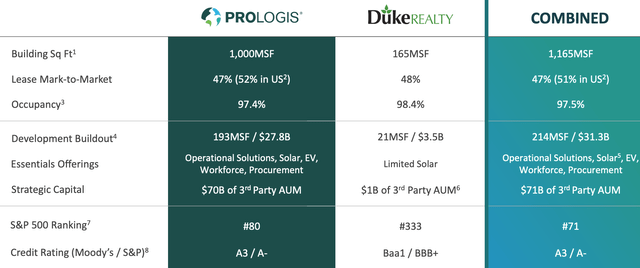

Merger Synergies

Prologis has announced a merger with Duke Realty for $26 billion in cash and stock. Although Wall Street has shunned this merger, you can’t argue with the “Strategic Fit” of these two industrial REITs. Prologis has also justified the planned merger with a variety of other benefits. These include an increase in square footage (obviously) which will bring the total to 1.165 billion square feet. The focus of properties on the East Coast will increase diversification for Prologis as a whole, which is a positive. In addition, Duke’s higher occupancy (~98% vs 97%) rate will help to increase the total by 0.1%. As a bonus, the better credit rating of Prologis may also help to improve credit interest rates for Duke Realty in the future.

Duke Realty and Prologis (Merger Presentation 2022)

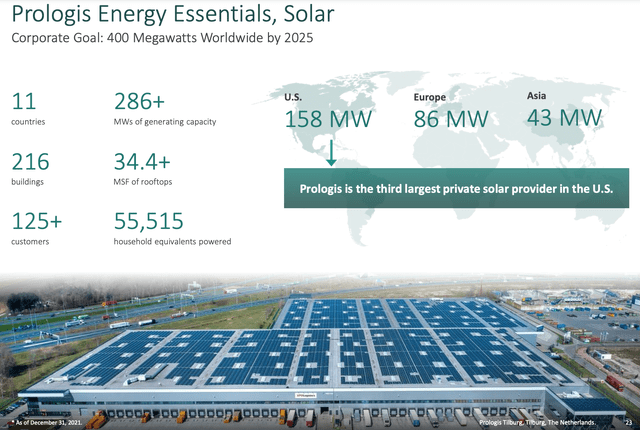

Solar Panel Surprise

A real special area where this merger can really benefit is through the expansion of PLD’s Solar Panels and EV charging solutions to Duke’s Properties. Prologis realized a long time ago that they have over 1 billion square feet of warehouse space with simple bare metal roofs. However, by installing Solar Panels on these roofs, they can leverage their properties for energy generation. This has resulted in Prologis becoming the third-largest private solar provider in the U.S., which is a big deal. In addition, this helps enterprise clients such as Amazon to become more ESG compliant. The Biden Administration wants solar power to make up 40% of U.S. electricity generation by 2035, from 3% today. PLD also has plans to enable electric vehicle (“EV”) charging at logistics facilities. Thus, the REIT is poised to benefit from both the growth in e-commerce and the renewable energy industry.

Prologis solar (Global CEO presentation )

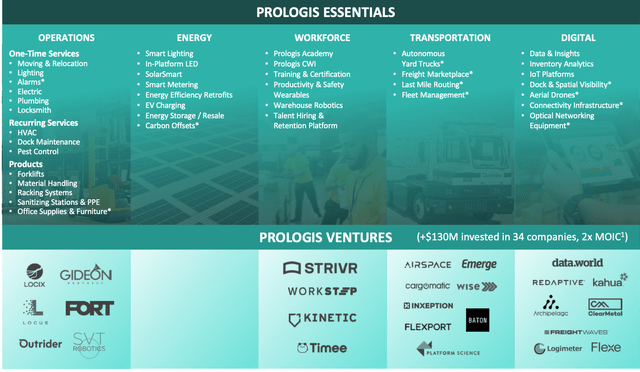

Prologis also has an “Essentials” segment which offers many services to its clients. These include operations services from moving and relocation to office supplies and furniture. In addition, Workforce services to help with talent hiring and retention. This has historically been a major issue for warehouse operators, as 73% stated they can’t find enough labor, according to a report by Instawork.

Prologis Essentials (CEO presentation)

Prologis also has a Venture Capital Arm which has invested $130 million in 34 different companies and offers bonus “optionality” in the stock for the future.

Financials And Valuation

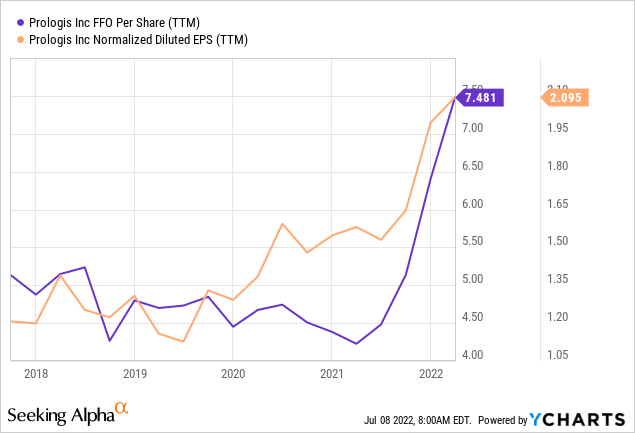

Prologis produced strong earnings for the first quarter of 2022. Net Earnings per diluted share were $1.54, up from $0.49 year-over-year, which beat analyst expectations by $0.96. Core Funds from operations per diluted share also increased to $1.09, up from $0.97 in the same quarter last year.

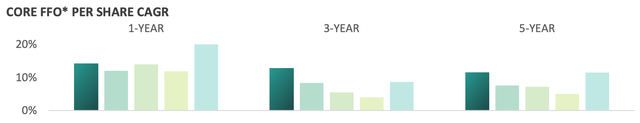

The company’s Funds from operations per share (FFO) (Dark Green bar below) has increased at over a 10% CAGR over the past 5 years. This has surpassed most other national logistics REITs (light green) over the period, which definitely means PLD is a high growth REIT.

FFO Prologis (CEO Presentation) Chart Legend (PLD)

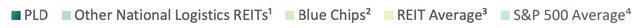

PLH has also been growing its dividend strong and at a faster CAGR than industry peers over the past 1, 3 and 5 years. It has a 5-year Dividend CAGR of 10.53% and 9 consecutive years of Dividend Growth.

Dividend Prologis (PLD)

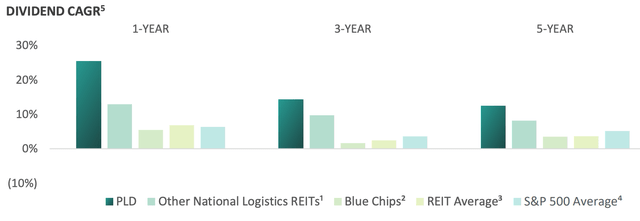

PLD currently pays a healthy 2.58% dividend, with a 54% payout ratio. The Seeking Alpha dividend grades highlight an A for Dividend Safety, A- for Growth and A for consistency. The only slight discrepancy is the yield of 2.58%, which is lower than the Real Estate industry average.

Dividend Rating (Seeking Alpha Financials)

PLD has a substantial amount of debt on its balance sheet, $18.4 billion to be exact, which is an increase of 10% year over year. This is a high amount of debt, although not a surprise for the REIT industry. The company has $1.9 billion on its balance sheet at the time of writing and strong free cash flow ($3.4B) to manage debt payments.

In order to value this REIT, I will look at one simple metric: the Net Asset Value per share. In this case, the consensus Net Asset Value dividend by the share price mean is $145/share, which is 15% higher than where the stock is trading at the time of writing ~$122. Thus, it is undervalued.

Risks

High Valuation Relative To Sector

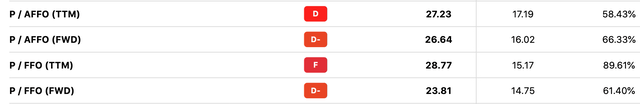

The Price to Funds from operations (P/FFO) does show the REIT is priced at a P/AFFO of 27. This is 58% higher than the sector median and thus could be a risk. However, as PLD has high quality tenants (Amazon) with large industrial scale. This should impact the valuation in a positive manner.

Recession/Tenants Not Paying

The high inflation and rising interest rate environment has led to analysts predicted a “shallow but long” recession, which is expected to start in Q422. For any real estate company, tough business can lead to tenants falling on tough times. In this case, the company has a 97% occupancy rate and 75% retention rate with many high quality tenants. Thus, I don’t believe this is a major risk.

Final Thoughts

Prologis is the largest industrial REIT in the world and a true backbone of the logistics industry. They have an elite list of well-established tenants and global diversification, which is rare in the industry. The recently planned acquisition of Duke Realty offers many synergies. In addition, the company’s Solar Panel and Operations initiatives offer many growth avenues for the future. The 2.58% dividend isn’t the highest in the industry, but future growth avenues and tenant means this is likely to be stable. The stock is currently undervalued relative to its Net Asset Value, and thus this is poised to “deliver” for investors long term.

Be the first to comment