akinbostanci

A leading equity market factor this year has been high-dividend stocks. Meanwhile, the insurance industry has offered investors shelter from 2022’s market storm. One domestic name checks both boxes and has an upcoming earnings report. With impressive YTD returns and high relative strength, is it a buy before its announcement Thursday night?

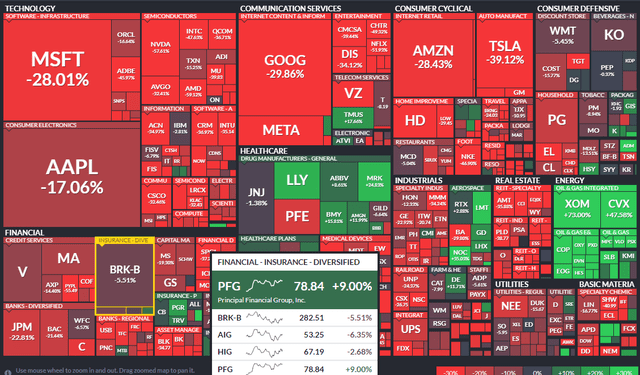

Year-to-Date Performance Heat Map: Insurance Stocks Green

According to Bank of America Global Research, Principal (NASDAQ:PFG) operates in four main areas: Retirement & Income Solutions (‘RIS’), Asset Management (‘PGI’), International, and U.S. Insurance. RIS delivers full-service accumulation, pension products, annuities, mutual funds, and other services to individuals and small-to-medium-sized businesses. PGI is a global asset manager. U.S. Insurance provides individual life and disability insurance and group life insurance. Lastly, the International business sells products in Latin America and Asia.

The Iowa-based $19.7 billion market cap Insurance industry company within the Financials sector trades at a low 4.8 trailing 12-month GAAP price-to-earnings ratio and pays a 3.3% dividend yield, according to The Wall Street Journal.

Principal generates significant free cash flow via its fee-based business lines. What’s been a positive factor for this insurance stock is a relatively small exposure to long-dated Treasuries, which have fallen big in price over the last few months.

Downside risks include problems at the macro level. PFG’s international business could also endure tough stretches given significant headwinds overseas. Longer-term, that diversification should promote better earnings, though. Investors must keep their eyes on fund flows for signs of improving or deteriorating market positioning.

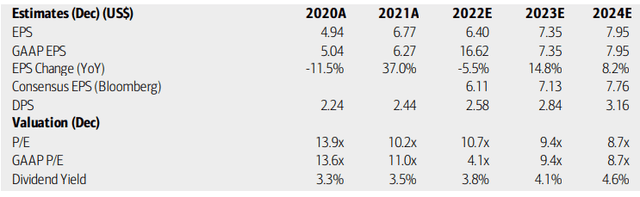

On valuation, BofA analysts expect earnings to fall about 6% this year while EPS growth returns in 2023, then moderate in 2024. The Bloomberg consensus forecast is slightly less optimistic. Meanwhile, dividends are seen as growing at a solid clip through 2024 while both PFG’s operating and GAAP P/Es remain in the low teens to high single digits. Seeking Alpha rates Principal’s valuation with a B, but the Financials sector stock’s price/book ratio is high at 1.8.

Principal Earnings, Valuation, And Dividend Forecasts

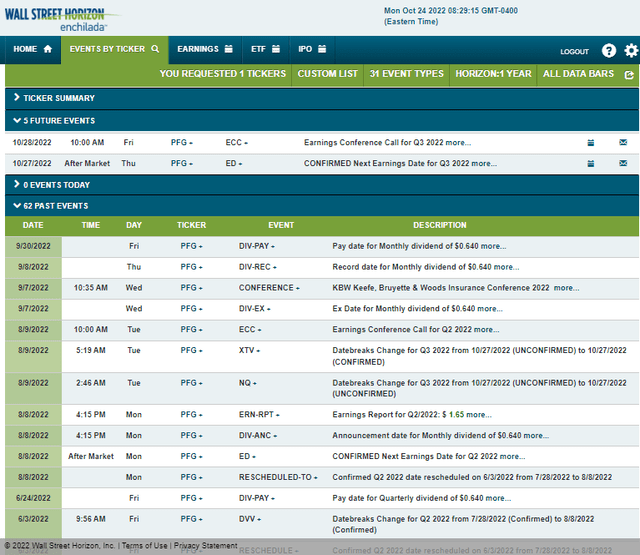

Looking ahead, PFG has a Q3 confirmed earnings date of Thursday, October 27 after market close with a conference call on Friday morning. You can listen live here. The corporate event calendar is light aside from the earnings date.

Corporate Event Calendar

The Options Angle

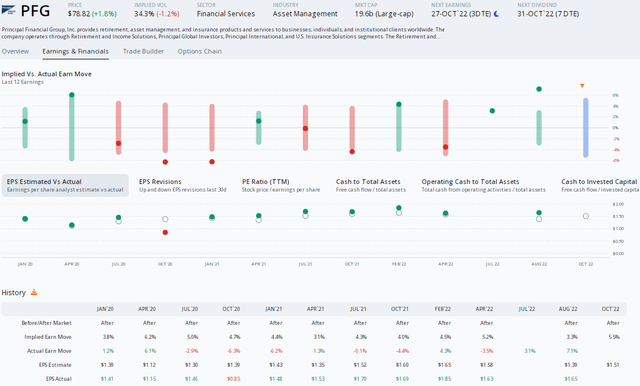

Digging into the upcoming earnings release, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $1.51 which would be an 11% per-share profit drop from the same quarter last year. Moreover, there have been four downward EPS revisions since it last reported and just a single upgrade. On the bullish side, though, PFG sports a strong EPS beat rate history.

In terms of the implied stock price move post-earnings, ORATS data show a 5.5% move up or down priced into the shares, which is higher compared to its recent history. We can gauge that anticipated swing using the nearest-expiring at-the-money straddle.

PFG: An Historically Big Implied Move Expected

The Technical Take

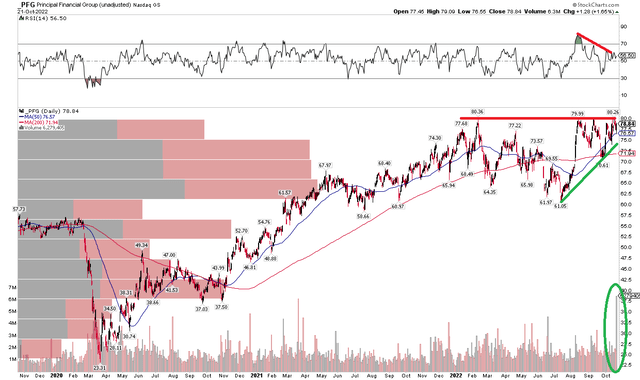

You won’t find too many charts as strong looking as PFG over the last year. Shares are coiling below the key $80 resistance point, which marks all-time highs. A move above $81 or so on a closing basis would portend a measured move price objective to near $100 based on the trading range over the past year.

Notice how the stock had some recent bearish negative divergence on the RSI indicator up top, but a breakout after earnings on both price and momentum would help confirm a new uptrend. On the downside, placing a stop under the recent low of $70.61 would make sense.

Overall, the broader trend is up and relative strength is high, so I expect the stock to generally trade well heading into the end of the year.

PFG: Shares Consolidating Near All-Time Highs, Impressive Relative Strength

The Bottom Line

High-dividend insurance stocks have been a bright spot in a challenging year. With earnings on tap, Principal looks poised to move up, but its valuation is no longer cheap. This is more of a long play for swing traders, but the stock still looks like a decent holding for long-term investors, too.

Be the first to comment