Alexander Shapovalov/iStock via Getty Images

Identifying attractive stocks can be a dicey endeavor while bearish market conditions loom alongside a significant military invasion, inflationary pressures, and hawkish central banks. As a result, I have tended to favor relatively unexciting stocks that seemingly have limited downside with the trade-off of modest upside potential. The stock for Primo Water Corporation (PRMW) is unexciting, just the way I like it these days. PRMW has essentially gone nowhere for 5 years. Eleven years ago, PRMW traded at current levels after its IPO. However, when I find a company earning record revenues and (adjusted) EBITDA trading for the same price from 10+ years ago, I get intrigued. As soon as the company proves it is on track to hit its 2024 forecast, PRMW could position for a breakout.

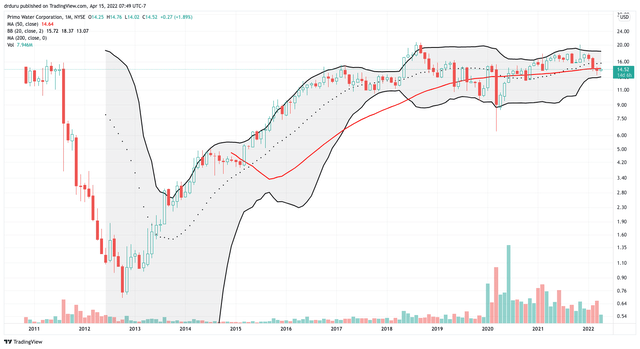

This monthly chart shows how Primo Water Corporation (PRMW) has tried for 5 years running to resume the momentum from a years long recovery from all-time lows. Given trading volume has surged since the pandemic, investors could be in (net) accumulation mode. (TradingView.com)

Quick Business Primer

Primo Water Corporation offers three different products and services as part of its portfolio of sustainable drinking water solutions: pre-filled exchange, refill, and delivery.

The pre-filled exchange service, or Water Exchange, uses a water dispenser as the “razor” part of the product of the strategy. Water dispenser models range in price from $260 to $350. The “blades” are sanitized and recycled 5-gallon bottles serviced at one of about 13,000 retailers across the U.S. and Canada. Each full bottle of filtrated and purified water averages $6.99.

The cheaper refill service, or Water Refill, has a wider footprint of about 22,000 retail locations that provide Primo water for any container. This water costs an average $0.35/gallon.

Delivery, or Water Direct, leaves bottle transfers to one of Primo’s business partners. Office managers might also choose to bundle other beverages like La Croix flavored sparkling water, Mountain Valley spring water, Sparkling Ice fortified water beverages, and other breakroom supplies. Primo provides an extensive filtration and purification process for the pre-filled exchange and home delivery services. The refill process uses a simpler filtration process. Primo also sells stand-alone water filtration units.

Primo Water sells across 24 different brands, partially thanks to an active M&A strategy. Remaining competition comes from the likes of Costco (COST), which partners with ReadyRefresh to provide home and office water delivery service for spring or purified water. Water straight from the tap, perhaps filtered by Brita filters, is of course a prime source of competition.

For a revealing review of the early days of the comeback for Primo Water Corporation, I recommend a 2013 article by a Seeking Alpha author titled “Primo Water Corporation Is Turning Around“. (Now THAT was an exciting time for PRMW!) Much has changed since then. Primo Water is positioning itself as a “growth” company (see the Seeking Alpha transcript of the Q4 2021 earnings conference call). A confident management provided guidance out to 2024. Moreover, Primo Water Corporation is now carbon neutral and could get an additional boost from ESG (environmental, social and governance) investors. The company also innovates on new water-related products and services.

What Is Growing and What Is Out

According to the company’s Q4 earnings presentation, Water Direct/Exchange contributed the most to year-over-year growth for continuing operations. Overall revenue grew 2.6% from Q4 2020 with Water Direct/Exchange delivering an incremental $20M. Water Refill/Filtration and water dispensers were a drag with a combined -$11M. “Other water” contributed $4M. Primo experienced flat to positive growth in all its segments outside of the U.S. despite Europe’s “flattish to declining business.” For the year, across all regions, Primo earned 6.1% revenue growth.

Primo forecasted 7-8% year-over-year organic revenue growth for 2022. Acquisitions will add 2 percentage points on top of organic growth. Accordingly, CEO Thomas Harrington proclaimed “growth company” status for Primo Water; this is the first time Harrington has been able to deliver such high expectations for the business.

Going out to 2024, Primo is “forecasting high single-digit organic revenue growth, targeted annualized adjusted EBITDA approaching $525 million, adjusted EBITDA margins of 21% to 22%, adjusted earnings per share of $1.10 to $1.20 per share, net leverage of less than 2.5x and return on invested capital greater than 12%.” The earnings target compares quite favorably to the $0.85/share net loss in 2021. The confidence and line of sight is what particularly interested me. In fact, Harrington declared “I’m more confident about what our outlook is for ’24 than I was when we did this in November.” Moreover, he is “…more bullish today than [he] was back in Investor Day.” With even a modest 15 multiple, Primo would trade around $18/share, a 24% gain from current levels. Once Primo proves out its growth trajectory, the market could pay an even higher multiple. PRMW currently trades at 1.1 times sales and 1.8 times book.

Primo Water continued to grow through acquisition. (In fact, the current PRMW is the result of an acquisition by Cott Corporation and then taking on the name Primo Water). In Q4, the company acquired Clear Mountain Refreshment Services in Little Rock, Arkansas with 5 locations in the Dallas-Fort Worth Metroplex. The company also acquired SipWell in Belgium which makes Primo Water “the leading provider of sustainable drinking water solutions in Belgium.” Primo Water quoted 2% growth for its global 2021 customer base to almost 2.3M. This growth is supported by a high subscription retention rate of 86.4%, up from 85.8% in the prior year.

Primo Water is jettisoning its North America single-use bottle business as a part of its push toward carbon neutrality: “The increasing effect of one-way single-use plastic bottles in our landfills and waterways have driven us to focus on a more environmentally friendly returnable bottle business.” The closure should be official by the end of Q2.

Paid to Wait

Primo Water currently pays a 1.9% dividend. While this rate is now a wash with the 10-year Treasury bill, the company will increase its $0.28 dividend by a penny a share each year through 2024. Primo is also repurchasing shares. The company spent $44M buying 2.6 million shares in 2021. The company ended 2021 with $128.4M in cash and cash equivalents and restricted cash.

Costs, Pricing, and Margins

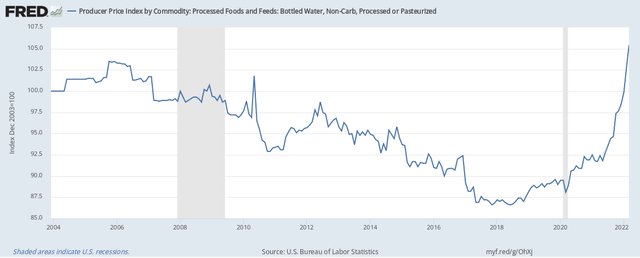

The water business has been impacted by today’s inflationary environment. As an example, the producer price index for bottled water soared right after the pandemic started. After years of drifting downward, suddenly the price is at an all-time high for the 18-year time series. No base effects in this price series. These prices no doubt helped motivate Primo Water’s interest in exiting the business! Indeed, management stated during the conference call: “so that’s one of the many reasons we are getting out of that business.”

The bottled water producer price index has gone parabolic! (U.S. Bureau of Labor Statistics, Producer Price Index by Commodity: Processed Foods and Feeds: Bottled Water, Non-Carb, Processed or Pasteurized [WPU02620608], retrieved from FRED, Federal Reserve Bank of St. Louis, April 15, 2022.)

In North America, the costs soared higher than expected. Primo Water paid more for raw materials for North American single-use bottles and ocean freight container rates. Overall, operating costs increased from a 4% year-over-year rate in Q1, Q2, and Q3 to 9% in Q4. These costs included tariffs and pricier labor.

Primo Water tried to address higher costs by charging a series of higher prices. While the price hikes contributed to revenue growth, they failed to close the gap with forecasted profitability for Q4. Thus, the company rolled out yet more price hikes in Q1. Adjusted EBITDA margin dropped from 18.5% in 2020 to 18.3% in 2021. Gross margin dropped from 57.0% to 55.8% from 2020 to 2021. Primo Water held the line in Q4 with a slight year-over-year decline from 55.8% to 55.5%. Clearly, the company has work ahead to get on the path to its higher 2024 forecast.

New Products and Initiatives

In February, Primo Water introduced a new alkaline water brand called Primo Plus. Primo also rolled out a revised app to improve the customer experience. The company plans to launch a new e-commerce site to boost dispenser sales.

Primo is also investing in “dispenser innovation, building a more environmentally friendly delivery and service suite, installing more efficient water production lines, which will reduce water usage and increased productivity and driving growth in refill with Sipple on-the-go units and new filtration innovations.” Primo Water purchased a minority interest in UK-based filtration company Sipple last September.

Primo Water is also very active on sustainability projects as a part of becoming globally carbon neutral last December. The company is funding “water infrastructure improvements in Sub-Saharan Africa, repairing and drilling new boreholes in small rural communities.” Purification displaces boiling fueled by wood from local forests. Primo also works in Guatemala to distribute water filters for reducing the incidence of waterborne disease and stoves that increase fuel efficiency and decrease indoor air pollution.

Conclusion

Primo Water is an unexciting company selling a mundane, yet important, product and service. Yet, management’s confidence in the business portrays an attractive stability for a tough macroeconomic climate. Share repurchases and dividends help buffer the stock. This is the kind of unexciting that appeals to me these days.

Be careful out there!

Be the first to comment