Petmal

Thesis

Renewable stocks have been in the rage recently, given the successful passage of the climate and tax package, with Plug Power Inc. (NASDAQ:PLUG) among the key beneficiaries.

The bill could unlock $370B in funding for renewable energy players, including a slate of tax credits and grants. It also includes a “new tax credit” for hydrogen projects, which “would quickly bring the industry closer to profitability.”

Therefore, we aren’t surprised by the significant buying momentum in PLUG. We informed investors that PLUG has likely bottomed out in our June update, even though we noted considerable pessimism among investors/readers in PLUG. We also followed through with another article in early July, highlighting that PLUG’s buying upside could continue further and is still constructive for adding exposure.

However, we believe the sharp momentum spike in PLUG may have overstayed its welcome in the bullish camp and is likely unsustainable in the near term, despite the market’s euphoria.

Therefore, we believe investors sitting on solid profits from May lows can consider cutting exposure. New investors should also consider holding off adding at the current levels as we head into Plug Power’s Q2 card on August 9 (tomorrow).

As such, we revise our rating from Speculative Buy to Hold and urge investors to exercise much-needed patience at the current levels.

The Climate And Tax Bill Could Accelerate Plug Power’s Path To Profitability

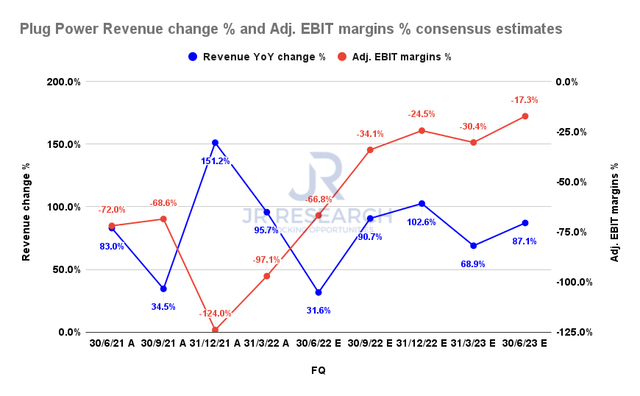

Plug Power revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

As a reminder, Plug Power is expected to post revenue growth of 31.6% in FQ2, according to the revised consensus estimates. Notably, Q2 is likely to be the bottom for its near-term financial model, as Plug Power’s topline growth should re-accelerate through Q2’23.

Consequently, it’s also expected to continue gaining leverage as CEO Andrew Marsh highlighted its operating efficiencies in Q1. He emphasized (edited):

The cost of our new products will continue to come down as we experience our traditional 25% learning curve for fuel cells and electrolyzers. All our present proxy at today’s volumes will have a minimum of 30% gross margins With the deployment of our green hydrogen network, 70 tons which will be available by year’s end, our cost will be 1/3 today’s cost. (Plug Power FQ1’22 earnings call)

Accordingly, the market’s positive sentiments on PLUG over the past few weeks are justified, as we believe the market has bet on the successful passage of the bill. Analysts believe that the bill is transformative for green hydrogen leaders like Plug Power, as it could speed up their path toward profitability. Barron’s reported (edited):

Analysts think that the hydrogen credits could be the most transformative part of the bill, particularly for the cleanest kind of hydrogen. Green hydrogen would get the largest subsidies of all the methods in the bill—as much as $3 per kilogram. That’s more than half of the cost of producing green hydrogen, by some estimates. ClearBridge Investments called that subsidy a “game changer” for companies in the industry. – Barron’s

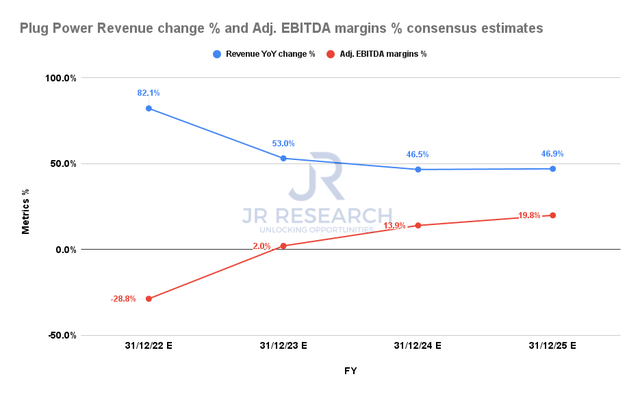

Plug Power revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Investors should also recall that management guided for Plug Power to post revenue of $3B by FY25 and an adjusted EBITDA margin of 20%, as seen above.

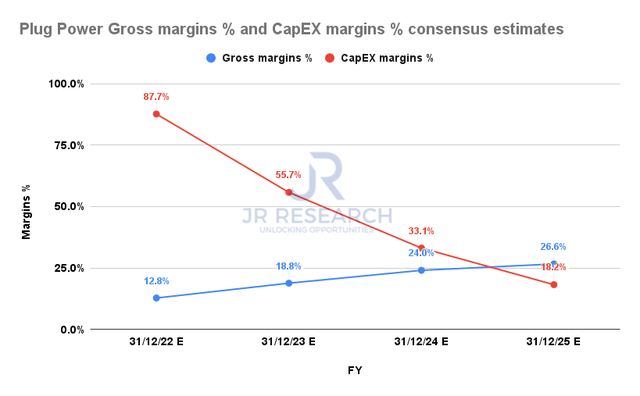

Plug Power gross margins % and CapEx margins % consensus estimates (S&P Cap IQ)

However, we think the low gross margins implied in its operating model, coupled with high CapEx, is a significant impediment to achieving free cash flow (FCF) profitability by FY25.

Therefore, we urge investors to parse management’s commentary on the potential implications of its long-term model at its upcoming earnings call. Recent buyers could have joined the rally in anticipation of a significant improvement in its long-term guidance.

BloombergNEF was also confident in a July update of the cost reduction of green hydrogen through 2030. Therefore, despite its unprofitability, Plug Power could ride on massive tailwinds if it executes well. BloombergNEF highlighted (edited):

Green hydrogen now costs far more than gray or blue: as much as $9.62 for a kilogram of green hydrogen, compared to $2.72 for blue, according to BNEF. But that likely won’t last. BNEF predicts that by 2030, green hydrogen will be cheaper than blue in every country the analysis service tracks. – BloombergNEF

Is PLUG Stock A Buy, Sell, Or Hold?

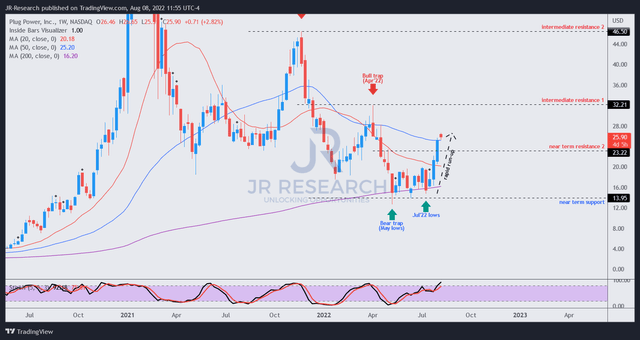

PLUG price chart (weekly) (TradingView)

We often espouse investors to pay close attention to price charts, as they are forward-looking. Even though the market sentiments in June were negative, we observed green shoots of recovery in PLUG’s buying momentum.

Therefore, we are not surprised that PLUG held its May and June lows firmly, as the market was staging an upward momentum recovery. However, if investors waited for the news to arrive (like now), they would have been late to the party.

As seen above, PLUG has recovered tremendously over the past four weeks, indicating rapid flush-up bars, often seen in the early stages of potential topping price structures.

However, we have not observed any bull trap (indicative of the market denying further buying upside decisively). Notwithstanding, we don’t encourage investors to add new positions heading into Plug Power’s Q2 card.

Therefore, investors are urged to bide their time and wait for a meaningful pullback first to find a sustained bottom before adding new exposure.

As such, we revise our rating on PLUG from Speculative Buy to Hold.

Be the first to comment