davit85

All values are in CAD unless noted otherwise.

Introduction

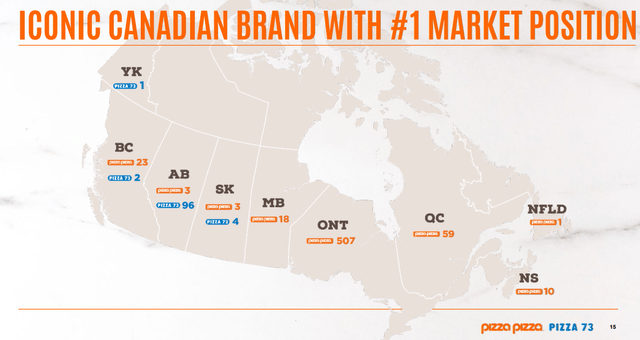

Pizza Pizza Royalty Corp. (OTCPK:PZRIF) has its hands in a couple of Canadian pies. It earns royalty on the gross sales of the restaurants in the royalty pool for the following brands.

1) Pizza Pizza Brand: 6% on 624 restaurants, located primarily in Ontario.

2) Pizza 73 Brand: 7% on 103 restaurants, located primarily in Alberta.

The royalty pool for the above two is adjusted on January 1 of each year to account for the opening of new locations in the preceding 12 months and corresponding permanent closings.

In November 2021, this group made its foray into Mexico. No restaurant openings have been reported as of now.

We Were Neutral

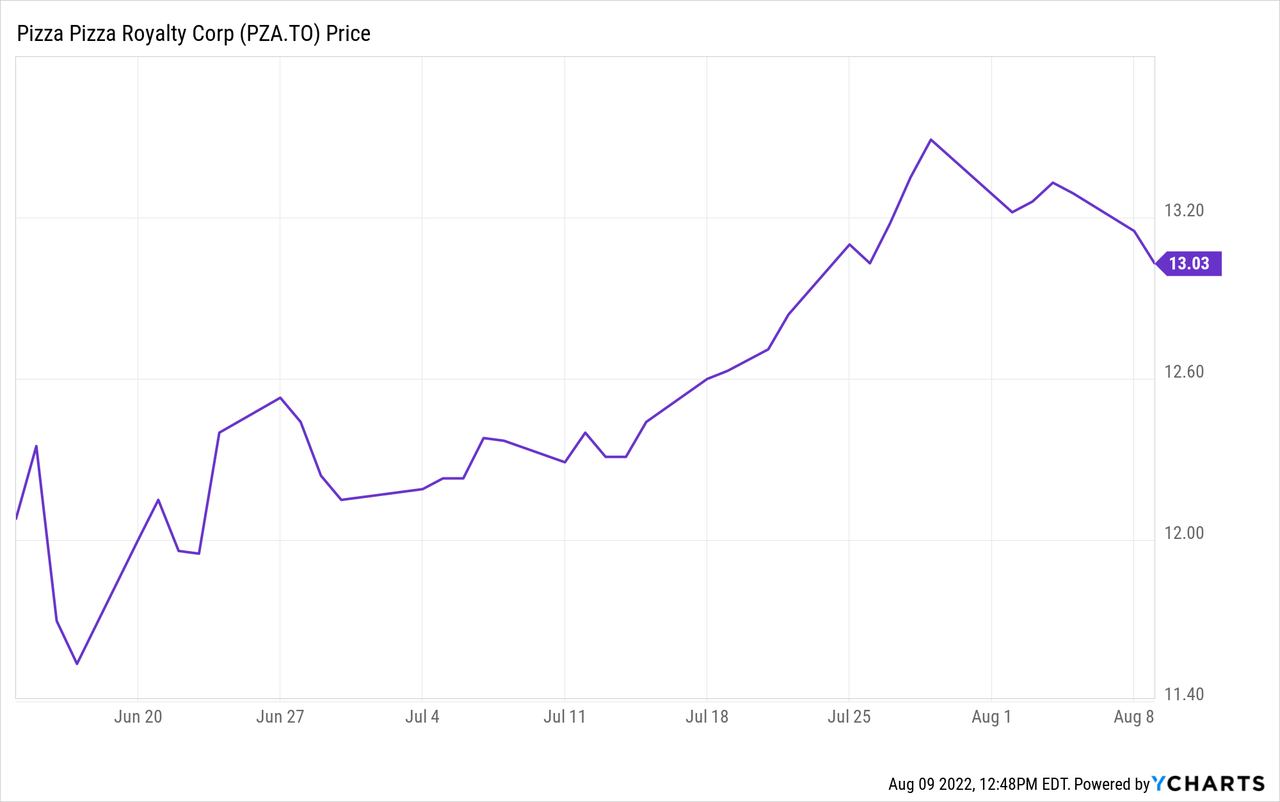

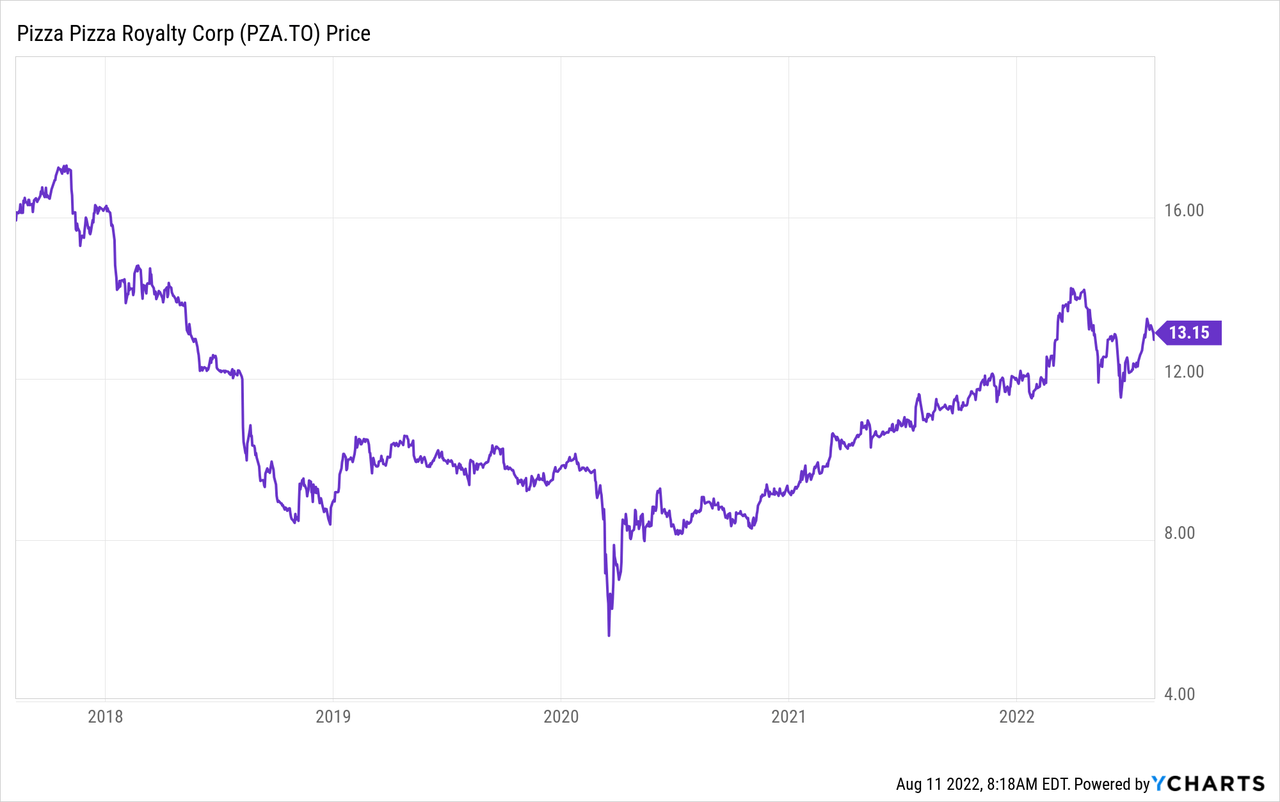

While personally holding this stock, we were still neutral on it back in June. We only liked it under $12 to initiate new position and chose to bide our time.

PZRIF’s dividend is very well supported. It appears one of the few firms in its market cap range that we think will hike. The stock has retraced and has removed some of the froth we saw at the highs. But we still don’t see it as attractive enough for a buy. It would have been wonderful if this had options, so we could sell cash secured puts at the right strike. But since it lacks those, we will have to go with the “buy-under” method. Here that would be about 14X earnings for 2023 (which we estimate at about 86 cents). That works out to about $12.00. We continue to rate this as a hold and we will only add if we see prices below that mark.

Source: 6% Yield And Another Hike Coming

The stock did cooperate and the price dipped under $12 shortly after that piece.

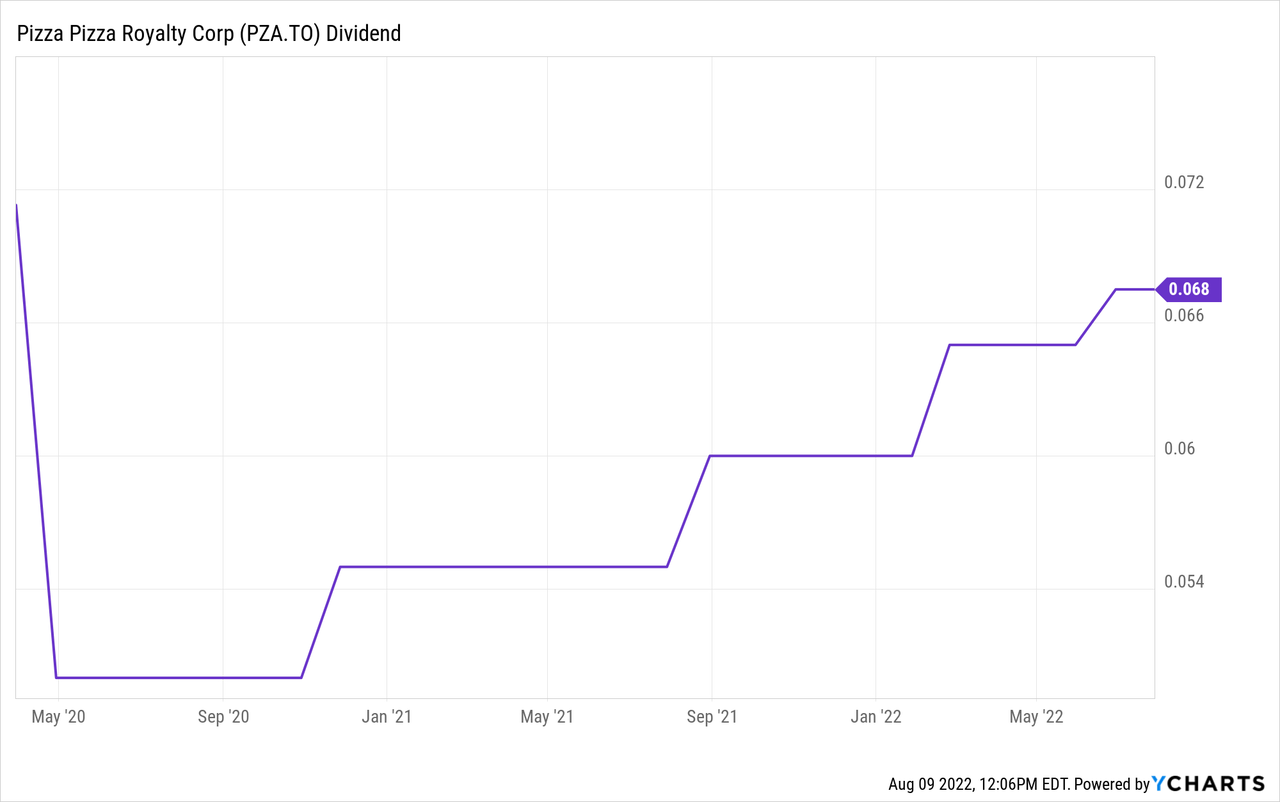

The closing in on the pre-Covid dividend levels also happened as expected with another dividend hike, a topic which we touch upon next.

Dividends

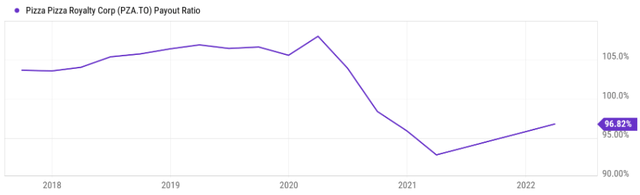

PPRC typically pays out substantially all of its net earnings in the form of dividends to its shareholders.

With the only expenses being for administration, interest on debt and income taxes, it does not suffer from huge variability between periods. Moreover, it is recovering nicely from the COVID-19 induced reduction in dividends due to the drop in royalty income and the decision to build a buffer to combat that time. After a series of hikes starting November 2020, it is almost back to its pre-Covid levels of 7.13 cents/month. The latest one was a 3.85% bump to 0.0675 cents a month.

With the back half typically bringing in higher revenue that the first one, we expect at least another hike before year end.

Q2 Earnings

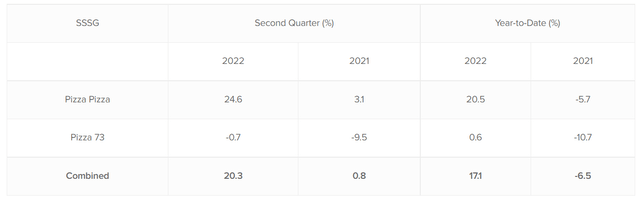

Q2 continued in the same vein as Q1 and showed an increase all around. The same store sales increased by 20.3% with the Pizza Pizza brand as usual being the stronger contributor of the two. The results noted that the later was impacted by a decrease in customer traffic during the quarter.

The overall sales growth increased by 20.8%, with the Pizza Pizza brand being 24.6% and the Pizza 73 brand being 1.3%. The adjusted EPS also showed an upward trajectory by 19.5% from the comparative quarter. The company has very little expenses and most of the revenue growth flows through to the bottom line. That is a huge advantage in a high inflation environment. You generally won’t find such a high transmission outside of the energy and royalty plays.

While the aforementioned royalty pool of 727 locations will remain unchanged until the annual reset next January 1, the restaurant openings net of closings for the first half of the year has been positive. The current royalty pool is a far cry from the 772 restaurants in 2019, however, management expects to maintain the growth momentum and said as much.

New restaurant construction continues across Canada as government mandated restrictions on commercial construction have been lifted in all provinces. PPL management expects to accelerate its traditional restaurant network expansion by 5% and continue its renovation program through 2022.

Source: PPRC Q2 Results

With an improvement in the debt to EBITDA, the interest rate on their credit facility (maturing in 2025) reduced to 2.685% from 2.935%. This happened as the credit spread was reduced 0.875%. Keep in mind though, the overall rate will now head higher perhaps much more, as Bank of Canada is on an aggressive hiking mission.

Verdict

We still like this royalty play but think we can get it cheaper down the line. Being one of the more inexpensive meal options out there, we think this royalty play will benefit as people become more discerning about where they spend their limited dollars. On the other hand, Pizza 73 restaurants faced a decrease in foot traffic when trying to pass on the inflation costs to the customers. Commodity prices have since retraced and this should help the food chain, but labor costs remain high and continue to rise, making life difficult for the restaurants. Investors should also be cognizant of the fact that a lot of the recent growth has been a form of catch-up from 2019. For example, Q2-2019 had sales of $134 million and we are right now at $142.5 million. So if you did not penalize it for the revenue losses, don’t cheer the catch-up.

Yes, we are likely to get yet another dividend hike as the company’s payout ratio dropped to 94%. While that may seem like an alarmingly high number, PPRC aims for close to 100% as it does not need to retain anything. So the old dividend should be back before the year end. That is great news for those that stuck with it. The stock is still not cheap at over 15.5X earnings. Yes, you can pay more in general for unleveraged royalty plays, and PPRC qualifies. But there are challenges here and the 15-16X earnings mark is still too expensive. Investors should also keep in mind that we are seeing these multiples alongside the most inverted yield curve Canada has seen in decades. Caution is the name of the game. We are not looking to add to our position at this price and maintain a buy under $12.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment