Fly_dragonfly/iStock via Getty Images

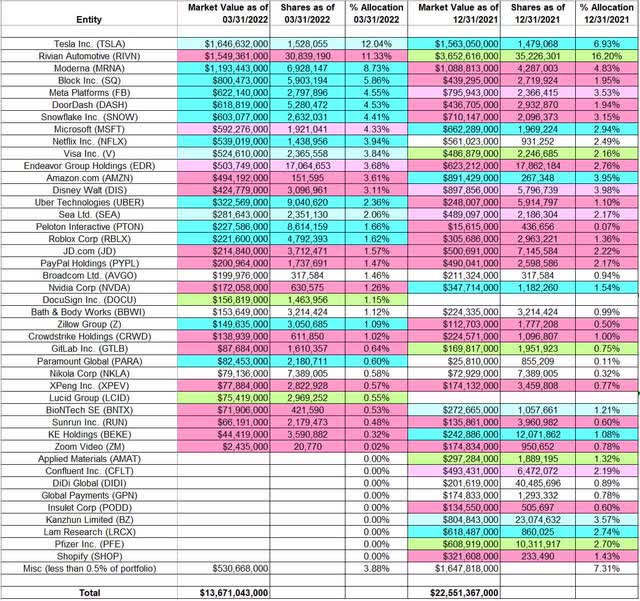

This article is part of a series that provides an ongoing analysis of the changes made to Coatue Management’s 13F stock portfolio on a quarterly basis. It is based on Coatue’s regulatory 13F Form filed on 5/16/2022. The 13F portfolio value decreased ~40% from $22.55B to $13.67B this quarter. Recent 13F reports have shown around 70 individual stock positions in the portfolio. The largest five stakes are Rivian Automotive, Tesla, Moderna, Block Inc., and Meta Platforms. They add up to ~43% of the entire portfolio. Please visit our Tracking Philippe Laffont’s Coatue Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q4 2021.

Philippe Laffont was a telecom analyst at Tiger Management from 1996. He founded Coatue Management as a tech-focused long-short hedge fund in 1999 and is one of the most successful among the “tiger cubs”. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears.

Stake Disposals:

Kanzhun Limited (BZ): BZ was a fairly large 3.31% of the portfolio stake built during Q3 2021 at prices between ~$29.50 and ~$39. The stock was sold this quarter at prices between ~$16 and ~$37. It currently trades at $27.49.

Pfizer Inc. (PFE) and Applied Materials (AMAT): PFE was a 2.70% of the portfolio position purchased last quarter at prices between ~$41 and ~$61. The disposal this quarter was at prices between ~$46 and ~$57. PFE currently trades at $52.31. The 1.32% AMAT position was purchased at prices between ~$125 and ~$163. The elimination this quarter was at prices between ~$119 and ~$167. It is now at $86.27.

Lam Research (LRCX): The 2.74% of the portfolio LRCX stake saw a ~110% increase last quarter at prices between ~$544 and ~$727. It was sold this quarter at prices between ~$469 and ~$730. The stock currently trades at ~$395.

Confluent, Inc. (CFLT): The 2.19% CFLT stake was built in Q3 2021 at prices between ~$39 and ~$73. There was a ~10% trimming last quarter and the disposal this quarter was at prices between ~$30 and ~$75. The stock currently trades at $24.54.

DiDi Global (OTC:DIDIY): DIDIY had an IPO last June. Shares started trading at ~$14 and currently goes for $3.14. Coatue’s position went back to funding rounds that started with a Series D in 2015 when the valuation was ~$9B. This is comparable to the current enterprise value of ~$10B. The stake was sold this quarter at prices between $1.76 and $5.36.

Global Payments (GPN), Insulet Corp. (PODD), and Shopify (SHOP): These small (less than ~1.5% of the portfolio each) positions were disposed during the quarter.

New Stakes:

DocuSign, Inc. (DOCU) and Lucid Group (LCID): DOCU is a 1.5% of the portfolio position established this quarter at prices between ~$73 and ~$157 and the stock currently trades below that range at $61.22. LCID is a small 0.55% of the portfolio stake purchased this quarter at prices between ~$22 and ~$46. It is now well below that range at $17.

Stake Increases:

Tesla, Inc. (TSLA): TSLA is currently the largest position at ~12% of the portfolio. It was purchased in Q1 2020 at prices between ~$85 and ~$180. Next quarter saw a ~40% selling at prices between ~$95 and ~$200. There was a stake doubling in Q3 2020 at prices between ~$242 and ~$443. The two quarters through Q1 2021 had seen a ~50% selling at prices between ~$390 and ~$880. There was a one-third selling in Q3 2021 at prices between ~$643 and ~$791 while last quarter saw a similar increase at prices between ~$775 and ~$1230. The stock currently trades at ~$682. There was a minor ~3% increase this quarter.

Moderna (MRNA): A small MRNA stake was purchased in Q1 2021 at prices between ~$109 and ~$186. There was a ~400% stake increase next quarter at prices between ~$130 and ~$235. Last quarter saw a ~30% reduction at prices between ~$226 and ~$369 while this quarter there was a ~60% stake increase at prices between ~$127 and ~$235. The stock currently trades at ~$150 and the stake is a top-three position at 8.73% of the portfolio.

Block, Inc. (SQ), previously Square: SQ is a top-three ~6% of the portfolio position first purchased in Q2 & Q3 2019 at prices between ~$62 and ~$82. The position has wavered. Recent activity follows. Last two quarters had seen a ~40% reduction at prices between ~$158 and ~$282. The stake was rebuilt this quarter at prices between ~$89 and ~$164. The stock currently trades at ~$64.

Meta Platforms (META), previously Facebook: META is a top-five 4.55% of the portfolio position first purchased in Q3 2013 at prices between ~$24 and ~$51. The stake has wavered. Recent activity follows. There was a one-third stake increase in Q2 2021 at prices between ~$295 and ~$356. Next quarter saw a ~15% selling while this quarter there was a similar increase. The stock currently trades at ~$160.

DoorDash (DASH): DASH is now a 4.53% of the portfolio stake. They had an IPO in December 2020. Shares started trading at ~$165 and currently goes for ~$68. Coatue’s stake goes back to funding rounds from August 2018 when the valuation was ~$4B. This is compared to current market cap of ~$23B. There was a ~70% selling last quarter at prices between ~$144 and ~$246 while this quarter saw a similar increase at prices between ~$76 and ~$145.

Snowflake Inc. (SNOW): SNOW is a 4.41% of the portfolio stake. They had an IPO last September. Shares started trading at $229 and currently goes for ~$145. Coatue’s original stake goes back to a third-party tender offer that closed in March 2020. The valuation per the Series G funding round around that time was ~$12.5B. This is compared to current valuation of ~$41B. There was a ~30% stake increase in Q1 2021 at prices between ~$209 and ~$314 while the next three quarters saw a ~60% selling at prices between ~$188 and ~$402. There was a ~25% stake increase this quarter at prices between ~$167 and ~$332.

Netflix, Inc. (NFLX): The 3.94% NFLX position is a very long-term stake. It was established in 2012 at very low prices. The stake has wavered. H1 2018 saw a ~40% selling at prices between ~$210 and ~$410 while this quarter there was a ~55% stake increase at prices between ~$331 and ~$597. The stock is now at ~$180.

Visa Inc. (V): The 2.16% of the portfolio stake in Visa was established last quarter at prices between ~$190 and ~$234 and it is now at ~$199. There was a minor ~5% stake increase this quarter.

Uber Technologies (UBER): UBER had an IPO in Q2 2019. Shares started trading at ~$42 and currently goes for $21.34. Coatue’s stake goes back to a funding round in 2018 when the valuation was ~$60B. This is compared to the current market cap of ~$44B. Q4 2019 & Q1 2020 saw the stake sold down by ~90% at prices between ~$21 and ~$41. The stake was rebuilt in the Q2 to Q4 2020 time period at prices between ~$23 and ~$55. Q1 2021 saw a roughly one-third selling at prices between ~$48 and ~$63. That was followed with a ~55% reduction last quarter at prices between ~$36 and ~$48. There was a similar increase this quarter at prices between ~$29 and ~$45. The stake is now at 2.36% of the portfolio.

Sea Limited (SE): SE is a ~2% of the portfolio position built in H2 2019 at prices between ~$28 and ~$40. H1 2020 saw a ~45% selling at prices between ~$38 and ~$110. That was followed with another ~40% selling over the two quarters through Q3 2021 at prices between ~$202 and ~$353. The stock currently trades at ~$69. Last two quarters have seen only minor adjustments.

Peloton Interactive (PTON): The 1.66% PTON stake was primarily built this quarter at prices between ~$20 and ~$39. The stock currently trades at $9.13.

Roblox Corp. (RBLX): Roblox had an IPO last March. Shares started trading at ~$69.50 and currently goes for ~$35. The 2.25% stake was acquired at prices between ~$64 and ~$100. Last quarter saw a ~60% selling at prices between ~$70 and ~$135 while this quarter there was a similar increase at prices between ~$37 and ~$99.

Zillow Group (Z): The ~1% Zillow stake was built in H2 2020 at prices between ~$60 and ~$140. The stock is now at $33.67. Last quarter saw a ~72% selling at prices between ~$53 and ~$104 while this quarter there was a similar increase at prices between ~$46 and ~$65.

Paramount Global (PARA), previously ViacomCBS: The small 0.60% PARA stake was primarily built this quarter at prices between ~$28 and ~$39. The stock currently trades below that range at $25.21.

Stake Decreases:

Rivian Automotive (RIVN): RIVN is the second-largest position in the portfolio at ~11%. They had an IPO last November. Shares started trading at ~$100 and currently goes for $25.70. Coatue’s stake goes back to funding rounds starting from July 2020 when the valuation was ~$10B. This is compared to current valuation of ~$8B.

Microsoft Corporation (MSFT): MSFT is a 4.33% of the portfolio stake purchased in Q3 2021 at prices between ~$277 and ~$305 and the stock currently trades at ~$260. There was a ~90% stake increase last quarter at prices between ~$283 and ~$343. There was a minor ~2% trimming this quarter.

Endeavor Group Holdings (EDR): Endeavor Group Holdings had an IPO last April. Shares started trading at ~$25 and currently goes for $21.83. Coatue’s 3.68% of the portfolio stake was through a private placement prior to the IPO. There was a ~17% selling in Q3 2021 at prices between ~$23 and ~$29. That was followed with a ~18% reduction over the last two quarters at prices between ~$18 and ~$35.

Note: They have a ~7% ownership stake in the business.

Amazon.com (AMZN): A large stake in AMZN was built in the 2009-2011 timeframe but was sold down next year. A similar stake build-up happened in H2 2013 at prices between ~$13 and ~$14. Next quarter saw a ~80% reduction at prices between ~$14 and ~$16. The stake has wavered. Recent activity follows. Last quarter saw a ~24% stake increase at prices between ~$155 and ~$185 while this quarter there was a ~45% selling at prices between ~$136 and ~$170. The stock is now at ~$110 and it is now at 3.61% of the portfolio.

Walt Disney (DIS): DIS is a 3.11% of the portfolio stake. A huge position was built in Q2 2020 at prices between ~$94 and ~$125. The next two quarters also saw minor increases. Q1 2021 saw a ~45% selling at prices between ~$163 and ~$202. There was another similar reduction this quarter at prices between ~$129 and ~$158. The stock currently trades at ~$96.

JD.com (JD): JD.com is a 1.57% of the portfolio position purchased in Q3 2021 at prices between ~$62 and ~$83 and it currently trades at $65.95. Last two quarters saw a ~55% reduction at prices between ~$43 and ~$88.

PayPal Holdings (PYPL): The 1.47% PYPL stake was built in H1 2016 at prices between ~$31 and ~$37. The stock has wavered. Recent activity follows. Q3 2021 saw a ~22% reduction at prices between ~$259 and ~$309. Last two quarters have seen another ~40% selling at prices between ~$94 and $272. The stock is now at ~$71.40.

NVIDIA Corp. (NVDA): NVDA is a 1.26% position that saw a ~200% stake increase last quarter at prices between ~$197 and ~$334. This quarter saw a ~45% selling at prices between ~$213 and ~$301. The stock is now at ~$145.

GitLab Inc. (GTLB): GitLab had an IPO in October 2021. Shares started trading at ~$104 and currently goes for $54.35. Coatue’s stake goes back to a Series E funding round when the valuation was ~$2.75B. The current valuation is ~$7B. There was a ~18% trimming this quarter.

Note: They have a ~11% ownership stake in GitLab.

BioNTech SE (BNTX), CrowdStrike Holdings (CRWD), KE Holdings (BEKE), Sunrun Inc. (RUN), XPeng Inc. (XPEV), and Zoom Video (ZM): These small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

Bath & Body Works (BBWI), previously L Brands, Broadcom Ltd. (AVGO), and Nikola Corp. (NKLA): These small (less than ~1.5% of the portfolio each) positions were kept steady this quarter.

The rest of the stakes in the portfolio are minutely small. They are Advanced Micro Devices (AMD), Agora, Inc. (API), Alibaba Group Holding (BABA), AMC Entertainment (AMC), Beyond Meat (BYND), BioNTech SE (BNTX), DexCom, Inc. (DXCM), Dingdong Cayman (DDL), Enphase Energy (ENPH), GameStop (GME), GDS Holdings (GDS), Hertz Global (HTZ), KE Holding (BEKE), Li Auto (LI), MSD Acquisition (MSDA), Novavax (NVAX), Palo Alto Networks (PANW), Pinterest, Inc. (PINS), QuantumScape (QS), Ribbit LEAP (LEAP), RingCentral (RNG), Singular Genomics (OMIC), Stitch Fix, Inc. (SFIX), and Victoria’s Secret (VSCO).

Below is a spreadsheet that shows the changes to Philippe Laffont’s Coatue Management 13F long portfolio holdings as of Q1 2022:

Philippe Laffont – Coatue Management’s Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment