DNY59/E+ via Getty Images

Executive Summary

Here I highlight some practical investment considerations. Great companies don’t always make for great investments.

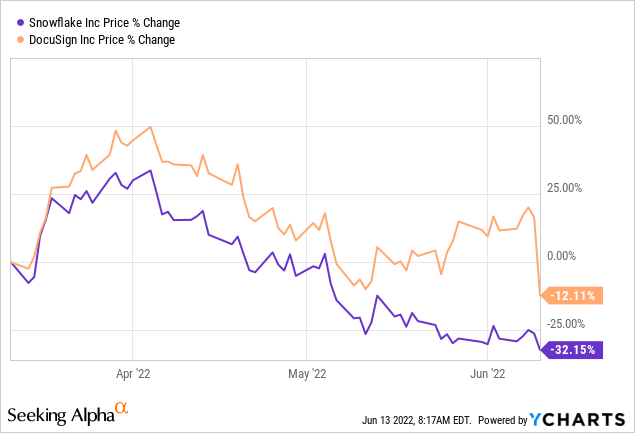

I note examples of Snowflake (SNOW) and DocuSign (DOCU). These two companies were perceived by investors to be really high-quality companies. But that investors were often willing to overpay for something that did not turn out to be compelling long-term investments.

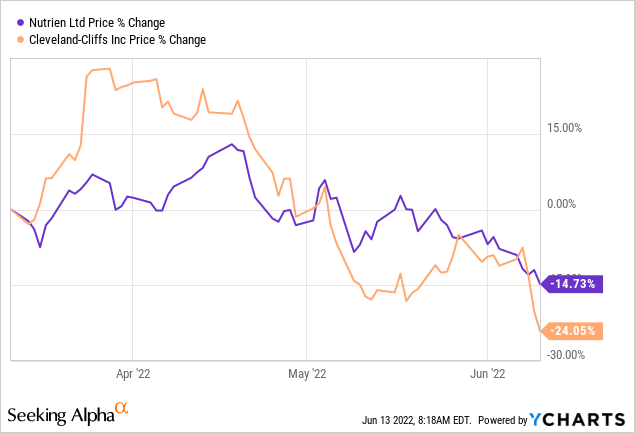

Then, I compare to two companies, Cleveland-Cliffs (CLF) and Nutrien (NTR). And how these two companies are representative of the types of investments that are well suited to survive the volatility in this market.

I have particularly chosen to highlight these 4 companies that are down in the past 4 months. This avoids cherry-picking my examples.

I highlight why Cleveland-Cliffs and Nutrien are likely to make superior investments, despite being perceived to be ”poor businesses” rather than Snowflake and DocuSign, which many investors perceive to be very high-quality companies, with strong competitive advantages.

Then, I’ll move on to longer-term considerations. And what elements one should keep in mind.

The key takeaway of this actionable investment insight is that you are better suited to survive the volatility by investing in companies that generate strong free cash flows, that are priced at a 10% or higher free cash flow yield. Recall, that free cash flow yield is free cash flows divided by market cap as a percentage.

Recent Developments, Tech Versus Commodities

The last 3 months have been brutal for nearly all investors, of all stripes, asides from those investors highly concentrated and essentially only invested in energy stocks.

In the tech space, I’ve been highlighting for some months to stay away from the likes of Snowflake and DocuSign. Both of these companies I have written up here and here, and provided a follow-up coverage here and here. I provided a sell rating on these names for months.

In the case of Snowflake, I had said that ”Snowflake’s slowing revenue growth rates are just one problem. The other problem is that investors no longer embrace ”investing for growth at any cost” strategies”.

Then, more recently, I followed up by saying, that Snowflake is still overvalued at 20x sales and that investors would do well to reconsider their investment.

Similarly, with DocuSign, I consistently noted that when it comes to ”thinking about [DOCU] in terms of bottom-line profitability leaves too much to be desired.”. And then, when the stock sold off last week I once again noted that ”DocuSign’s path to profitability moves in the wrong direction.”

The theme is basically the same in both instances. These businesses are printing shares but are far from reporting attractive clean GAAP cash flows.

However, the problem is not only pertaining to these two names. The problem is that these very high-quality companies were believed to be less cyclical than they actually turned out to be.

The market believed that they didn’t have to be all that price-sensitive since these were secular growing companies with unique offerings. The valuations that these and other names traded at didn’t matter, because these businesses’ value would grow into their valuation.

Moving on, before going further, I’ll briefly turn our focus to what’s happening in the fertilizer and steel sector.

The idea here is very different. Investors have become infatuated with the belief that since last year these share prices were lower, they are now ”overbought”.

Even though these two businesses are very different, from comments that I read, many investors argue that these stocks are overdue a pullback since their share prices are higher than they were last year. Many have called these stocks over-extended.

To that, I push back and question how? How can stocks priced at single digits free cash flow yields be overextended?

This is what I said about Cleveland-Cliffs recently, even if things were to slow down for this steel manufacturer, the business is still likely to make around 10% free cash yields. Hence, even in my bearish case, the business is priced at 10x free cash flows.

Meanwhile, with Nutrien, I argued paying ”3x this year’s EBITDA is a very compelling investment”. The stock is priced at approximately 12% free cash flow yield.

To sum up the thesis here, in the first two tech companies, investors are being narrative driven. While in the second two cases, Cleveland-Cliffs and Nutrien, these businesses are being driven by their solid free cash flows that may or may not be sustainable.

Yet, in all 4 of these businesses, investors are price anchoring to a significant extent. For shareholders of Snowflake and DocuSign there’s hope that they will soon revert higher. Why? Because they were higher last year, therefore we should return to those higher soon.

While for the 2 commodity companies, those stocks were lower last year, therefore there’s the unspoken belief that they must return lower soon.

None of these ideas make any sense to me. The price that something was last year is irrelevant. All that matters is the value of the business going forward.

With this framing in mind, let’s now discuss the overall backdrop that we are facing.

We Have Already Embraced the Pain

The simple truth of the matter is this. There’s a lot of pessimism out here in the market right now.

In hindsight, the time to be pessimistic would have been last year. Right now, I believe that a lot of the carnage has now been done.

How many companies out there are not down 50% to 60%? In fact, there are huge swaths of the market that are already down substantially more than 60%.

That doesn’t mean that everything pops back up tomorrow morning. What it does mean is that we have already embraced a lot of the pain of being an investor.

The Pendulum Swings

All around me I see pessimism in the stock market. Many investments have been hit so hard, that few investors have the imagination to believe what is possible.

And while everyone knows that when you invest, stocks can go down as well as up, previously everyone appeared to have forgotten the first part, that stocks can go down.

Right now, people appear to have forgotten the second part, that stocks do tend to go up over time.

How to Position Your Portfolio for a Bear Market?

I make the case that during a bear market the most important investment consideration is staying power. You need to position your portfolio in businesses that can survive through the cycle.

But ultimately, to concretely pinpoint the single most important consideration, one needs to buy businesses that have products that actually make strong free cash flows.

As two examples, I noted both Cleveland-Cliffs and Nutrien. There are other basic material and agriculture stocks, too. Many of these stocks are priced at higher than 10% free cash flow yield.

Finally, we have to be humble enough to know that no strategy is perfect. There are going to be days when investing in this manner will have significant limitations.

For example, there are going to be days when tech stocks will have their strong green days in the market. And in those days, investing in steel and fertilizer stocks, and more generally commodity companies will feel like one is missing out on the upside that tech stocks could provide.

However, I believe that if one simply aims for a slow and steady gain compounding of gains, one will be better placed than trying to chase returns on any given day.

Takeaway

A great scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it. (Max Plank)

In the quote above, Plank refers to the field of physics moving forward when the old guard dies off and the guard is willing to learn new ideas.

In investing, it’s largely the same. You are forced to constantly adapt or underperform. Take on new ideas and points of view, or be left behind.

Along these lines, I argue that the biggest danger for an investor is price anchoring. While the second biggest danger is anchoring to ideas that once made sense, but no longer make sense.

In sum, investing in slow and steady cash flow generating businesses while they are cheaply priced is the way forward.

I hope you found this piece useful.

Thank you for reading!

Be the first to comment