Alexandre Schneider/Getty Images News

What Happened?

With a new boss in town, Petrobras plans to increase its CapEx spending to roughly $15.6 billion per year. In addition, Petrobras’s CEO is stepping down, and Lula should be involved in the appointment of a new CEO.

Over the past five years, Petrobras has been divesting its least profitable refineries, leading to industry leading profitability on an ROA basis:

Return On Assets

| Exxon Mobil (XOM) | Petrobras (NYSE:PBR) | Shell (SHEL) | Chevron (CVX) |

| 14% | 19% | 10% | 13% |

Now, Petrobras will be investing in refineries and renewable energy once again, as per the priorities of the new government. While this may hurt PBR’s return on assets, it should also strengthen its integrated model and build a more resilient company. We’ll take a look at Lula’s track record, a Buffett and Munger case study, and the market’s miss-pricing of this oil & gas cash machine. In the decade ahead, we project returns of 18% per annum.

A Buffett, Munger Case Study

In the long-run, fundamentals matter more than politics. If you don’t want to take it from me, take it from Warren Buffett, “If you mix your politics with your investment decisions, you’re making a big mistake.” Buffett got rich in the 1970s when the U.S. government was implementing prices controls, effectively banning businesses from raising prices. While this seemed like socialist policy to most, Buffett knew that ‘this too shall pass.’ Depressed by government policy, the S&P 500 traded between 7-11x earnings. Warren Buffett and Charlie Munger accumulated businesses like crazy during this period. It was this kind of foresight that eventually made them billionaires. There are plenty of opportunities like this globally, and Brazil is one of them.

Now, you may say, “That was in America, this is completely different.” It may be, or it may not. Buffett and Munger also accumulated a large stake in PetroChina (OTCPK:PCCYF) back in 2002. At the time, PetroChina was 90% government owned. Asked at the Berkshire Hathaway (BRK.B) annual meeting why he purchased shares of the oil giant, Buffett said, “It was bought, not because it was in China, but it was bought simply because it was very, very cheap in relation to earnings, in relation to reserves, in relation to daily oil production, in relation to refining capacity. Whatever metric you want to use, it was far cheaper than Exxon, or BP, or Shell, or companies like that.” Story summarized, PetroChina’s stock went on to 8x before Buffet sold it five years later, in 2007.

Petrobras can now trades at an even lower valuation than Buffett purchased PetroChina for in 2002:

| Metric | PetroChina (2002) | Petrobras (Today) |

| Price To Book | 0.97 | 0.78 |

|

Price To Sales |

1.25 | 0.49 |

| Price To Earnings | 6.53 | 1.65 |

Lula’s Track Record

Now, let’s take a look at Petrobras’ ownership structure. While the government of Brazil owns a 29% stake, it controls over 50% of the voting rights. This means the government has a hefty say in how Petrobras allocates its capital.

I believe it is in Brazil’s best interest to maintain a highly profitable Petrobras. The taxes and dividends the government collects from PBR can be invested to create more employment opportunities and increase social welfare. As the charts below show, when Petrobras performs well, the entire Brazilian economy performs well.

The re-election of Lula has been mourned by many capitalists. Lula previously served as the president of Brazil from 2003-2011. The ironic part is, Brazil’s stock market and economy performed far better during Lula’s presidency in the 00s.

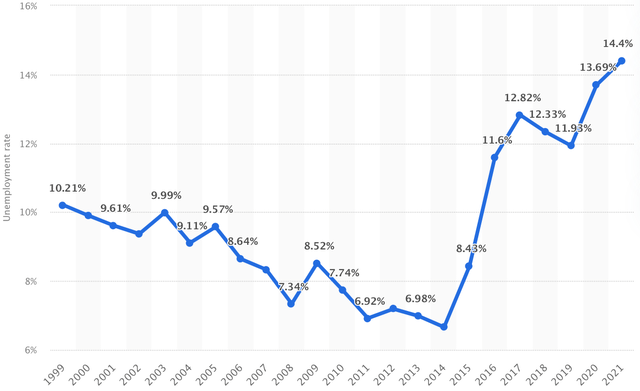

Unemployment in Brazil fell steadily throughout his tenure (From 2003 to 2011):

Statista (Brazil Unemployment Rate)

Unemployment in Brazil is on the way down again. Since the beginning of 2021, unemployment in Brazil has fallen to 8.3%.

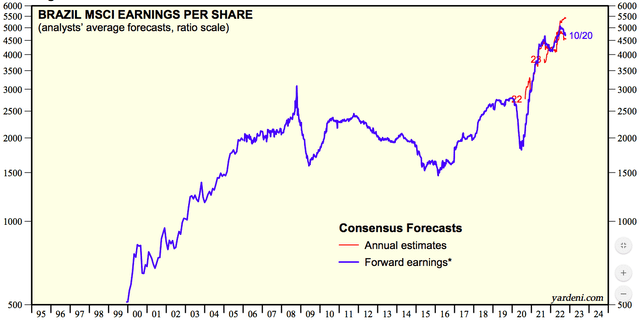

Now, take a look at what happened to earnings during Lula’s presidency; earnings per share more than doubled from 2003 to 2011:

Brazil MSCI Earnings Per Share (Statista)

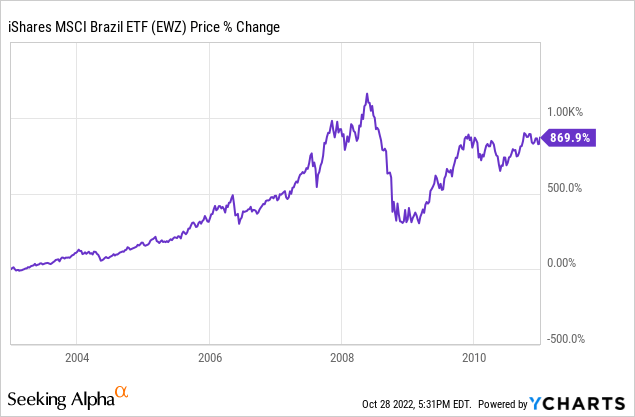

The stock market did ‘alright’ as well, with an almost 9-fold increase in value during that time:

A Brazilian Bull Market?

Looking forward, Brazil’s population of 214 million consumers could surge once again. Brazil’s been in somewhat of a modern-day depression. The country’s household debt levels are laughably low compared to global standards. The resurgence of the Brazilian consumer, combined with low asset prices could lead to a huge bull market in Brazilian equities. Petrobras is nicely positioned near the top of market-cap weighted indexes like the iShares MSCI Brazil Capped ETF (EWZ), and should thus benefit from inflows.

The Business – Long-term Returns

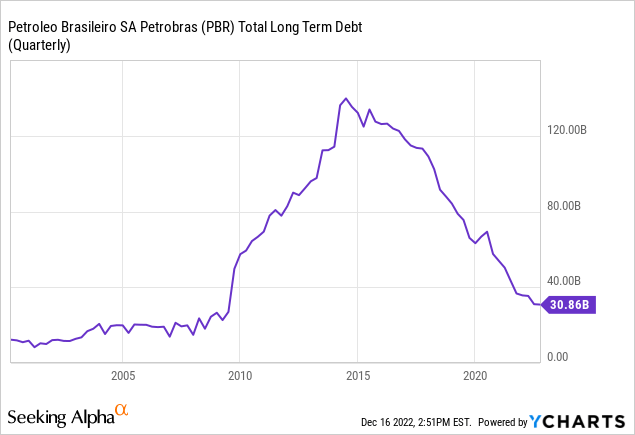

Petrobras has a remarkably profitable business, with industry leading returns on capital. You could argue it’s been one of the best managed oil and gas companies over the past five years. The companies’ debt levels have fallen tremendous during that time:

In addition, management’s said repeatedly that the current assets will remain profitable even if prices fall to $35 per barrel Brent Crude.

Looking forward, PBR will be investing a lot of money. The majority of which, 83%, will be spent on exploration and production. This should boost Petrobras’ oil reserves as it taps into off-shore black gold. As a result, I’ve boosted my forecast for Petrobras’ terminal multiple.

Given the higher levels of CapEx spend, I’ve lowered my estimate of Petrobras’ normalized earnings to $14 billion ($2.15 per share), giving PBR a normalized PE of 4x. To come up with this number, I studied Petrobras’ average return on assets and profit margins over time, as well as normalized operating cash flows, offset by expected CapEx spend.

As for the dividend, management’s said it will pay out 25% of its adjusted net income, at a minimum. Petrobras also stated it will pay special dividends, representing 60% of free cash flow, whenever their gross debt is less than $60 billion. PBR had to cut the dividend in 2015 when debt levels reached extreme levels. To be extremely conservative, I’ve used a dividend yield of just 7% in my valuation.

My 2033 price target for PBR is $31.70 per share, implying returns of 18% per annum with dividends reinvested.

- This is the result of growing $2.15 of normalized earnings at 4.5% per annum and applying a 2033 terminal multiple of 9.5x.

In Conclusion

Petrobras offers enormous upside. As Lula’s scared investors off in a complete fire sale, PBR is trading at a cheaper valuation than Buffett purchased PetroChina for in 2002. We’d caution investors on selling PBR too early. In the words of Sir John Templeton:

“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

If Brazil’s stock market takes off, PBR could really soar. Despite this, I do expect earnings, dividends, and profitability to decline. I think normalized earnings are around $14 billion, giving PBR a normalized PE of 4x. While I don’t mind PBR plowing $15.6 billion back into exploration and production as well as some more renewable energy, I’d caution the new CEO from using debt to achieve his/her goals. Investors should keep their eyes on this as well.

With prospective returns of 18% per annum, we doubled down on PBR with a cost basis around $9.30 per share. I hope this analysis and case study helps you sleep well owning this Brazilian cash machine. Until next time, happy investing.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment