patpitchaya/iStock via Getty Images

Thesis

PGIM High Yield Bond Fund (NYSE:ISD) is a high yield CEF from PGIM Investments. As per its literature:

The Fund seeks to provide a high level of current income by investing primarily in below investment-grade fixed income instruments.

The fund employs a low leverage ratio of 20%, and has a high allocation to “BB” credits, factors which make this fund a bit of a conservative one in terms of risk. In today’s environment conservative is a good thing. The fund is granular, with all issuers below a 2% portfolio threshold, and the maximum industry concentration at a 10% level.

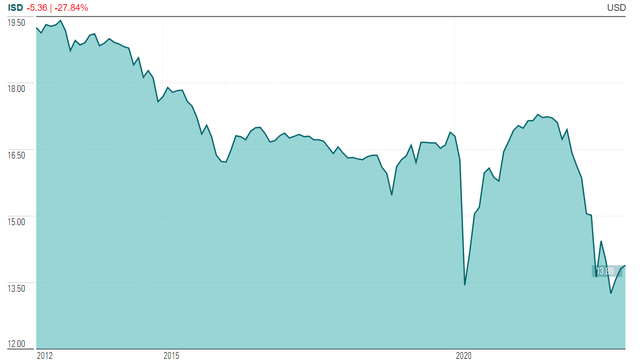

The fund is down almost -15% on a total return basis this year, but compares favorably to its peers, both on a year to date basis as well as on longer time frames. The vehicle represents a leveraged take on a portfolio of high yield bonds, with a conservative robust construction (low leverage, granular profile). The CEF is down this year due to the violent rise in rates and credit spreads, but will outperform in the coming years.

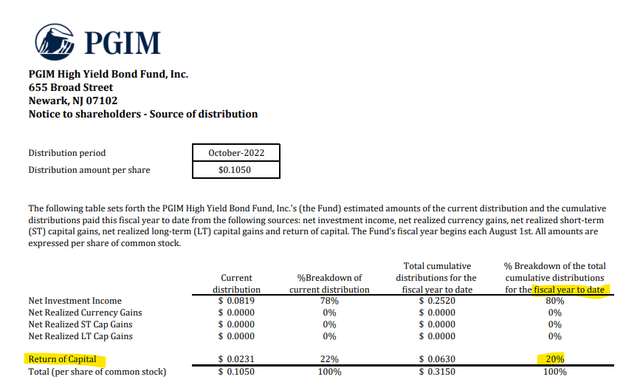

The fund is currently yielding 10%, but it is not fully supported. As of the latest Section 19a statement, only 80% of the dividend was composed of interest income, with the rest representing return of capital. While notable, the ROC percentage is not extreme. We like this fund, its granularity and composition. It is a classic build for a durable long term leveraged high yield exposure.

ISD Holdings

The fund holds a portfolio of mainly below investment grade bonds:

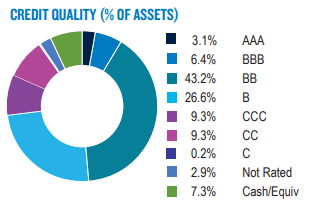

Ratings (Fund Fact Sheet)

We can see from the above pie charts that “BB” and “B” credits account for most of the holdings, adding up to over 69% of the fund. This is a conservative composition, with the “CCC” bucket below a 10% threshold.

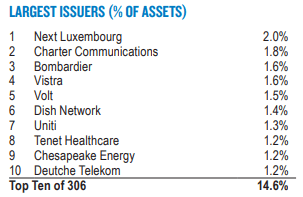

The fund’s composition is very granular, with a low allocation to individual issuers:

Issuers (Fund Fact Sheet)

We do not like to see individual credits exceeding a 3% to 5% portfolio allocation, because a sudden default in one of those names would have a significant impact on the portfolio. It is not the case here.

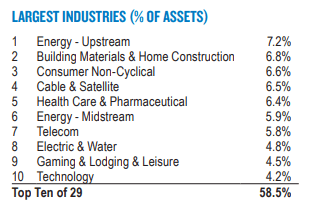

From an industry/sector stand-point the build is similarly granular:

Industry (Fund Fact Sheet)

We like the fact that Energy is the largest sectoral composition, given the structural up-cycle for this sector. Ultimately credits in sectors with strong cash flow generating capabilities will outperform long term.

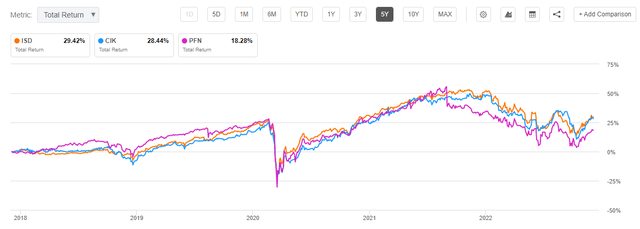

Performance

The fund is down year to date, but in line with other high yield peers:

We can see the entire cohort being down -12% to -15% this year due to rates and credit spreads. ISD performs on a long term basis as well:

What is interesting about this graph is the tightness of the cohort distribution – there are no significant outliers here. The three funds we are looking at had a very similar performance, with PFN slightly underperforming as of late. These are funds from three large, well known asset managers, with a good track record and brand. ISD stacks up there.

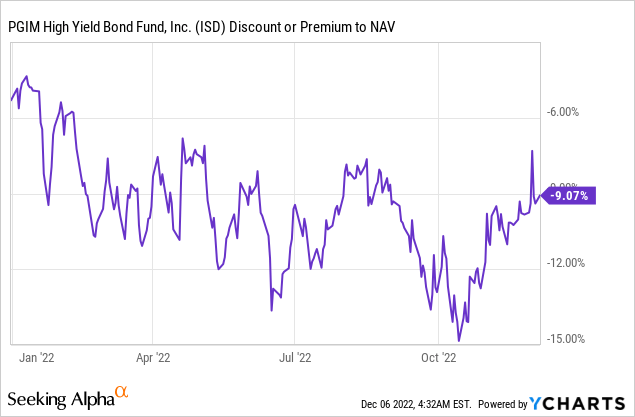

Premium / Discount to NAV

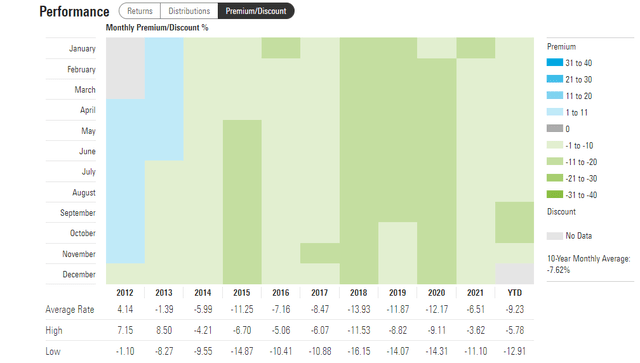

The fund usually trades at a discount to NAV:

Premium/Discount to NAV (Morningstar)

We can see how ISD historically has averaged a -7% discount to net asset value. The last time this fund traded at a premium was in 2013.

The fund has a high beta to risk-off environments:

As the market sold off in June and September, the fund’s discount to NAV widened significantly. Expect more of the same during the next bout of the current bear market. It is interesting to note the volatility around the fund’s discount to NAV – since the bottom in October, the fund’s discount narrowed by almost 6%. That is almost 7 months of interest income if holding the CEF outright.

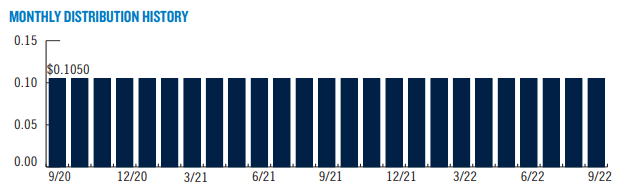

Distributions

The fund has a monthly $0.105 distribution:

Distribution History (Fund Website)

We can see that the CEF has not changed its monthly dividend for a substantial amount of time.

The distribution is not entirely supported, with an annual -2.7% give-up in the past decade:

This fact is confirmed by the most recent Section 19a statement, where interest income has increased, but still accounts for only 80% of the distribution:

Conclusion

PGIM High Yield Bond Fund is a high yield CEF from PGIM Investments. The fund focuses on fixed paying high yield bonds in the U.S. The vehicle is down -15% this year due to the rise in rates and credit spreads. ISD is conservatively built, with a granular portfolio approach and a low leverage ratio of only 20%. Long-term, the fund’s performance matches other well regarded CEFs in the space, and its conservative build is a plus for today’s environment. The fund is trading at a -9% discount currently, and has tended to trade below net asset value historically. While now 80% covered, the CEF’s 10% yield is not fully supported. ISD is a good choice for investors looking for a more conservative build in the U.S. high yield space, and it will have a bright 2023 and 2024 ahead of it.

Be the first to comment