POUND STERLING TALKING POINTS

- Can UK GDP beat estimates?

- GBP/USD in limbo pending fundamental catalyst.

GBP/USD FUNDAMENTAL BACKDROP

After yesterday’s dollar selloff post U.S. inflation (reduced rate hike expectations from the Fed), GBP/USD has not moved much from it’s previous close. Looking at the fundamentals facing the UK economy as well as the message relayed from the Bank of England (BoE), recessionary fears remain at the forefront of everyone’s minds. This heightens the impact of tomorrow’s UK GDP print (see calendar below) and anything less than expected could likely result in pound depreciation, thus amplifying recession fears in the region.

Later in the day, U.S. consumer sentiment is expected higher than the July issue and if actual data reads in line with forecasts, the greenback could find some bids late in the European session.

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

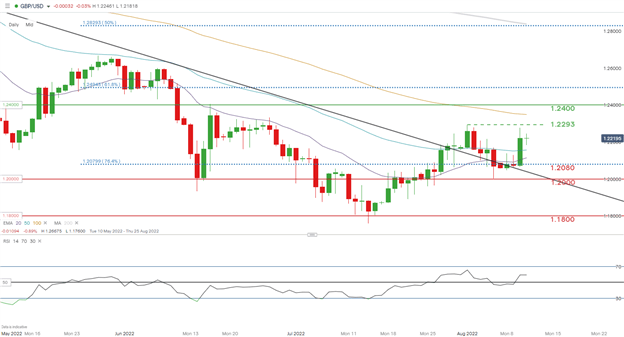

GBP/USD price action shows bulls unable to breach the August swing high at 1.2293 with todays doji candlestick indicative of short-term indecision as investors await UK GDP. My view on cable remains constrained between 1.2080 and the psychological 1.2400 levels over the next month or two with my short-term bias skewed in favor of dollar strength ceteris paribus.

Key resistance levels:

- 1.2400

- 100-day EMA (yellow)

- 1.2293

Key support levels:

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 64% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however due to recent changes in long and short positions we settle on a short-term upside bias.

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment