Robert vt Hoenderdaal/iStock Editorial via Getty Images

After having analysed Deutsche Post AG and Royal Mail Group, we have decided to move on with PostNL N.V. (OTCPK:TNTFF) (OTCPK:PSTNY) and to offer our SA readers some mitigating factors to consider.

PostNL engages in postal and logistics services to B2C and B2B mainly in the Netherlands, but also in Europe and worldwide. The company provides its activities within three divisions:

- Parcels,

- Postal services in the Netherlands,

- Other services.

PostNL also offers direct marketing and document management. It was formerly known as TNT N.V., but in May 2021 it changed its name to PostNL and it is headquartered in the Hague.

Generally speaking, there is always a negative sentiment towards companies that dedicate services to delivering letters and parcels. Trends are not supportive and many analysts usually counterbalance this argument by looking at e-commerce growth.

According to our analysis, here below we present what PostNL is missing:

- Looking at the company’s main competitors, PostNL is one of the many players in the European market. Royal Mail and Deutsche Post, thanks to their GLS and DHL businesses are gaining market share;

- Anyone in the Netherlands can attest that the company has a dominant market position. On the other hand, growth is completely reliant on price power;

- Looking at the volume mix over the past decade, PostNL mail has had to manage a decline in its business;

- If we look at CAPEX, we note that PostNL has invested a lower amount in growth, favouring maintenance CAPEX over transformation CAPEX, this will impact company profitability over the long term;

- Related to point four, PostNL needs to decarbonise its vehicle fleet and it will require additional CAPEX which we believe is not fully priced in;

- Last but not least, is labour cost. The company needs to manage unprecedented inflationary pressure. Transportation costs will also surge due to the current macroeconomic conditions.

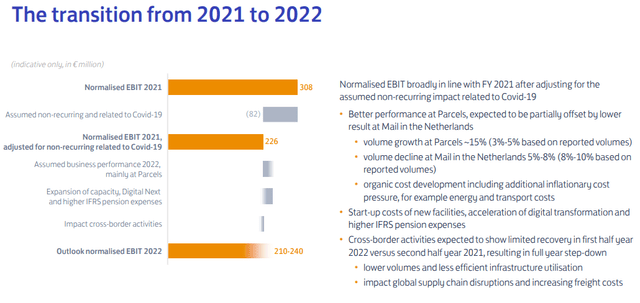

We are not surprised by the guidance indication for 2022 to see a normalised operating profit forecast below 2021 – after an adjustment for non-recurring items related to Covid-19 outbreaks.

Guidance 2022

Source: PostNL Q4 and FY Results

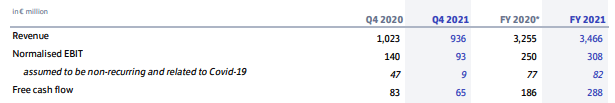

Latest results comment and Valuation

We feel it’s quite important to emphasise the words of CEO Herna Verhagen that note how 2021 was an “exceptional year“. Since the pandemic outbreak, they have “been recognising and rewarding the efforts and hard work of our people, partners and retailers, who we supported with extra fees during the lock-down period. Thanks to them and the resilience of our business, we showed strong results driven by a solid business performance at Parcels and a strong result at Mail in the Netherlands“.

Looking at the Q4 numbers, we see that parcels segment performed poorly. Revenue stood at €604 million compared to €632 million a year ago. This was due to higher domestic volume growth, but lower international volumes. We note a very similar situation in the mail for the Netherlands division with top-line sales at €482 million compared to €542 million a year ago. This impact was due to a volume/price mix impact reflecting PostNL’s lower pricing power (and higher competition).

PostNL Results 2021

Source: PostNL Press Release

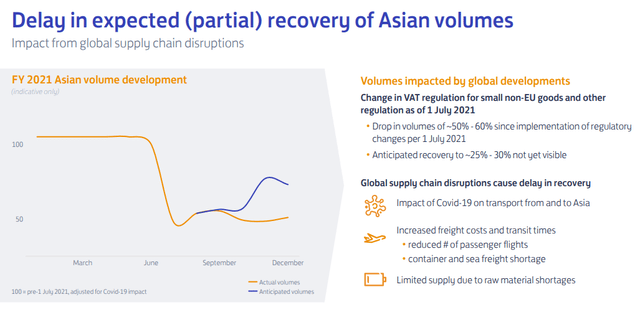

PostNL Asian Volume

Source: PostNL Q4 and FY Results

After the results, PostNL announced a 2021 dividend per share of €0.42 with a payout ratio of 75% while there is a stock repurchasing program of €250 million in place. Despite a pretty high ROIC, we believe that CAPEX growth needs to be priced in. We derive a valuation thanks to a DCF model with a valuation of €3.7 per share. We then rated the company neutral.

Be the first to comment