Tatyana Berkovich/iStock Editorial via Getty Images

Why Is Philip Morris Stock Rising?

Philip Morris International Inc. stock (NYSE:PM) rose 4.2% on Thursday (July 21) after Q2 2022 results were released.

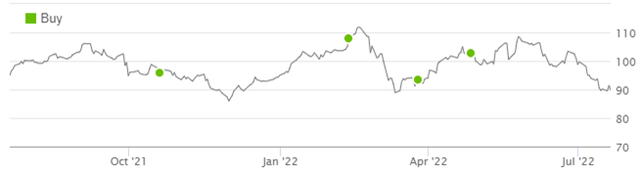

We initiated our Buy rating on PM in June 2019. Since then, shares have gained 39% (including dividends), though the share price has fallen 17% from its peak in mid-February, just before Russia invaded Ukraine:

|

Librarian Capital Rating History vs. PM Share Price (Last Year)  Source: Seeking Alpha (21-Jul-22). |

Q2 2022 results reflect the exceptional one-off events that have impacted PM this year, notably the loss of earnings from Russia and Ukraine and the sharp appreciation of the U.S. dollar. Excluding these, the underlying drivers behind PM’s businesses have remained strong, and full-year 2022 outlook has been raised on an organic basis.

We believe that PM stock can generate a total return of 44% (12.2% annualized) on a standalone basis, and the pending acquisition of Swedish Match (OTCPK:SWMAY) should generate further value. The Dividend Yield is 5.3%. Buy.

Philip Morris Buy Case Recap

PM combines a strong cigarettes business and a broad-based and growing Reduced Risk Products (“RRP”) franchise.

We expect PM’s cigarette business to be stable, except where cannibalized by its own RRPs. We believe PM’s IQOS will continue its dominance of the Heat-Not-Burn (“HNB”) category, to grow strongly in Europe and remain at least stable in Japan. PM has also launched its own e-vapor products since 2020, and has entered the nicotine pouch market with its own products on a limited scale.

In addition, PM has agreed to acquire Swedish Match and the transaction is expected to close in Q4. Swedish Match is predominantly an oral tobacco player, selling snus, moist snuff as well as nicotine pouches. Two thirds of its sales are in the U.S., where its ZYN nicotine pouch leads its category. Another 25% of sales come from its cigars business in the U.S. PM plans to use Swedish Match’s platform to re-enter the U.S. market with some RRPs; we believe this can potentially include IQOS, should Altria’s (MO) exclusive U.S. license not be renewed past 2024.

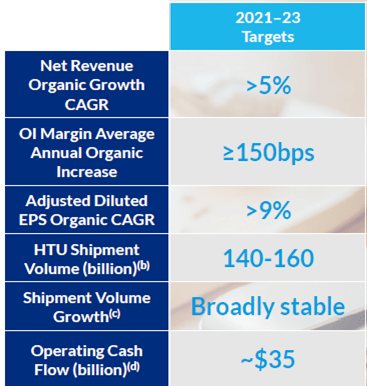

Historically, PM targeted an (ex-currency) EPS CAGR of 8-10%. 2021-23 targets, announced at the February 2021 investor day, include a revenue CAGR of at least 5%, an average annual EBIT margin uplift of 150 bps or more, and an EPS CAGR of at least 9% (excluding currency):

|

PM Medium-Term Financial Targets  Source: PM investor day presentation (Feb-21). |

With the loss of earnings from Russia and Ukraine following the conflict there, PM now expects to achieve the same 2021-23 growth rates but on rebased earnings that exclude these countries. Should PM successfully complete the Swedish Match acquisition, we expect new, more ambitious targets to be announced in 2023.

Q2 2022 results show the continuing strength of PM’s current business, albeit with impact from macro headwinds.

Philip Morris Q2 Results Headlines

During Q2 2022, PM had good volume growth and good currency-neutral revenue growth. However, EBIT growth was weaker due to margin contraction and, including currency, both revenues and EBIT fell year-on-year.

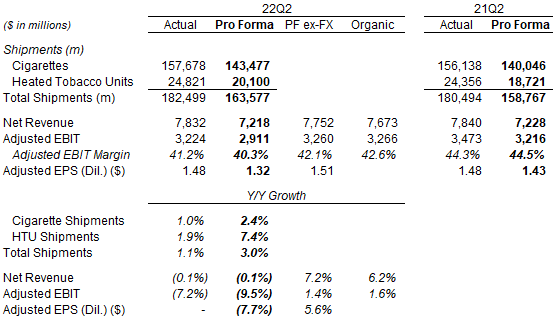

The table below shows PM’s key volume and financial data for the quarter:

|

PM Key Volumes & Financials (Q2 2022 vs. Prior Year)  Source: PM results release (Q2 2022). NB. Net Revenues exclude $246m Saudi Custom Assessment impact in Q2 2021. |

The “Pro Forma” column excludes Russia and Ukraine from all periods and best reflects underlying trends. On a pro forma basis, total shipments grew 3.0% in Q2, driven by growth of 2.4% in cigarette shipments and 7.4% in Heated Tobacco Units (“HTU”) shipments. However, Net Revenues were only flattish (down 0.1%), Adjusted EBIT fell 9.5% and Adjusted EPS fell 7.7%, largely due to the strengthening of the USD against nearly all currencies during the quarter.

The “Pro Forma Ex-FX” column shows that, excluding currency, Net Revenues rose 7.2%. Adjusted EBIT still grew only 1.4%, due to a significant margin contraction (discussed in more detail below). Adjusted EPS grew more, by 5.6%, largely due to a lower tax rate and helped by a 0.5% lower share count.

The “Organic” column shows that, further excluding acquisitions, Net Revenues rose 6.2% and Adjusted EBIT grew 1.6%. The difference with the ”Pro Forma Ex-FX” column consisted primarily of the contribution from the Vectura and Fertin businesses acquired in 2021.

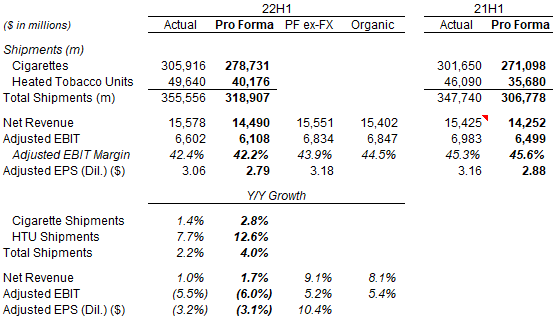

Similarly, across H1 as a whole, total shipment growth was still strong at 4.0%, Pro Forma Adjusted EBIT and Adjusted EPS was still lower year-on-year, while Pro Forma ex-FX Adjusted EPS rose 10.4% year-on-year:

|

PM Key Volumes & Financials (H1 2022 vs. Prior Year)  Source: PM results release (Q2 2022). NB. Net Revenues exclude $246m Saudi Custom Assessment impact in Q2 2021. |

H1 Pro Forma ex-FX Adjusted EPS growth was within previous full-year 2022 guidance of 9-11%. Volume growth would have been stronger except for supply chain constraints, and the margin contraction was also due to one-off factors.

Q2 Growth Limited By Supply Chain

PM’s volume could have grown even more in Q2 except for supply chain constraints, particularly a delay in HTU shipments to Japan, partly due to the cancellation of planned production capacity in Russia.

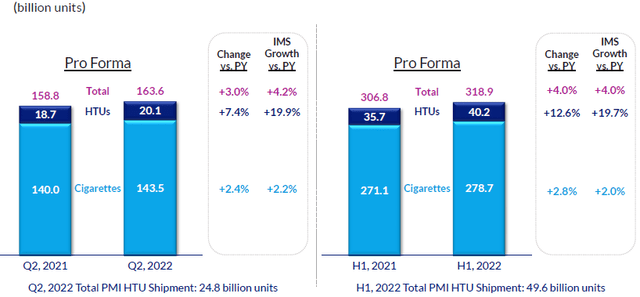

HTU shipment volume grew just 7.4%, a significant lag behind In-Market Sales (“IMS”) growth of 19.9%, so total shipments also lapped IMS growth by 0.8ppt (3.0% vs. 4.2%):

|

PM Shipment Volumes vs. In-Market Sales (Q2 & H1 2022)  Source: PM results presentation (Q2 2022) |

Across H1, shipment volume and IMS were roughly equal, but HTU shipment volume still lagged IMS significantly, which reduced revenue growth and EBIT margin for the group (as HTUs have higher revenues and margin).

Q2 Margin Impacted by Headwinds

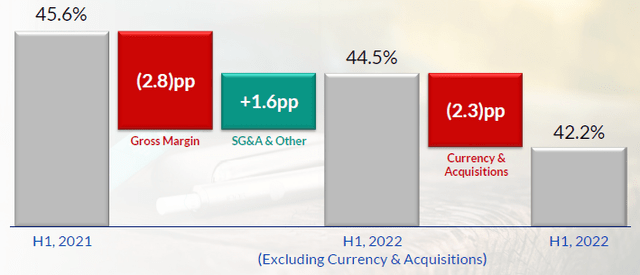

PM’s Pro Forma Adjusted EBIT margin fell from 45.6% to 42.2% in H1 2022, largely due to a deterioration in Gross Margin and currency, partially offset by improvements in SG&A & Other:

|

PM Pro Forma Adjusted EBIT Margin (H1 2022 vs. Prior Year)  Source: PM results presentation (Q2 2022). |

Margin was impacted by a number of one-off factors. The roll-out of the new ILUMA device to new markets was a negative, as device sales are low-margin, Cost of Goods Sold on ILUMA consumables is still being optimized, and the roll-out involved additional investments. Supply chain issues were also a factor, necessitating for example $80m in additional air freight expenses. General inflation across a number of areas added 4% to Cost of Goods Sold.

PM did have several ways to offset cost headwinds. Combustibles achieved a net pricing of 3.5% on a pro forma basis year-on-year, or “almost 5%” excluding Indonesia. The mix shift towards RRPs has continued to benefit margins. PM is also more than halfway through its $2bn gross cost savings program for 2021-23, with substantial potential remaining.

Management continues to expect a flat or expanding Adjusted EBIT margin in 2022, but with improvement weighted to Q4. Headwinds are expected to fade in Q3, but the benefit is expected to be offset by additional investments.

Progress Across Reduced Risk Products

PM has continued to make progress across its various RRP categories.

In Heated Tobacco, IQOS has continued to grow across key markets:

- In Japan, IQOS grew IMS sequentially from 8.1bn to 8.2bn, and was 22.9% of the nicotine market in Q2 (from 21.0% last year), a dominant position compared to total HTU market share of about a third

- In Europe, IQOS grew IMS sequentially from 7.4bn to 8.0bn, and was 7.1% of the nicotine market in Q2 (from 5.5% last year). Market share rose 3.1 ppt year-on-year to 8.9% in Switzerland (a key proxy for the large German market), and 0.5 ppt to 1.7% in Spain (a large market)

- IQOS IMS in Low and Middle Income Markets IMS reached 2.3bn, up from 2.1bn in Q1 and 1.6bn last year

IQOS’ growth was helped by the new ILUMA device. Greece was the latest to be added to the list of ILUMA markets, and further market launches are planned for Q4. During Q2 PM also launched the SENTIA, a mainline-priced consumable to be used with the ILUMA device, to supplement the TEREA premium consumables already in the market.

In E-Vapor, PM’s VEEV device was launched in France during Q2, and is now in 10 markets. In Italy VEEV has grown to #2 market share in the closed pod market, with a category share of around 20%. PM also launched the disposable VEEBA product in Canada during Q2.

Raising Organic 2022 Outlook

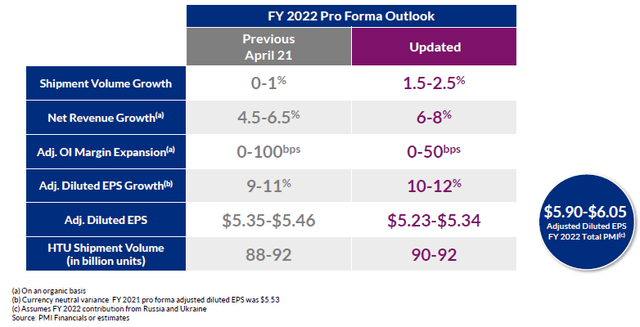

PM raised its organic 2022 outlook, with organic Adjusted EPS growth now expected to be 10-12% (was 9-11%), largely driven by better-than-expected volume growth (now 1.5-2.5%, was 0-1%), including in HTU shipment (now 90-92bn, was 88-92bn), and more than offsetting a lower expected EBIT margin expansion (now 0-50 bps, was 0-100 bps):

|

PM 2022 Outlook (New vs. Previous)  Source: PM results presentation (Q2 2022). |

However, a $0.23 increase in the currency headwind (to $0.83) is expected to more than offset the higher organic EPS growth. 2022 Adjusted EPS is now expected to be $5.23-5.34 on a pro forma basis, lower than $5.35-5.46 before

2022 Operating Cash Flow outlook has been raised from $10bn to $10.5bn, while 2022 CapEx outlook is unchanged at $1bn.

Management stated that HTU production capacity was “the main constraint for not further raising our HTU volume target”. Nonetheless 2022 is expected to be the second consecutive year of positive volume growth for PM.

Management also stated that they now expect to “comfortably exceed” their 2021-2023 minimum CAGR targets.

Other Strategic Updates

On Swedish Match, PM still expects to complete its acquisition in Q4, despite the reported involvement of activist investor Elliott Management. CFO Emmanuel Babeau had this to say on the earnings call:

I would like to reiterate the fact that we believe that this is a very compelling offer for Swedish Match shareholder. Can I remind everybody that we offered a 40% for the premium at the time of the announcement in May, since then, the markets have been quite volatile, most of them going down, and that this offer has been approved by the Board of Swedish Match, which was confirming the fact that they thought it was compelling for their shareholders.”

On further acquisitions, to a question about PM’s appetite for “additional assets for sale in the U.S. market,” Babeau stated that “the priority and the focus today is on Swedish Match”, seemingly ruling out any PM interest in the NJOY, which has reportedly hired bankers this month to organize a sale process.

On the recent European Commission proposal to ban flavored (including menthol) Heated Tobacco products in the European Union, management stated that menthol was a “minority” of their business, the proposal does not equal a final decision, and that experience with a similar ban on menthol cigarettes suggest this would likely not have a “meaningful impact” on IQOS and PM “have limited concern on that matter.”

On IQOS’s future availability in the U.S., PM continues to expect this to be in H1 2023.

Philip Morris Valuation

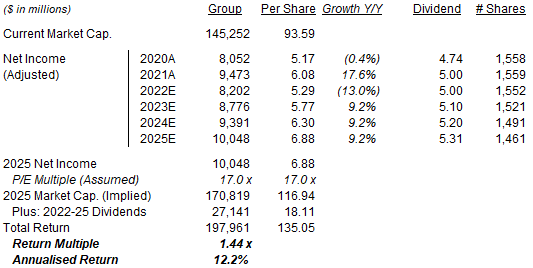

At $93.59, PM stock is trading at 16.9x 2021 Pro Forma Adjusted EPS ($5.53). Relative to the mid-point of its 2022 Pro Forma Adjusted EPS outlook ($5.23-5.34), the P/E is 17.7x.

The dividend is $5.00 ($1.25 per quarter), representing a 5.3% Dividend Yield. The implied Payout Ratio, relative to 2021 pro forma Adjusted EPS, is 90%, but expected to return to PM’s 75% target over time as EPS grows.

Relative to 2022 cashflow guidance ($10.5bn Operating Cash Flow and $1bn CapEx), PM stock is at a Free Cash Flow Yield of 6.5%.

Management comments reiterated their “unwavering” commitment to the dividend and hinted at the possibility of increasing it with cashflows from Swedish Match after deal close:

Our commitment to our progressive dividend policy is unwavering and we look forward to the additional cash flows the proposed combination with Swedish Match would bring”

– Emmanuel Babeau, PM CFO (Q2 2022 earnings call)

Philip Morris Stock Forecasts

We maintain our PM forecasts on a standalone basis for now. In our assumptions, we have reduced 2022 EPS in line with the new outlook, but increased growth in later years to represent a partial reversal of the currency headwind:

- 2022 EPS of $5.29 (was $5.47)

- From 2023, Net Income grows at 7.0% annually (was 6.0%)

- Share count to be 1,552m in 2022 (was 1,543m)

- Share count to fall by 2% annually from 2023 (unchanged)

- 2022 dividend of $5.00 (unchanged)

- From 2023, dividends to grow 2% annually, so the Payout Ratio falls to 77% by 2025 (unchanged)

- P/E at 17.0x at 2025 year-end (unchanged).

Our new 2025 EPS is 0.5% lower than before ($6.92):

|

Illustrative PM Return Forecasts  Source: Librarian Capital estimates. |

With shares at $93.59, we expect an exit price of $117 and a total return of 44% (12.2% annualized) by 2025 year-end.

Should PM successfully complete the Swedish Match acquisition, we expect to increase our forecasts significantly.

Conclusion: Is Philip Morris Stock A Buy?

We reiterate our Buy rating on Philip Morris stock.

Be the first to comment