Nikolay Pandev

Piedmont Office Realty Trust, Inc (NYSE:PDM) is a real estate investment trust (“REIT”) that owns and operates a portfolio of Class A office properties that are leased to a diversified tenant base primarily comprised of investment-grade or nationally recognized corporations or governmental agencies. Headquartered in Atlanta, Georgia, their properties are located in seven major U.S. office markets, primarily in the Sunbelt region, which accounts for over 60% of annualized lease revenue (“ALR”).

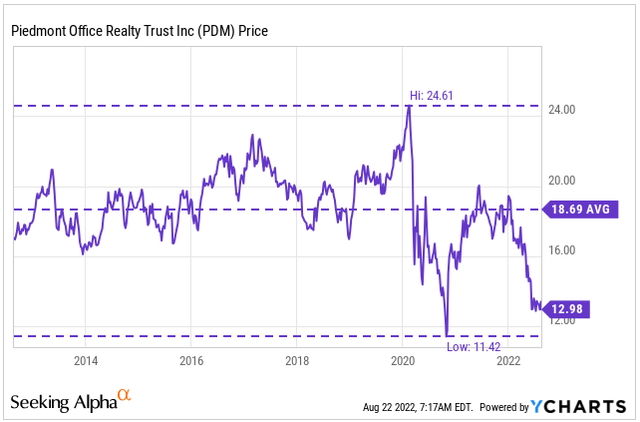

Currently, shares are trading at just 6.4x forward funds from operations (“FFO”) and are hovering at the bottom of their 52-week range. This is a sizeable discount to the REIT sector at large, which is trading at about 17x forward FFO, and to a related peer, City Office REIT, Inc (CIO), who is a third of the size of PDM by market cap, but is trading at a multiple of 8x.

YCharts – Summary of Recent Share Price History

YTD, PDM is down over 30% and is not too far off their lows last attained during the height of the COVID-19 pandemic. This is despite a significantly improved outlook that includes rising occupancy levels and more certainty regarding the future of work.

For investors, shares in PDM offer sizeable upside potential with the risk/reward very much in their favor. In addition to share price upside, investors would also receive a quarterly dividend payout, currently yielding nearly 6.5%. Though there are plenty of attractive opportunities in the office sector, PDM is one selective investment that can produce stand-out returns.

A Quality Portfolio With Room For Improvement

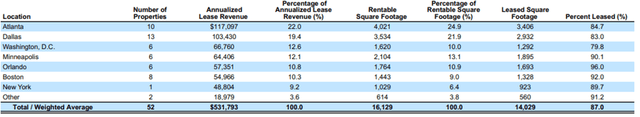

PDM’s portfolio of assets include 52 properties concentrated in seven markets, 23 of which are in Atlanta and Dallas, representing approximately 40% of ALR. At 87%, total leased occupancy is still trailing 2019 levels, which stood above 90%, but they are 150 basis points (“bps”) improved from the end of 2021.

In their second largest market, Dallas, the trailing leased rate of 83% presents an attractive future growth opportunity for PDM. In the current quarterly period ended June 30, 2022, for example, the market experienced strong new leasing and touring activity, with corporate relocations into the area totaling 200 for the year, which is up significantly from 90 in 2020.

Q2FY22 Form 10-Q – Summary of Geographic Concentration

In addition, there is one large lease in the market which is set to expire in 2023. This expiration is expected to be accompanied with an extension of up to five years at a spread of 25%. The Dallas market, therefore, is likely to contribute meaningfully to future NOI growth, despite its currently lagging leased rate.

Solidified Strength In The Atlanta Market

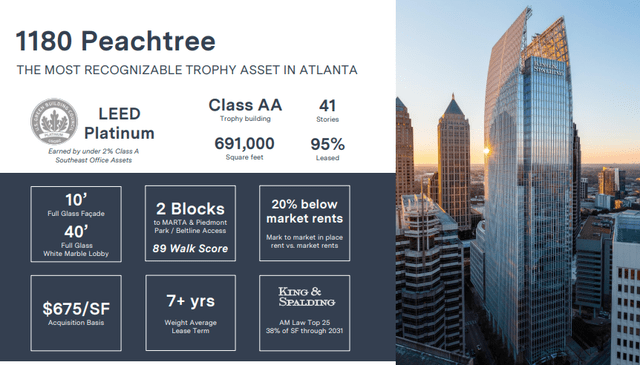

During the current quarter, PDM also strengthened their market position in Atlanta by closing on 1180 Peachtree, which is a landmark asset that is one of the most recognizable trophy assets in the city. Anchor tenants in the 41-story skyscraper include Bain & Company and Cushman & Wakefield (CWK), to name just two. The acquisition of the property cemented PDM’s position in Midtown Atlanta, ranking them as the largest landlord on Peachtree Street.

PDM Company Website – Snapshot of Recent High-Profile Acquisition

Additionally, the acquisition came at a significant discount with an acquisition cost of $675 per square foot (“sqft”) and a blended acquisition basis of approximately $525/sqft. This is estimated to be modestly below replacement cost with in-place rents that are 20% below market values.

Furthermore, the current leased rate on the building is 95%, and the historical occupancy levels have never dipped below 90% in the last ten years. The strong occupancy levels paired with the upside potential in rents is sure to provide accretive benefits to PDM beginning in Q3, which is when the acquisition is expected to be completed.

Diversified Tenant Base With Strong Portfolio Metrics

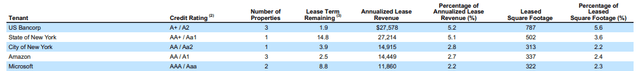

PDM also has a diversified tenant base where no single tenant accounts for over 5.5% of ALR. Within their top five are U.S. Bancorp (USB), whose national headquarters are owned by PDM, and Amazon (AMZN) and Microsoft (MSFT). Both the State and City of New York are also among the top five. Collectively, these five tenants accounted for less than 20% of ALR, a testament to the portfolio’s diversification.

Q2FY22 Investor Supplement – Summary of Top Tenants

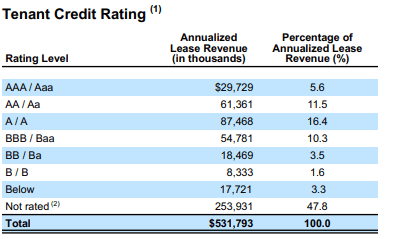

The overall tenant base is also comprised of highly credited companies, operating primarily in the professional services industry, as well as in the governmental sectors.

Q2FY22 Investor Supplement – Summary of Tenant Credit Ratings

The engrained popularity of hybrid/remote working arrangements is one oft-cited risk for office-related landlords. But the governmental sector, especially in New York, are among the biggest proponents of bringing workers back to the office, if nothing else but to claw back those that have left their governing localities. This works in PDM’s favor, considering governmental entities account for nearly 10% of ALR.

For others, a full return to the office may be unlikely. But that doesn’t mean they are eliminating space in its entirety. Hybrid arrangements still requires in-person work. And for that, there certainly appears to be a flight to quality, which is likely to be a continued tailwind for PDM.

Continuing Strength in Leasing, Despite Ongoing Concerns Regarding The Future of Work

In addition to rising occupancy levels, PDM’s leasing activity remains robust, with over 700k square feet signed during the current quarter, surpassing last quarter’s volume. In addition, over 200k of this activity was attributable to new leasing activity.

Moreover, spreads are still growing, with cash roll-ups at 3% at an average lease term of 6.5 years. If offices were truly at secular risk, signings wouldn’t be commanding positive spreads, nor would companies be committing themselves to long-term leases.

There was one high-profile short-term signing during the quarter that did cause some concern. And that was with USB. However, it should be noted that the company is currently going through a merger. The short-term nature of the renewal likely had more to do with merger economics as opposed to the holistic question regarding the future of their working arrangements, which is unlikely to change, given the space is their national headquarters.

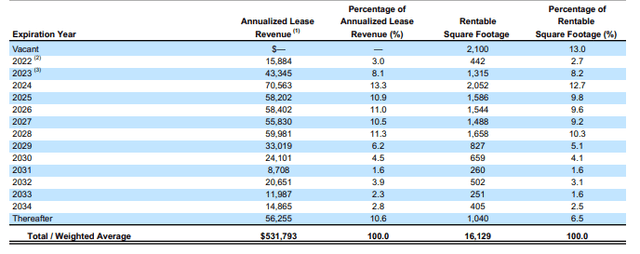

With few leases set to expire for the remainder of the year, management is expecting positive net space absorption for the year with an anticipated year-end occupancy level of 87-88%.

And over the next several years, PDM will benefit from a healthy expiration schedule that will enable the roll-up of existing leases to market rates. They will also benefit from the continuing commencement of signed leases in vacant space or under rental abatement, representing approximately +$36M in ALR.

Q2FY22 Investor Supplement – Summary of Lease Expirations

Anchored By An Investment-Grade Balance Sheet

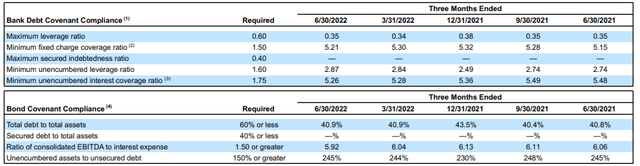

Supporting PDM’s acquisition strategy is their strong balance sheet that includes a stable investment-grade rating from two out of the three major credit agencies. This is backed by a low debt ratio, representing 34.6% of their total market cap, 250bps lower than the end of 2021 despite the significant decline in their share price. As a multiple of core EBITDA on a twelve month basis, net debt stood at 5.7x, within targeted levels.

PDM is, furthermore, well within compliance of their covenant requirements. The strong fixed charge coverage ratio of 5.2x is a reliable indicator of their ability to adequately cover their interest obligations, which is expected to increase in subsequent periods, creating a drag on earnings, at least in the near-term.

Q2FY22 Fixed Income Supplement – Covenant Compliance Summary

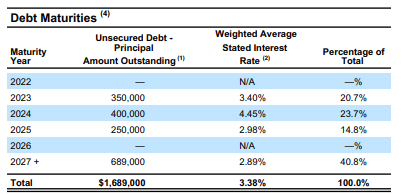

Insulating PDM from the worst of rising interest rates is their limited exposure to variable-rate debt, which stood at just under 15% in the current period. With just +$350M due at the end of 2023, the company also faces little repayment risk. This is reinforced by their available capacity on their revolver, which was over +$400M at the end of June.

Q2FY22 Fixed Income Supplement – Summary of Debt Maturities

For income-focused investors, PDM offers a well-covered quarterly dividend payout of $0.21/share. This is just over 50% of the adjusted FFO generated during the period and about 85% of total quarterly operating cash flows. Clearly, there is room for growth. But the Board is likely to maintain a conservative approach, given current market conditions. Still, the current payout represents a yield-on-cost of nearly 6.5%, which is well above other equity REITs and the broader S&P in general.

A Standout Office REIT With Significant Upside Potential

PDM’s portfolio of Class A properties concentrated in the Sunbelt region of the United States is one competitive strength that has produced consistent growth in FFO for over a decade.

At 87%, leased occupancy is still shy of pre-pandemic levels, which stood at 91.2% at the end of 2019, but it is a notable 150bps improvement from the end of 2021. The flight to quality as companies reassess their spacing needs should provide further improvement in future periods, as will the continuing growth in the market region, which is seeing an influx of inbound migration as a growing list of companies relocate their operations from states such as Illinois, New York, and California.

An investment-grade balance sheet that includes a high ratio of fixed-rate debt, ample liquidity, and limited near-term debt maturities, in addition to a diverse tenant pool where no single tenant accounts for more than 5.5% of ALR, are two defenses that should insulate PDM from broader market uncertainty.

Down over 30% YTD and trading at levels not too far off their lows last reached during the worst of the COVID-19 pandemic, there is material upside available in PDM’s shares. Even at an 8x valuation, which is what CIO currently trades at, despite being considerably smaller, PDM would be valued at about $16 based off the low end of their FFO guidance for 2022. This would represent upside of over 20%, excluding the 6.5% yielding dividend. With the broader office sector due for a sizeable rebound, PDM is just one selective investment that provides an attractive risk/reward value proposition to long-term focused investors.

Be the first to comment