NicoElNino/iStock via Getty Images

There is progress at Synchronoss Technologies Inc. (NASDAQ:SNCR), but investors aren’t buying. Quite the contrary. Two of the company’s three segments are shrinking, but (by far) the largest one, Cloud, is growing decently. That growth is expected to continue as existing carrier clients onboard more customers and a number of recent contract wins start this process in the coming year.

In the meantime, the company has gotten rid of the $278.5M death spiral preferred stock that paid a 14.5% dividend a good half a year ago. That has greatly reduced interest cost on top of other cost-cutting, so the company can now look forward to getting back into the black.

FinViz

Cloud

Cloud storage is benefitting from a number of trends, such as:

- 5G, which opens up many new use cases and storage needs

- Bundling services, often including cloud storage

- FWA (fixed-wireless access) opens up the enterprise and home internet market for carriers and is opening many more connected device types, which need storage for the data they produce

- Security, where Synchronoss is partnering with carriers and the latter are uniquely positioned as the trusted end-to-end security solution for consumers.

The company’s main customer is Verizon Communications (VZ), which has been mainly responsible for an 18% increase in subscriptions and a 15% revenue rise in Q4. Verizon announced its 5G Home Plus service offering in Q3, including unlimited Verizon cloud storage.

But things are starting to increase at AT&T as well and then they’ll have the introduction of recent wins like Kitamura (Q1), Telkomsel, and Telkom Sigma in Q2.

There are a potential 400M subscribers for the company to go after already. Half of these are from Verizon and AT&T with 170M potential subscribers from Telkomsel.

SNCR is also working on innovations like private folders, shared storage, AI-based personalization (like highlights and flashbacks), and security enhancements.

RCS Messaging

Despite some new license sales, revenue is shrinking. They have 25M subscribers at Japanese carriers but plan to launch with Verizon in the US later this year as the CCMI US carrier initiative fell apart, as we reported last time.

The company will concentrate on solutions that generate profitable cash flow, basically treating the segment as a cash cow. RCS is a considerable disappointment so far, despite its strong position in Japan.

Digital Business

The company had multimillion-dollar contract wins for financial analytics through the Sage partnership and another with Quasarone through the Bricsys partnership for the Spatial product lines.

But the news here is the sale of their Digital Experience Platform and Activation Solutions to iQmetrix for $14M ($11M upfront), which was good for some $20M in yearly revenue (albeit shrinking).

Finances

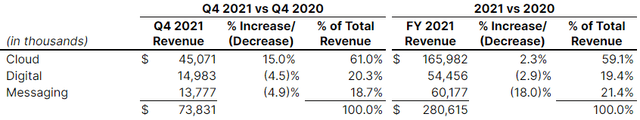

FY 2021 revenue declined 3.8% as a result of the decline in the Advanced Messaging business from the CCMI nonrecurring license sales and professional services revenue.

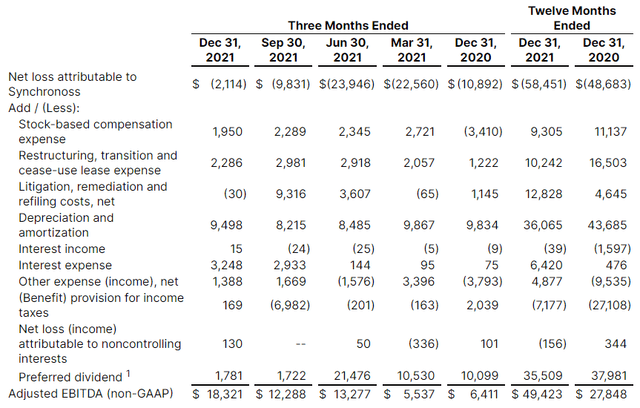

Recurring revenue was 84% of the total in Q4, up from 78% a year ago. For the full year ended December 31, 2021, the net loss was $58.5M.

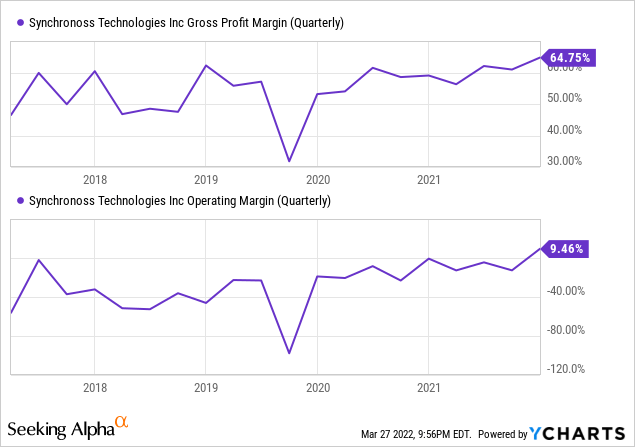

Margins

These are GAAP figures. The gross margin was 64.8% in Q4 due to a favorable mix shift (license sales in both Cloud and RCM segments, as well as a shift to Cloud revenue).

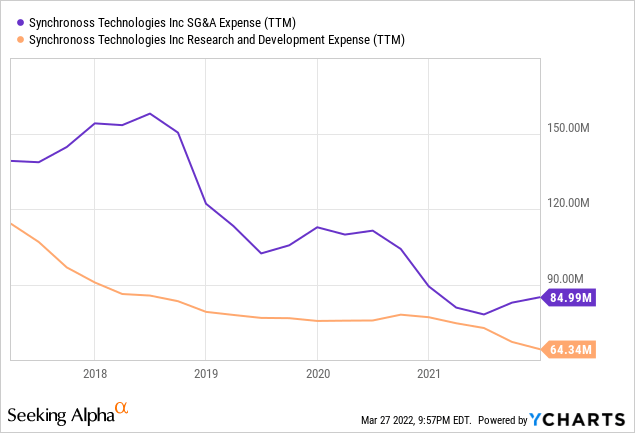

The company managed an operational profit of $4.6M in Q4 on cost savings, which is quite an improvement given that for the year as a whole, operations still produced a significant loss of $19M. The cost savings are pretty impressive:

FY 2021 adjusted EBITDA was up 186% to $18.3M from $6.4M in the prior-year period while net loss was $58.5M. That’s quite a gap, so it’s worth looking into:

With the preferred dividend largely gone the gap is getting to more normal proportions. Investors might remember the company finally got rid of their death-spiral preferred shares that were paying 14.5% dividend mid last year. They were replaced by:

Guidance

From the company’s earnings PR:

For the fiscal year ending December 31, 2022, the Company expects GAAP revenue to range between $260.0 million and $275.0 million. The comparable 2021 revenue is $264.0 million after adjusting for the sale of the Company’s DXP and Activation assets over the last nine months of 2021. The net contribution to GAAP revenue from non-cash deferred revenue is expected to be approximately $10 million less in 2022 than it was in 2021. Revenue in the first quarter is expected to be at a similar level to 2021 performance.

The Company expects adjusted EBITDA to range between $40.0 million and $50.0 million.

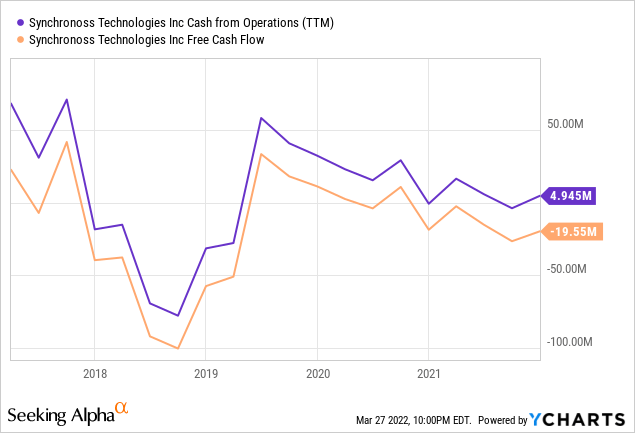

Cash

Q4 experienced a negative free cash flow of $6.7M. Cash and cash equivalents were $31.5M at the end of Q4, compared to $24.1M at the end of Q3. The company issued $16M of senior notes in Q4. There is a potential $32M of tax refund, but the timing of that is uncertain.

Valuation

A few basic figures:

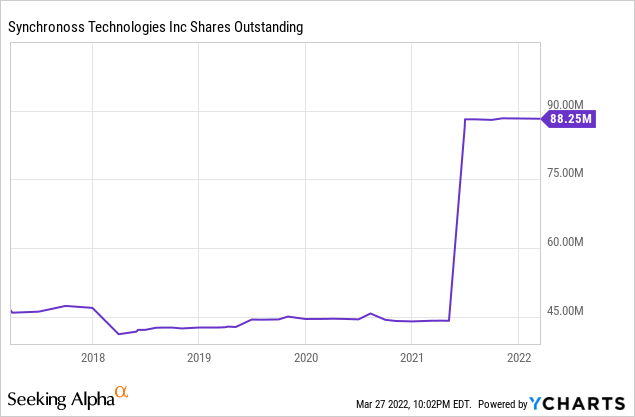

- Shares outstanding 88.4M

- Market cap: $105M

- Debt (convertible notes): $141M ($125 in June and another $16M in Q4)

- Cash: $31.5M

- Preferred stock $75

- EV: $290M

- Adj. EBTDA: $45M

- Revenue $270M

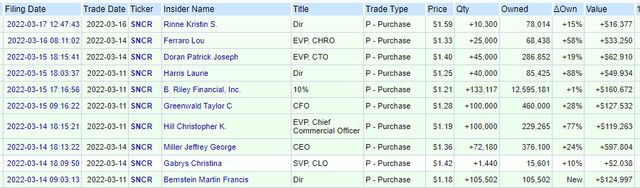

So the shares are trading at 1x EV/S or 6.5x EV/EBITDA. Analysts still expect a loss of $0.25 per share this year. Things look marginally better with the $32M tax refund. The valuation seems attractive enough for a number of executives to buy the shares recently:

Conclusion

There is definitely progress at Synchronoss:

- The company is concentrating on the Cloud segment, which is increasing with new customers and products;

- The other two segments are treated as cash cows;

- Refinancing brought down interest cost in a big way, but at the cost of considerable dilution;

- Cost-cutting has greatly reduced the company’s cost basis

- Selling off part of digital services;

- The big disappointment is Messaging, but we’ll see what the Verizon launch this year will bring.

The death spiral financing brought the company to the brink. The financing that replaced it is undoubtedly better, but still knocked the valuation of the shares down in a big way.

Things should improve from here, given that there are new Cloud customers starting to enlist customers and Verizon is launching RCM messaging this year. But it’s going to be a long way back for the shares.

Be the first to comment