onurdongel

PHX Minerals Inc. (NYSE:PHX) is a somewhat unique independent oil and gas exploration and production company. It operates in a very different way than many of its peers, though, which is what makes it a unique company. Rather than operate its properties itself, the company leases the land to other companies that actually operate it.

This has some advantages over the more traditional models used by its peers. One of the most important of these is that PHX Minerals does not incur the operating and drilling costs that is peers do, which tends to result in somewhat higher margins. However, PHX Minerals also has not delivered nearly the performance of many other oil and gas companies, as the stock is only up 5.63% over the past year. This is likely a sign of the market’s lack of confidence in the firm. Indeed, I pointed out a few potential concerns in my last article on the company. The company does boast a reasonably attractive 2.27% dividend yield and an incredibly attractive valuation, though, so it might still be worth considering.

About PHX Minerals

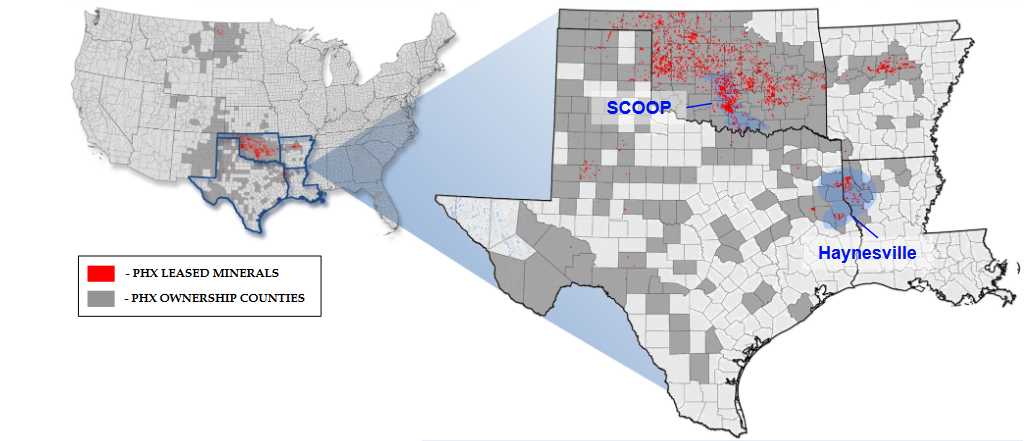

As stated in the introduction, PHX Minerals is a somewhat unique independent exploration and production company. The company itself does not actually produce any oil and gas, though. Rather, PHX Minerals acquires resource-rich acreage that it then leases out to companies that will actually utilize the land to produce the resources. The company states on its webpage that it possesses approximately 75,000 net acres across Oklahoma, Texas, Louisiana, North Dakota, and Arkansas, although, curiously, it does not actually provide any exact figures in its earnings reports.

PHX Minerals

The one thing that we see here is that the company’s acreage is heavily focused around the Permian Basin and Haynesville Shale. The Permian Basin is a name that will undoubtedly be familiar to anyone that has been following the American oil and gas industry over the past decade or so. This is because this particular basin has been at the center of the production boom that the country has benefited from over the period. It makes a lot of sense that this would be true as the Permian Basin is by far the most oil-rich basin in the United States and it is generally considered to be one of the richest in the world. According to the U.S. Energy Information Administration, the basin still contains proven reserves of five billion barrels of crude oil and nineteen trillion cubic feet of natural gas despite having been exploited since the 1920s. The Haynesville Shale is not quite as familiar of a name to many but it is a major source of natural gas. The Energy Information Administration projects that the basin has proven reserves of 44.8 trillion cubic feet of natural gas, which is more than any other basin except for the Marcellus Shale and the Permian Basin.

This tremendous resource wealth is reflected in PHX Minerals’ reserves, which stood at 60.287881 trillion cubic feet of natural gas and 1.439860 billion barrels of crude oil as of September 30, 2021 (the most recent date for which information is currently available). An energy company’s reserves are frequently overlooked by investors but they are critically important. This is because the production of crude oil and natural gas is by its nature an extractive process. These resources are literally produced by them out of reservoirs in the ground.

As these reservoirs contain a limited quantity of resources, an energy company needs to continually obtain new sources of resources or it will eventually run out of products to sell. As this is by no means guaranteed, the company’s reserves determine how long production can be maintained before it eventually runs out of resources. Although PHX Minerals does not actually produce any resources itself, this concept is still very important because the company will obviously not be able to find anyone to lease its land if its land does not contain any resources.

It is not a surprise to anyone that crude oil and natural gas prices have risen substantially over the past two years or so. As of the time of writing, the price of West Intermediate crude oil is up 10.97% and the price of natural gas at Henry Hub is up 23.36% over the past twelve months. PHX Minerals benefits from this despite not actually producing any crude oil or natural gas itself. This is because the company takes a royalty interest in the production of its properties. Basically, anyone that is leasing land from it is required to give the company a certain percentage of the resources produced on the property. Thus, whenever prices go up, so does the value of the royalties that the company receives.

This is one of the biggest reasons why the company’s revenues increased from $5,671,489 a year ago to $17,383,671 in the most recent quarter. Perhaps more importantly, PHX Minerals saw its operating cash flow increase 50% year-over-year, going from $5.6 million a year ago to $8.4 million in the most recent quarter. Curiously, though, the firm’s stock price does not reflect these improved financials. Indeed, the stock is only up 5.63% over the trailing twelve-month period:

Seeking Alpha

This appears to be a sign that the market believes that the company may have something wrong with it. We can see one potential problem simply by looking at the map of the company’s acreage above. To put it simply, less than 20% of the company’s acreage is currently producing any resources and contributing to the company’s revenues or cash flows. The rest is essentially dead weight. Thus, there are very real signs that the company may have too much capital tied up in its land that could be productively used for other purposes. Thus, the company may not be as profitable as it potentially could be.

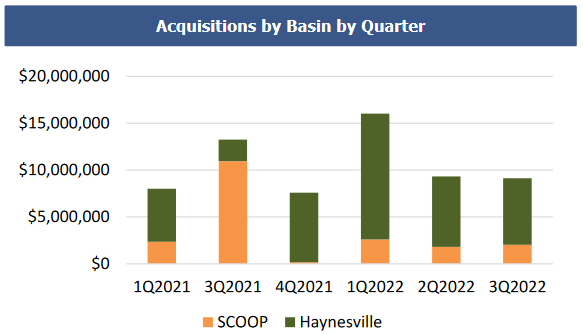

The company is nearly constantly acquiring new land for its portfolio. It did this again recently, spending nearly $10,000,000 in the most recent quarter to acquire acreage:

PHX Minerals

This is in spite of the fact that the company already has a considerable amount of unleased land. To a point, it certainly makes sense for the company to do this since it needs to always have land available for its customers to utilize but it does feel somewhat like the company has been going overboard. Nevertheless, though, it has not been needing to take on too much debt to make these acquisitions, which is quite nice to see.

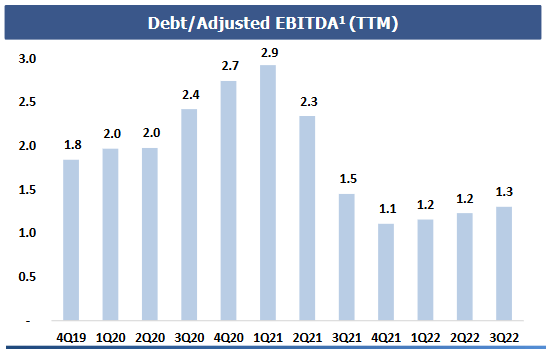

We can see this clearly by looking at the company’s leverage ratio, which is also known as the debt-to-adjusted EBITDA ratio. This ratio essentially tells us how long (in years) it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to this task. As of June 30, 2022 (the company starts its fiscal year in October), PHX Minerals had a leverage ratio of 1.3x, which admittedly is higher than it was earlier in the year but it is still quite reasonable:

PHX Minerals

The increase in debt is rather unfortunate to see but it is still reasonable for the sector. It is identical to the 1.3x leverage ratio sported by Northern Oil and Gas (NOG), which is about the only other company in the industry that uses a somewhat similar business model to PHX Minerals. Thus, despite all the acquisitions that the company is constantly making, it has managed to keep its debt at a level that is low enough to prevent any significant risks with respect to the company’s leverage.

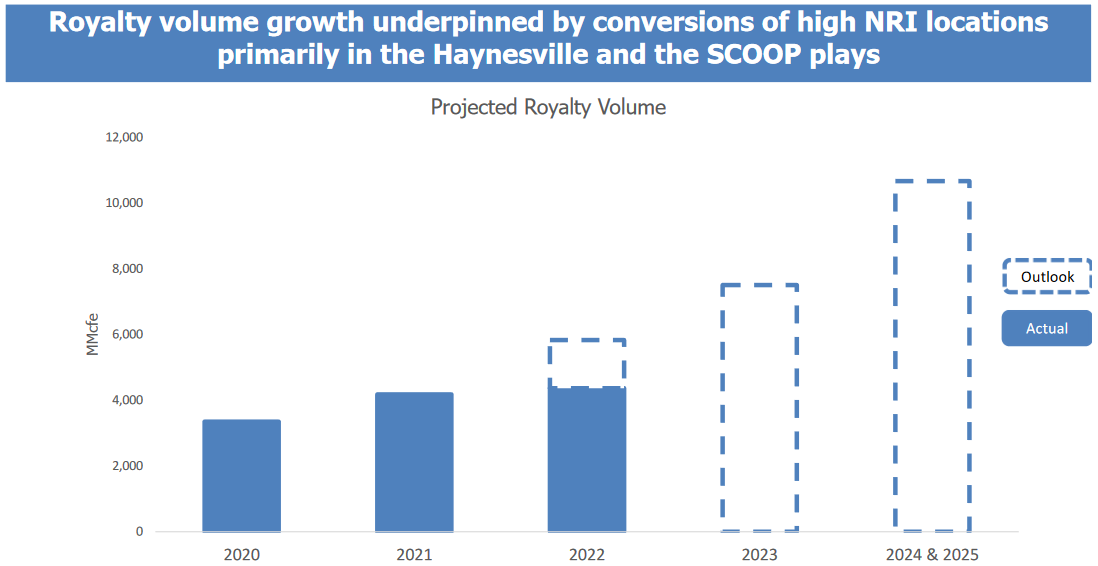

As might be expected, some of these acquisitions are intended to support the plans of the company’s customers that are operating in the Permian Basin and the Haynesville Shale. This is because these customers do share their plans with PHX Minerals, at least to a certain degree. As a result, the company is reasonably confident that it will see growing production on its acreage over the coming few years, which will result in PHX Minerals seeing higher royalties:

PHX Minerals

This helps to offset some of the deadweights that the company has as a result of its unused acreage throughout the country. This is because if oil and gas prices remain high, PHX Minerals should be able to grow its cash flows over time. As we will see in just a few minutes, the long-term fundamentals do indeed point to the likelihood of rising crude oil and natural gas prices. Thus, PHX Minerals does appear to be positioned for growing royalty production over time and delivering growth to its investors.

Fundamentals Of Crude Oil And Natural Gas

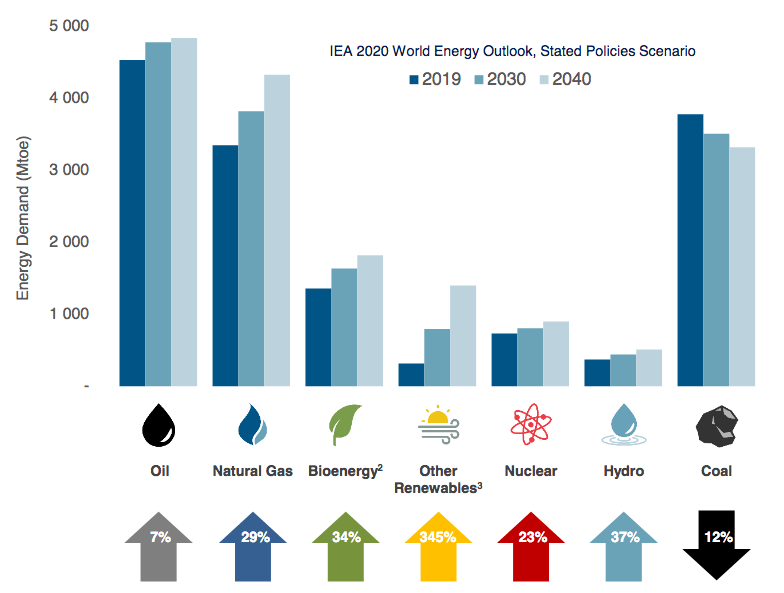

The fossil fuel industry has been under considerable fire from politicians, activists, futurists, and media personalities that may lead people to believe that the industry’s end is near. However, nothing is further from the truth. In fact, most of the fundamentals point to rising demand for both crude oil and natural gas over the coming years. According to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2022 World Energy Outlook

Perhaps surprisingly, the demand growth for natural gas will be driven by global concerns about climate change. As everyone reading this is certainly well aware, these concerns have led the governments of countries all over the world to impose a variety of incentives and mandates that are intended to reduce greenhouse gas emissions within their borders. One of the most common methods being utilized to accomplish this is to encourage utilities to replace their aging coal power plants with renewable power. This is because coal emits more greenhouse gases than any other source of energy that is currently in use. However, there is one major problem with renewable power and that is that it is unreliable. After all, solar power does not work when the sun is not shining and wind power does not work when the air is still.

The common solution for this problem is to supplement renewable energy sources with natural gas turbines because natural gas burns much cleaner than any other fossil fuel. This is why natural gas is often referred to as a “transitional fuel,” since it provides a method for electric utilities to maintain the reliability that we expect of the modern grid and still reduce carbon emissions while we wait for renewable technology to advance sufficiently to allow these energy sources to accomplish it on their own.

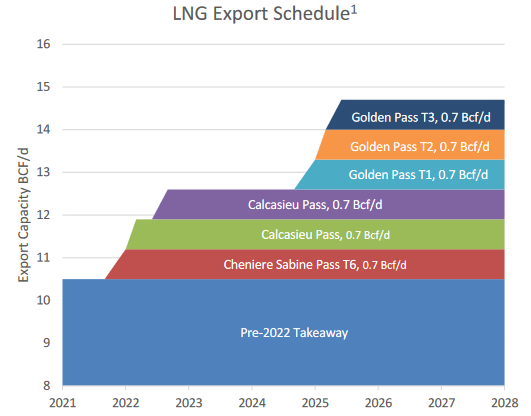

The United States is uniquely positioned to provide the natural gas that the world needs to achieve this energy transition due to the incredible mineral wealth of areas like the Permian Basin and the Haynesville Shale. This has given rise to the rapidly-growing American liquefied natural gas industry as the only way to ship natural gas across large bodies of water is by converting it into a liquid. This can only be done at specialized liquefaction plants and numerous companies across the country have announced plans to construct such facilities. As these plants require natural gas to convert to a liquid, the demand for natural gas is expected to increase. Indeed, between now and 2025, an additional 4.4 billion cubic feet of natural gas per day will be demanded by these plants:

PHX Minerals

The majority of these plants are being constructed along the Gulf Coast and Louisiana, which positions PHX Minerals very well. Over the course of this article, we have been discussing the company’s fairly aggressive acquisition of natural gas-rich property in the Haynesville Shale, which is on the border between Texas and Louisiana. Thus, we can conclude that operators that are looking to produce natural gas to be used by these liquefaction plants will be interested in drilling in the Haynesville Shale in order to minimize their transportation costs. This could very easily result in PHX Minerals seeing growing interest in companies wishing to lease its land for this purpose.

Thus, the earlier-mentioned projections of growing royalty payments are not so farfetched and the growth that the company expects may indeed materialize. This may ultimately help the company reduce its supply of unleased land should it begin to slow down somewhat on property acquisition. That would also help to improve the efficiency of the company’s capital utilization.

Financial Considerations

It is always critical that we examine the way that a company is financing itself before investing in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As few companies have the ability to pay off their maturing debt with cash, this repayment is usually accomplished by issuing new debt to repay the existing debt. This can cause a company’s interest costs to increase following the rollover, depending on conditions in the broader market.

In addition, a company must make regular payments on its debt if it is to remain solvent, so an event that causes a company’s cash flow to decline may push the company into financial jeopardy if it has too much debt. This can be a particularly big concern for companies in the oil and gas industry due to the general volatility of commodity prices.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio essentially tells us to what degree a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of June 30, 2022, PHX Minerals had a net debt of $25.0 million against $98.0 million of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.26. Here is how that compares against a collection of the company’s peers:

|

Company |

Net Debt-to-Equity Ratio |

|

PHX Minerals |

0.26 |

|

Northern Oil and Gas |

7.21 |

|

Diamondback Energy (FANG) |

0.39 |

|

Viper Energy Partners (VNOM) |

0.30 |

|

Continental Resources (CLR) |

0.61 |

Admittedly, the closest two companies to PHX Minerals on the list are Northern Oil and Gas and Viper Energy Partners and we can clearly see that PHX Minerals has a stronger balance sheet than either of them. This is something that should prove reassuring to investors, particularly given that the company appears to be easily able to carry its debt obligations, as we discussed earlier. Overall, the company’s debt appears to pose very little risk to investors and nobody should have particular concerns here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In this case, we can value PHX Minerals by using the PV10 method, which basically values the company based on the future revenues that it can generate given its current reserves. In short, what we do is we estimate how much the company can earn in a given year because of limits on how much it can drill and how much each well can actually produce in a given time period. We then net out the expenses that the company will incur over the course of its drilling program. Finally, we discount everything back to the present.

We can calculate three values for PHX Minerals depending on whether we want to only used proved reserves or all reserves:

|

Reserve Type |

Value (in millions of U.S. dollars) |

|

Proved |

$191.6 |

|

Proved + Probable |

$411.6 |

|

All Reserves |

$442.7 |

As of today, PHX Minerals has an Enterprise Value of $156.90 million. This gives the company an EV/PV10 ratio of 0.82 based solely on proven reserves. As proved reserves are the reserves that are definitely there and can be produced profitably with crude oil and natural gas prices at today’s levels, this is a clear sign that PHX Minerals is considerably undervalued right now.

In order to be fairly valued based simply on the company’s reserves, the enterprise value would need to increase by $34.7 million, which represents an 18.11% increase over today’s level. If we assume that the company’s debt remains static, that works out to a stock price of $4.28 per share. Thus, it does appear that PHX Minerals is substantially undervalued even considering the market’s concern about it.

Conclusion

In conclusion, PHX Minerals is a rather unique exploration and production company with a unique business model. This business model works pretty well though as it positions the company quite well for growth. When we combine this with a formidable balance sheet and an attractive valuation, we have all the makings of a wonderful investment. The biggest downside for PHX Minerals appears to be that the company has a considerable amount of capital tied up in unleased land, which could probably be used for other more profitable purposes. Overall though, PHX Minerals Inc. looks to be presenting investors with a reasonable proposition.

Be the first to comment