westphalia/E+ via Getty Images

Introduction

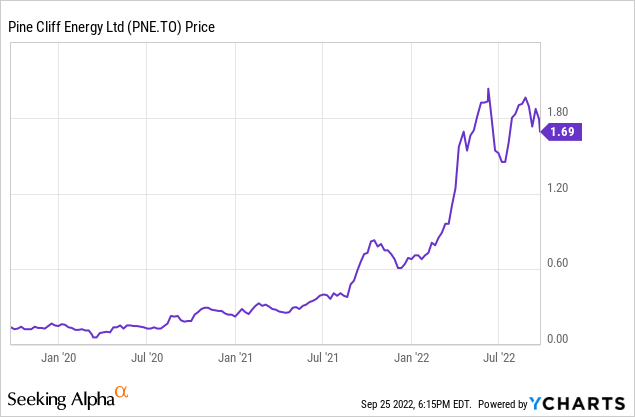

Pine Cliff Energy (TSX:PNE:CA) (OTCPK:PIFYF) is a small natural gas producer in Canada. It’s widely known the second quarter of this year was one of the best quarters Canadian natural gas producers experienced (and Pine Cliff was no exception) but now the attention shifts towards Pine Cliff’s plans to deal with a more normalized (but still elevated) natural gas price. As the company recently hiked its dividend, Pine Cliff could now be appealing to both income investors as well as investors pursuing exposure to the natural gas space.

The company’s Canadian listing offers superior liquidity. Trading with PNE as its ticker symbol, the average daily volume on the Toronto Stock Exchange is approximately half a million shares per day. The company currently has just over under 350M shares outstanding, resulting in a market capitalization of C$590M. As the company reports its financial results in Canadian Dollar, I will use the CAD as base currency throughout this article unless indicated otherwise.

Q2 was a blowout quarter, but expect a weaker Q3 and Q4

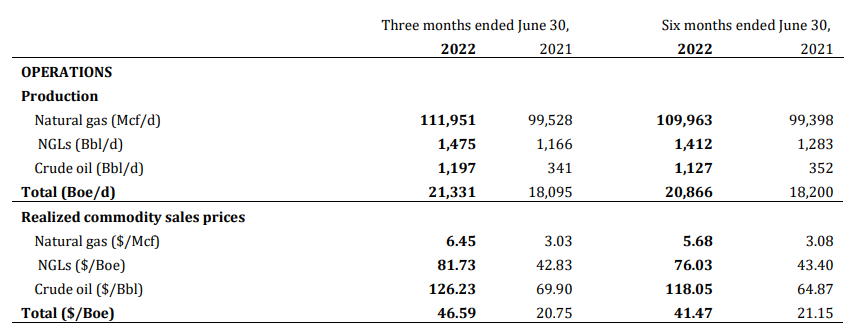

Pine Cliff still is a relatively small producer with an average output of just over 21,000 barrels of oil-equivalent per day. As the NGL and crude oil production represents just over 15% of the oil-equivalent output, it’s very clear we should look at Pine Cliff as a natural gas producer.

Pine Cliff Investor Relations

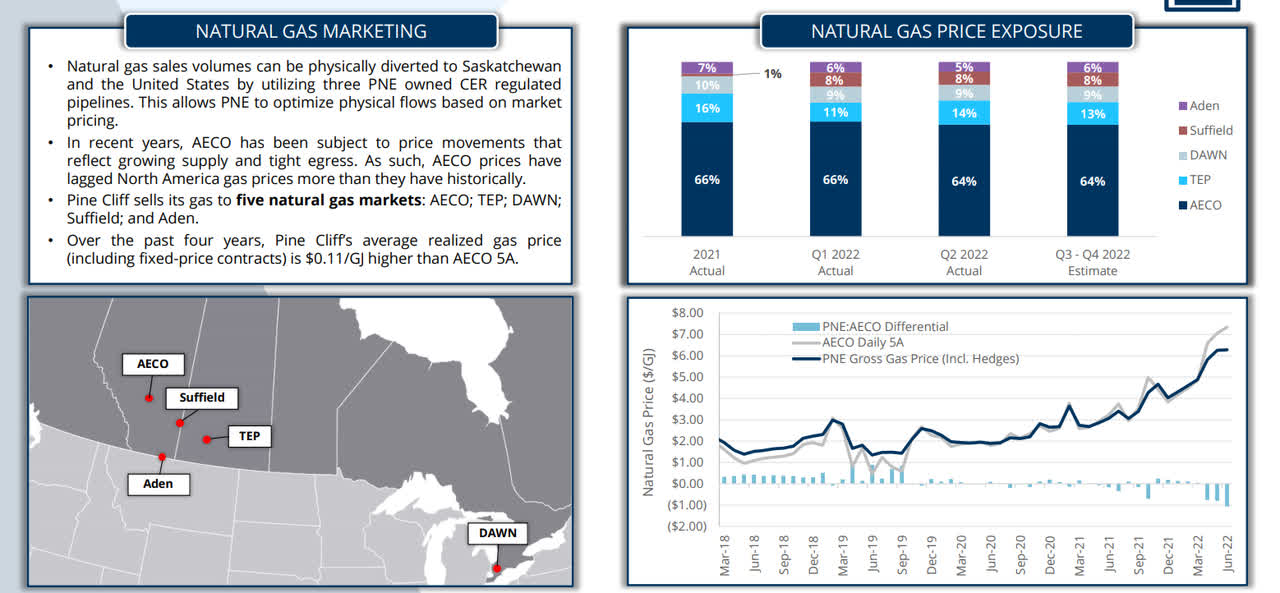

The second quarter was obviously excellent. The average realized natural gas price was C$6.45 per Mcf. That’s more than twice the price received in the second quarter of last year and it also is a 30% increase compared to the first quarter of this year. Keep in mind the natural gas is sold based on AECO prices (with exposure to some other Canadian selling points) so there will for sure be some volatility.

Pine Cliff Investor Relations

In the first half of the year, Pine Cliff received an average natural gas price of C$5.68 per Mcf, and although the Q2 performance was clearly stronger than the Q1 results, I prefer to work with the ‘lower’ average realized price generated in H1.

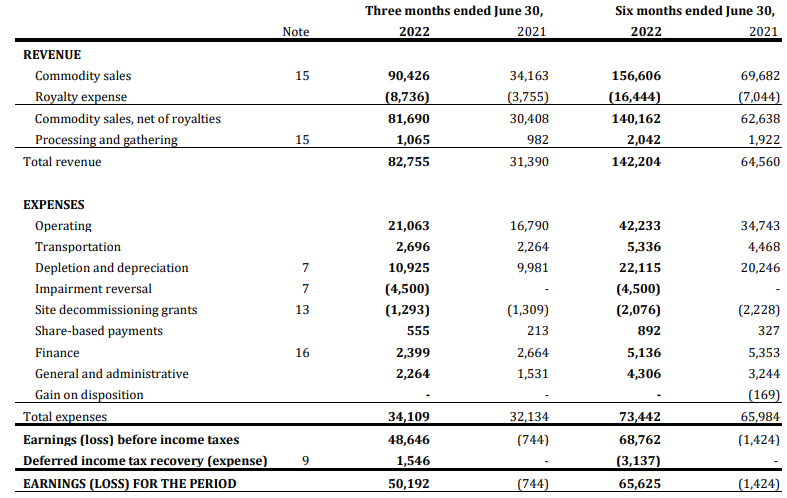

The total revenue in the first semester was just over C$156M resulting in a net revenue of just over C$142M after taking the royalty payments and the processing revenue into account as well. The total amount of operating expenses was just under C$73.5M (and this would have been about C$78M excluding the C$4.5M impairment reversal). And as you can see below, about 60% of the normalized operating expenses consist of operating and transportation expenses.

Pine Cliff Investor Relations

The depletion and depreciation expenses are relatively high at C$22M but aren’t the most important element of the operating expenses. The company reported a pre-tax income of almost C$69M and a net income of just over C$65.6M in the first half of the year. This resulted in an EPS of C$0.19 in the first semester. It is important to see about 76% of the net income in the first semester was generated in the second quarter. That being said, this also was the quarter the company was able to reverse an impairment charge which boosted the reported net income by about 10%. Additionally, Pine Cliff also recorded a tax benefit. On a pre-tax basis, the second quarter would have contributed C$44M of the C$63M pre-tax income.

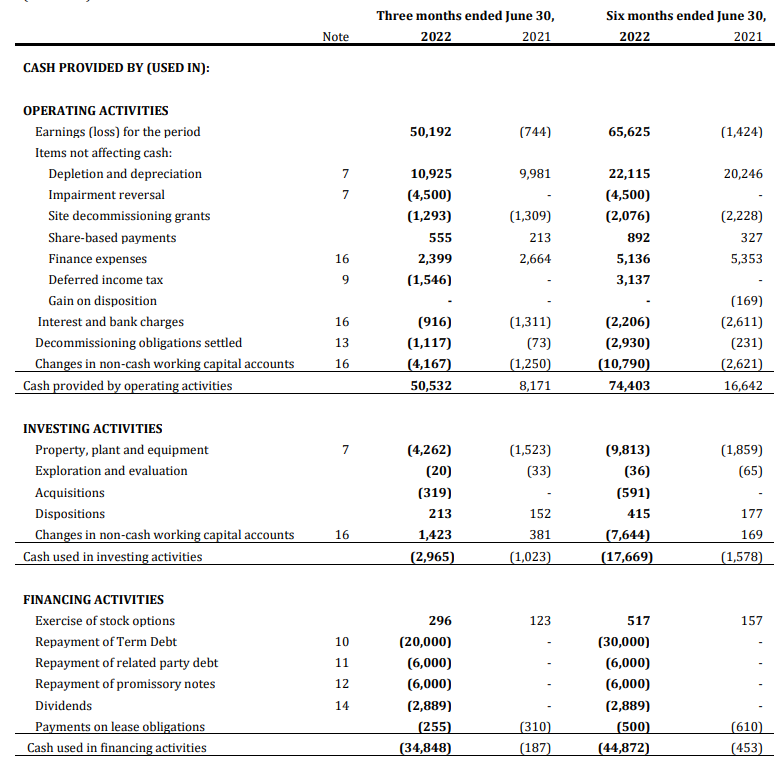

Looking at the cash flow statement, Pine Cliff obviously posted an excellent result as well. The reported operating cash flow was C$74.4M for the first semester and after adding back the investments in the working capital position and deducting the lease payments, the adjusted operating cash flow was C$84.5M.

Pine Cliff Investor Relations

The total capex was just under C$10M resulting in a net underlying free cash flow of C$74.5M for a free cash flow per share of just over C$0.21. The adjusted free cash flow in the second quarter was approximately C$0.14 per share.

Pine Cliff repaid all of its debt during the first semester and ended June with a positive net cash position of C$18.7. The main liability on the balance sheet are now the C$200M+ in decommissioning provision.

The strong financial results also helped the company to increase its shareholder payout. It hiked the monthly dividend by 20% to C$0.01 per share per month. At the current share price, this represents a dividend yield of in excess of 7%.

An updated guidance for 2023 shows the financial strength

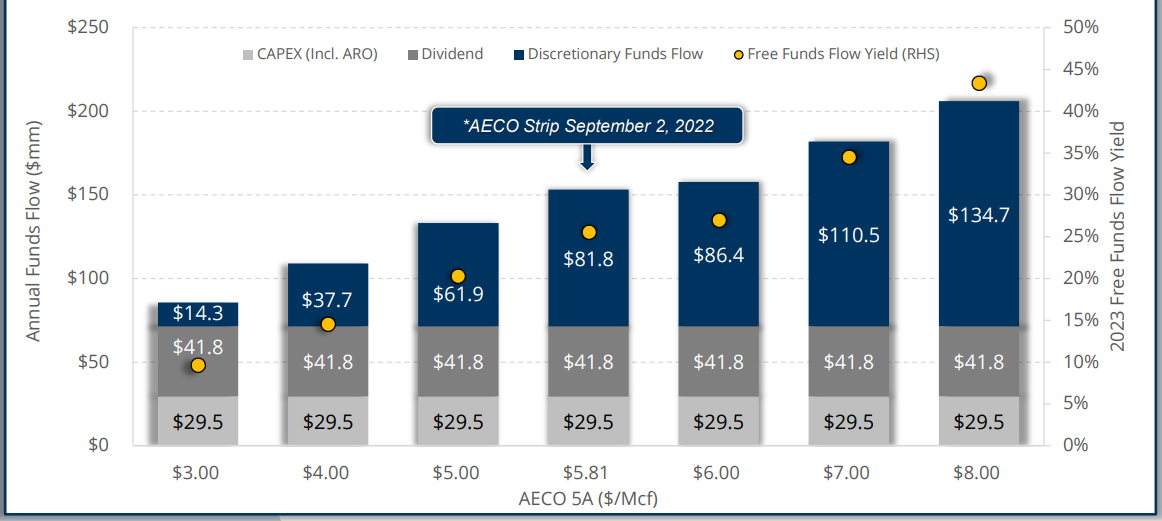

Pine Cliff does a good job in providing details to its shareholder base. For next year, Pine Cliff estimates it needs a natural gas price of C$2.40 per Mcf to break even. The full-year capex is estimated at just C$30M thanks to Pine Cliff’s assets with a low decline rate.

Pine Cliff Investor Relations

As you can see in the image above, even at C$4 AECO, the company will generate just under C$110M in operating cash flow resulting in about C$80M in free cash flow. After also covering the dividend which is currently costing about C$42M per year, Pine Cliff would still have access to almost C$40M in discretionary cash flow. And even at C$3 AECO the company would still fully cover its dividend and have just over C$14M in ‘excess’ cash flow.

Investment thesis

As explained in my previous article, my main issue with Pine Cliff is the relatively low reserve life. The PDP reserve life index is just 6 years and even the 2P reserves are underpinning a remaining reserve life of 8.2 years (based on the year-end 2021 reserve estimates which means the reserve life index is now down to approximately 7.5 years).

I am looking forward to seeing an updated reserve calculation which should be published in Q1 next year. I am interested in Pine Cliff but would like to see a sizeable increase in the reserve life index before going long.

Be the first to comment