Khosrork

It is hardly a secret that one of the biggest problems facing Americans today is the inflation that is permeating the economy. As inflation has been prevalent in the necessities of food and energy, this has had a crippling effect on people of somewhat limited means and has forced many people to take on multiple jobs or look for other methods to obtain extra money to pay their bills. Fortunately, as investors, we have other methods available to us that we can use to obtain the extra money that we need to maintain our standard of living. One of these methods is purchasing shares of closed-end funds (“CEFs”) that are focused on the generation of income. These funds are nice because they provide us with easy access to a diversified portfolio of assets that can in many cases provide a higher yield than anything else in the market.

In this article, we will discuss the Pioneer High Income Fund Inc (NYSE:PHT), which yields an impressive 10.19% at the current price. I have discussed this fund before, but as more than a year has passed since that time, we can expect that a great many things have changed. This article will, therefore, focus specifically on those changes as well as provide an updated analysis of the fund’s financial performance. As the fund is undervalued right now, let us investigate and see if there could be an opportunity here.

About The Fund

As I mentioned in my previous article, the Pioneer High Income Fund is somewhat unique among closed-end funds as it does not have its own dedicated website. The closest thing that the fund provides is a listing of all the funds offered by Amundi Asset Management, which acquired Pioneer Investments back in 2017. However, the fund does have a fact sheet that is updated monthly and serves as a website. According to this document, the Pioneer High Income Fund has the objective of providing its investors with a high level of current income.

The fund is a fixed-income fund, so this objective is not particularly surprising. The fund invests in a portfolio of high-yield bonds and convertible securities to achieve its objective so we should not expect very much in the form of capital gains. This is mostly because fixed-income securities do not have significant capital gains potential as their performance is not connected to that of the underlying company. Rather, most capital gains would come during a period of time in which interest rates are declining.

When we consider statements made by the Chairman of the Federal Reserve’s Open Market Committee yesterday, it seems unlikely that interest rates will be declining anytime soon. Thus, we can assume that nearly all of the returns that we will be receiving from fixed-income securities will be in the form of direct payments to investors. Admittedly, convertible securities might have some upside potential since they can be converted to common stock, but they currently only account for 2.1% of the portfolio, so the capital gains potential here is negligible.

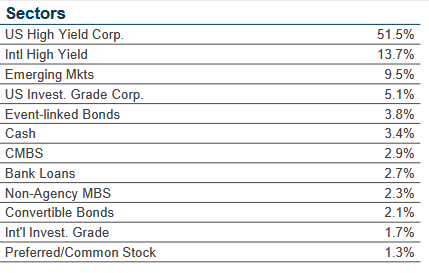

Currently, 65.2% of the portfolio consists of high-yield bonds (colloquially called “junk bonds”) and another 9.5% consists of emerging market bonds:

PHT Fact Sheet

This is something that may concern risk-averse investors, which is the typical type of investor interested in income-focused investments. This is because these bonds are often considered to have a high risk of default and thus the principal may be more at risk than we would see with other types of bonds. There are some ways to reduce this risk, though. One of these is to have a sizable number of positions in the fund as this ensures that any single default will have a minimal impact on the value of the portfolio as a whole. This fund has 328 holdings, which is admittedly not a lot for a fixed-income fund, but it should still be enough to ensure that we do not have to worry about any individual issuer defaulting on their bonds. It is admittedly still possible that we could take losses should a sector- or economy-wide series of defaults happen, but in such a case, the country has bigger problems than a few people losing money. In fact, in such a situation, there will probably not be any safe haven because the stock market would collapse in value too.

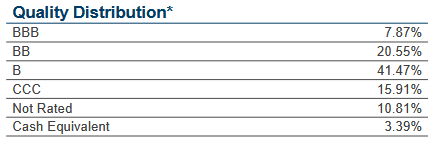

In addition to having a large number of holdings in its portfolio, the fund’s portfolio is fairly high quality. We can see this by looking at the bond ratings across the portfolio. As any experienced fixed-income investor is well aware, the major rating agencies (S&P, Moody’s, and Fitch) assign letter-grade ratings that theoretically tell us how likely a particular bond issuer is to default on its obligations. Here are the current ratings of the fund’s portfolio in aggregate:

PHT Fact Sheet

As we can see, the majority of the bonds held by the fund are rated B or above. This is something that is nice to see, despite the fact that investment-grade securities have a BBB or above. The reason for this is that any bond with a rating above B is still fairly unlikely to default. According to the official bond rating scale, anything rated B or BB should be able to maintain its obligations in normal economic times but might be vulnerable to a prolonged economic shock. We very rarely see prolonged economic shocks, so we can conclude that the risk of default is likely to be rather low across the entire portfolio, which should provide us with reassurance that we are unlikely to lose too much should a default happen.

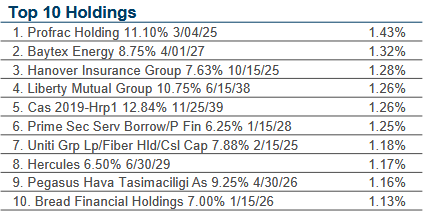

As we may be able to conclude from the 328 positions in the fund, each position only accounts for a small proportion of the portfolio. We can confirm this by looking at the largest positions in the fund. Here they are:

PHT Fact Sheet

There have been quite a few changes to this list since the last time that we looked at the fund, although not as many as I expected to find. Liberty Mutual, Hanover Insurance Group, Baytex Energy, Hercules, and Pegasus Hava Tasimaciligi all remain among the largest issuers whose bonds are held in the fund, although that does not mean that these are all exactly the same bonds that the fund had a year ago. All of the other positions that we see here were added over the past twelve months.

Despite the changes though, the fund only has a 50.00% annual turnover. This is higher than many other fixed-income funds, but admittedly it is not too bad. The reason why we do not generally like to see a high turnover is that trading assets costs money, which is billed to the shareholders. This creates a drag on the fund’s performance and makes management’s job harder. This is because management has to generate sufficient returns to cover the fund’s expenses and still provide shareholders with a desirable return, so the higher the expenses the higher the needed return.

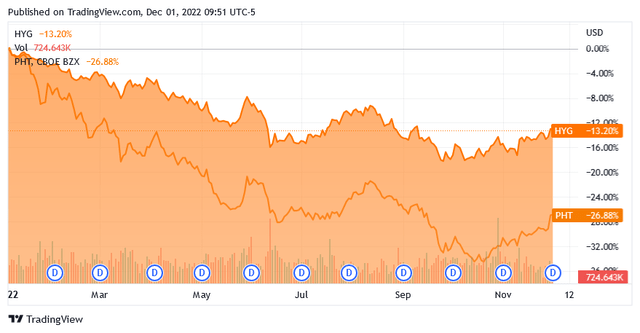

This is one reason why index funds have become so popular as their low expenses and minimal expenses allow them to outperform many actively-managed funds. This one is not an exception here, as the high-yield bond index (HYG) is only down 13.26% year-to-date compared to a 26.88% decline for the Pioneer High Income Fund:

Admittedly, this is not a perfect comparison, since the Pioneer High Income Fund does include things other than high-yield bonds, but it does still give a pretty good idea of how well the funds compare since most of the Pioneer fund’s assets are high-yield bonds. The Pioneer High Income Fund does boast a considerably higher yield than the index fund, which helps to close the performance gap somewhat and may make this fund more appealing to some investors. However, the index fund did still deliver a higher total return, even though both funds suffered losses.

One thing that is somewhat nice to see is that the Pioneer High Income Fund is a global fund that invests in both American and foreign bonds. In fact, only 61.54% of the fund’s portfolio is invested in securities issued by American entities. The remainder is all issued by foreign companies and governments. This is somewhat nice because of the protection that it provides us against regime risk. Regime risk is the risk that a government or other authority will take some action that has an adverse impact on a company that we are invested in. One potential example here would be if the Federal Reserve raises interest rates but a foreign central bank does not, the foreign bond may then outperform the American one. Currently, most central banks are raising interest rates, but this may not always be the case. As such, it is still nice to have this foreign exposure. For comparison purposes, the index fund that we just mentioned does not include foreign bonds so it has more risk due to its exclusively American exposure.

Leverage

In the introduction, I mentioned that closed-end funds can frequently use certain strategies that allow them to deliver higher yields than any of the underlying assets possess. One of these strategies that are utilized by the Pioneer High Income Fund is the use of leverage. In short, the fund borrows money and uses that borrowed money to purchase fixed-income securities. As long as the purchased securities have higher yields than the interest rate that the fund has to pay on the borrowed money, this strategy works pretty well to boost the yield of the overall portfolio.

However, the use of leverage is a double-edged sword because it increases both gains and losses. As such, we want to ensure that the fund does not employ too much leverage since that would expose us to too much risk. I do not generally like to see any fund’s leverage above a third as a percentage of assets for this reason. The Pioneer High Income Fund currently has a leverage ratio of 34.49% of its assets, so it is above this level. However, the fund is barely above the one-third level, so it is probably okay. I will admit that I would like to see the fund decrease its leverage slightly, but overall, it appears to be striking a reasonable balance between risk and return.

Distribution Analysis

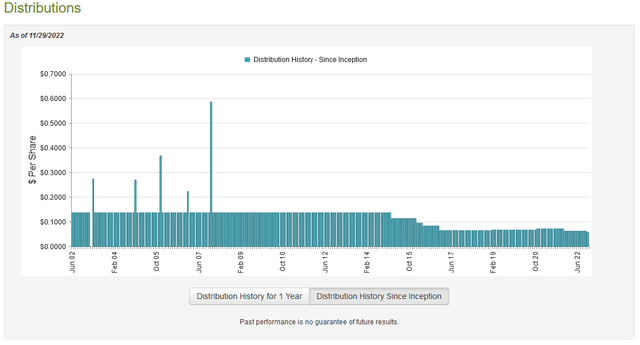

As mentioned earlier in this article, the primary objective of the Pioneer High Income Fund is to provide its investors with a high level of current income. The fund accomplishes this mostly by putting its assets into high-yield bonds that offer interest rates that are considerably above those of other fixed-income securities. As such, we can assume that the fund will have a very high yield. This is indeed the case, as it currently pays out a monthly distribution of $0.0575 per share ($0.69 per share annually), which gives the fund a 10.19% yield at the current price. The fund has admittedly not been very consistent about this yield over time, but it has not been too bad since 2017:

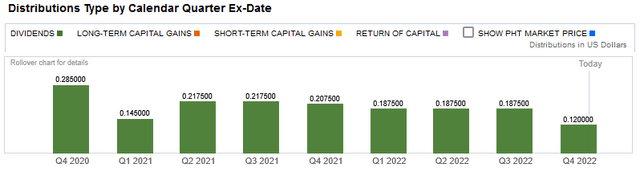

The fact that the fund cut its distribution this month, though, is likely to be disappointing to many investors, particularly those looking for a stable and consistent source of income. It may not be surprising, though, considering that the rising interest rates have caused the values of fixed-income portfolios to decline significantly despite the fact that the fund will be receiving much higher yields on newly purchased bonds. This situation may be assuaged slightly by the fact that the fund’s distributions are classified entirely as dividend income with no return of capital component:

The reason why this may be somewhat comforting is that a return of capital may be a sign that the fund is returning the investors’ own money back to them. In addition, a capital gains distribution may not be repeatable or sustainable. As a general rule, dividends are the most sustainable ways for a fund to finance its distributions. However, as I pointed out in a previous article, it is possible for these distributions to be misclassified. As such, we want to investigate further in order to determine how sustainable the distributions are actually likely to be.

Fortunately, we have a very recent report that we can consult for that purpose. The fund’s most recent financial report corresponds to the six-month period ending September 30, 2022. This is a much more recent report than we had available the last time that we looked at this fund and a more recent one than most other funds have published right now. It should give us a very good idea of how well the fund has been performing during the bulk of the recent string of interest rate increases, which is something that any potential investor would want to know.

During the six-month period, the Pioneer High Income Fund received a total of $12,940,018 in interest and another $215,511 in dividends from the assets in its portfolio. This gave the fund a total income of $13,155,529 during the period. The fund paid its expenses out of this amount, which left it with $10,556,556 available for investors. This was not enough to cover the $11,003,113 that the fund paid out in distributions over the six-month period, although it did get pretty close. It is still somewhat concerning that the fund did not fully cover its distributions, though.

There are other methods that the fund can use to get the money that it needs for its distributions, of course. The most common of these is capital gains. However, as might be expected the fund failed miserably at this during the six-month period. It reported net realized losses of $4,966,773 along with net unrealized losses of $40,784,842 in the current period. This caused the fund’s total assets under management to decline by $46,198,172 after accounting for all fund inflows and outflows.

Overall, the fund did fail to cover its distribution. This is likely the reason for the recent distribution cut, as the new distribution should be a bit below the fund’s net investment income if we assume that net investment income remains static going forward (as it should).

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Pioneer High Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. This is the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of November 30, 2022, the Pioneer High Income Fund had a net asset value of $7.58 per share but it only trades for $6.98 per share. This gives the shares a 7.92% discount to net asset value at the current price. This is not nearly as attractive as the 12.52% discount that the shares have had on average over the past month. Thus, it may make sense to wait a bit and see if a more attractive price does ultimately present itself; however, the current price is certainly not a bad entry point.

Conclusion

In conclusion, the Pioneer High Income Fund is one way that investors can obtain an income boost to help them overcome the ravages of inflation that are affecting all of us in a very big way today. The fund boasts a fairly attractive and well-diversified portfolio that should provide protection against defaults despite the fact that the fund invests mostly in high-yield bonds.

Unfortunately, the Pioneer High Income Fund significantly underperforms the high-yield bond index and failed to cover its distribution over the past six months. It did, however, cut the distribution sufficiently to maintain it at the new level. The fact that the fund is trading at a discount helps to overcome some of these shortcomings though. The biggest risk here is that the Federal Reserve will continue to raise rates, which seems likely. Overall, there are some things to like here about Pioneer High Income Fund Inc, but one cannot be faulted for waiting a bit.

Be the first to comment