onurdongel/iStock via Getty Images

The following segment was excerpted from this fund letter.

Pool Corp. (NASDAQ:POOL)

Those of you who own a backyard pool already know the Pool Corp. story quite well. (Honey, why is the pool water green?) Those who don’t own a pool, well, we recommend a little rent seeking on your neighbor’s pool by owning these shares. The Pool Corp. strategy is beautifully simple; build a pool and become its customer for life. Once the major discretionary expenditure of building a pool is made, that high-maintenance asset becomes an annual annuity for your local pool service company. Increasingly, that local pool service company could well be owned by Pool Corp.

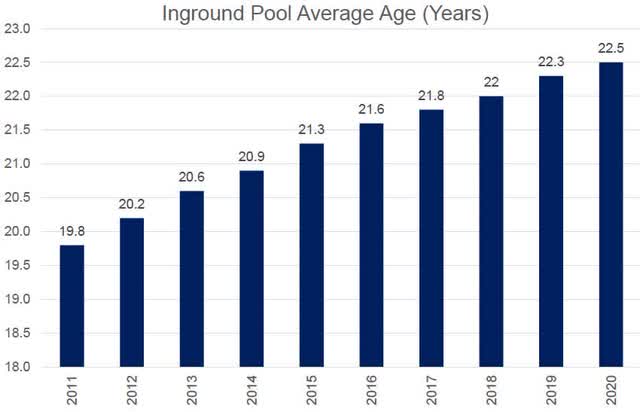

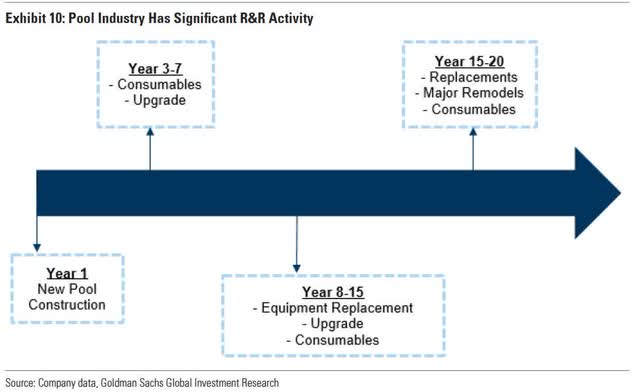

Those who own older pools know quite well that pool maintenance is much more involved (read: expensive) than just annual chemicals in the early years. Once a pool reaches its early teen years (often sooner), maintenance reaches a very different level of (read: expensive) when every part of the pool’s filtration system wears out. As the years progress, then pool/backyard rebuild kicks off. Well, that original pool becomes a brand-new second pool. Rinse and repeat. Your local pool-service company is assuredly not the lonely Maytag repairman.

Source: Pool Corp. Source: Pool Corp.

A decade or so ago, most backyard pools were simply pools surrounded by some type of hard coping. Fast forward to today, and our backyards have turned into major entertainment centers. We are spending much more time outdoors, and the backyard is now a focal point of our homes. Healthier outdoor living is now ingrained in our lifestyles and budgets. According to Zillow Research Surveys, respondents asked of the importance of a house with a pool (or spa) jumped to 35% in 2021, from 25% in just 2019.

Pools are now surrounded by decking and patios, outdoor fireplaces and kitchens, majestic fireplaces and waterfalls, outdoor lighting, weatherproof speakers, hardscapes, landscapes, and irrigation – much of it connected to apps controlled by smartphones. Indeed, significant technological advancements are found across the entire spectrum of a modern pool, dominated by automation; sanitizing systems (salt systems, UV systems, ozone systems); heat pumps (which cool water too); robotic cleaners; whisper-quiet, variable speed pumps, and LED lighting. Pool Corp. distributed all this backyard evolution.

A short history of the Company may be in order now. It’s rare that multibillion-dollar companies don’t have some type of Horatio Alger founding, driven by a single-minded, focused individual with that unique combination of entrepreneurship, grit, and perseverance through adversity. Pool Corp. founders would no doubt make Alger proud.

Source: Pool Corp.

South Central Pool Supply was founded in 1980 by Frank St. Romain in Metairie, Louisiana. Metairie is a suburb of New Orleans, which is in South Central Jefferson Parish. Starved for capital, the Company’s early years were marked by slow growth. In 1993 the Company was purchased by the Chicago-based private equity firm Code, Hennessey, and Simmons (CH&S). CH&S used the Company as a “platform company” to aggressively integrate vertically and horizontally. CH&S’ capital would prove to be insufficient too for its growth desires, so, in 1995, the Company went public as SCP Pool. (CH&S would sell half of its stake in SCP in 1997 and exit the remainder in 1998.)

Then the POOL party commenced. The list of the Company’s acquisitions are too numerous to list here, but here are the first two-decade milestones, post CH&S:

- 1996: 44 service centers.

- 1997: 85 service centers in 30 states, distributing 34,000 national brand and private products to 23,000 customers.

- 1998: Enters New England, New Jersey, New York, and Pennsylvania.

- 2000: 20th consecutive year of both sales and earnings growth. $670 million in sales.

- 2001: 160 service centers in 35 states, distributing 52,000 national brand and private label products to 28,000 customers.

- 2006: 274 service centers; 70,000 customers. $1.9 billion in sales.

- 2016: 344 service centers; 100,000 customers. $2.6 billion in sales.

Today, the Company with $5.3 billion in sales in 2021, is the world’s largest wholesale distributor of swimming pool and related outdoor living products operating over 410 sales centers in 12 countries – North America, Europe, and Australia, distributing more than 200,000 national brand and private label products from over 2,200 vendors to roughly 120,000 wholesale customers.

Notable too is the Company’s November 2021 acquisition of Largo, Florida-based Porpoise Pool & Patio, including its main operating subsidiaries, Sun Wholesale Supply and Pinch A Penny. Sun Wholesale Supply is a wholesale distributor of swimming pool and outdoor living products, including a key, state-of-the-art (chlorine) specialty chemical packaging operation, which until now only sold to Pinch A Penny franchisees. Pinch A Penny is the largest franchiser of pool and outdoor living-related specialty retail stores in the U.S. with approximately 260 independently owned and operated franchised stores in Florida, Texas, Louisiana, Alabama, and Georgia and brings Pool Corp. substantial opportunities for expansion.

Most of the Company’s business mix, 90%, is derived in the U.S. Canada is 5% and Europe is 5% too. 60% of the Company’s business revolves around the installed base of pools (and spas). Pool renovations and upgrades are 20%, and new pool construction is 20% as well. Its typical customer, +80%, are local maintenance contractors and professional builders. Local backyard-related retailers make up 12% and the rest is a small mixture of do-it-yourself customers and commercial customers (hotels, theme-parks, universities).

The Company operates four distribution networks: SCP Distributors (SCP), Superior Pool Productors (Superior), Horizon Distributors (Horizon) and National Pool Tile (NPT). The Company further breaks down its business lines into two categories – “Blue” for its pool related products and services and “Green” for its outdoor, primarily backyard living products. Blue represents about 84% of revenue, Green represents 8%, and the rest is from outside the U.S.

The Company estimates its U.S. share of the pool industry to be around 38% in the $10 billion wholesale market ($22 billion retail) – based on the U.S. installed base of 5.4 million pools. The Company is about four times larger than its only national competitor (Heritage Pool Supply – a division of SRS Distribution). Horizon (Green), the fourth largest landscape distributor in the U.S., with 81 locations largely in the Sunbelt, services into a $14 billion national Green addressable market.

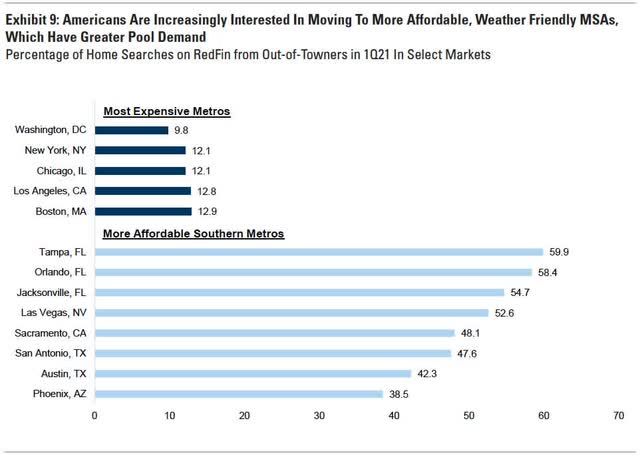

In addition to healthier outdoor lifestyles (plus the growing popularity of staycations), the Company also enjoys a significant tailwind of the migration to southern states. Such states include Arizona, Florida, and Texas. Texas is notable because its pool market is underdeveloped relative to other Sunbelt states. In U-Hauls annual review of interstate moves in 2021, it noted the following based on well over 2 million one-way U-Haul truck transactions:

- Texas narrowly beat Florida in transactions.

- Tennessee ranked third, followed by South Carolina and Arizona.

- California ranked 50th and Illinois 49th – both for the second consecutive year.

- 2021 migrations out of California weren’t as bad as in 2020, but that was only due to the fact U-Haul ran out of trucks to meet demand in 2021.

- Three of the states with the largest net losses were New York (45th), Massachusetts (47th) and Pennsylvania (48th).

Source: RedFin and Goldman Sachs

The Company reports that +82% of the population in the Sunbelt lives within 20 miles of a Superior/SCP branch and 54% with 10 miles. (An industry joke: “No moving vans go north, right. They go north with oranges, south with furniture.”)

Pool Corp. has been a growth and profitability powerhouse for years. The Company reminds us of another powerhouse, Old Dominion Freight Line. Both share a long-ingrained culture of organic growth by nonstop capacity additions. Both too have surely benefited by strategic acquisitions, but at the end of the day, the consistent ability to serve more customers from existing locations is the seed-corn of organic growth. Such growth, on top of the long crawl of operating leverage is the mothers-milk of ever-increasing profitability.

Over the past 10 years or so, up to the pre-pandemic year or 2019, the Company’s operating margin increased slowly, but steadily from 6.3% to 10.7%., net profit margin from 4.0% to 8.2%, and return on invested capital from 12.3 % to 27.3%. And then the pandemic hit. The Company’s business boomed like no other time as the country was locked down in their residences. Consider the outsized the boom calendar years of 2020 and 2021 and the outsized stock performance, respectively:

- Revenue: +23% and +35%.

- Operating Margin: +110 basis points and +390 basis points.

- Operating Income: +36% and +79%.

- Earnings Per Share: +44% and +78%.

- Return on Invested Capital: 33% and 36%. (Per the Company’s calculation, 44% in 2021.)

- Stock Price: +76% and +53%.

On the most recent earnings release and conference (1Q 2022, April 21st) demonstrated that the Company is still firing upon all cylinders. Here are the highlights of that call:

- 36 consecutive quarters of revenue growth.

- Record 1st quarter sales. +33%.

- 2nd largest biggest quarter ever.

- 5th consecutive quarter with sales +$1 billion.

- 2-year sales stack +108%.

- State revenue: Arizona +33%, California (even with migration out of that state), +31%, Florida +30%, and Texas (tough winter freeze comp.) +7%.

- Northern, Midwest seasonal markets +28%.

- PK Data: 2021 average price of pool $56,000, +17% over 2020. +$100,000 pools becoming commonplace.

- Outsized technology (automation-smartphone) gains notable gains new pool construction.

- Good news: renovation and remodel backlogs solid into early 2023; bad news: bigger backyard projects stressing already tight labor markets.

- Commercial markets still less than 10% of business, but grew +34% during the quarter, on top of +24% growth for calendar 2021.

- Chemicals +58%; 40% price, 20% volume; supply shortages improving; Suncoast Chemical (Pinch A Penney) significant on this score.

- Pool equipment +18%.

- Building materials (new construction, renovations) +29%.

- New construction/remodel 50/50 cash versus financing.

- Horizon +32%. 2-year stack +64%.

- Europe +5%, but rest of year awful given war-related inflation.

- Technology: Pool 360 app +28%.

- Pass-through price inflation continues (so far) +10%-12%.

- Gross profit +49%. Margin +330 bps.

- Operating income +83%. Margin +450 bps.

- EPS $4.41 +82%.

- 420 locations by year-end.

- Migration from seasonal northern states to year-round southern states continues.

- Work from home continues to drive outsized pool, patio and outdoor kitchen spend.

- Market share take continues weaker competitors.

- Balance sheet strength continues to separate the Company from its few diminished peers and all the mom-and-pop shops.

- Inventory +68% year-over-year (nobody can access and stock supply like Pool Corp.)

- Capacity to serve more customers better than competitor’s due to both vertically horizontally integrated acquisitions during the past couple of years, plus service center expansion to 420 in 2022.

- 80% of business in maintenance is non-discretionary – again, with more pools in year-round markets (reminder: poor water chemistry can destroy equipment after just a few months of neglect.)

- New pool construction is important, of course, but just 20% of business; such new pools dominate year-round markets, adding at the margin, to year-round installed base.

- PK Data reports 2021 new pool construction 117,000: +22% over 2020.

- Installed base continues to age – non-discretionary spending on failing equipment and pool infrastructure/decking a must after 7-10 years.

- Installed base still loaded with previous generation manual, analog equipment – smartphone app technology, plus more digital equipment (and automation) a major tailwind within aged installed base (high-efficiency equipment and LED lighting versus halogen lighting, high-efficiency heaters versus standard gas heaters or heat pumps, etc.)

- Assume most recent price increases will stick; some chemical prices may decline, but small declines only back to 2019 levels possible; input cost of manufacturing such chemicals has risen sharply too.

- Of course, the big question: After the past 2 stellar years, and a strong forecasted 2022 (everything backlogged, plus pricing), what about 2023? This question dominated the call; management laid out a cogent case of returning to industry leading growth of +6-9% in 2023.

While 2022 has started quite well for the Company, our growth expectations for late 2022/early 2023 encompass a material decline in 2020-2021 growth rates. Namely, for calendar double-digit growth in revenues and low +20% growth in earnings per share – and back to high single-digit growth in each during 2023.

The current bear market has corrected the once excessive valuation in the stock. As of this writing, the stock has sharply declined by -38%, year-to-date and -43% from its mid-November high to its most recent low in mid-June. In terms of valuation, the stock is much more reasonably valued at 19X calendar year EPS expectations of around $19 per share.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment