Ton Molina/Getty Images News

Petrobras (NYSE:NYSE:PBR) stock is famed for its high dividend yield. The payout fluctuates a lot, but investors who bought a year ago have bagged about 45%. That’s a very high yield, and it’s likely that the yield will stay high for the foreseeable future. Why? Because PBR has a minimum payout ratio: 25% of net income. In the last 12 months, PBR brought in $2.37 per share in earnings. If this earnings level is maintained, then PBR shareholders will enjoy a minimum yield of 4.3%. That is, 25% of $2.37 ($0.5925), divided by the current share price of $13.80.

Now, it’s quite possible that investors who buy Petrobras today will enjoy a much higher yield than 4.3%. PBR’s 25% payout policy is a floor; over the last 12 months the company has been paying out much more than 25%. For example, in the second quarter, PBR paid out $12.42 billion in dividends on $10.8 billion in earnings. That gives us a payout ratio above 100%, although the free cash flow payout ratio comes in at 97%.

PBR’s high payout ratio isn’t a good thing–a dividend that exceeds earnings is at risk of being cut. Nevertheless, it helps to illustrate a point: that Petrobras shareholders can reasonably expect more than 25% of the company’s earnings to be paid to them as dividends.

The question is, exactly how much more?

PBR tends to declare its dividends quarterly, it does not commit to dividends for a whole year. That makes estimating its future dividends hard. However, it is possible to put a floor on the amount of dividends that shareholders could receive in the year ahead. Assuming that PBR is profitable in the next 12 months, its holders will receive dividends. The only question is what amount of dividends.

When I last wrote about Petrobras, I said it was a reasonably good company subject to certain risk factors. My overall take on the company is still consistent with that, but my opinion on the dividend has changed. Previously, I thought that PBR’s dividend was a source of risk and uncertainty. Today, I do not believe that is the case. My overall opinion on the company is still just mildly positive, but I’m now bullish on the prospect of investors receiving the high yield they expect, for reasons I’ll elaborate on in the coming paragraphs.

PBR’s Dividend Policy

To gauge what kind of dividend PBR will pay in the year ahead, we need to know what the company’s dividend policy is. This is a source of considerable controversy. If you check various financial data platforms, you’ll notice that they’re all reporting very different yields for PBR. That’s not due to inaccuracies, but genuine difficulty in calculating the stock’s yield. The only yield we can be sure about is the trailing yield, which I calculate as 34% based on the table below and today’s stock price.

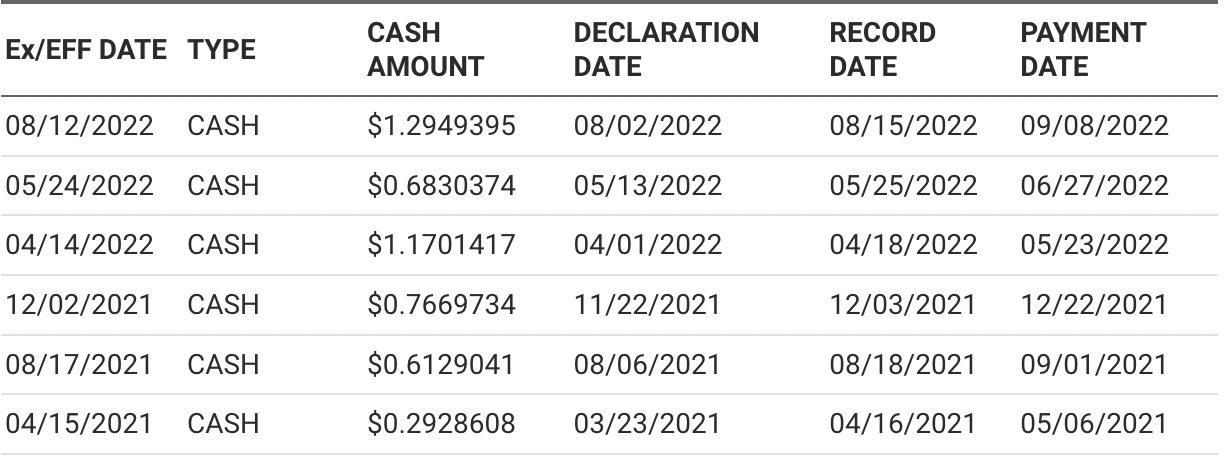

Petrobras dividends (NASDAQ.com)

The future payout is less certain, because Petrobras doesn’t declare a whole year’s worth of dividends in advance. Most American companies will announce a quarterly payout for the next year at the end of the previous one. The dividend still has to be declared each quarter, but usually, companies deliver the dividends they announced at the start of the year. PBR has no such policy. As the table above shows, the company’s payouts vary widely from quarter to quarter, making it impossible to calculate a forward yield for PBR. However, we can possibly calculate a “floor yield” by looking at several factors that could influence the future payout.

We know four crucial facts:

-

PBR pays out a minimum of 25% of earnings to shareholders.

-

It was profitable in every single one of the previous 7 quarters.

-

The 2021 quarters were much less profitable than the 2022 quarters.

-

America’s strategic petroleum reserve (“SPR”) release is scheduled to conclude at the end of October.

Given these facts, we can gauge the minimum amount of dividends that PBR shareholders are likely to receive in the year ahead.

PBR’s Breakeven Oil Price

Like most oil companies, PBR’s earnings fluctuate with oil prices. When you sell a commodity for profit, your sales grow when that commodity goes up in price. That’s obvious enough. The question for PBR shareholders is, what oil price does Petrobras need to break even?

According to Petrobras’ own statements, it only needs $21 a barrel. That’s extremely low. For comparison, Exxon Mobil’s (XOM) breakeven price has been estimated at $41 per barrel, while Chevron’s (CVX) has been estimated at $45.

One caveat here is that $21 is a self reported figure from the company. It’s not externally verified. With that said, there are reasons to believe that PBR’s breakeven price is fairly low. For example, if we look at the company’s balance sheet, we see that it has $27 billion in debt, and $78 billion in equity. That gives us a 0.34 debt to equity ratio, suggesting high solvency. More to the point, it suggests that PBR doesn’t hold too much interest bearing debt compared to the whole enterprise, so its interest expense should be fairly low. The lower an oil company’s total costs, the higher its profit, and PBR’s interest expenses are low. I’m not sure I can take the $21 breakeven claim at face value, but given PBR’s balance sheet and costs, it should be safe at $40.

Tail Risk – Very Low Oil Prices

Having looked at PBR’s breakeven price, we can now try to gauge whether oil will ever go below that level. This is of crucial importance to PBR’s shareholders because PBR has no mandate to pay dividends when it’s not profitable. It reported unprofitable quarters as recently as 2020, so this is a risk worth considering.

As of this writing, WTI Crude Oil was at $86. It averaged $39 in 2020, $68 in 2021, and $101.59 in 2022 to-date. None of these prices are below PBR’s reported breakeven, but for the sake of conservatism, we should model its earnings assuming a higher break even price than it claims. Oil was well above $21 for most of 2020, yet PBR lost money in 3 out of 4 quarters that year.

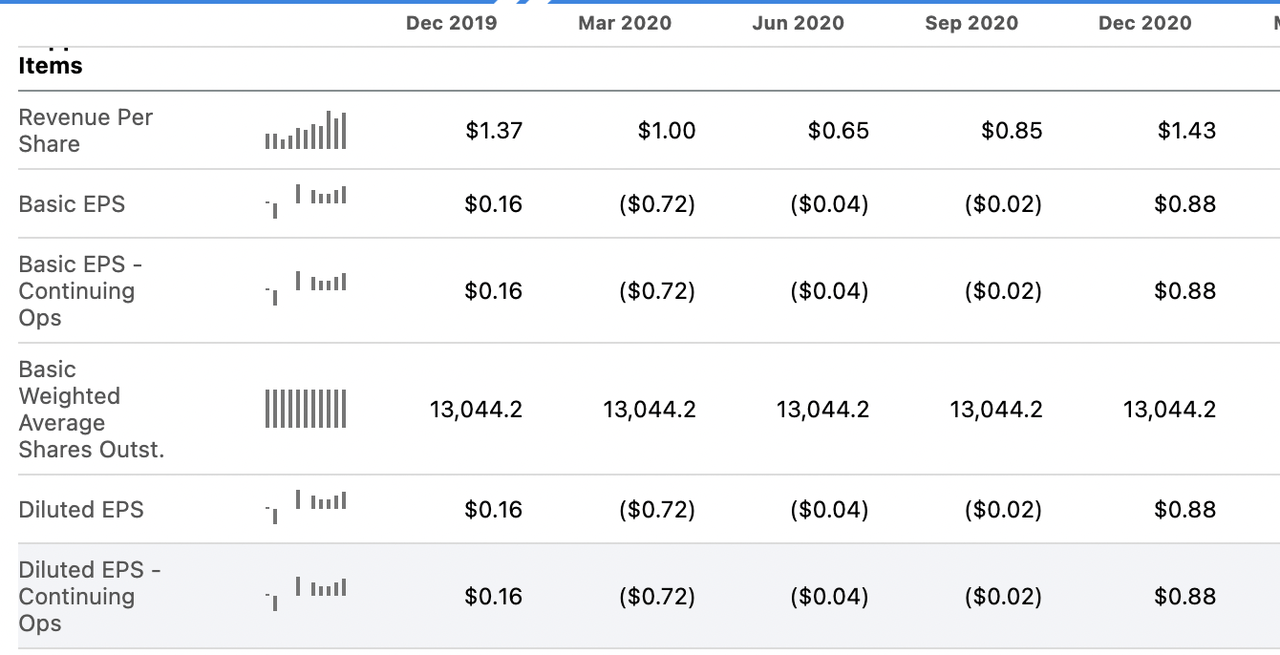

Petrobras earnings (Seeking Alpha Quant)

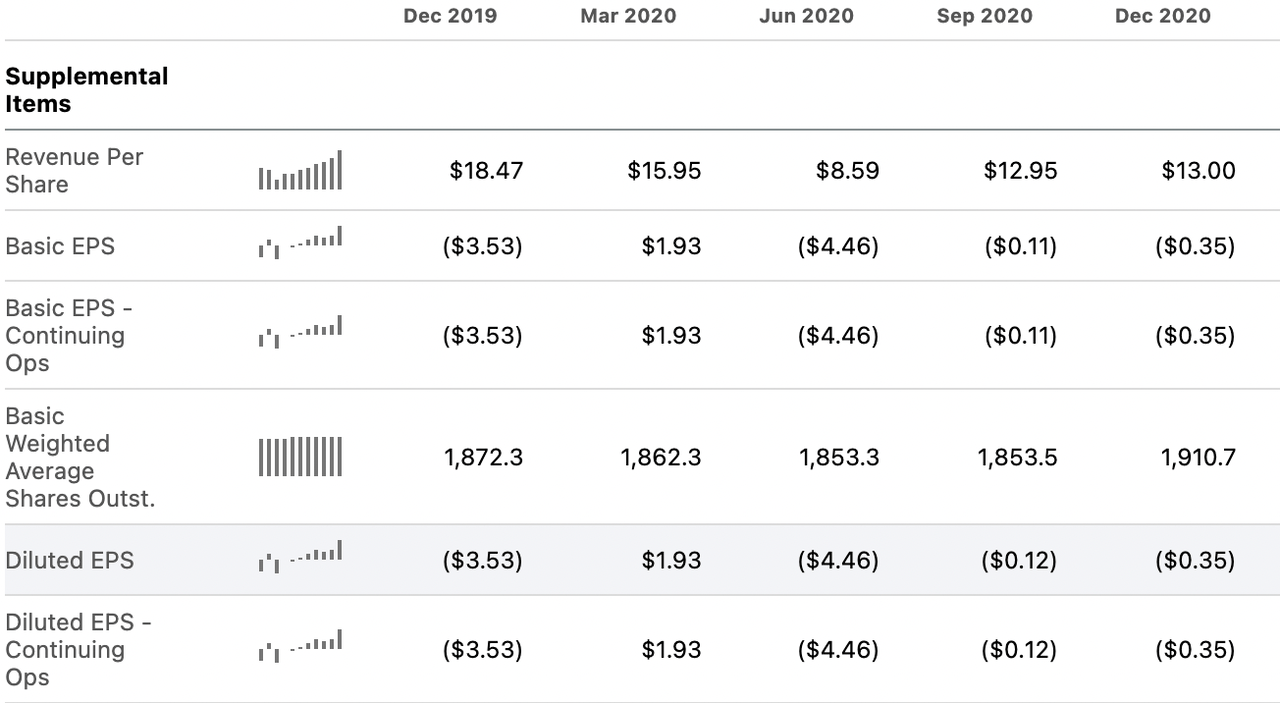

To be honest, PBR’s profit track record looks similar to those of the U.S. oil companies that break even around $40. The table below shows Exxon’s EPS for the same period I showed above for PBR, and the 2020 picture is almost the same: 3 profitable quarters, 1 not. The only difference is that PBR’s one profitable quarter was the last of the year, while CVX’s was the first.

Chevron earnings (Seeking Alpha Quant)

Given PBR’s profitability track record, I will assume that it breaks even at $40, not the reported $21. So the key question is, can oil sink below $40 and cause PBR to lose money?

Oil Prices – Where They’re Headed

It’s impossible to predict exactly where oil prices are headed, but we can put a floor on their value. The last time when oil prices dipped below $40 was in 2020, when the vast majority of developed countries were under lockdowns and travel bans. The travel bans prevented people from traveling abroad without quarantining, which killed demand for gasoline and jet fuel: hardly anybody needed to travel.

The 2020 situation is no longer applicable. The only big country still doing mass lockdowns is China, but even those are highly localized. So we can say with confidence that oil probably isn’t going to $39.

Where is it going?

What we know is the following:

-

The WTI oil price has averaged $101.59 this year.

-

It averaged $68 in 2021.

-

It’s currently at $86.

-

Global oil consumption is currently 1.6 million b/d higher than in 2021.

-

The U.S. began its emergency SPR sales in April.

-

The SPR release is bringing an extra 1 million barrels to the market daily.

-

The SPR release is scheduled to end in October.

-

Russian oil output is 310,000 barrels below pre-war levels.

-

The Ukraine war is still ongoing.

Given the facts above, it appears that $68 is a “worst case scenario” floor price for oil. As the points above demonstrate, global oil consumption is higher than in 2021, production is lower, and the release of emergency supplies will end soon. All of this combined makes it extremely unlikely for oil to fall below 2021 prices in 2022.

Modelling PBR’s Minimum Dividend

With our forecasted floor price established, we can now model what PBR would earn in a worst case scenario.

We know that PBR earned $19 billion on $81 billion in sales in 2021. Oil prices averaged $68 that year. Given that we’re modelling for a worst case scenario, we will assume that PBR matches 2021’s revenue level in the coming 12 months, since that’s the revenue level that $68 oil produced.

In 2021, PBR had $62 billion in total costs. Since then, its interest expense has shrunk from $3 billion to $2.6 billion. We know that PBR is still likely to be profitable in this quarter, given the $86 oil price. We also know that it’s committed to paying off debt. So we can safely assume that its interest expense will fall again. So, we’ll put $2.5 billion as the interest expense for the next 12 months. Apart from interest expenses, PBR has other types of expenses that are falling too; operating costs are down $1.3 billion from 2021. However, the goal is to be conservative, so I’ll assume that it only saves $500 million interest expense. In that case, its net income comes out to $19.5 billion (the $19 billion earned with $68 oil back in 2021, plus $500 million in savings on interest).

According to Seeking Alpha Quant, PBR has 13.044 billion shares outstanding (6.522 billion PBR shares plus 6.522 billion PBR.A shares). Modelling for 19.5 billion in net income, we get to $1.50 in EPS. With the minimum 25% payout ratio, we get $0.375 in dividends per share, for a 2.7% yield. Going by last quarter’s 100% payout ratio, we get $1.50 in dividends per share, or a 10.8% yield.

The Bottom Line

The bottom line on Petrobras stock it is very likely to keep paying dividends to shareholders. In an absolute worst case scenario, with oil falling to 2021 levels and PBR paying absolute minimum it’s allowed to pay, we get a 2.7% forward yield. In a slightly better scenario, where oil falls to $68 and the current payout ratio is maintained, we get a 10.8% forward yield. All of this is assuming “disaster scenario” oil prices. If oil stays at $86, or rockets back above $100, then shareholders could very well enjoy the 20% yield that got them into this stock in the first place. It wouldn’t be conservative to say that that will happen, but it easily could. In any case, 10% appears likely.

Be the first to comment