Opla

For a diversified portfolio to be effective in maximizing returns, it is sometimes necessary to determine when an appropriate time is to make an investment in what has been a poorly performing sector. For example, the energy sector significantly underperformed the broader market from 2016 through 2020 when it hit a multi-year low due to the worldwide slowdown caused by the Covid-19 pandemic. Investors who loaded up on energy stocks in the spring of 2020 when oil futures were negative have seen outsized performance since then.

Likewise, many companies in the metals and mining sector have seen downward pressure in the past six to nine months. Like many other sectors of the economy, the impacts of inflation, labor shortages, higher energy costs, and supply chain constraints caused the metals and mining sector to struggle in the first half of 2022.

Conversely, rising costs of base metals such as copper and nickel have boosted the returns for some mining companies. According to one recent report from S&P Global, higher commodity prices have benefited companies like BHP Group (BHP), who reported record results in their Q2 earnings report.

Metal prices remained high in the second quarter, though they were down from their peaks. The S&P GSCI All Metals Capped Commodity index rose 23.9% from the beginning of 2022 to reach a year-to-date peak of $375.12 on March 7 before steadily dipping over the last five months.

One ETF that includes holdings in the metals and mining sector (excluding gold and silver) that is currently down -10% YTD on a NAV basis but showing signs of recovery is the iShares MSCI Global Metals & Mining Producers ETF (BATS:BATS:PICK). The price performance of PICK has essentially tracked the YTD performance of the S&P GSCI All Metals Index Spot (SPGSAM), so as spot metal prices rise and fall, the PICK ETF has been rising and falling along with it.

PICK price compared to spot metal prices (Seeking Alpha)

Fund Overview

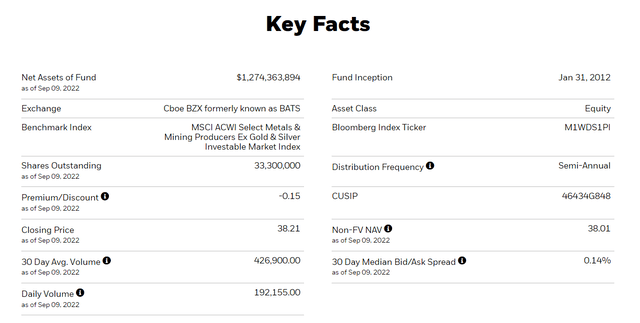

From the fund’s website, some key facts are presented here.

PICK key facts (fund website)

Based on the top holdings in PICK and the steadily increasing semi-annual distributions that currently result in a TTM yield of over 9% annually, I believe that PICK is a Strong Buy for long-term investors to take advantage of the commodity super-cycle that is still in its early stages, according to some sources.

“China, infrastructure spending and the global green-energy transition are candidates that may drive demand over the next bull supercycle.” — John LaForge, head of real asset strategy at the Wells Fargo Investment Institute

The investment objective of PICK is described in the Prospectus for this ETF:

The iShares MSCI Global Metals & Mining Producers ETF (the “Fund”) seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver.

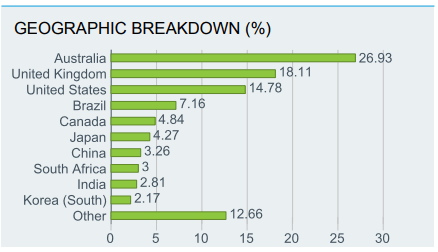

The fund is geographically diverse with most of the top holdings based in countries that are generally “friendly” to mining interests as shown in the fund’s fact sheet.

Geographic breakdown (fund fact sheet)

Fund Holdings

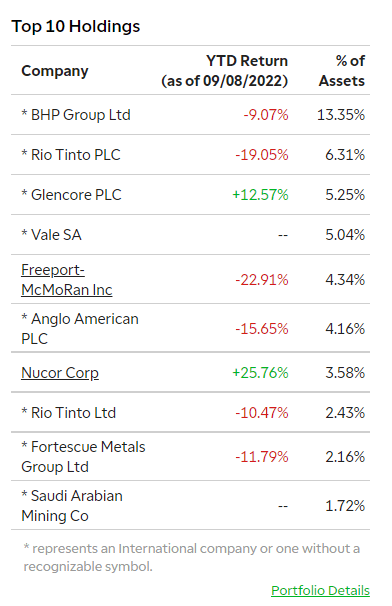

The top 10 holdings in the fund are all down -10% to -20% YTD with the exception of Glencore (OTCPK:GLCNF), which is considered a deeply undervalued dividend gem by one SA author, and Nucor Corp. (NUE), up 25% YTD and which also gets mostly Buy ratings from SA authors.

One top holding, Rio Tinto (RIO) is suffering from lower iron ore prices and slowdowns in China’s economy. Nevertheless, most SA authors rate RIO a Buy and it offers a yield of nearly 12% annually at the current market price.

PICK Top 10 holdings (TD Ameritrade)

On August 16, BHP reported record earnings for Q2 and fiscal year ending June 30, and announced a record full-year dividend. From BHP:

The miner also announced a final dividend of $1.75/share, bringing total cash dividends for the full year to a record $3.25/share.

The annual yield on BHP distributions amounts to about 12% based on the TTM semi-annual amounts paid of $6.50 ($3.00 paid in March and $3.50 to be paid in September), which represents an increase of about 8% over the 2021 annual distribution of $6.02. The earnings announcement describes the dividend payment but for shareholders in the US who own ADRs the payout is further explained by this comment,

They declare in USD even though Australian, but the ADRs traded in the NYSE represent 2 shares of the common. So the announcement of 1.75 per share ends up being 3.50 per ADR traded on the NYSE. If you own shares traded in Australia, then it is 1.75/ share. Interim dividend was 1.50/share (so 3.25 for the year) but the payout for the NYSE ADRs was 3.00 (6.50 for the year).

Another top holding is Vale (VALE) which yields about 10% annually. Some question whether it is a good dividend stock, but most authors on SA rate it a Buy now, also.

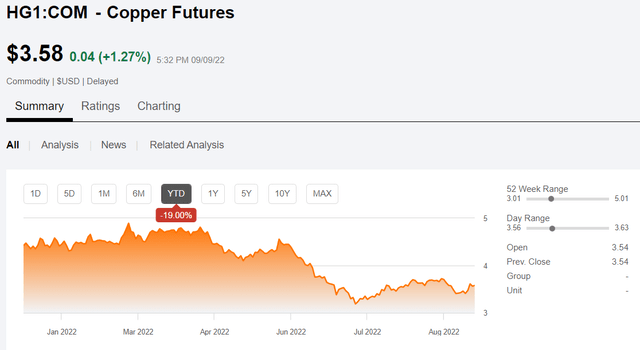

Another top holding, Freeport-McMoRan Inc. (FCX) has experienced the worst YTD performance (-22.9%) due to dropping copper prices, however, those prices are starting to trend back up in September. FCX is “on the mend” as copper prices begin to rise again and it is paying a distribution of $0.15 quarterly ($0.075 base plus $0.075 variable dividend) since November 2021 after suspending it in 2020.

Top holding at 4% of the total portfolio asset value, Anglo American plc (OTCQX:AAUKF), is a worldwide mining company based in London that has seen its ups and downs in 2022. Currently down about -13% YTD as of 9/9/22, the stock has paid $2.92 in dividends in the last twelve months based on semi-annual distributions of $1.18 and $1.24, and a special dividend of $0.5 paid in April for an annual yield of about 8.5%. Authors on SA rate it a Buy.

Fund Performance

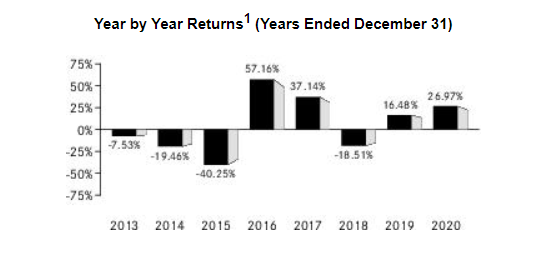

The performance of the fund has been variable over the past 10 years with returns ranging from -40% in 2015 to +57% in 2016. In 2020 the calendar year total return was 26.97% and in 2021 it was 22.35%.

Year by Year Returns (fund Prospectus)

The YTD total return so far in 2022 is -6.65% which is better than the S&P 500 at -14.26%.

YTD Total Return (Seeking Alpha)

Semi-Annual Distributions

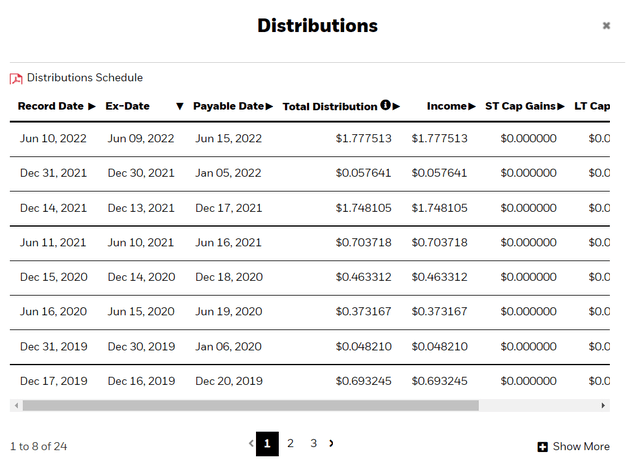

The PICK ETF pays a regular semi-annual distribution and has also paid a special supplemental distribution (income distribution for excise purposes) in 2018, 2020, and 2022. The distributions are variable but have been growing over the past 5 years. Dividends are paid in June, December, and supplementals in January when applicable.

Dividend History (Seeking Alpha)

The sources of distributions have consisted of 100% income since the fund’s inception in 2012.

fund Distributions (fund website)

Risks and Ratings

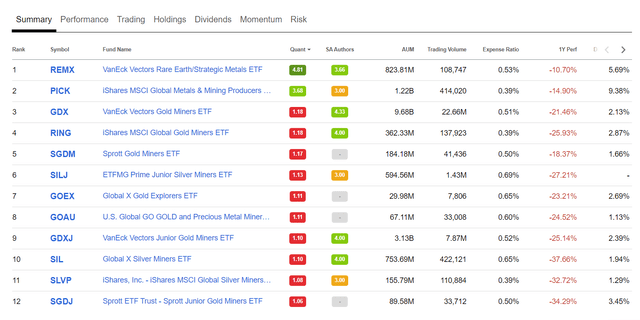

Most authors on SA in the past year rate PICK a Buy with one recent author giving it a Hold rating.

The ETF rating system on Seeking Alpha shows PICK as #2 out of 12 in the Equity Precious Metals ETF category. Considering that the fund does not include gold or silver miners, I am not sure there is much validity in the comparison, but it is a data point to review.

ETF comparison (Seeking Alpha)

There is ongoing geopolitical risk that could impact the mining and metals industry and commodity prices are likely to fluctuate as demand for copper, iron ore, nickel, and other base metals rise and fall with the global economy, especially based on what happens in China. For example, copper prices are expected to rise in the future as China pursues its stated goal to increase their renewable energy capacity.

“China’s push for installing infrastructure to deliver 1,200 GW of renewable energy capacity by 2025 would require an additional 3M tons of copper, which would see annual copper demand from solar and wind increase by nearly 1M tons,” ANZ said in a note.

BHP should benefit from rising copper prices as they hold the world’s largest endowment of high-grade copper and have ambitious plans to grow through exploration focused on copper, nickel, and iron ore according to a recent investor presentation.

FCX also benefits from rising copper prices and rose by nearly 8% on September 8, the highest daily increase in 10 months, after copper futures posted a rise of 3.7% that day.

Copper futures (Seeking Alpha)

As the global economy recovers it is expected that copper prices will continue to rise, but that is still a big unknown risk that investors should remain somewhat cautious about. With rising interest rates and weakening global demand there is still the potential for copper prices and other base metals to resume the downward trend.

It is my belief that we have already witnessed the worst for the most part with respect to a global downturn and demand should begin to pick up again as inflation seems to have peaked and is now showing signs of slowing.

It is my belief that PICK represents an excellent way to play the recovery in global demand for copper, nickel, and iron ore and that now is the time to buy while prices are down, and the future looks golden.

Be the first to comment