I think there are lots of troubles coming… There’s too much wretched excess. – Charlie Munger

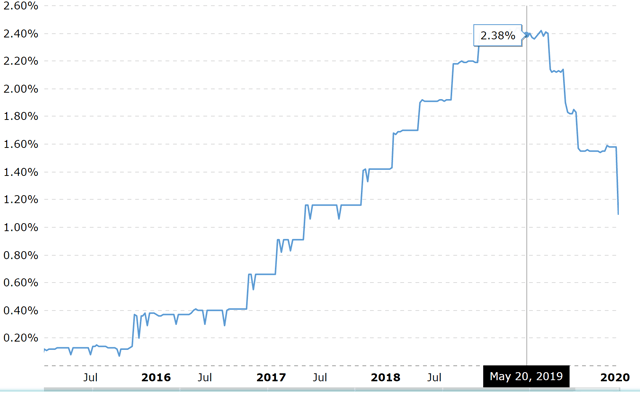

The PIMCO Enhanced Short Maturity Active ETF (MINT) is a descriptive name for what it does. According to their website, MINT seeks maximum current income, consistent with preservation of capital and daily liquidity. I thought it was an excellent time to highlight this holding because, as I mentioned on the Lead-Lag Report last week, now is not a bad time to be parking some cash on the sidelines, and MINT is a way to generate some return while doing so. The ETF’s first and foremost goal is capital preservation, liquidity, and a more robust return than traditional cash holdings, in exchange for a slight increase in risk. The ETF is also not passive, despite most other cash holdings being so. The fund “offers PIMCO’s veteran liquidity management team, as well as an extensive credit research process to source what are believed to be the most attractive securities.” With assets of over $15 billion invested in the holding, you are not alone if you are investing in this holding. It offers an ultra-low duration of 0.27 years effective maturity and 0.23 years effective duration, despite an estimated yield to maturity of 1.38%. It is also highly liquid, and you can trade it like any other ETF on the market.

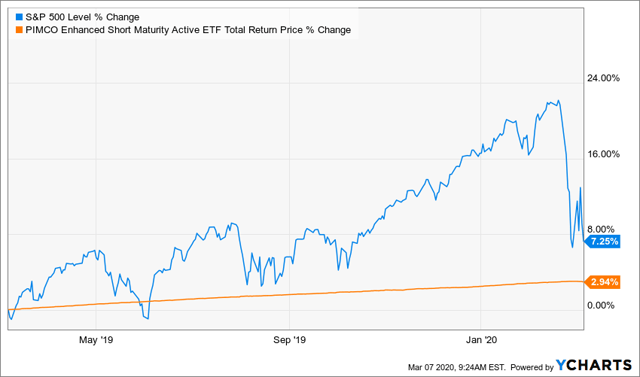

A look at its top 10 holdings shows you how diversified MINT is. None of the top 10 holdings are over 1.07% (its largest position), and the ETF holds 857 separate positions as of March 5, 2020. This is an extremely safe holding to park your cash. In a late-cycle market with volatility swings that we have seen lately, having an allocation to MINT would be in your best interest to help you sleep at night. Yes, it will likely never return more than the long-term returns of the S&P 500. But that is the thing with risk. It is good when stock markets are going higher, but when it punches you on the chin, you sure would prefer the no-risk option. Besides, the allocations to T-bills and money market funds are not keeping pace with other short-term investments. What that means is, especially if you have a given liquidity allocation, you should consider MINT a part of it. Also, if you are looking to make a quick trade, commission-free brokerages on ETFs give MINT another leg-up. You can trade this position intraday and purchase a beaten-up stock if you wish, or you can put the cash you’ve raised from your stocks instantly into this holding.

When you look at what one of the best money managers are doing, specifically Charlie Munger and Warren Buffett with Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B), they have a massive cash pile to protect against uncertainty right now. The coronavirus outbreak is proving them right to be wary, if not for the exact right reason. Berkshire has a $128 billion cash pile right now, and that’s after buying back $700 million of its shares. Think about that for a minute – $128 billion on cash, representing 58.1% as much cash as it has equity securities. That is the highest level of cash to equities since 2007. We all know what happened next. Maybe it isn’t the coronavirus that is the black swan event that everyone is looking for – perhaps it passes much as SARS did back in the early 2000s. What is apparent, though, is that there are lots of issues to be concerned about right now at these market levels. Remember, we are only in a correction right now, and if you think that feels bad, remember that a bear market feels much worse. We haven’t had one of those since 2018 (not technically a bear market with a closing % loss of 20% from the high, but close enough for me to quantify it as one as it did cross that threshold intraday).

One thing that is different about this cash holding than other money market funds is the active management that cannot be discounted at this point in the market cycle. Yes, the downside is that you must pay for it. MINT comes with a gross expense ratio of 0.36%, not an insignificant number when you are only getting a small yield on your holdings. But the advantage of having liquidity and active management on your short-term liquidity allocation is advantageous and worth the cost.

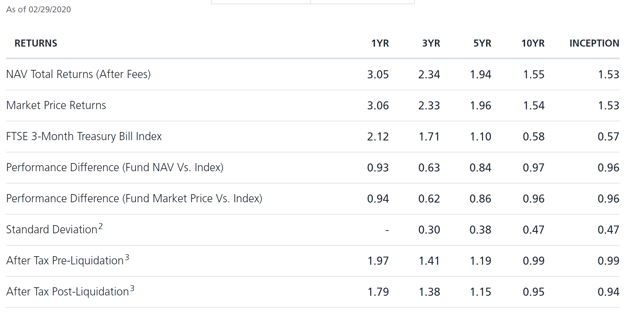

The one-year return is sitting at 3%, the three-year return at 2.34% annualized, and five-year return at just under 2%. Given how low interest rates have been over that period, that is a fantastic return for a cash-like instrument. Those return numbers are all after-fees as well, in case you were wondering, and are well above the returns of their index the FTSE 3-month Treasury bill index of 2.12%, 1.71%, and 1.10%, respectively. After a week where you were smacked by the coronavirus, which is not over, in an election year, after a 10+ year bull cycle for the economy, it is time to consider your liquidity needs. MINT allows you to profit from it.

Source: Macrotrends

Source: PIMCO

*Like this article? Don’t forget to hit the “Follow” button above!

How To Avoid the Most Common Trading Mistakes

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment