AscentXmedia/E+ via Getty Images

Philip Morris International Inc. (NYSE:PM) is a dividend powerhouse that has one key thing to offer to its potential investors: safety. Quite strange given the fact we are discussing a Big Tobacco “sin stock,” but the company delivered a remarkable level of both resilience and consistency throughout the last decade, proving once again that tobacco is much more than a “death industry.”

The markets have been on a downturn for the better part of the year, with the Russian invasion of Ukraine only serving to further frighten investors who were already deeply concerned over rising inflation and the upcoming rate hikes. Many investors are pulling their money out of stocks and moving into safer havens, including bonds, gold, silver, or simply the U.S. dollar. However, Philip Morris, with its consistency in delivering results and seeming resilience to the broader market movements, seems to offer exactly that: safety in a turbulent period.

My analysis of Philip Morris is the latest article in my ongoing coverage of tobacco companies. You can read my analysis of British American Tobacco (BTI) (OTCPK:BTAFF) and my views on Imperial Brands (OTCQX:IMBBY) (OTCQX:IMBBF).

The Moat Fortress of Big Tobacco

Philip Morris International is a Swiss-American multinational tobacco and tobacco-alternative manufacturing company that is often defined as one of the pinnacle companies comprising Big Tobacco. The history of Philip Morris International is a strange one. It was conceived in what could be defined as Altria Group, Inc.’s (MO) attempt to distance itself from the tobacco industry. The company was officially created in the 2008 spin-off, but the true history of the company and its brand is almost 200 years old.

Philip Morris sells products in over 175 countries across the world, which include cigarette brands such as Marlboro, Philip Morris, L&M, Chesterfield, Parliament, and others. Its brands also include modern tobacco alternatives such as tobacco-heated IQOS and vape IQOS VEEV.

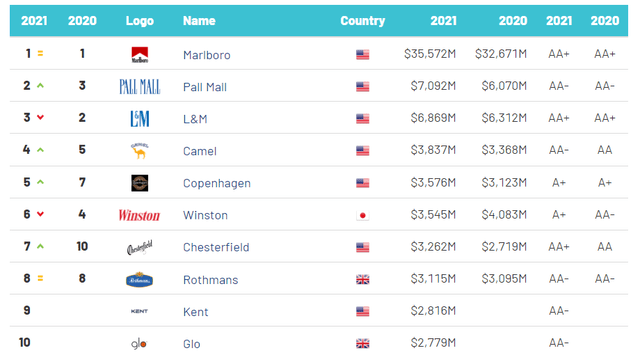

Tobacco Brands By Value (BrandDirectory.com)

The crown jewel of the tobacco brand empire is the jointly held brand Marlboro. The brand itself is considered to the worth more than $35 billion. The impact of the brand is significant to the point that Forbes ranked it as the 25th most valuable brand in the world. The brand is currently owned by both the Altria Group and Philip Morris; to be more precise, Philip Morris owns the brand outside of the United States. Overall, the company owns 5 out of the 15 international top brands.

Tobacco brands have been carefully built for decades and represent one of the strongest moats in existence. Philip Morris holds the undisputed most valuable tobacco brand in the world, which ensures a strong and loyal customer base for years to come. Brand loyalty is particularly noticeable in premium price segments, to which PM’s brand portfolio is oriented. With the combination of tight government regulation resulting in difficulties in market penetration of new brands and a clear advantage in terms of economies of scale from which the big manufacturers benefit, Philip Morris sits high on top of an impenetrable moat fortress.

Resilience and Consistency

Many would consider Philip Morris as a death company that is operating within a dying industry. However, if we are to take a look at the fundamentals, they seem to be telling us a different story. By far the most remarkable thing is that the company almost seems to have been frozen in time.

PM Price Change 10y (TIKR Terminal)

For the past ten years, shares of the company have been selling for pretty much the same price almost consistently, if we are to disregard the slight upwards movement experienced between 2016 and 2018. In general, a share of Philip Morris could have been bought around the $100 range throughout the decade. This fact, combined with the cash flow and dividend stability, almost makes Philip Morris look like a 5% yielding bond.

We might conclude that Philip Morris seems to be handling the decline of the tobacco industry rather well. Both the top and bottom lines have shown stellar consistency over the last ten years. To be perfectly clear, traditional tobacco use has, in fact, been on a decline, and the company is struggling to introduce new products with the goal of offsetting the revenue decline from traditional tobacco. This creates a situation where PM is sensitive to its alternative product offerings’ financial success and is likely going to grow in the low to mid-single digits. Still, it is clear from looking at the numbers that Philip Morris is far from dying out and that tobacco is here to stay.

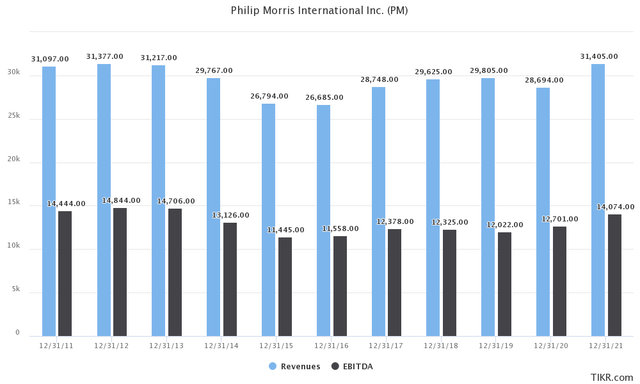

Revenues and EBITDA (TIKR Terminal)

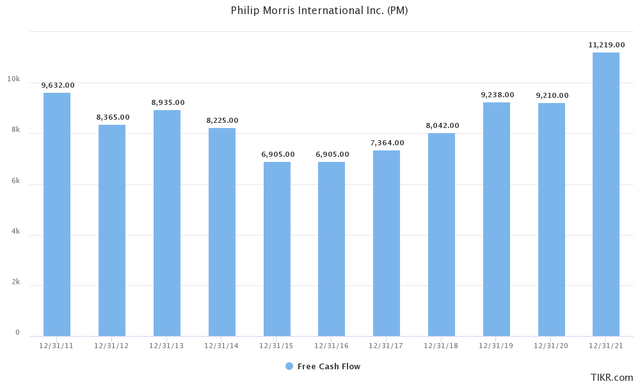

Ending 2021 with $31.40 billion in revenues and $14.07 billion in EBITDA, the company generated almost the same results as back in 2011. This is obviously not something that investors tend to look favorably upon. However, considering the pressure the industry is experiencing, we can view this as a sign of strength rather than weakness. The giant remains a free cash flow machine, managing to generate north of $8 billion in FCF over the course of the last ten years.

Free Cash Flow (TIKR Terminal)

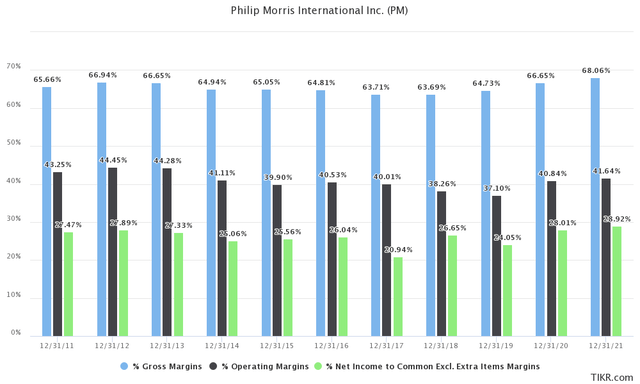

One of the greatest things about being in the tobacco industry is the high margins PM consistently manages to produce. In essence, the combination of the limited capital requirements in the tobacco manufacturing process, combined with limited marketing thanks to the regulatory environment, results in unbelievably high margins. And Philip Morris, like the other companies in the industry, has a long history of generating high margins.

Dividends and Share Buy-backs

The fact that the capital gains generated by the company throughout the last decade have been in the single digits does not mean that Philip Morris has failed to generate adequate returns to the shareholders.

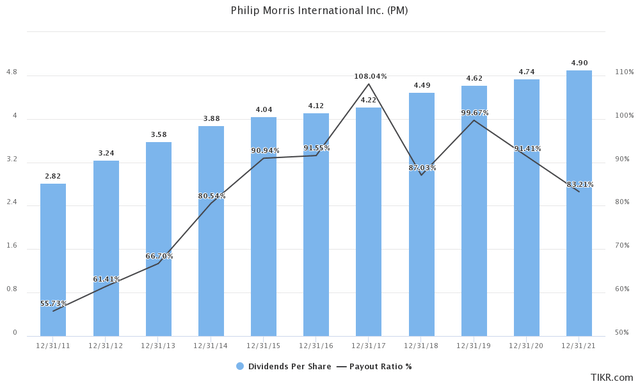

Dividend History (TIKR Terminal)

Philip Morris has been adored by the dividend investing community for decades. The company is fully committed to generating shareholder value through its strong dividend program. The tobacco giant has grown its dividend by 74% from when it was paying out $2.82 per share just ten years ago. We can easily conclude that the dividend safety was relatively compromised, with the main increases happening in the early 2010s. The overall dividend CAGR the company produced is set at 5.7%. Future dividend increases are mainly dependent on the success of the alternative products lineup.

The company’s dividend payout ratio is currently set around 80%, with the historical trend of the last five years of breaking that level. In the coming years, the company will ideally look forward to stabilizing the payout ratio, possibly in the high 60s or low 70s.

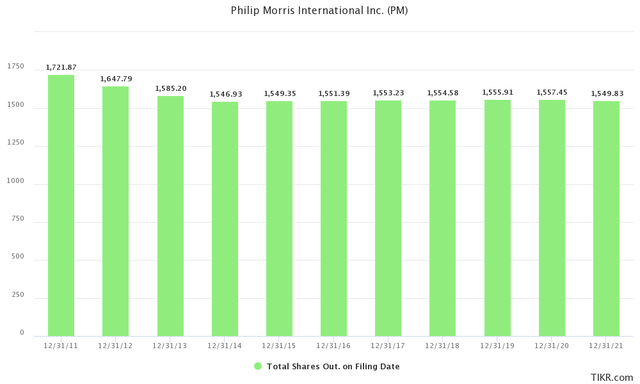

Philip Morris was well known for the generous buyback programs it initiated in the 2000s. Even though management has failed to mount a more meaningful share buy-back program of late, the commitment to deploy capital in terms of the share buyback is welcome and should always be appreciated by investors. Major buy-back programs were last executed in 2013. From the 2008 to 2013 period, the company reduced the number of its shares outstanding by more than 20%.

Shares Outstanding (TIKR Terminal)

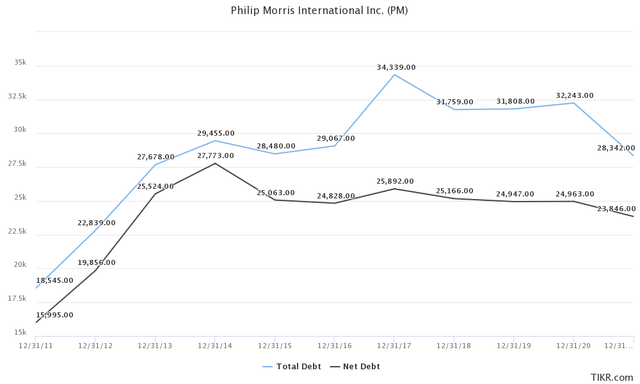

The focus for Philip Morris increasingly has shifted from increasing dividends and executing buy-back programs to servicing and maintaining its debts. Management has focused on deleveraging the company in the past five years and had achieved respectable results as of late. The debt levels peaked with the Total Debt standing at $34.33 billion back in 2017, with 2.09x Net Debt/EBITDA. Since then, the company cut down debt by more than $6 billion, and today it stands at $28.34 billion, with Net Debt being set at $23.84 billion. The Net Debt/EBITDA ratio has been lowered to 1.61x.

Debt Situation (TIKR Terminal)

Valuations and the Rest of the Industry

Let us take a broader look at the other companies operating within the industry and how well their valuations compare to Philip Morris.

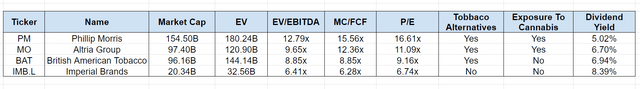

Industry Competitors (Author Spreadsheet)

Altria Group is somewhat of a smaller company that seems to be selling at somewhat of a discount compared to Philip Morris. The market cap is set at $97.40 billion, while the EV of the company is $120.90 billion. It sells for a P/E of 12.36x and an EV/EBITDA ratio of 9.65x, all seemingly more attractive than PM. Furthermore, it offers a dividend of 6.7%. It carries exposure to both cannabis and tobacco alternatives.

British American Tobacco seems to be selling at quite a bargain price and is currently valued at x9.16 P/E. This is an immensely attractive P/E ratio considering the broader market movements. Furthermore, the company is selling for 8.85x EV/EBITDA and also 8.85x MC/FCF. However, with a Market Cap of 96.16B and an EV of roughly $144.14 billion, BTI also carries the most amount of debt. It includes exposure to both cannabis and tobacco alternatives. My opinions on the company are well-summarized in my British American Tobacco article.

Imperial Brands PLC is the smallest company in the bunch. It has a market cap of just $20.34 billion and an EV of just $32.56 billion, barely competing with the rest. However, Imperial is interesting as it trades at a significant discount to all three companies. It currently trades for a P/E ratio of 6.74x, while the EV/EBITDA and MC/FCF ratios are set to 6.41x and 6.28x, respectively. Most notably, the company remains a pure tobacco play and has little exposure to tobacco alternatives and no exposure in terms of cannabis. My grievances with the company are well summarized in my Imperial Brands article.

In terms of valuing Philip Morris to the rest of the market, we can conclude that the company is selling for a bargain. However, when comparing the company to direct competitors such as British American Tobacco or Altria Group, it becomes apparent that the company commands somewhat of a premium. Interestingly, it still lacks proper exposure to cannabis products, while the new category product offering seems to be lacking compared to what British American Tobacco has to offer. Even so, I believe that even though there are more attractive offerings, it is very difficult to deny the compelling value proposition of Philip Morris.

Looming Risks

If one plans to invest in Philip Morris, there are several things that are worth keeping in mind:

- The tobacco industry has been under regulatory scrutiny for the better part of the decade, and little is expected to change in this regard even though new category products are slightly offsetting the risks.

- Philip Morris has plenty of international exposure, meaning the company pushes its products into dozens of markets worldwide and has to deal with forex risk as well as different regulatory bodies.

- While the company is generating strong cash flow, it is still burdened by a lot of debt, which is a risk worth keeping in mind.

- The company is losing a patent dispute against British American Tobacco, which jeopardizes its tobacco alternative products.

- Due to the ongoing Russia-Ukraine situation, PM has decided to leave the Russian market, which carries several negative impacts as explained here.

Final Thoughts and Conclusions

Philip Morris is delivering on a remarkable level of resilience and certainty, which comes as greatly beneficial in these troublesome times. For a “dying company,” it is displaying immense fundamental strengths and is positioned well to continue generating value for its shareholders. The company offers an attractive valuation of roughly 16 times P/E and 13 times EV/EBITDA while offering a 5% dividend at the same time, making it look almost like a bargain.

One of my favorite saying about the tobacco industry is that “Big Tobacco has been making millionaires for decades out of anyone who can stomach the ethics behind it.” I believe that little is going to change in that regard. Philip Morris is here to stay.

Be the first to comment