StockPhotoAstur

Like many oil and gas companies, Phillips 66 (NYSE:PSX) has benefited from the rapid surge in energy prices this year. The Texas headquartered company, which has interests in midstream, chemicals, refining and marketing businesses, is expected to rake in revenues of $175.5 billion for FY22 and achieve a record EPS of $20.10. This is in comparison to revenues of $111.4 billion in 2021 and EPS of $2.97 in 2021.

Thanks to this strong financial performance, PSX is up more than 40% YTD and currently has a market cap of around $50 billion. It’s instructive to note that ever since the company was founded in 2012 following its spin-off from ConocoPhillips (COP), the value of its outstanding stock has never breached the $50 -$55 billion range. In fact, it has never traded at this range for an extended period of more than six months as the chart below shows.

PSX market cap close to historical highs (Seeking Alpha)

Can PSX finally break this historical resistance level and soar past $60 billion in terms of market cap (which represents a 20% upside from current levels)? This is the question on investors’ minds, particularly after the decent run this year.

Looking at the valuation, PSX still has room to grow. Its P/E is currently low against historical averages. The low P/E is a result of the aggressive growth in earnings over the past year. The stock is currently trading at a P/E (FWD) of 4.36x which is more than 50% off the pre-pandemic valuations (2017 – 2019) when the P/E came in at a range of between 6-9x.

However, an attractive valuation alone is hardly a reason to invest. What investors need to look at are the factors that can drive multiples higher over time.

In cyclical industries like oil and gas, one factor that can make a huge difference over time is a company’s capital allocation strategy – this is particularly true during boom cycles like the one we have now when everyone is swimming in cash.

The oil and gas industry is expected to enter 2023 with its healthiest balance sheets yet, according to a survey by Deloitte. Moreover, sentiment is overwhelmingly positive among industry executives, with 93% of industry executives polled in the survey stating they’re positive about the industry in the coming year.

In this kind of environment, financial discipline and farsightedness will make the difference for energy companies. Supernormal profits and positive sentiment often leads to overexuberance, which results in questionable acquisitions at ridiculous valuations among other financial blunders.

It is therefore reassuring to see that PSX is pursuing a disciplined and strategic capital allocation strategy that could see it emerge stronger from this cycle. PSX’s strategy, which was unveiled at its Investor Day 2022 this November, focuses on three pillars: rewarding shareholders, optimizing the business model and strengthening its financial shape. As you dig deeper into the strategy, you will realize it is a major point of differentiation vs the industry. If successfully executed, the strategy could lead to a higher multiple and stock price.

Rewarding shareholders

Investors in oil and gas stocks have this year enjoyed a record haul of dividends amid record profits for the industry. Dividends from oil firms rose by 75.1% to a record $46.4bn in the three months through September.

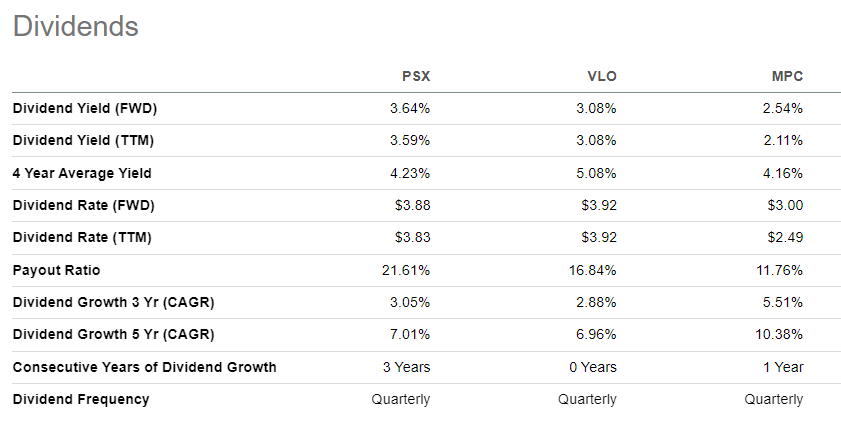

PSX has not been left behind. It has also significantly increased its dividends this year. Compared with peers Valero (VLO) and Marathon Petroleum Company (MPC), it has the highest payout ratio at 21.61%. This means it cedes a higher proportion of its net income to shareholders relative to peers.

PSX dividend vs peers (Seeking Alpha)

The payout ratio is not the only indicator of how committed a company is to rewarding its shareholders. It is also important for investors to look at how a company’s dividend policy has evolved over time. This is key in distinguishing companies that have a culture of rewarding shareholders over time as opposed those that make one-off payouts during good times. PSX scores favorably in this regard. “We’ve increased our dividend 11x since inception, and you can expect annual dividend increases going forward,” said the CEO Mark Lashier on the Investor Day presentation. Notably, the company did not cut or eliminate its dividend during the pandemic.

Another way PSX rewards shareholders is through share repurchases. Since 2012, its share buybacks have reduced the shares outstanding count by more than 24%, the company noted during its Investor Day. Overall, the company has since 2012 returned more than $30 billion to investors through a combination of share repurchases and dividends. It intends to spend a further $10 to $12 billion on dividends and share repurchases through 2024. This is impressive considering at the end of Q3 the company had total assets of $77 billion, as per its 10-Q.

Optimizing the business model

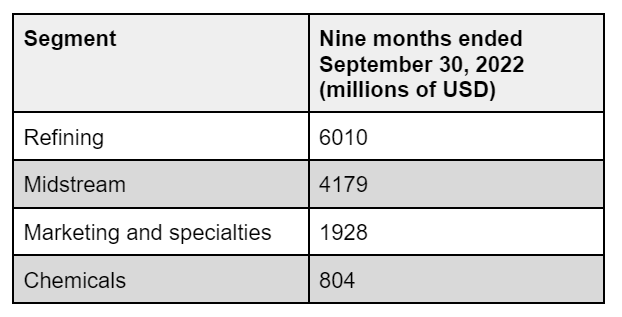

Refining is PSX’s largest business line, followed by midstream, marketing and specialties, and finally chemicals. The income before tax derived from these business lines in the first nine months of 2022 is as follows:

PSX’s income before tax for different segments (PSX 10-Q)

PSX’s focus in the coming years will be on improving the performance of its refining business. The company aims to spend its capital on projects that can improve refining margins and increase the speed at which it captures opportunities, given how volatile oil prices are. “We will implement targeted capital investments focused on small projects that have high returns. Bottom line, we will improve our market capture by 5%. We are reducing costs to produce by $0.75 per barrel. This is equivalent to reducing our operating expense by $500 million annually,” noted Richard Harbison, Senior Vice President Refining.

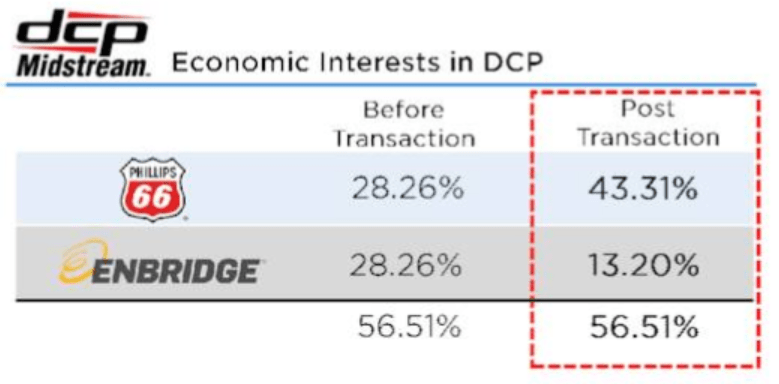

PSX has also significantly increased its exposure to the midstream business following a transaction that increased its economic interests in DCP.

PSX has increased exposure to midstream (PSX)

The midstream sector is a fee-based operational model that is reliant on volumes and not directly exposed to commodity price risk. This makes PSX revenues less cyclical compared with refining peers with less or no exposure to the midstream sector. It’s also worth noting that the demand for natural gas liquids (NGLs) is growing more robustly relative to oil demand, making PSX’s increased exposure to midstream assets that are focused on NGLs timely.

Strengthening its financial shape

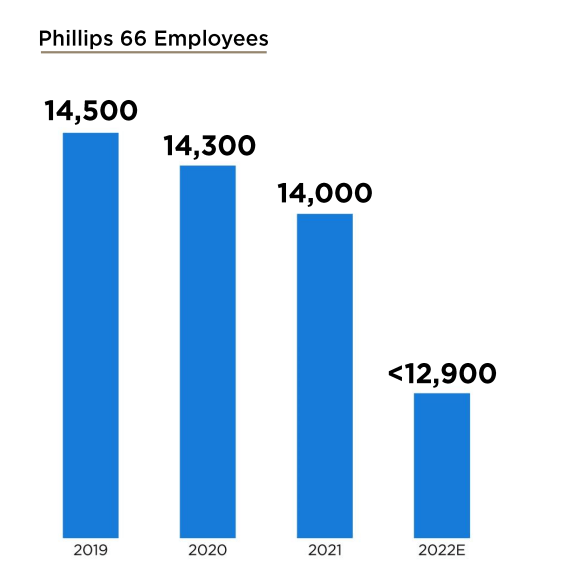

PSX is also keen on strengthening its financial shape. It has in the past few years consistently reduced its headcount in a bid to reduce operational costs. Overall, the company aims to deliver overall cost savings of $1 billion annually by 2023 through driving a lean structure and other cost saving initiatives across its operations.

PSX is driving a leaner operating structure (PSX)

The company is also keen on reducing its debt. “We’re targeting a net debt-to-capital ratio between 25% and 30%. And just one point of clarification on that. At the end of the third quarter, our net debt-to-capital ratio was 29% and that included the consolidation of DCP Midstream,” noted CFO Kevin Mitchel.

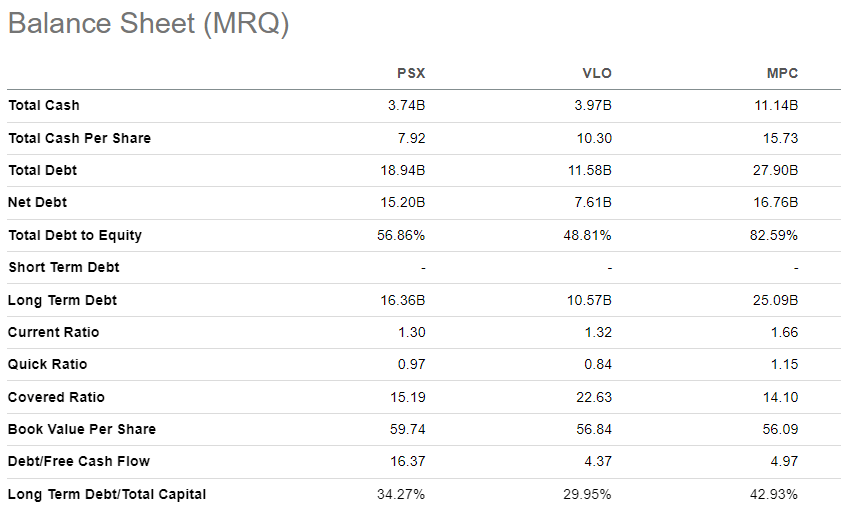

PSX’s current debt levels are manageable and within the same range as its peers VLO and MPC as the screenshot below shows.

PSX balance sheet vs peers (Seeking Alpha)

Conclusion

PSX stock has had a great year and continues to show promise of performing well given the strategies the management has put in place. Its increased exposure to midstream assets is particularly promising, given refining margins are expected to come under pressure in 2023. Fitch Ratings expects an approximate 40% decline in the US refining sector’s median EBITDA. It further expects the industry’s median leverage to increase to slightly over 2.0x. PSX’s move to increase its income from the midstream sector will be helpful in offsetting the expected decline in refining margins.

While PSX’s valuation suggests it still has room to grow, the stock in our opinion still needs to get past the $60 billion market cap psychological level before it can really start a new chapter in its bullish run. However, the main risk is that before this happens, it could fall together with other energy stocks when the current oil price environment changes.

This leads to the conclusion that, while PSX is a good business with a sound strategy, the downside risk is higher than the upside opportunity at current levels. Given its sound business strategy, it’s certainly a buy at a lower price, but for now, it’s better to hold or to trim your holdings.

Be the first to comment