Bet_Noire/iStock via Getty Images

Introduction

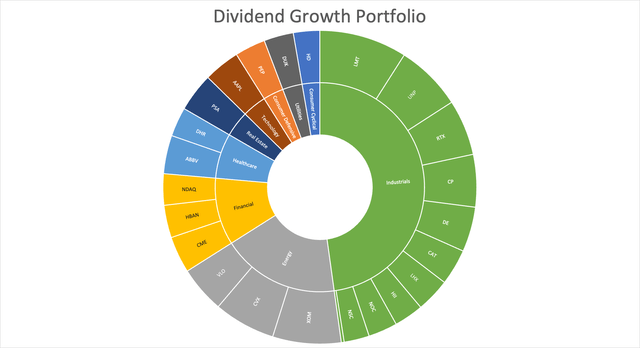

Thanks to the massive surge in energy stocks since 2020, I have roughly 17% exposure to the industry through my dividend (growth) stocks. I also have some oil stocks in my trading portfolio. One of the reasons I’m writing this article is to discuss the current environment and to explain why I hold energy stocks. The only reason I hold energy stocks is to get a good yield. In this case, I own the “big guys” Chevron (CVX) and Exxon Mobil (XOM).

Author Portfolio

A stock I own only in my trading portfolio is a stock that is in a terrific spot to deliver high shareholder value – even in lower oil price environments.

That stock is Pioneer Natural Resources (NYSE:PXD). This stock is the perfect fit for any strategy that aims to use energy stocks for yield and a degree of “safety” during sell-offs.

In this article, I will discuss how the company generates shareholder value based on the return of capital, its inventory, and its balance sheet – among other things.

A Quick Look At the Oil Market

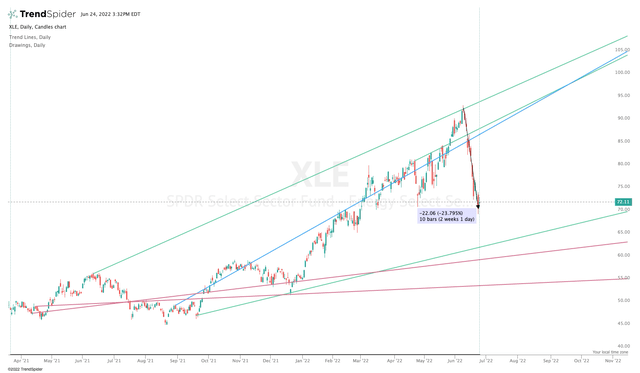

June started off quite well for energy stocks as most components continued the uptrend they started in 2021. Then, energy stocks did what energy stocks do best: suddenly drop while crushing anything in its way. As the TrendSpider graph below shows, energy stocks lost a quarter of their value in roughly 2 weeks’ time. That’s quite something and it did scare a lot of people who were used to oil being a one-way street since 2021.

TrendSpider

I didn’t predict the downturn. As a matter of fact, I don’t care what happens to oil stocks on a short-term basis. When I bought energy, I knew I would have to deal with regular (steep) sell-offs during bull markets and devastating downtrends whenever oil gets hammered in a serious recession. After all, I hope to hold energy stocks for many decades.

Earlier this month, I wrote an article titled “Thanks To Politicians, Exxon Mobil Remains A Buy”.

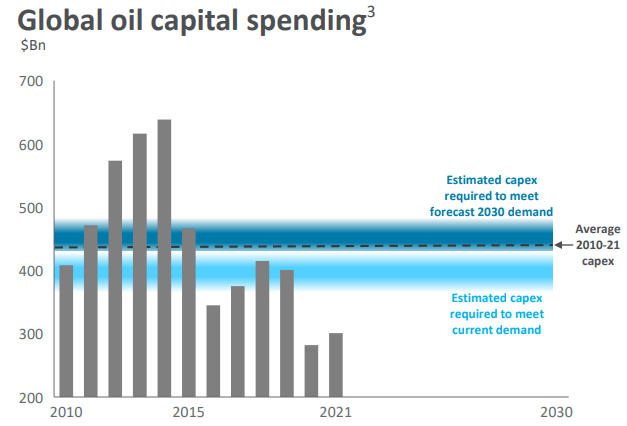

It was a long article that explained why the oil supply side is in trouble – caused by i.e., the decision of politicians to end oil as quickly as possible. One of the charts that I used can be seen below.

Seeking Alpha

For the first time since the oil bottom of 2016, producers are not boosting capital expenditures (“CapEx”). As I wrote in my Exxon article:

Estimates are that global CapEx needs to be close to $450 billion to satisfy oil demand in 2030. That is not happening at this rate.

Reasons are broad, but it all comes down to ESG (environment, social, governance). Governments don’t want “polluting” oil anymore. Large corporations are focusing on renewable energy, and activist investors are pushing for lower production to reduce the carbon footprint of companies. In the case of Exxon, it is Engine No. 1.

New York Times

I believe that oil sold off this month because investors expected that demand would weaken enough to offset the problems caused by supply. The same is happening to copper – or as some like to say “Dr. Copper”. It’s a typical recession trend.

FINVIZ

Even though I’m bullish on oil stocks, most of my articles are aimed to achieve one thing for myself and my readers: steady (and high) cash flow in the form of dividends, buybacks, or preferably both.

While I do like that my energy stocks have done well, it’s not my main goal to achieve high capital gains as I won’t sell anyway.

Hence, I try to look for the best companies that offer quality dividends. That’s where Pioneer comes in. Which writes “Quality” with a capital “Q”.

Pioneer Natural Resources’ Dividend Quality

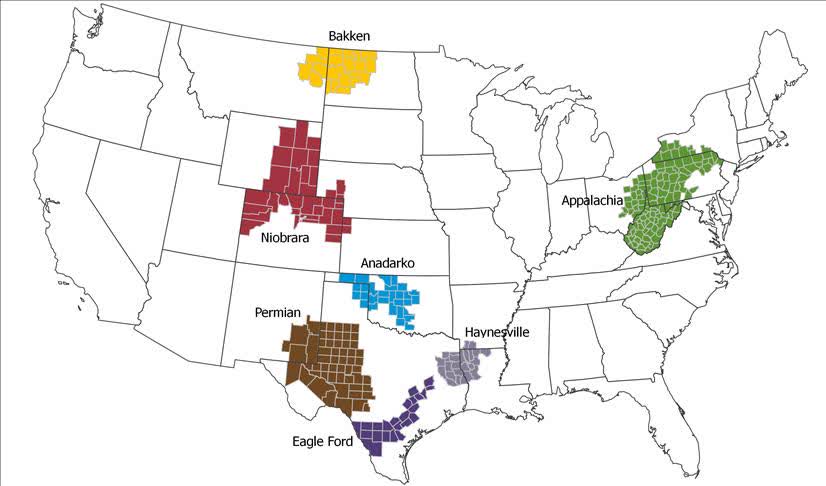

With a market cap of $54.1 billion, Pioneer Natural Resources is one of the world’s largest oil drillers. Unlike the big guys like CVX and XOM who are well-diversified, PXD is a Midland Basin pure-play independent driller.

For people who are new to oil, it means the company drills all of its oil in the Permian basin (in Texas). There’s no company that holds as much land in that area as Pioneer.

Anadolu Agency

Like its peers, the company is focused on very moderate oil production growth and high free cash flow.

The five pillars of the company’s plan to enhance shareholder value are:

- Focus on returns (return of capital, free cash flow)

- Return of capital (durable returns for shareholders through dividends and buybacks)

- Long duration inventory (the company has more than twenty years of high-quality inventories in high-return locations)

- Preserving its balance sheet (low leverage provides the flexibility to boost returns)

- ESG leadership (a focus on high ESG standards)

What I like about these five pillars is that (if maintained on a long-term basis) it provides the basis for the thing I care most about: steady cash flows for investors.

After all, the one thing that keeps me from worrying for a single second during energy sell-offs is that I know I will get my dividends. That’s all I ever wanted. These dividends are then invested in stocks that provide more dividend GROWTH and higher expected long-term capital returns.

Anyway, one of the reasons why Pioneer is in the position to deliver high returns is its assets and the way it operates. The company has more than 20 years’ worth of inventory it can drill with a breakeven oil price of less than $40 per barrel WTI.

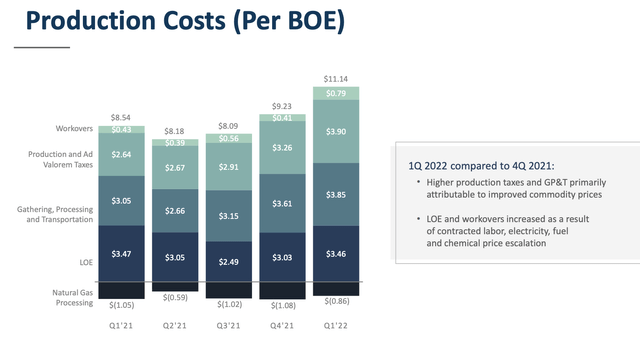

This beats any competitor in the Midland Basin. Moreover, the company’s cash costs to drill oil are close to $11 per barrel of oil equivalent – also better than any competitor.

Pioneer Natural Resources

Add to this that Pioneer has not hedged any 2022 production volumes. In other words, it can use high oil prices to receive more free cash flow. The downside is that lower oil prices hurt the company more than necessary. However, I believe these risks are limited because of low breakeven drilling costs and because its balance sheet is very healthy (to be discussed in this article).

Thanks to no hedges, price realization is stellar. In 1Q22, the company received $94.60 per barrel WTI. That’s a premium of $0.31 over NYMEX crude (that’s WTI crude). When it comes to gas, the company received $4.81 per MCF. That’s $0.15 below-market prices.

In 1Q22, the company produced 355 thousand barrels of oil per day. It produced 153 thousand barrels of oil equivalent of natural gas liquids and 777 thousand MCF of gas per day. Adding these numbers according to the standardized BOEPD (barrels of oil equivalent per day) method gets the company to 637 thousand. This is roughly 10 thousand above 2Q21 levels, but below the prior two quarters as the company is not looking to grow oil volumes at a high rate (none of its competitors are).

With that said, whenever a company is able to cut costs and benefit from high volumes, investors benefit from high free cash flow, another pillar of shareholder returns.

This year, Pioneer is looking to produce between 623 and 648 thousand BOEPD with a capital budget of $3.3 to $3.6 billion. This is expected to result in $13.5 billion in operating cash flow. When subtracting CapEx, we end up with a free cash flow estimate of $10 billion.

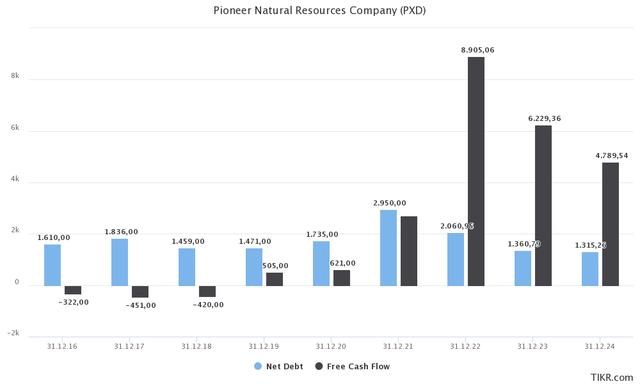

Analysts are looking for roughly $8.9 billion in free cash flow. Please don’t focus too much on 2023 and 2024 FCF estimates. Analysts are pricing in a moderation of the oil price. It could happen, but it could also not happen. If oil remains high (which I expect to happen), high (upward) revisions will be on the agenda.

TIKR.com

To put things into perspective, $8.9 billion in free cash flow is 16.5% of the company’s market cap. $10 billion gives us an implied FCF yield of 18.5%.

What this means is that if the company were to distribute all of its FCF, this would be the implied dividend yield. The company isn’t distributing all of it, but you get the idea why income-oriented investors get so excited about energy stocks these days.

Based on declared dividends in 2Q22, the annualized dividend yield is 11%. On top of that, the company repurchased $250 million of its own shares in the first quarter. It returned 88% of its FCF to shareholders this way.

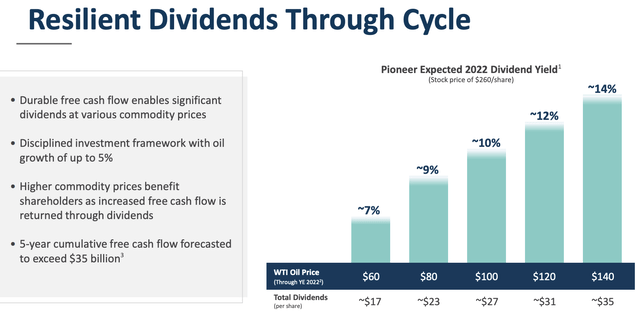

Note that the $7.38 dividend paid in 2Q22 consists of a base dividend of $0.78 and a variable dividend of $6.60. Almost needless to say, PXD’s dividend will be volatile. The lower the oil price, the lower the dividend. The higher the price of oil, the higher the dividend. The variable dividend will be up to 75% of post-base dividend FCF. In other words, free cash flow minus the base dividend multiplied by 0.75. Then, buybacks will be used to distribute 80% of FCF – in other words, the gap between 80% and the base and variable dividends.

As a matter of fact, PXD provided a little cheat sheet for us showing what it expects to distribute based on various oil prices. These numbers below are based on a $260 stock price. The stock price is currently $224 while I’m writing this. So, the implied numbers below are lower than what people are likely to receive at current prices.

Based on 5% production growth this year, $100 per barrel results in a 10% yield (again based on a $260 stock price). A surge to $140 would add another 400 basis points to the implied yield. Even a decline to $60 would still get investors a 7% yield. That’s not bad at all. Just bear in mind that an oil price decline to $60 will more than likely result in steep (temporary and unrealized) capital losses.

Pioneer Natural Resources

With that said, there’s another reason why the company can pay a high dividend – on top of high free cash flow. It does not need to prioritize its balance sheet. Companies with high debt need to repay that first before rewarding their shareholders.

As my TIKR chart above shows (the one showing expected free cash flow), the company is expected to end this year with $2.0 billion in net debt (gross debt minus cash). That’s roughly 0.10x EBITDA. In other words, extremely healthy. Note that even in 2020 when the net debt load was higher and EBITDA was much lower, net debt ended the year at 0.7x EBITDA.

So, what about the valuation at current prices?

Valuation

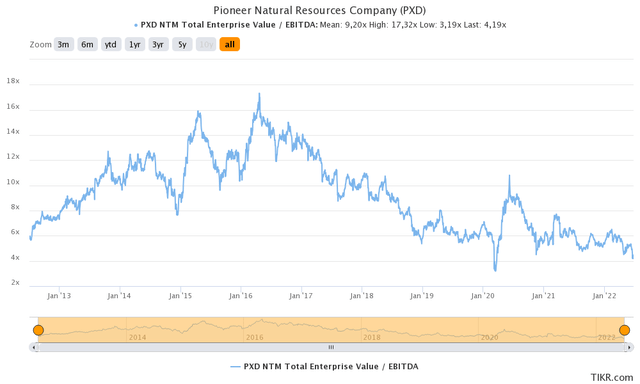

As usual, I like to go with the enterprise value versus EBITDA to incorporate the company’s debt. I always prefer this over price/earnings. In the case of PXD, we’re dealing with a $54.1 billion market cap and $2.0 billion in expected 2022 net debt. Next year, net debt is expected to fall to $1.4 billion.

In 2023, EBITDA is expected to be $11.9 billion. That’s down from $13.7 billion expected in 2022. I’m using the 2022 number as analysts are pricing in moderation of oil prices – the same applied to FCF estimates as I showed in this article. It gives us a bit of a margin of error in case oil does indeed fall a bit towards the $80 WTI area.

Using an implied 2023 enterprise value of $55.5 billion gives us a 4.7x 2023 EBITDA multiple. That’s too cheap. I believe that PXD should trade at least at 6.0x NTM EBITDA. That would imply a stock price of at least 30% higher than current prices (target: $290).

TIKR.com

Takeaway

I have a love/hate relationship with energy stocks. I “hate” them because of volatile behavior during market downturns, the fact that they never seem to reach their “fair” value as investors are unwilling to price in a prolonged period of high oil prices, and because governments are 24/7 busy trying to figure out how to end oil production.

I love them because oil production isn’t going anywhere. If anything, government policies provide a path for long-term elevated oil prices, which energy companies use for the one thing they are really good at, which is generating high free cash flow.

That’s where Pioneer Natural Resources comes in. While I believe that the stock is significantly undervalued, I don’t like it because of the potential upside. It’s all about a juicy variable dividend.

Pioneer distributes up to 80% of its free cash flow via dividends and buybacks, resulting in high expected dividend yields – even if oil were to fall more than 40% to 50%.

The company has very low production costs, high inventories of more than 20 years’ worth of production, a healthy balance sheet, and the willingness to distribute its cash to its shareholders.

It also helps that energy sold off this month as the market worried about the demand side. This made the valuation (and implied dividend yields) way more attractive.

Long story short, if you are looking for quality dividends and don’t mind high volatility, PXD is the way to go.

(Dis)agree? Let me know in the comments!

Be the first to comment