seewhatmitchsee/iStock Editorial via Getty Images

Investment Thesis

We were neutral in our initial article on Pinterest (NYSE:PINS) in August 2021, due to the negative MAU performance, fundamental business issues with user engagement, and a relatively high price. Since then, the stock has fallen more than 50%.

Pinterest has gone through a period of rapid growth, and management is testing various hypotheses in an attempt to find a source for a second wind. Simultaneous investments in creators, shopping, personalization, and discovery experiences are another try to develop in two different directions at the same time: in e-commerce and social media. Of course, some of the company’s initiatives may turn out to be successful, but there is still uncertainty. In addition, PINS has accumulated a significant balance of Cash & ST investments and is likely to resort to an M&A strategy, which could lead to a negative revaluation of the shares. According to our valuation, the company is trading near its fair market value. On multiples, Pinterest looks quite expensive. We again rate shares as a Hold.

Cash Cow Or Startup?

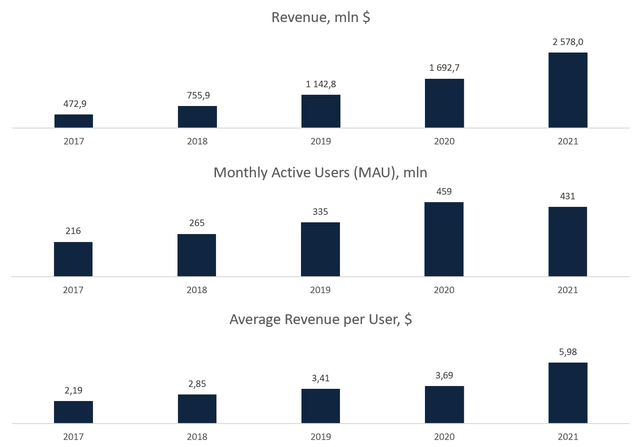

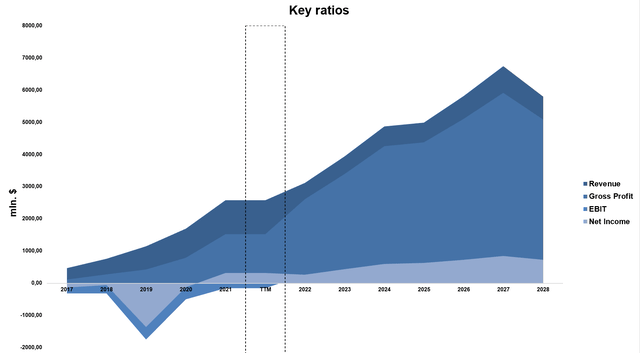

At first glance, this subtitle looks out of place about Pinterest, but it perfectly describes the situation in which the company finds itself. For a long time, Pinterest has been one of the favorite stocks of growth investors, the number of monthly active users has doubled since 2017, and the company’s revenue has grown five and a half times.

Created by the author, based on the company data

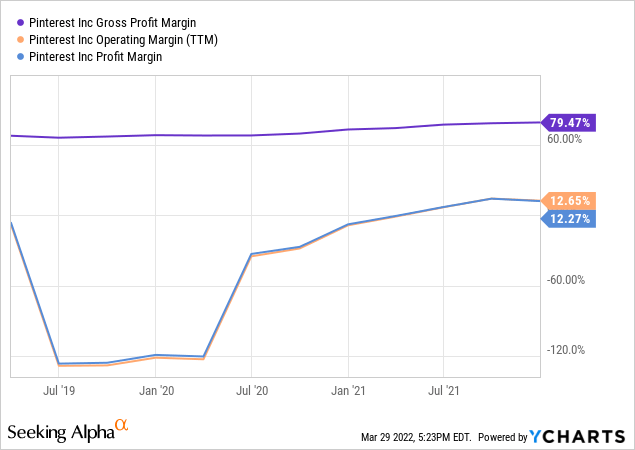

The tailwind of the pandemic has not only been a driver of growth but has also allowed the company to significantly improve profitability. At the end of 2021, Pinterest’s gross margin reached 79.5%, operating margin of 12.7%, and net profit margin of 12.3%. The free cash flow that PINS generates is much more impressive (Levered FCF margin of 23.9%). The FCF margin shows how good the potential for a business to create shareholder value is.

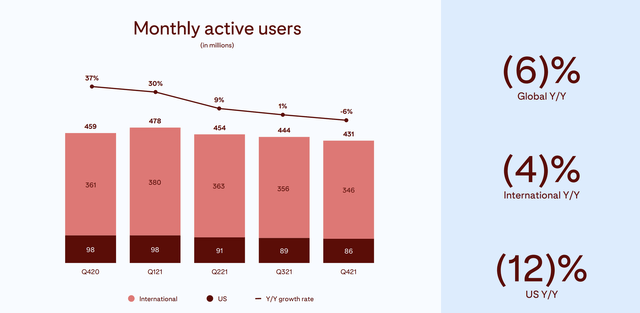

However, the post-pandemic world threatens PINS’ role as a growth company. Pinterest has been unable to maintain the solid user base it has gained during the pandemic, with monthly active users dropping permanently every quarter in FY 2021.

Company’s Presentation

At the conference call, the CFO of Pinterest Todd Morgenfeld noted that the number of MAUs on February 1, U.S MAUs were approximately 86.6 million and global MAUs were approximately 436.8 million, there is a signal that the bottom has been passed. However, it is not yet clear how sustainable this increase is.

Pinterest appears to have gone through a period of explosive growth as its users include 47% of internet users in the US, half of all millennials aged 18 to 34, and eight out of 10 moms.

Bulls often make an argument that the reducing number of monthly active users doesn’t matter because PINS increases average revenue per user. Furthermore, the potential for further ARPU growth remains strong as Pinterest needs to grow the indicator by 500% to just match the current Facebook (FB) levels. However, here we run into a fundamental problem with the PINS business model – low user engagement compared to other social platforms. It is a mistake to assume that one monthly user can generate the same amount of revenue as one daily active user on Facebook. Since a Pinterest user uses the platform much less often, its value is a priori several times lower. In foreign markets, growth potential remains, but it is insignificant. The key market for any social media platform is the US.

Thus, Pinterest is faced with a choice: use a solid free cash flow to reward shareholders, or look for new growth opportunities. Management chose the second path. Like a startup, the company is testing different hypotheses in an attempt to find a source for a second wind. Simultaneous investments in creators, shopping, personalization and discovery experiences are an attempt to develop in two different directions at the same time: in e-commerce and social media.

To boost engagement, in May Pinterest incorporated “Idea Pins” that allowed users to post short-form videos with enhanced editing capabilities. In October, Pinterest introduced a “watch feature,” which like TikTok, allowed users to scroll through short videos. In addition, management announced that the company will invest $20 million to compensate certain creators.

Shareholders are already paying to test hypotheses that may fail. Management forecasts FY 2022 non-GAAP operating expenses to rise by approximately 40% year-over-year due to investments in the native content ecosystem, core Pinner experience, headcount across R&D, and sales and marketing. With an expected 20% top-line growth, the non-GAAP operating margin will drop from 30.5% to 19%. GAAP numbers will drop significantly more.

| in mln $ | FY 2021 | FY 2022 E |

| Revenue | 2,578 | 3,093 |

| OperatingExpenses | 1,791 | 2,507 |

| Operating profit | 786.9 | 585.5 |

| Operating margin | 30.5% | 19% |

Source: Created by the author

In addition, Pinterest has accumulated a significant balance of liquid assets, with Total Cash & ST Investments accounting for 78% of the company’s total assets. Probably, PINS will resort to an M&A strategy. This is an additional factor that can lead to a decrease in profitability due to asset turnover and a negative revaluation of shares.

Indeed, some Pinterest initiatives may turn out to be successful, but there is still uncertainty that should be priced in.

No Longer Growth, Not Value Yet

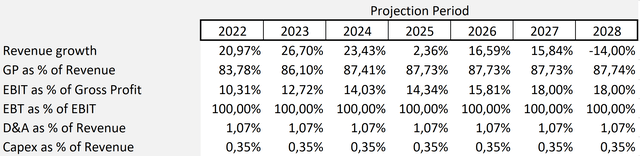

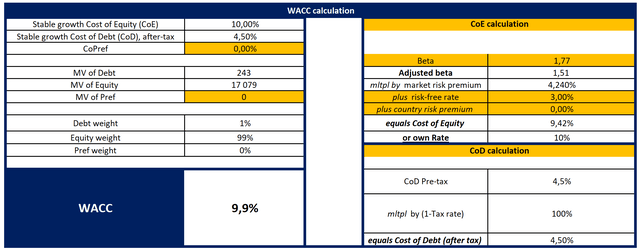

Our DCF model is based on some assumptions. We expect revenue to rise in line with the Wall Street consensus. For the past five years, the Goss margin has grown by an average of 4.31 percentage points per year, we expect the figure to grow by a comparable amount by the end of FY 2022. We also expect operating expenses to rise by 40% YoY for the year, in line with management’s expectations. We assume that future D&A and CapEx as a percentage of revenue will be in line with FY 2021. The terminal growth rate is 6%. Our assumptions are presented below:

Created by the author

Based on the assumptions, the expected dynamics of key financial indicators are presented below:

Created by the author

With the cost of equity equal to 10%, the Weighted Average Cost of Capital (WACC) is 9.9% as Pinterest has low financial leverage.

Created by the author

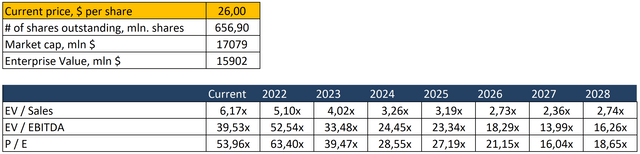

With a Terminal EV/EBITDA of 25x, the model projects a fair market value of $12,129 million, or $18.46 per share. Thus, Pinterest is trading near our estimate of fair value.

You can see the model here.

On current and forward multiples, Pinterest also looks quite expensive.

Created by the author

Conclusion: Neutral On PINS

After a period of explosive growth, Pinterest management faced a choice: reward shareholders or look for new opportunities for further growth. The company has focused on finding new growth points and is actively investing in three areas: creators, shopping, personalization and discovery experiences. However, it is not yet clear how successful these investments will be, and shareholders are already paying for testing hypotheses that may turn out to be unsuccessful. In our opinion, the margin of safety for the purchase is still insufficient. We are neutral on PINS.

Be the first to comment