Vadzim Kushniarou/iStock via Getty Images

Introduction

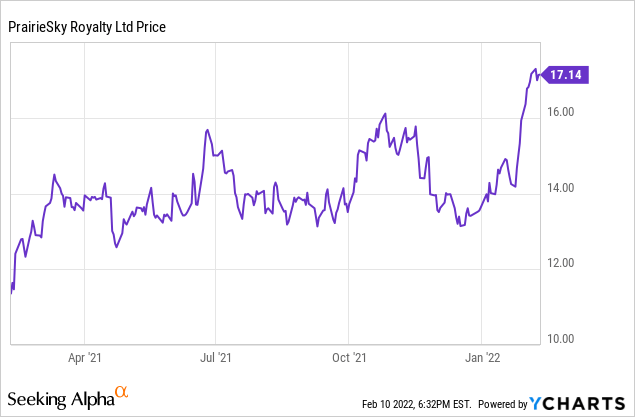

I like royalty companies in the oil and gas space. I have a substantial long position in Freehold Royalties (OTCPK:FRHLF) (oil and gas) and Topaz Energy (OTCPK:TPZEF) (natural gas). I missed out on PrairieSky Royalty (OTCPK:PREKF) but after carefully looking at the recent results and taking the newest acquisition into consideration, perhaps I should consider going long PrairieSky anyway.

PrairieSky’s most liquid listing is on the Toronto Stock Exchange where it’s trading with PSK as its ticker symbol. The average daily volume exceeds 600,000 shares which represents a monetary value of in excess of C$10M per day. As the company also reports in Canadian Dollars, I will use the CAD as base currency throughout this article, and I will refer to the Canadian listing.

A very satisfying result in 2021

I will be rather brief about the 2021 results as the overview of last year’s results are meant as a starting point to back my expectations for 2022.

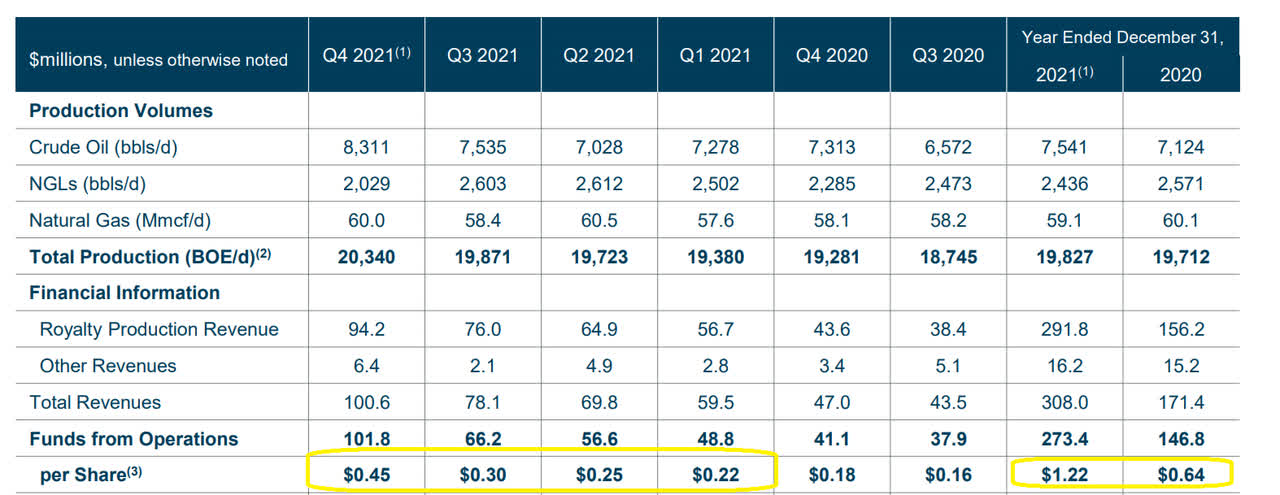

In 2021, PrairieSky’s attributable production increased to just over 19,800 barrels of oil-equivalent per day with a strong performance in the final quarter of the year wherein the attributable production rate exceeded 20,300 boe/day. Looking at the full-year results, the breakdown consists of just over 7,500 barrels of crude oil per day, just over 2,400 boe/day in NGLs with the remainder of the oil-equivalent production (approximately 50%) consisting of natural gas.

PrairieSky Investor Relations

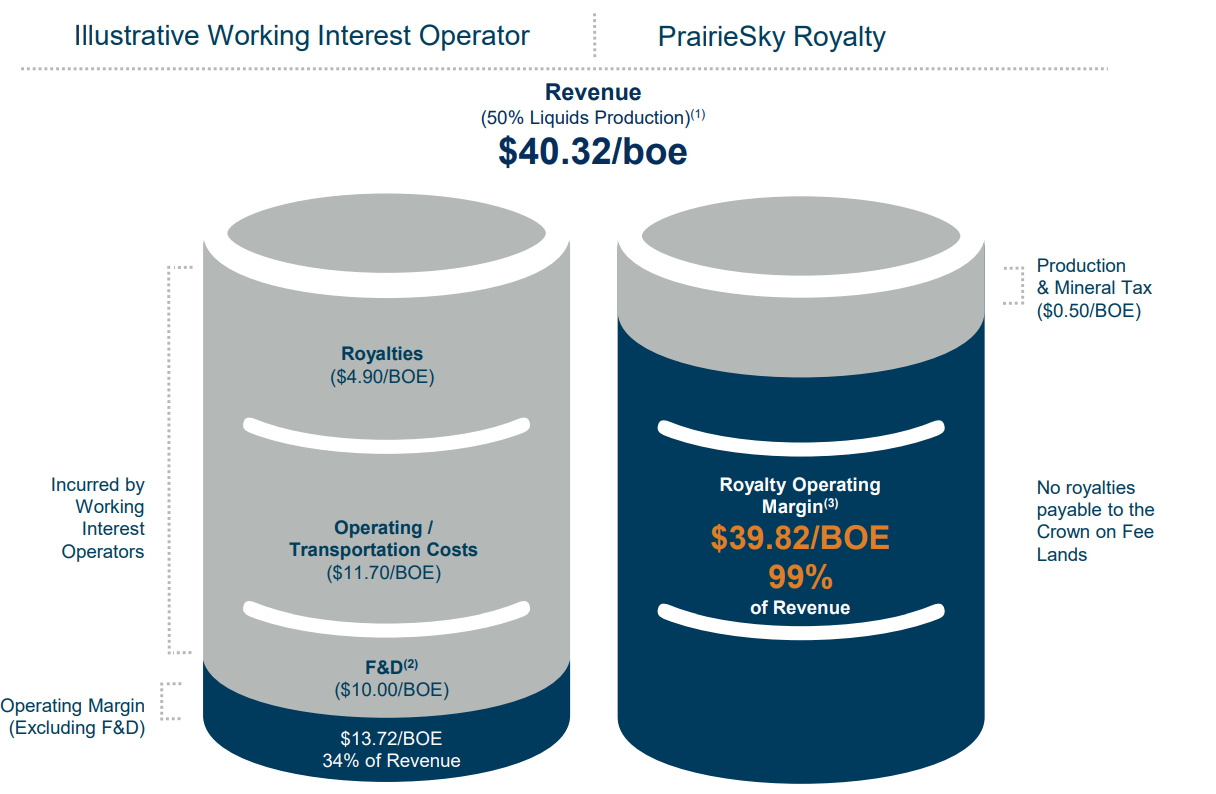

As this is a royalty company, the capital expenditures are pretty close to zero: the business model tends to have a high up-front cost (the acquisition of the land package) but as the development is carried out by the operator, PrairieSky can just sit back, relax, and deposit the royalty cheques in the bank.

As you can see in the image above, the company posted a total funds from operations of C$273M in the entire financial year, but the fourth quarter was the strongest thanks to the highest production rate and very high oil and gas prices.

PrairieSky ended 2021 with a net debt position of C$635M as it completed a very large acquisition (see later). The relatively high net debt is not an issue as it represents less than 1.5 times the FFO. Additionally, I expect the net debt to decrease fast. If I’m to assume a FY2022 FFO of C$460M and a share count of 239M shares, the current quarterly dividend of C$0.09 per share will require just C$86M in cash which means PrairieSky will be able to retain almost C$400M to strengthen its balance sheet. US-based investors are encouraged to check the tax status of the PrairieSky dividends, as they could be considered passive income and have a different tax status. As an European, I simply pay the 15% dividend withholding tax, but other countries may have different tax systems.

And at the current strip pricing for oil and gas, I expect PrairieSky to have paid off its entire net debt by the summer of next year.

PrairieSky Investor Relations

More to come in 2022 as the company just closed a large acquisition

And I think 2021 was just the ‘warming up’ phase as 2022 could be much better. Not only because of stronger oil and gas prices (the average received price was less than C$70/barrel for the oil and C$3 for the natural gas) but also because the recently completed acquisition will add more production to the mix.

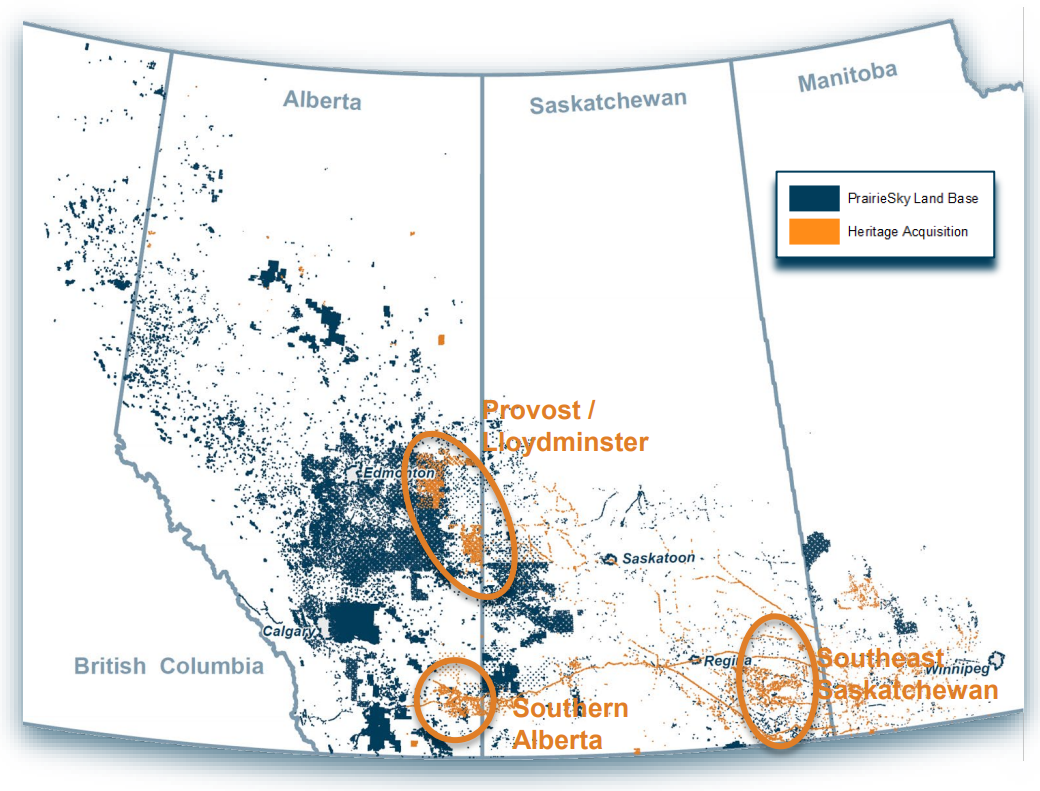

The company closed a very large C$728M acquisition in December. The acquired land (1.9 million acres of royalty lands) has a current production rate of 2,700 boe/day and should add about C$65M in royalty revenue in 2022 (note, this was based on lower oil and gas prices, so the C$65M estimate appears to be rather conservative these days). The effective date of the transaction was December 31st which means the assets will only start to contribute from January 1st of this year on.

PrairieSky Investor Relations

The C$728M appears to be relatively high based on the existing production, but considering the total land package is almost 2 million acres there’s plenty of potential to further increase the production rate. Of course, the C$65M will not directly flow to the company’s bottom line. First of all, a large portion of the acquisition was funded by extra debt and although debt is rather cheap, it will obviously reduce the net cash inflow.

Additionally, PrairieSky Royalty issued 17.2 million new shares priced at C$13.4 per common share for total proceeds of C$230M in a bought deal offering which helped to fund the acquisition. The total share count as of the end of December was just under 239M Shares, an increase from the 223.3M shares as of the end of 2020. That being said, I do expect the acquisition at the current prices to be very accretive. Despite expecting a higher interest payment, the total operating cash flow will likely increase by a double digit percentage while the share count increased by just 7%. And that excludes the potential to expand the production rate on the newly-acquired lands.

Investment thesis

PrairieSky offers all the ingredients for an excellent performance in 2022. It generated an FFO of just over C$100M in the final quarter of 2021 indicating that – keeping all things equal – the royalty company will likely generate C$400M in FFO this year. Add in the recently completed acquisition and I think we can easily aim for C$450-500M in FFO this year which would bring the FFO/share to around C$2.

I missed out on the bought deal which I think was very attractively priced at C$13.40 as the lead underwriters were not accepting offshore orders. Rather than buying PrairieSky, I subsequently decided to buy more Freehold Royalties and, as such, I currently don’t have a long position in PrairieSky. I would like to add the company to my portfolio and perhaps I should consider writing some put options that are out of the money. A P15 expiring in June 2022 for instance has an option premium of C$0.55 and should the put expire in the money, I’d effectively be buying the stock at C$14.45 and that would be approximately 10X the underlying FFO using US$70 WTI and $3 natural gas.

Be the first to comment