Dzmitry Dzemidovich/iStock via Getty Images

When I wrote about stagflation here for the first time nearly four years ago, it was for an entirely different set of reasons. It was 2018, the economy was humming along with a 3.5% unemployment rate, and it seemed the only obstacle on the horizon was the decision of the Trump administration to impose tariffs on goods imported from China. My thinking went that with unemployment and growth in good shape, the tariffs, which are a form of taxation, would only serve to slow economic growth and ultimately raise consumer prices and the unemployment rate. While the premise has changed, the risk of prolonged higher than trend inflation and possibly stagflation remain.

As a reminder, stagflation is the situation during which economic growth slows at the same time that prices rise. At this stage, we are experiencing the price increases with annualized CPI in recent months in the 7-8%+ range. Fortunately, despite this higher than trend inflation, growth, as measured by GDP, has also increased, avoiding stagflation for the time being. GDP growth, unemployment, wages, etc. have all been improving at rates not seen in decades. Unfortunately, for the average worker, inflation is outpacing wages, causing real wages for some workers to decline. At the same time, there is a record number, over 11 million, of unfilled jobs in the U.S. economy. While job openings are important to understanding the supply/demand imbalance in the labor market, it is important to understand that many of these opening can evaporate quickly in the event of an economic slowdown.

What Could Cause Stagflation

Future Fed policy is likely the greatest risk for causing stagflation. Monetary policy is largely isolated to influencing the price of money (i.e. interest rates) and does little to nothing to alleviate the real world issues that are causing inflation. At the margin higher interest rates can curb demand for houses, cars, and other large purchases. It can raise the hurdle rate for companies investing in expansion projects, causing some to be shelved. This would result in slower economic growth (potentially), but would likely have little impact on the drivers of higher prices right now. Higher interest rates will do little to unclogged supply chain bottle necks, lower commodity prices, or end the war in Ukraine. Fed policy will have a limited immediate impact on the supply/demand imbalance in commodities and labor and the multi-year shortfall in U.S. housing. Raising rates does not solve these issues, but can make them worse by causing an economic slowdown and making housing costs rise further in the form of higher mortgage payments and rents while wages don’t keep pace with inflation. As a result, an aggressive Fed could potentially cause stagflation. Maybe inflation will decline if they cause a recession, ideally a shallow and short-lived one, but this balance is difficult to strike and there is a lot of room for error.

Searching for Opportunities

The combination of high inflation, low interest rates, and stocks near all-time highs creates challenges for investors: Keep cash and guarantee its purchasing power erodes by the level of inflation. Buy bonds and get hit when/if rates climb, in addition to the erosion from inflation. Buy stocks and experience declines in the event of a slowdown or recession. It is a uniquely difficult time to put new capital to work. As a solution, I suggest a barbell approach based on consumer demand and the ability of certain types of companies to maintain margins by passing along higher input costs.

Consumer staples

To be truly prepared for any economic environment requires diversification across asset classes, geographies, sectors, etc. For this article, I will focus on a few key areas. From the perspective of the consumer (at the risk of being too academic), in the event of a slowdown, with or without rising prices, it is important to understand the priority of purchases. It is also important to understand which types of suppliers of goods or services can pass along higher labor and other input costs to customers. The companies that are able to do this would be expected to thrive in this environment as the demand elasticity for their goods and services is relatively low. In other words, what products and services experience little to no drop in demand due to rising prices or declining income?

Unsurprisingly, two of the most inelastic product categories would be considered “sin stocks” and filtered out in an ESG search: alcohol and tobacco. Aside the ESG constraint, I am not enthusiastic about either group’s near to intermediate term future. Smoking is in secular decline, and has been for decades, and like so many businesses, I believe the pandemic exaggerated demand for alcohol. It’s not that alcohol sales were necessarily “pulled forward”, more like consumption surged with lockdowns/work from home conditions that are slowly unwinding. So while sales are at relative highs, I would expect future growth to be slower.

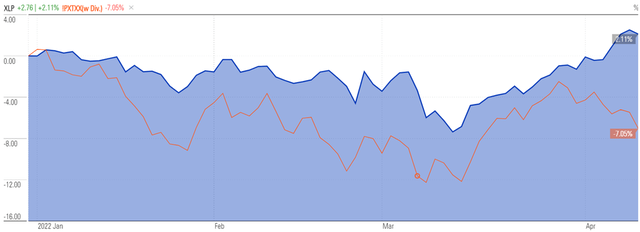

I expect sales and margins to be stable at more traditional staples names like Coca-Cola (KO), Procter & Gamble (PG), and Colgate-Palmolive (CL). These, and similar companies, sell products with fairly inelastic demand, meaning that consumers are relatively insensitive to price changes. This prevents sales from dropping off, margins are maintained, and the ability of these companies to continue paying and growing their dividends is preserved. Rather than trying to pick winners and losers in this category, I suggest using a low cost, liquid, and diversified ETF. The Consumer Staples Select Sector SPDR ETF (XLP) has an expense ratio of 0.10% and current yield of about 2.3%. This sector has outperformed the S&P 500 by over 9% year-to-date.

Morningstar

Tech Offers Flexibility and Solutions

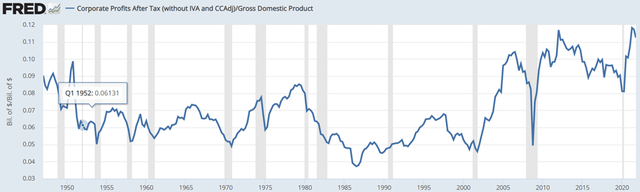

Taking the other side of the barbell approach would be investing in tech companies with significant exposure to intangible assets. Like the consumer staples on the other end of the spectrum, many of these companies are able to pass along higher prices, innovate around them, and provide real value to their customers. In fact, corporate profit margins, and profits relative to GDP, are hovering near the highest levels on record.

St. Louis Fed

Many tech companies have sold off in recent months, with the NASDAQ down over 14% year-to-date. Within tech (and consumer discretionary), some names remain in a bear market, down more than 20% on the year. Regardless of year-to-date performance, there are certain names that are positioned to perform well during a period of increasing prices and potentially slower economic growth. Many tech names have the market strength and pricing power needed to perform well during periods of rising prices and even stagnant growth. These companies are secular growth businesses that are less sensitive to economic cycles due to their innovation and adaptation.

Amazon (AMZN), for example, has never been in a stronger position. While the goods and services provided to individual consumers continue to add value, other parts of the business, namely Amazon Web Services, are providing critical computing infrastructure to companies large and small for a fraction of the cost of building it themselves. Alphabet (GOOG) (GOOGL) is also attractive as a long-term position. The tech giant continues to dominate search while YouTube revenue continues to grow at exceptional rates and is bringing in nearly $30 billion annually. Despite being around more for the 45 years, Microsoft (MSFT) continues to innovate and be relevant to households and businesses alike. Purchasing Windows as a subscription is simple and seamless for households while Teams has proved to be real competition for Zoom (ZM) as many workers remain remote.

The difficulty with choosing individual names is that it is easy to miss rallies when they happen and to suffer disproportionate declines during a sell-off. Because of this, I always suggest investors consider using diversified, low-cost ETFs. I had previously suggested the ARK Innovation ETF (ARKK) in my 2018 article, after which it tripled, then more recently was cut in half. Many of the names in that portfolio were major beneficiaries of the pandemic (lockdowns, work from home, etc.) that have since been unable to sustain those artificially high growth rates. As an alternative to that fund, I suggest the Invesco QQQ Trust (QQQ), which is more diversified than the ARK fund with about 100 holdings versus 35 and cheaper with an expense ratio of 0.20% versus 0.75% for ARKK.

Final Thoughts

At this point, stagflation remains a future risk, not a present one. As the Fed raises interest rates in coming months it will be critical to keep a close watch of how this impacts both economic growth and inflation. The challenge is to reduce inflation without killing growth. Unfortunately, as stated above, monetary policy is better at slowing growth than it is at reducing inflation caused by real world issues. While slowing growth will eventually lead to reduced demand, and therefore lower inflation, the timing could be off. In other words, rising interest rates can slow the economy faster and sooner than the drivers of inflation are resolved. Rates raised today will impact capital expenditures on growth projects today, but those same higher rates will not necessarily bring commodity and labor markets into balance at the same pace.

The ideas I have suggested above are intended to be tilts and tweaks to your portfolio, not a total overhaul of your strategic asset allocation. A proper asset allocation should be highly diversified and positioned for long-term needs and goals. I look forward to your feedback and answering your questions in the comment section below.

Be the first to comment