Detry26/iStock via Getty Images

Introduction

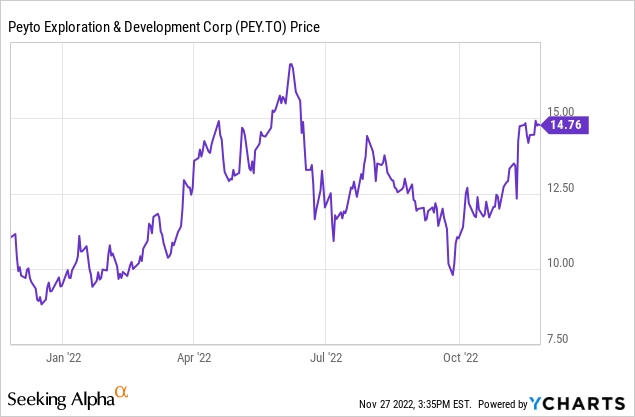

Peyto Exploration (OTCPK:PEYUF) (TSX:PEY:CA) is a large produce of natural gas in Canada and thanks to its access to multiple natural gas markets, it is able to benefit from the different prices across North America. Unfortunately, the hedge book is weighing on the results as Peyto’s realized hedging losses essentially mean the average realized natural gas price was less than C$4. But even at that specific price, the company’s sustaining free cash flow should still exceed C$2/share per year, making the stock very appealing at C$11.

The Q3 results were strong despite hedging losses

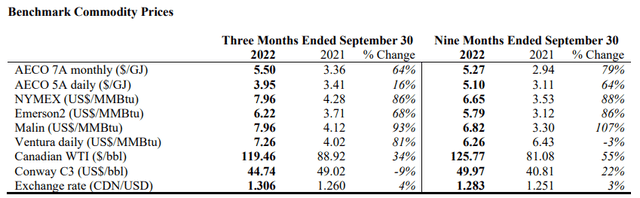

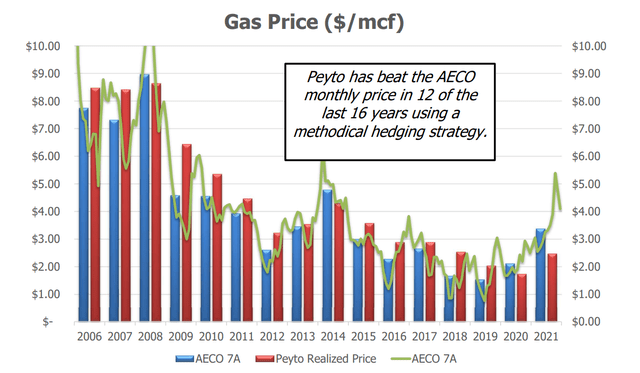

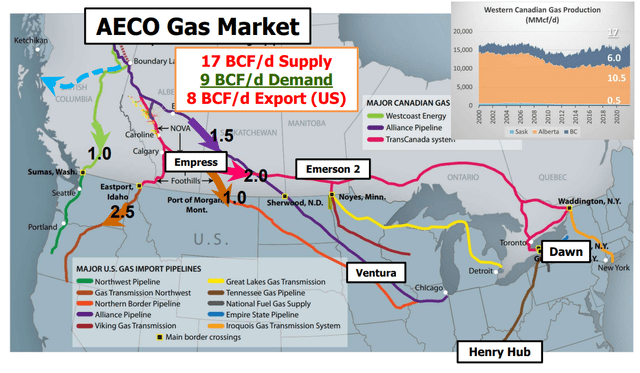

One of the main reasons why I like Peyto as a natural gas producer is the company’s decision to market its natural gas on a bunch of different markets, which also means it is selling gas at different price points. As you can see below, there is not just ‘one natural gas price’ and there can be some substantial differences depending on the market.

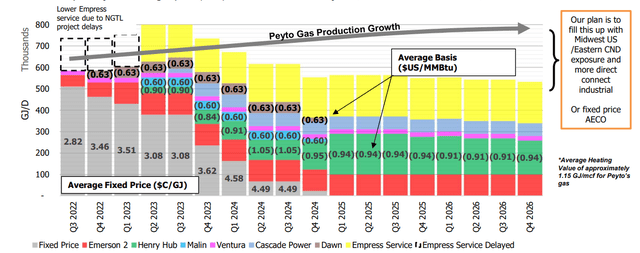

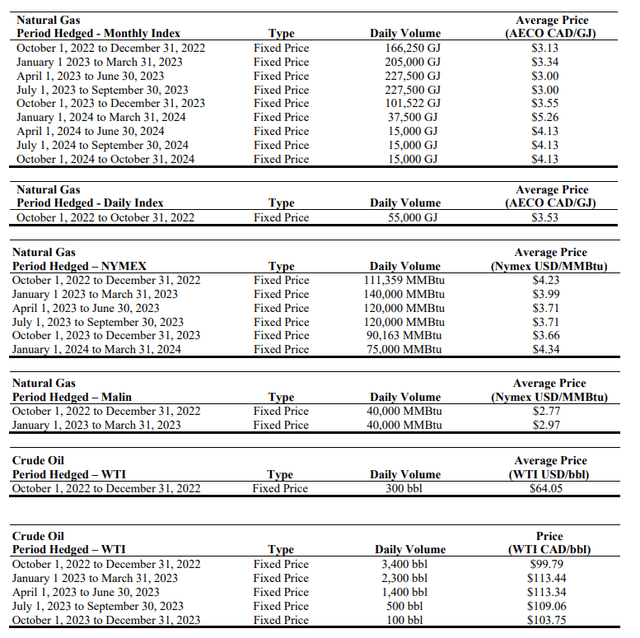

And that’s a strategy Peyto will continue to pursue. As you can see below, the exposure to different end markets will remain pretty high and I like this kind of long-term thinking and planning.

During the third quarter of this year, Peyto’s total output came in at just over 104,000 barrels of oil-equivalent per day, and about 88% of the oil-equivalent output actually consisted of natural gas. The average realized price for the natgas was C$6.18 although the average AECO price for natural gas was just C$3.95 and C$5.50 based on the 5A and 7A AECO price respectively. This once again shows how important it is for a Canadian producer to be able to sell its output into different markets as the average realized price is substantially higher than the local benchmark price.

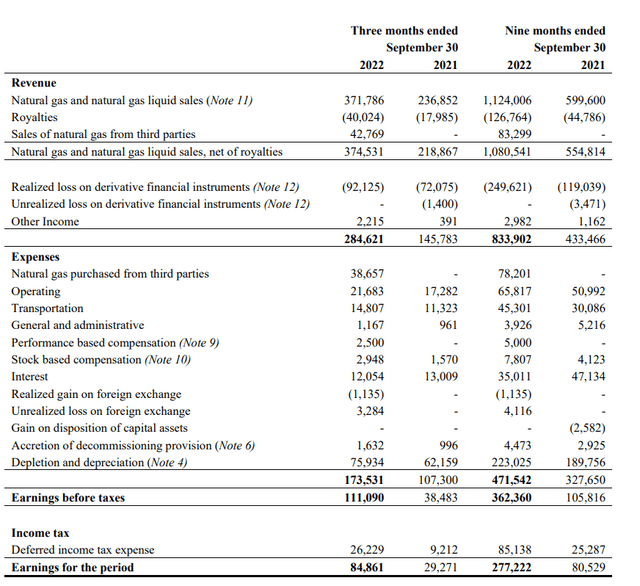

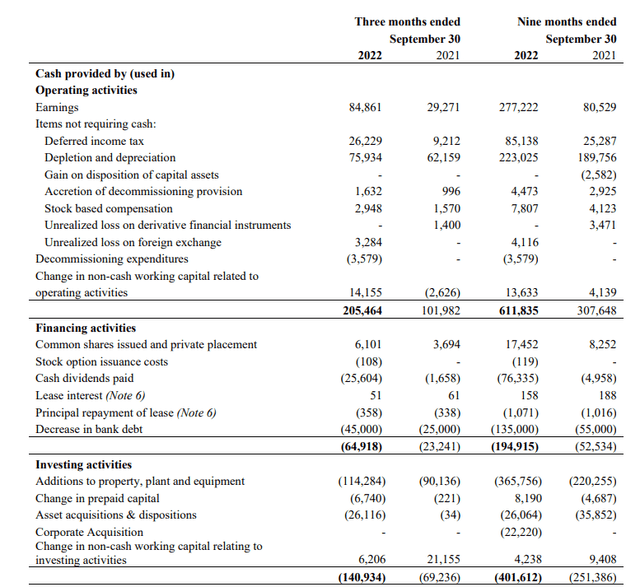

The total revenue in the third quarter was approximately C$285M including the realized loss on derivatives. The total operating expenses are still very low and despite recording a hedging loss of almost C$100M, the company was still able to report a C$111M pre-tax income and a C$85M net income.

This resulted in an EPS of C$0.50, and pushed the 9M 2022 EPS to C$1.63 per share, despite a C$250M realized loss on derivatives.

During the quarter, Peyto reported a total operating cash flow of C$205M but we should deduct the C$14M in working capital changes resulting in an operating cash flow of C$191M on an adjusted basis. This still includes the hedging losses of in excess of C$92M, but it also includes a C$26M deferred tax: Peyto still had some tax pools available to offset the pre-tax income.

The total capex during the quarter was C$114M resulting in a free cash flow of C$77M. That’s C$0.45 per share. And again, excluding the impact of the hedges (and assuming taxes, including the C$26M in deferred taxes, would effectively have to be paid), the underlying free cash flow would have been C$0.67 per share. And yes, that includes the growth capex as the sustaining capex is likely somewhere around C$80M per quarter given the current capital intensity and the decline rate. This means that at an average realized natural gas price of C$6, Peyto is generating about C$0.87 per share in sustaining free cash flow.

Hedging a portion of the production is not necessarily a bad strategy. Peyto is generally able to generate a higher price than the average AECO price.

Peyto still has a rather substantial hedge book and we can expect additional realized hedging losses, but the average realized natural gas price should still comfortably exceed C$4 in the current quarter.

The image below shows the total hedge book as of the end of September.

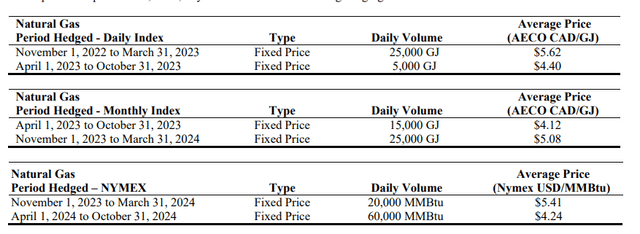

But subsequent to the end of the quarter, Peyto entered into additional hedging contracts, locking in a higher natural gas price.

The outlook for 2023 is impressive

Peyto already provided a preliminary outlook for 2023 and the company is obviously anticipating another production increase next year. Peyto will start the development activities in Whitehorse, a new area, to supply a new gas plant with 50 MMcf/day of natural gas once that plant will be operational in the second half of next year.

Those new developments represent just a portion of the anticipated C$425-475M capex program which will add approximately 35,000-40,000 barrels of oil-equivalent per day. A large portion of the anticipated production increase will be needed to cover the impact of the 27% decline rate. Based on an anticipated exit rate of 110,000 boe/day, a decline rate of 27% basically means Peyto needs to replace 30,000 boe/day of production which means that an anticipated 35-40,000 boe/day production increase will add 5-10,000 boe/day to the current production profile. Peyto indeed expects to end next year with a production rate of 120,000 boe/day.

Peyto will use half of its anticipated cash flow to reduce its net debt and fund the dividend, while the remainder should be sufficient to cover the capex needs. These plans for 2023 include a 120% increase of the dividend. The company will hike its monthly dividend from C$0.05 per share on a monthly basis to C$0.11 per share per month.

Investment thesis

While I understand some investors may be put off by the hedge book and the hedging losses, I don’t mind. I’m particularly pleased Peyto continues to hedge to smooth out the natural gas price swings. If a company consistently hedges and continues to hedge, it’s just an element to keep in mind and I respect that strategy more than a natural gas producer entering into hedging contracts at low prices but ignoring the potential to hedge some of its production at higher prices.

The sustaining free cash flow in Q3 at C$3.68 natural gas (including the hedging losses and taxes while excluding the growth investments) would have been C$0.50 for C$2.00 per share per year (and this will increase as Peyto continues to reduce its gross debt and net debt which should result in lower interest expenses).This means the current share price of approximately C$11 is definitely not outrageous and despite the 25% share price increase in the past month, Peyto is still attractively priced. I currently have no position but Peyto is now pretty high on my list.

Be the first to comment