Ignatiev/E+ via Getty Images

Introduction

We are reducing our forecasts on Philip Morris International Inc. (NYSE:PM) after the company announced plans to exit Russia yesterday (Thursday March 24).

This was likely already priced in. Philip Morris stock closed up 1.5% for the day, though still down 14.7% since Russia invaded Ukraine on February 24:

|

PM Share Price (Last 1 Year)  Source: Google Finance (24-Mar-22). |

PM shares have gained 34.6% (including dividends) since we initiated our Buy rating in June 2019, including 19.2% since the end of 2020.

Events in Russia and Ukraine represent a temporary setback, but our reduced forecasts still indicate a total return of 49% (12.4% annualized) by 2025 year-end, and we reiterate our Buy rating.

Philip Morris Buy Case Recap

Philip Morris combines a historically strong cigarettes business and an accelerating new Reduced Risk Products (“RRP”) business.

We expect PM’s cigarettes business to be stable, except where cannibalized by its own RRPs. We believe PM’s IQOS will retain its dominance of the Heat-Not-Burn (“HNB”) category, grow strongly in Europe, and be at least stable in Japan; we did not assume material U.S. sales. PM has launched its own vapor product (“VEEV”) and is entering the nicotine pouch market.

Historically, PM targeted an (ex-currency) EPS CAGR of 8-10%. Current management 2021-23 targets, announced at the February 2021 investor day, include a revenue CAGR of at least 5%, an average annual EBIT margin uplift of 150 bps or more, and an EPS CAGR of at least 9% (excluding currency):

|

PM Medium-Term Financial Targets  Source: PM investor day presentation (Feb-21). |

We expect PM to return most of its Net Income to shareholders in dividends and buybacks. A new $7bn buyback program was announced in June 2021, with $5-7bn to be repurchased in the three years after Q2 results.

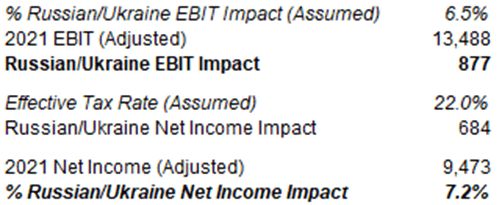

What Philip Morris Announced For Russia

Philip Morris’ announcement stated that executives “are working on options to exit the Russia market in an orderly manner”; PM has already discontinued some products in Russia and suspended marketing in the country:

|

PM Latest Announcement on Russia  Source: PM press release (24-Mar-22). |

PM did not update its 2022 outlook, but do so at its Q1 results on April 21.

PM’s decision to exit Russia was a surprise, marking a change of direction from the previous announcement on March 9, which merely stated that PM was suspending investments and scaling down manufacturing in the country. Also, prior to today, the only Tobacco companies that have announced plans to exit Russia were those with low-single-digit percentage exposures, specifically:

- British American Tobacco (BTI), which had only 3% of revenues and a “slightly lower” percentage of EBIT in Russia and Ukraine

- Imperial Brands (OTCQX:IMBBY), which had 2% of revenues and 0.5% of EBIT in Russia and Ukraine

Japan Tobacco (OTCPK:JAPAY), which has approx. 17% of its volume in Russia, has suspended new investments and marketing, but continues to operate in the country.

The new PM announcement refers to an “increasingly complex and rapidly changing regulatory and operating environment”.

Russia & Ukraine Will Likely Cost 7% Of EPS

Philip Morris stated in the announcement that Russia represented 6% of its 2021 Net Revenues; it has stated before that Ukraine was “under 2%”.

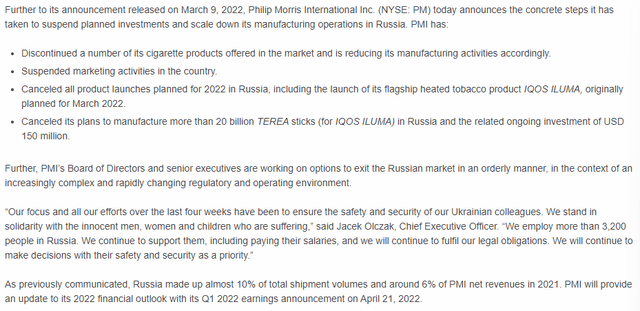

Russia is the second largest non-OECD cigarettes market in the world, and PM was #1 in the market with a 32% market share:

|

PM Cigarette Volume and Market Share by Country  Source: PM investor presentation (2021). |

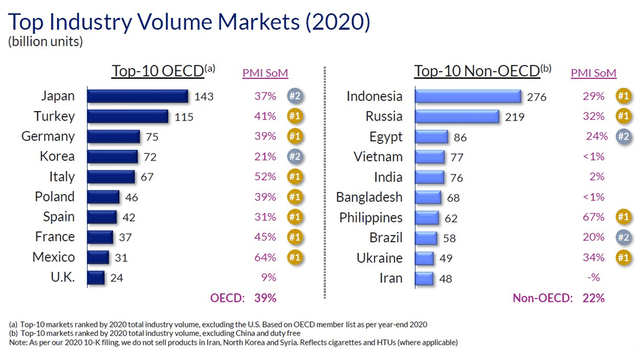

Russia and Ukraine are both part of PM’s Eastern Europe region, which was 11.3% of group Net Revenues and 9.1% of group EBIT in 2021:

|

PM Net Revenues & EBIT by Region (2021)  Source: PM results release (Q4 2021). |

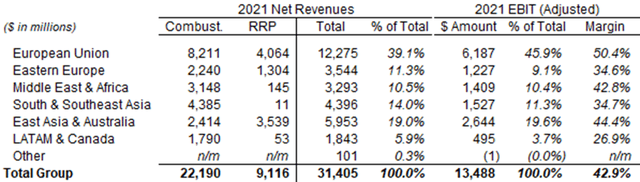

Russia and Ukraine represent 70% of Eastern Europe sales, so likely share its margin profile. This implies they were approx. 6.5% of group EBIT in FY21. With PM exiting Russia and much of Ukraine being a warzone, this EBIT contribution is likely to be lost entirely, at least for the time being.

With financial leverage, this would mean an approx. 7% hit to Net Income:

|

Estimated Russia/Ukraine Impact on Net Income  Source: Librarian Capital estimates. |

This is a moderate impact, but equivalent to one year of growth for PM.

Russia & Ukraine Likely Worth 1-2% In Growth

Losing Russia and Ukraine will have an impact on Philip Morris’ growth.

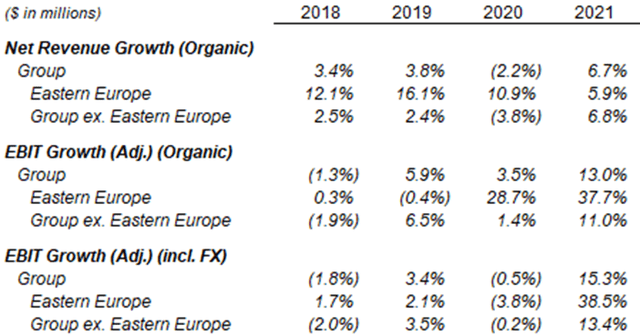

EBIT from Eastern Europe has grown at strong double-digits organically in both 2020 and 2021, mainly due to the strong growth of IQOS. However, measured in USD, EBIT growth actually shrunk in 2020:

|

PM Net Revenue & EBIT Growth – Eastern Europe vs. Group (2018-21)  Source: PM company filings. |

Currency was a small tailwind for Eastern Europe in both 2018, 2019 and 2021, but was a major headwind in 2020, primarily due to the Russian Ruble, with USD/RUB rising from 62 to 74 during the year.

PM’s organic EBIT growth would be approx. 2 ppt lower in both 2020 and 2021 if Eastern Europe was excluded from the group.

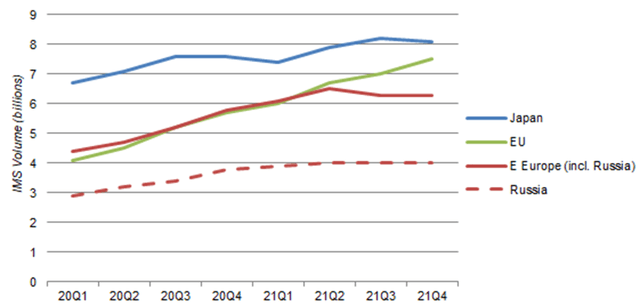

Russia represented 63% of IQOS Heated Tobacco Units (“HTU”) in-market sales in Eastern Europe in Q4 2021, though down from 66% in Q1 2020; growth has slowed in the region in 2021 due to IQOS device shortages (a result of the global chip shortage) and with PM prioritizing other markets:

|

PM HTU In-Market Sales – Key Markets (Since 2020)  Source: PM results presentations. |

Taking everything into consideration, we believe losing Russia and Ukraine would likely cost PM 1-2% in its organic EBIT growth.

Likely Non-Cash Write-Off For Distributor

Philip Morris holds a 23% equity interest in Megapolis Distribution BV, the holding company of CJSC TK Megapolis, its distributor in Russia.

PM originally agreed to pay $750m in cash (plus up to $100m in contingency payments) for a 20% stake in 2013, and the investment is carried at cost on the balance sheet.

We expect PM’s exit from Russia to involve a write-off of potentially the entire value of this stake, but it would be a non-cash, one-off charge that would not affect Adjusted EPS.

EPS Will Likely Fall 9.5-12.5% In 2022

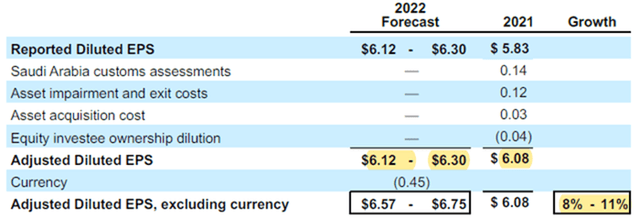

Philip Morris’ existing 2022 guidance, issued at Q4 2021 results, is for 2022 Adjusted EPS to be $6.12-6.30, compared to $6.08 in 2021:

|

PM 2022 EPS Outlook (Previous)  Source: PM results release (Q4 2021). |

The implied 0.7-3.6% year-on-year growth is the result of an 8-11% organic growth and a 7.4% currency headwind. Management does not include the impact of share buybacks in its EPS outlook.

For organic EPS growth, the loss of Russia and Ukraine revenues will be worth 7.2% of Net Income (per our estimates), and we also assume 2 ppt of the original EPS growth to be from these countries (based on plans to launch IQOS ILUMA in Russia in March 2022). So we believe the new organic EPS growth will be between -1% and 2%.

For actual EPS growth, USD has strengthened further since Q4 results, including by 3.7% against EUR and 4.7% against JPY, so we assume currency headwind has increased 4 ppt to 11.5%. This gives a new actual EPS growth of between -12.5% and -9.5%, and an EPS of $5.32-5.50 (before buybacks).

PM may offset these headwinds with cost cuts, but we have not assumed any.

Valuation: Philip Morris Dividend And P/E

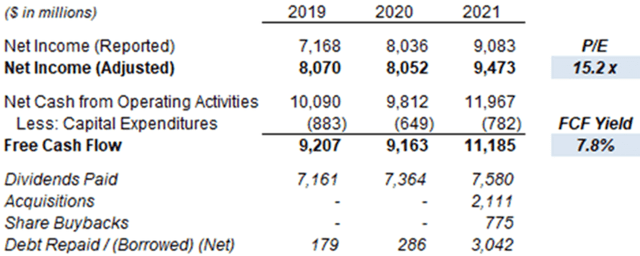

At $92.58, relative to 2021 financials, PM stock is trading at a 15.2x P/E and a 7.0% Free Cash Flow (“FCF”) Yield; however, taking the mid-point of our 2022 EPS estimate ($5.41 before buybacks), the P/E is 17.1x:

|

PM Net Income, Cashflow & Valuation (2019-22E)  Source: PM company filings. |

The Dividend Yield is 5.4%, from a dividend of $5.00 per share (annualized). The dividend is significantly exceeded by our estimated 2022 EPS ($5.32-5.50 before buybacks).

Share buybacks were resumed in 2021, with $785m repurchased during the year (including $691m in Q4). Management has targeted $5-7bn of buybacks during 2021-23, implying 2022-23 buybacks that are equivalent to 3%-4.5% of the current market capitalization.

Dividends & Buybacks Will Likely Continue

We believe PM will continue growing its dividend, and any pause in its share buyback program would be temporary.

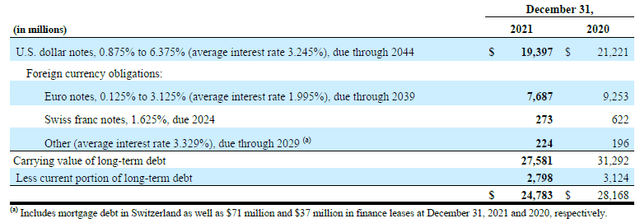

Net Debt / EBITDA was 1.62x at 2021 year-end, down from 1.93x the year before. Losing Russia and Ukraine would push up this ratio, as would currency headwinds, though the latter would be partially offset by 30% of PM’s long-term debt being in non-USD currencies (primarily EUR):

|

PM Long-Term Debt by Currency (2021 vs. Prior Year)  Source: PM 10-K filing (2021). |

Some of the debt would be repaid in 2021. We estimate a 14% rise in Net Debt / EBITDA in 2022, with 7% from Russia/Ukraine and 7% from currency headwinds. The new ratio would still be a reasonable 1.85x.

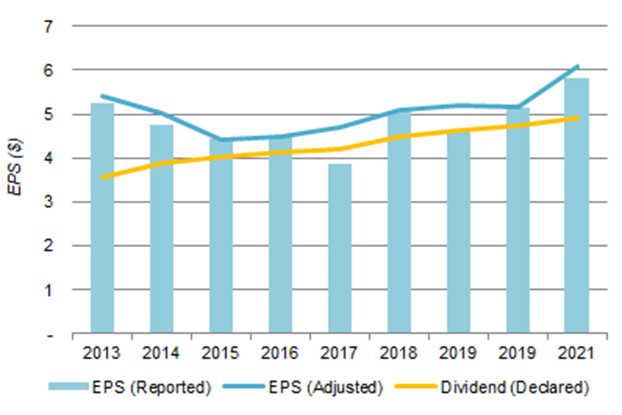

PM has been paying a rising dividend, even when Net Debt / EBITDA was higher (as high as 2.15x at 2015 year-end, and above 2x until 2019), including in 2013-15 when Adjusted EPS was declining (due to currency):

|

PM EPS and Dividends (2013-21)  Source: PM company filings. |

As PM’s then CEO, Andrew Calantzopoulos, said to Bloomberg News in 2019:

“The dividend is very sacrosanct for us … we have increased the dividend every year since the spin-off”

PM did suspend buybacks in 2015. They were resumed with Q2 2021 results, when Net Debt / EBITDA has fallen to 1.74x, from 1.92x the quarter before. In our estimates, Net Debt / EBITDA will be 1.85x at 2022 year-end, between the two numbers, but will be just over 1.7x at 2023 year-end. There is thus a small chance that PM would pause its buybacks during 2022, but even then it would likely resume them in 2023.

Philip Morris Stock Forecasts

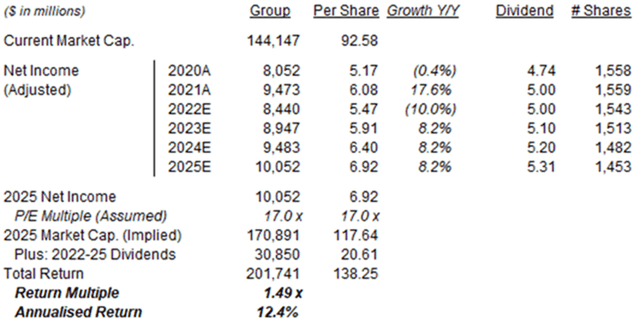

We significantly reduce our forecasts to reflect the loss of earnings and future growth from Russia and Ukraine, and the increased currency headwind.

We also increase our assumed P/E by 1x to reflect a lower-risk profile (the high-risk Russian and Ukraine markets now being lost) and bring it in line with the current P/E (adjusted for the headwinds mentioned).

Our key assumptions are now:

- 2022 EPS of $5.47 (was $6.30), down 10% year-on-year, reflecting the mid-point of our estimate above, plus 1% of growth from buybacks

- From 2023, Net Income grows at 6.0% annually (was 7.0%)

- Share count to fall by 1% in 2022 and 2% annually from 2023 (was 1.3%)

- 2022 dividend of $5.00 (was $5.04)

- From 2023, dividends to grow 2% annually, implying a Payout ratio that falls from 91% to 77% over time (was based on a 75% Payout Ratio)

- P/E at 17.0x at 2025 year-end (was 16.0x)

Our new 2025 EPS forecast of $6.92 is 14% lower than previously ($8.03), but is still 14% higher than in 2021 (which included Russia and Ukraine):

|

Illustrative PM Return Forecasts  Source: Librarian Capital estimates. |

With shares at $92.58, we expect an exit price of $118 and a total return of 49% (12.4% annualized) by 2025 year-end.

Russia And Ukraine Sales May Return

Our forecasts assume all Philip Morris sales to Russia and Ukraine are lost forever, without any offset in other markets. This is highly conservative.

In reality, we believe sales to Russia and Ukraine may return at some point. The world still needs Russia’s oil and gas, as well as other commodities, and Russian consumers still want Western goods. We do not believe Western companies will stay away forever.

Even if Russian smokers were to switch to local cigarettes, PM’s Marlboro and IQOS products remain highly desirable and will be able to reclaim their market share on their return.

Is Philip Morris Stock A Buy? Conclusion

We expect Adjusted EPS to fall 9.5-12.5% in 2022 (before buybacks), implying a 17.1x P/E. The Dividend Yield is 5.4%

The dividend should continue growing. Buybacks should also continue, though they may be paused during 2022.

With shares at $92.58, we expect a total return of 49% (12.4% annualized) by 2025 year-end.

We reiterate our Buy rating on Philip Morris.

Be the first to comment