skynesher/E+ via Getty Images

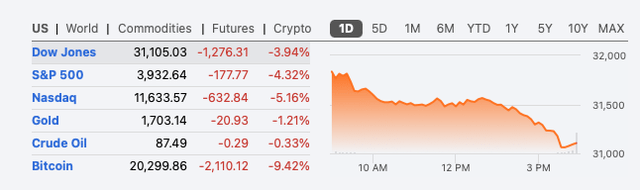

If you’ve been paying any attention to markets then you should be well aware equity markets have been extraordinarily tricky year-to-date through September 13, 2022. In fact, on Tuesday, September 13, 2022, Mr. Market slapped us all, at least us longs, to the tune of down 4.32% for the S&P 500 (SPY) and down 5.16% for the Nasdaq (QQQ)! It was the worst day since June 2020. And if you recall, back in June 2020, it was still very hazy, a period marked by exceptional uncertainty due to Covid.

Seeking Alpha (September 13, 2022)

Year-to-date through September 13, 2022, the broader equity market returns are as follows:

- S&P 500: -17.5% (4,766 on 12/31/21 and 3,933 on 9/13/22)

- Nasdaq Composite: -25.6% (15,645 on 12/31/21 and 11,634 on 9/13/22)

- Russell 2000: -18.4% (2,245 on 12/31/21 and 1,832 on 9/13/22)

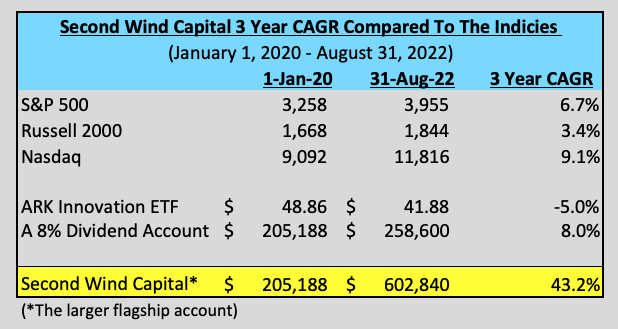

As of August 31, 2022, here is the broader market performance:

- S&P 500: -17.0% (4,766 on 12/31/21 and 3,955 on 8/31/22)

- Nasdaq Composite: -24.5% (15,645 on 12/31/21 and 11,816 on 8/31/22)

- Russell 2000: -17.9% (2,245 on 12/31/21 and 1,844 on 8/31/22)

As for my performance, I currently manage two accounts. The first is my larger and very active flagship account. The second account is the less active, more aggressive, and smaller.

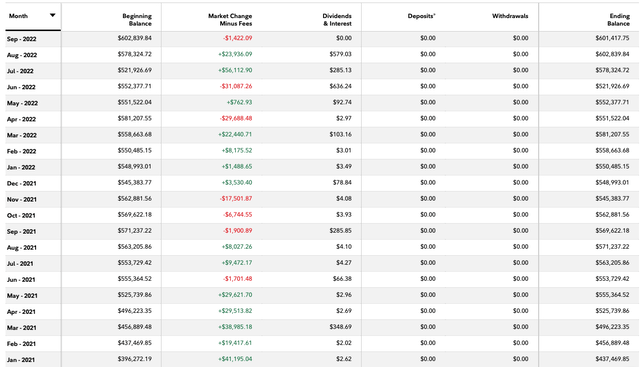

Through August 31, 2022, enclosed below please find the performance:

- Flagship Account: +9.8% ($548,933 on 12/31/21 and $602,840 on 8/31/22). That said, I’m required to keep at least $250K in cash, at all times. So the return on available capital ‘at risk’ is +17.9% (+$53,850 / $300K of available risk capital).

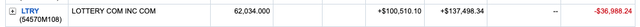

- Second Smaller Account: -22.7% ($121,365 on 12/31/21 and $93,822 on 8/31/22). YTD, I’ve made three sizing errors here, but the lion share of the losses were driven by Lottery.com (LTRY), which turned out to be pure financial fraud (with an audited annual report that turned out to be total fiction).

For perspective, despite losing $37K in the flagship account, on Lottery.com, other gains have more than offset this big mistake.

Fidelity Realized Loss Snapshot

In the second, smaller account, however, I lost $20,253 on Lottery.com. No question, I way over sized this bet, with a 15% max sizing here. The reason I didn’t sell sooner and actually aggressively added in the low $2s, was because I thought I had some margin of safety, as according to LTRY’s FY 2021 10-K and subsequently 2022 10-Qs, those financial statements said LTRY had nearly $1.75 per share in net working capital and no debt. As I mentioned above, it turns out the management blatantly misrepresented its financials. Perhaps, par for the course, as this came public as a SPAC. That said, no question, I way over sized this bet. Also, I didn’t spent enough time on the backgrounds of the management team. Had I done so, I probably would have taken my medicine (losses) much sooner. Either way, par for the course, as no one bats a thousand.

Fidelity Realized Loss Snapshot

If you take a step back, though, on a blended weighted dollar value basis, year-to-date, through August 31, 2022, cumulatively, in net dollars, the two portfolios have returned a net $26,305, which is +6.2%, on an accessible starting base of capital of $421,365, as of January 1, 2022. This is despite $57,250 in cumulative Lottery.com losses.

And in case you are wondering, as I very frequently hear many authors and readers say they want to see a strong three-year performance record as opposed to just a good one-year record, I will share my three-year compound annual return. The reason people want to see the three-year stack is to separate the role of luck from an ability to generate alpha. And as Sir Warren Buffett often says, you see who is swimming naked when you have a broader market drawdown year. And trust me, I get people’s other point that a person can get lucky during a one-year stretch, notably in a roaring bull market.

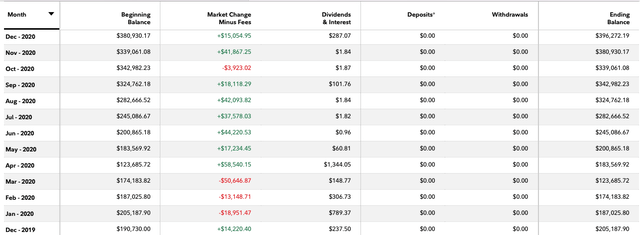

In the larger account flagship account, on January 1, 2020, this account had a value of $205,188. As of August 31, 2022, the account value was $602,840.

For perspective, enclosed below is a snapshot of how the flagship, larger SWC account has performed, from January 1, 2020 to August 31, 2022. As you can see, and this is despite a requirement to hold ridiculous amounts of cash, in absolute dollar term and as a percentage of the portfolio, since July 1, 2020. Despite the excessive cash requirements, the flagship account has generated a 43.2% compound annual return, over the past nearly three years. (See the Appendix section for the granular monthly data).

This is well in excess of the indices and outpaced Cathie Wood’s flagship ARK Innovation ETF (ARKK) by a wee tad.

Author’s Chart (3 Year CAGR Performance)

How I’m Navigating 2022

Around April 2022, albeit I should have worked this out sooner, I realized we are in a bear market. As scary and dangerous as bear markets are, there is also ample opportunity to make a lot of money, albeit tactically, by trading in a bear market. The reason is that markets get extraordinarily oversold, leading to huge drawdowns, in so many stocks. In addition, bear markets tend to be highly shorted, as the sentiment gets so negative it can also get a number of counter trend short squeezes and fierce, albeit short lived, rallies. During these stretches, and it is nearly impossible to precisely time them, when it looks the absolute scariest, this can be a great time to run up the scoreboard and generate a lot of alpha.

I want to point readers to four free site pieces that captured how I read the tea leaves fairly well thus far in 2022.

(*This article was originally written, in two pieces, on May 8th and 12th, for my Marketplace group.)

And in case you are curious the individual stocks that drove these tactical trading gains, I will list them. In order to make the list, there has to be at least $2,000 net realized gains, cumulatively.

The List Of Realized Winners (YTD as of September 13, 2022)

- XCEL Brands Inc. (XELB): $3,900

- Yellow Corp. (YELL): $3,500

- Vacasa Inc. (VCSA): $3,300

- CVR Partners LP (UAN): $3,000

- Travel Centers of America (TA): $3,500 (I still own some TA shares)

- Sypris Solutions Inc. (SYPR): $2,800

- Spartannash Co. (SPTN): $3,950

- Shopify Inc. (SHOP): $5,000

- Red Robin Gourmet Burgers (RRGB): $3,500

- Regis Corp. (RGS): $5,800 (still own Regis as I only sold half in the $1.60s)

- Revlon Inc. (REV): $3,400

- RCM Technologies (RCMT): $4,500

- Peloton Interactive: $3,800

- Penn Entertainment (PENN): $2,000

- Orion Group Holdings (ORN): $7,600 (I still own some Orion shares)

- Ollie’s Bargain Outlet (OLLI): $3,000

- Moneygram Intl (MGI): $2,100

- Ramaco Resources (METC): $4,200

- Kohl’s Corp (KSS): $4,200

- Kirkland’s Inc. (KIRK): $5,500 (still own some KIRK shares)

- HireRight Holdings (HRT): $2,000

- Hibbett Inc. (HIBB): $2,800

- Grow Generation Corp. (GRWG): $2,400

- Electrocore Inc. (ECOR): $2,000

- Carvana Co. (CVNA): $3,100 (still own some CVNA shares)

- Citi Trends Inc. (CTRN): $3,300

- Chicken Soup For The Soul Entertainment (CSSE): $3,000

- Cooper-Standard Holdings (CPS): $2,600

- Bassett Furniture (BSET): $2,100

- Build-A-Bear Workshop (BBW): $2,000 (still own some BBW shares)

- Bed Bath And Beyond (BBBY): $2,000

- ARK Innovation ETF (ARKK): $2,200

- ALTO Ingredients (ALTO): $3,400

(I am happy to discuss any of these companies, in comments section, as I can’t write on 33 companies in one article.)

As you can see above, and the cut off for making the list was $2,000, in cumulative gains. Therefore, in addition to this list, I have number of smaller gains, in a number of other stocks, but felt the list would be too long to list that many names.

Moreover, as you can also clearly see, I have hit exactly zero home runs in 2022!

Yet, despite hitting zero home runs, as you might have worked out, if you’re highly engaged and constantly grinding, despite an exceptionally tough year, with a big market drawdown, the singles do add up. And again, this is despite a monster bases loaded strike out on Lottery.com.

That said, although these tactical trading wins have fueled performance, the vast majority of my ‘at risk capital’ is invested. My tactical trading dollars, cumulatively are only about 30% to 35% of the capital.

And just to be crystal clear, I’m sitting on a few decent sized unrealized losses, notably in Advanced Emissions Solutions (ADES). This is a stock where I have gone from a big unrealized gain to a big unrealized loss. I also have core positions in Summit Midstream Partners LP (SMLP), Netflix Inc. (NFLX), and a few stocks.

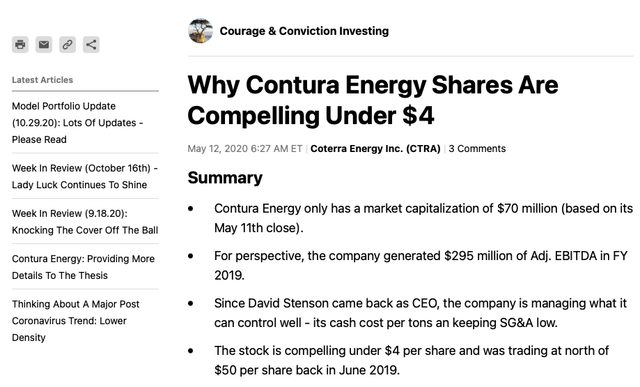

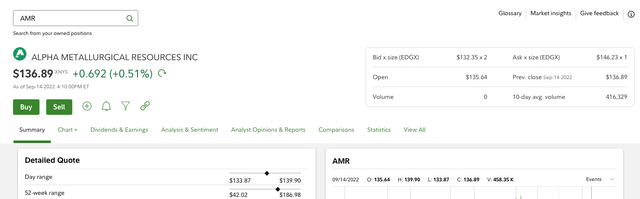

Incidentally, and just to be clear, I do get the power of Buy and Hold. Back on May 12, 2020, for my Marketplace group only, as I just never got a chance to write it up on SA’s free site, Contura Energy, now called Alpha Metallurgical Resources Inc. (AMR). Back then, I was long 4,000 shares of AMR, with a cost basis of $5. To save you the suspense, I sold this way too early, as I was forced to raise a bunch of cash, back on June 30, 2020 (I will spare you the excruciating details).

Second Wind Capital Research Archives (May 12, 2020)

Lo and behold, and shares actually hit $187, earlier in 2022, those 4,000 shares, if anyone held on through September 14, 2022, that $20K investment would be worth $547,560. That is a 27 bagger!

Fidelity

Putting It All Together

I apologize in advance for being so slow to publish my recent performance data. I try to do this on a quarterly basis. We were traveling a lot in July and I was so engaged with markets, managing the portfolios, and trying to avoid the iceberg, I lost track of this and it slipped on my to-do list.

At least thus far, 2022 has been a brutal market, with a big drawdown. The losses have been so big, and so widespread, notably in so many high fliers, with ground zero impacting technology stocks, that this drawdown has even ensnared some famous hedge fund managers. These are the highly paid and once heralded Masters of the Universe, and they too, were really caught off guard.

The key, and I was definitely a few months late here, was recognizing we were in a nasty bear market. So when you’re in a bear market, you have to allocate some of your capital towards tactical trading, and in most cases, when you get the 20% to 50% (more in some instances), in many individual stocks, you have to either take the gains or sell a portion of your position (perhaps half). The bear market rallies can be so fierce, as the shorts tend to get really, really aggressive that you can get these great opportunities to generate some monster tactical trading returns. Again, though, precisely timing it is really tricky, so you have to scale in.

Lastly, after having gone to 35% to 40% cash, as of August 5, 2022, I have selectively and opportunistically been putting that cash back to work. As of last night, I only have 9% in cash.

Thanks for reading and I wish good luck to the readership, as you navigate the next 3.5 months of 2022!

Appendix: Actual Monthly Performance Data Of the Flagship Account from January 1, 2020 – August 31, 2022.

(Please note: The September figure, in the snapshot below, is as of September 13, 2022, but as there is plenty of time left in September, so let’s stick with monthly data.

Fidelity Performance Tracker

Fidelity Performance Tracker

Be the first to comment