alexsl

Investment Thesis

Pinterest (NYSE:NYSE:PINS) has been left for dead as investors want nothing to do with what was a growth stock that suddenly becomes ex-growth.

Furthermore, substantial change in the executive suite leaves a company that investors have no interest in touching with a barge pole, let alone invest in.

However, underneath all the headlines, there’s a lot to be excited about this unique social media platform that reaches more than 430 million monthly users.

In sum, Pinterest has been left for dead. But its turnaround could be sooner than many think.

Revenue Growth Rates Could Worsen in Q4

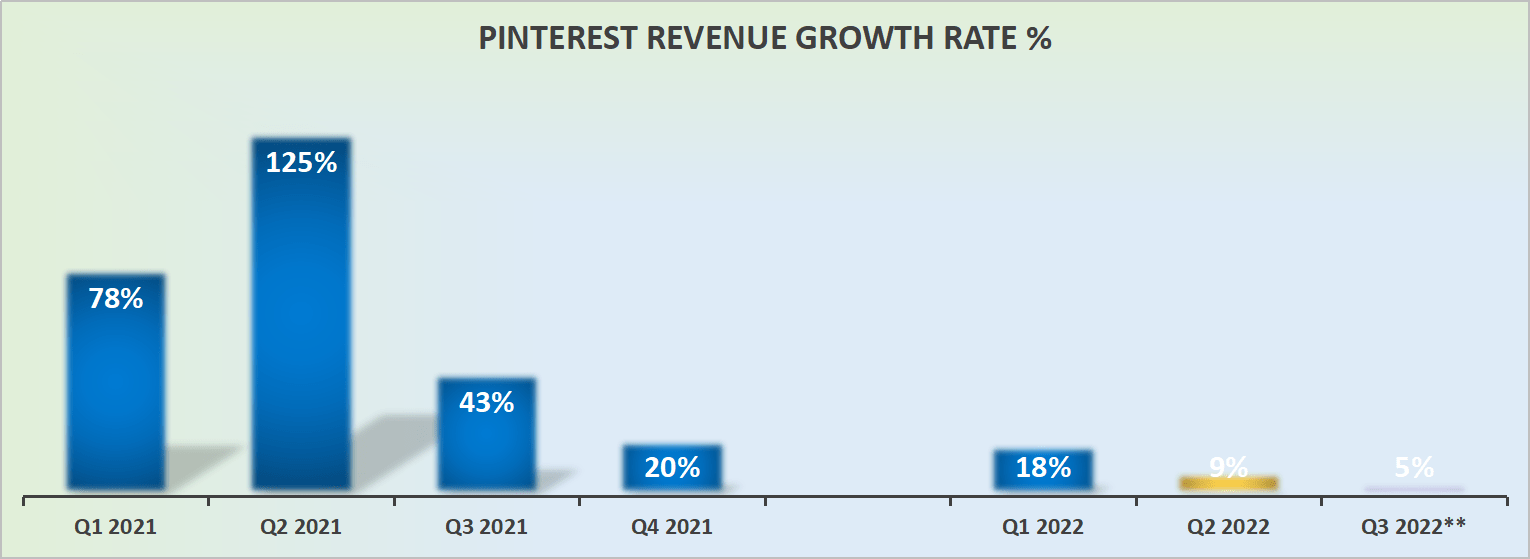

Pinterest’s revenue growth rates

The graphic above highlights the reality facing Pinterest. This is a company that is no longer printing premium growth. In fact, we’ve recently heard from wide-ranging industries that their spending budget is tightening. See DocuSign (DOCU), Coupa (COUP), and UiPath (PATH).

What this means in practical terms is that as we get towards the back end of 2022, the underlying prospects of advertising companies are likely to weaken.

What’s more, note above that in Q4 of last year, Pinterest still posted 20% growth rates. Consequently, I believe that when Pinterest reports Q4 of this year, there’s a significant likelihood that it will post no revenue growth. Or perhaps, it could even post negative revenue growth.

This is not a popular opinion, as analysts following the name believe that Pinterest’s Q4 could actually print up to 5% y/y in revenue growth rates.

Nevertheless, one way or another, I’m confident that you’ll agree that Pinterest is no longer a growth story.

However, this is where things get interesting. Why?

Because I believe that much of this insight is already priced in by the market. Why? After all, Pinterest’s share price is already down more than 50% in the past year!

Hence, I contend that the opportunity for investors is not in understanding that Pinterest is no longer a growth company. But in thinking about what’s next for Pinterest.

Could It be a New Dawn?

A month ago I wrote a bullish article about Pinterest titled A New Dawn. In that article, I note that CEO Bill Ready was chosen to lead Pinterest into a new chapter.

The goal for Ready is to convince investors to give Pinterest some time. Ready will seek to turn the company’s focus toward its e-commerce opportunity. Indeed, as consumers increasingly gain confidence and interest in buying indie brands from online influencers, Pinterest is very well positioned to embrace this dynamic.

In fact, there’s been a recent trend from some of the mega tech companies to unlock Livestream e-commerce.

This is where influencers engage with younger demographics and get consumers to transact on promoted products. This is a very compelling avenue for commerce platforms.

Here indie brands are eager to pay to be on these commerce platforms. Then, the value add here is when indie brands also pay to be given a spotlight on the commerce platforms.

Finally, the more transactions through the marketplaces, the more GMV that these marketplaces can take a cut from.

Incidentally, it’s important to recall that Pinterest doesn’t lack users. As of Q2 2022, Pinterest’s MAUs were 433 million, flat compared with Q1 2022. Again, its user base hasn’t been the issue for Pinterest.

Where Pinterest has struggled with is getting its users to go beyond “just looking” for ideas. How can Pinterest get its users to transact on Pinterest?

Meanwhile, there’s evidence that Instagram (META), YouTube (GOOG)(GOOGL), and Amazon Live (AMZN) are deploying substantial capital to get users accustomed to purchasing on these platforms’ Livestream.

Pinterest’s Rock Solid Balance Sheet

As I’ve touched on already, Pinterest needs time to right its ship. This is not going to come overnight.

Furthermore, as I discussed, I believe that the latter parts of 2022 will be particularly challenging for Pinterest.

This is not only due to companies restricting their ad budgets leading to lengthening sales cycles but also that in a higher inflationary environment we’ll see Pinterest’s profitability margins compress.

As of Q2 2022, Pinterest’s cash flows from operations reached $120 million. Of that figure, nearly all of it was in the form of stock-based compensation. Further, given that the stock is down significantly, this means that a substantial portion of that stock-based compensation has now lost its value.

Therefore, I suspect that in the coming quarters Pinterest will have to increase its stock-based compensation in order to retain executive talent.

On yet the other hand, Pinterest carries more than $2.7 billion of cash on its balance sheet and no debt. This means that Pinterest has a rock-solid balance sheet that will provide it with the firepower to buy time to turn around its ship.

PINS Stock Valuation – 5x Next Year’s Revenues

If we were to make a bold assumption that Pinterest could grow its revenues next year by approximately 15%, that would see Pinterest reporting $3.2 billion in revenues next year.

This would put Pinterest’s share price at approximately 5x next year’s revenues. I don’t believe that in the present state paying 5x next year’s revenues multiple is a compelling enough valuation for Pinterest.

That being said, if Pinterest could under its new executive leadership convince investors that it is still a growth company and that it’s likely to unlock a larger vertical in Livestream sales, then in that condition there’s a chance that Pinterest could be compelling.

The Bottom Line

Pinterest has been left for dead, with its stock now trading in the bargain basement. Meanwhile, there are some positive developments that are not getting enough attention from the market. In particular, Pinterest’s potential move toward Livestream could lead the company to unlock a new growth vertical.

Presently, the stock is priced at 5x next year’s revenues. This is not the cheapest stock around. But it is a fair entry point for investors that fundamentally believe that Pinterest has low-hanging fruit within its Livestream sales and that the market is already pricing in a lot of negative sentiment. Whatever you decide, good luck and happy investing.

Be the first to comment