PetMed Express, Inc. (PETS) operates the website 1800petmeds.com, a top vet pharmacy licensed in all 50 states. Both over the counter and prescribed medications are sold. The website also sells pet supplies which are drop-shipped to customers by third parties.

PetMed Express does not have physical stores and is an Internet play. Its stock price is at a 52-week high and accelerating. My suggestion is you pay attention to online businesses like PetMed Express because I believe its revenue is surging while much of the country is locked down, and will continue to do so long afterwards from reorders.

PetMed Express’ Stock Price is at a Yearly High and Accelerating During the Coronavirus Pandemic

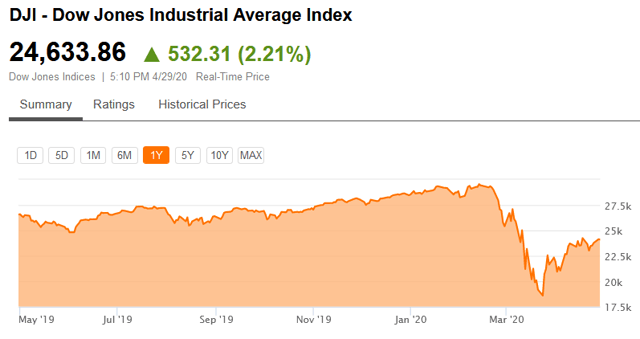

Price data from Seeking Alpha shows PetMed Express’ stock is at a yearly high, and the stock price has been rapidly accelerating during the coronavirus pandemic:

By comparison, the Dow Jones during the last year saw a major coronavirus price collapse which has only partially recovered:

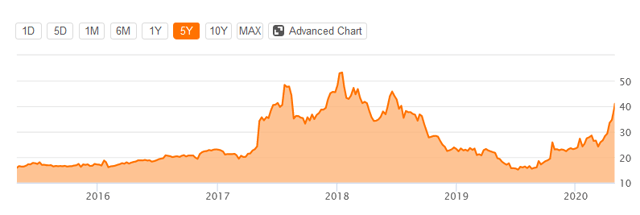

However, if we make a longer view of PetMed Express, we see that over the last few years it has exceeded the $40 price point several times and then seen retrenchment.

The question is whether the current run-up is another example of this boom-bust pattern, or will have a more long-lasting result.

Media Reports and Government Actions are Scaring Pet Owners and Promoting Online Sales

Recent media reporting stated pet cats could contract coronavirus. Then pet dogs.

Then the CDC suggested social distancing also be applied to pets to limit their interactions with animals and humans outside their household.

This has the makings of a Planet of the Apes type plot where a plague wipes out dogs and cats, pets are replaced by apes, and after another virus eliminates many humans the real battle begins. Planet of the Apes is already tongue in cheek being called a documentary.

The key point is recognizing such emotional elements. People love their pets, often more than other people. The coronavirus reports put a focus on pet health. Many are locked down and/or afraid to make unnecessary visits to stores. This includes veterinarians. Recognizing these factors the FDA has suspended various regulations to promote veterinary telemedicine, including making prescriptions without physically examining the animal. States, such as Arizona, have similarly taken steps to promote veterinary telemedicine.

In my view, telemedicine makes it easier for people to get their pets medicated, resulting in more business for vet pharmacies.

However, government regulatory suspensions are not currently planned to last forever. For example, the Colorado Veterinary Medical Association has noted the loosening of regulations is only during the coronavirus emergency. But the association also notes a purpose of regulatory suspension is to prevent the spread of the coronavirus by reducing personal contacts.

I believe (1) the online successes seen while regulations were suspended, (2) public demand for continued online convenience, and (3) a long-lasting desire to reduce personal contacts – and animal to animal contacts – which can cause viral spreads, will mean long-term there is not a return to the 2019 regulatory environment. This should benefit company sales.

I may be wrong in this assessment, and pet regulations are far down the list of current government priorities. But I think once the virus clears and there is time to reassess what happened, what regulations turned out to not be necessary but would be unpopular obstacles in the future, there will be changes benefitting the company.

PetMed Express Pre-Coronavirus Financials

According to the January 28, 2020, quarterly report, a whopping 89.8 percent of sales come from reorders versus new sales. It is a stunning number.

It suggests:

- Revenue increases are primarily either from price increases or new buyers. Reorder income, by its nature, should be steady.

- New customers and orders will continue to generate a steady flow of income. New customers generated from the coronavirus situation bode well for the future of the company.

The quarterly report says the company sells 2500 products for dogs, cats and horses. There is no breakdown for horses, but from personal experience I view the horse niche to have significantly higher per-product sales value than household pets.

The 2500 products seemed low. Especially when products are being drop-shipped by third parties without PetMed Express needing to warehouse inventory or package and ship the items. It suggests to me the company could easily, and significantly, expand its offerings and sales.

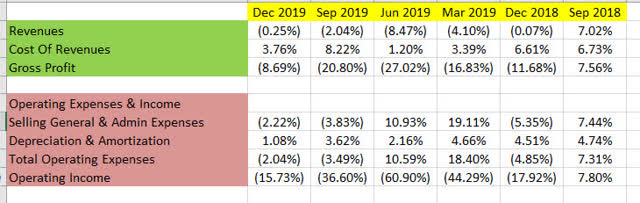

Turning to actual numbers, pre-coronavirus the situation has not been good. The revenue and cost data was compiled into a spreadsheet using Seeking Alpha data. This is for the last six quarters evaluating a year-over-year percentage change in values.

In summary:

- Steady decrease in gross revenue.

- Steady increase in cost of revenue.

- Recent improvements in SG&A expenses after prior significant increases.

- Significant decreases in operating income.

No wonder, pre-coronavirus, the stock had been decreasing in value.

During an earnings call, management noted new customer acquisition had decreased on a year-over-year basis by 6.2 percent. New order sales decreased 9.9 percent. The reason given was online competition, which I took to mean price competition.

Management noted manufacturers’ MAP policies, minimum advertised prices, were stabilizing prices in the market. But this is a problem with drop-shipping that is hardly new in 2020 – the manufacturer may be drop-shipping for numerous websites and dictating minimum prices. If someone is willing to advertise a lower price, and the manufacturer does not enforce their MAP, then 1800PetMeds can be undersold. It can create a competitive race to the bottom.

As I understand the anti-trust issue, the manufacturer technically cannot enforce a MAP. However, the manufacturer can stop doing business with a vendor who does not abide by the MAP.

I was a bit surprised management in the call leaned so heavily on MAP to stabilize prices across the market. This seemed like a decade-old issue to me and not a new excuse now for decreasing profits.

Worse, management is suggesting 1800PetMeds products are commodities where all websites are selling at the same MAP. This is where the company needs some differentiation from competition.

On the website 1800petmeds.com offers:

- 100 percent satisfaction guarantee

- Free shipping for orders over $49, otherwise shipping starts at $4.99

By comparison, competitor chewy.com offers:

- No guarantee

- Free shipping for orders over $49, otherwise flat rate of $4.95

There is some differentiation, but not significant. The doctors on the 1800PetMeds.com team are not highly promoted on the website home page to create more authority.

I also noticed the competitor Chewy (CHWY) offers products for fish, birds, small animals, and reptiles – markets PetMed Express has not pursued. The issue I see here is many families have multiple animals, such as fish and cats. If they visit Chewy to buy fish products, because those products are not available on 1800PetMeds, then I believe they are more apt to also buy their cat products on Chewy as it is more convenient to buy from one source.

The cost of revenue increase was due to payroll.

Bottom line: Pre-coronavirus the company seemed to be slowly drifting downward, but seemingly had significant opportunities untapped by management.

PetMed Express Stock Forecast

The current boost, if any, to company revenue from the coronavirus situation is yet unknown. As noted at the top, I believe it is significant – and new customers can generate reorders for many quarters.

The virus may make management look better than what its performance would otherwise justify. It may also create a disincentive to be more aggressive in pursuing new opportunities.

The company has paid dividends since 2009 and steadily increased the payout. The dividend payout is now 27 cents per share.

Dividends are significant in my view for providing certain income and a return regardless of market and paper value fluctuations.

The PE is 31.8, which is high, but also based on pre-coronavirus earnings, so it actually may be much lower. If the current situation is the opportunity the company needs to reverse declining financials and new customers generate lasting streams of new income, I believe the stock will be further rewarded. How much depends what the company next reports.

If you believe I am wrong and company sales are not substantially increasing and the regulatory environment will quickly return to 2019 levels when the coronavirus pandemic ends, assuming it ends, then short the stock. The stock price has received a tremendous lift from the coronavirus and in this situation will be primed for a quick fall.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment