mladenbalinovac/E+ via Getty Images

Pet Valu (OTCPK:PTVLF) (TSX:PET:CA) is a leading specialty pet retailer in Canada, with over 700 franchised and corporate stores. The Pet Industry is relatively recession resistant, as ~70% of the spend is on consumables like food and litter. Pet Valu has benefited from the increased humanization of pets by delivering 15%+ revenue growth CAGR in the past few years. However, shares are fully valued for now. I would look to accumulate shares on a pull back to the ~$28 range.

Company Background

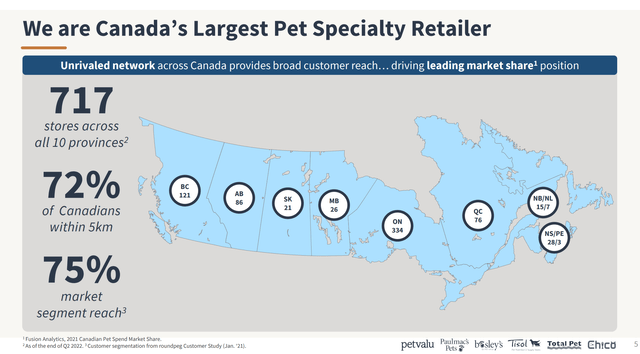

Pet Valu Holdings Ltd. (PET:CA) is the largest specialty pet retailer in Canada, with over 700 franchised and corporate-owned stores across Canada. It has been growing its store network at mid-single-digit (“MSD”) growth rates and management has indicated that there is scope for 1,200 stores in Canada.

Figure 1 – PET store network (PET investor presentation)

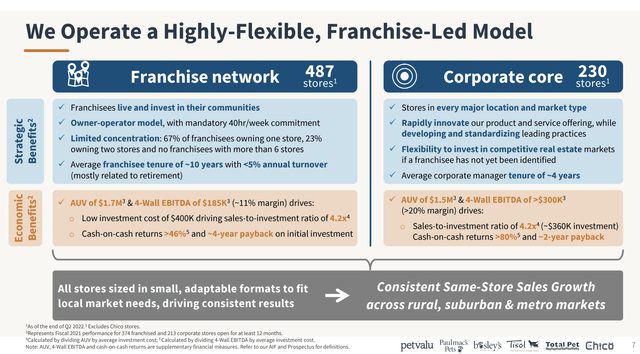

Pet Valu’s stores have strong financial metrics, especially for franchisees. The average franchised store has volume of $1.7 million and 4-wall margin of $185k (11% margin) vs. an investment capital of ~$400k, which drives a quick ~4-year payback on initial investment. Corporate stores are also highly profitable with $1.5 million average volume and 20% margins for a ~2-year payback (Figure 2).

Figure 2 – Franchised vs. Corporate stores (PET investor presentation)

Canada Is A Land Of Animal Lovers

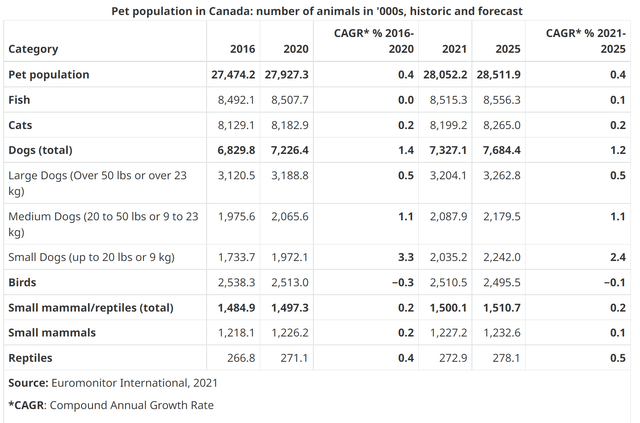

According to Agriculture Canada, Canada’s pet population reached 27.9 million animals in 2020, growing at a 0.4% CAGR. This means that there are 3 pets for every 4 people in Canada.

Figure 3 – Canadian pet population (agriculture.canada.ca)

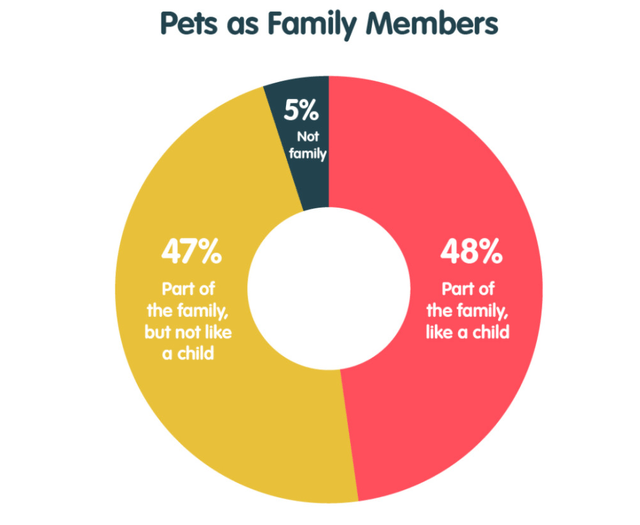

According to a survey from Pawzy.co, 95% of Canadians view their pets as part of the family.

Figure 4 – Canadian pet owner attitudes towards pets (pawzy.co)

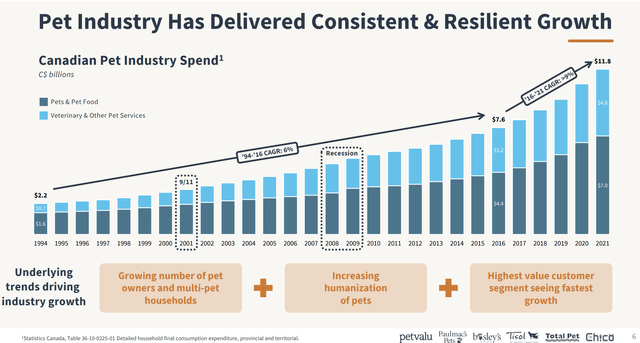

This humanization of pets has fueled strong growth for the Pet Industry, which has seen overall spending growth of over 9%+ CAGR in the past 5 years to almost $12 billion.

Figure 5 – Strong Pet Industry Trends (PET investor presentation)

Pet Spending Is Relatively Recession-Proof

The Pet Industry is relatively recession-proof, as ~60% of the spending is on consumables like food and litter that must be purchased on a regular basis. As we can see from Figure 5 above, industry spending have continued to grow during the 2001 recession, the 2008 Great Financial Crisis, and the 2020 COVID-19 pandemic. Furthermore, the discretionary purchases in the space are typically low dollar-value toys that do not see significant decrease in spending, even during recessions.

Financials

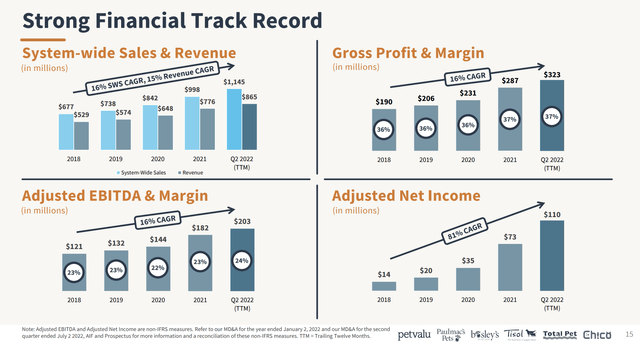

Pet Valu, as the leading specialty retail chain, stands to benefit from this massive tailwind in pet spending. 4% store growth combined with ~11% same store sales growth (“SSSG”) has led to 15% revenue CAGR for Pet Valu, among the highest in the sector. Gross and EBITDA margins have held steady/expanded slightly along with top line growth, leading to adjusted net income growing at an incredible 81% for the past 5 years (Figure 6).

Figure 6 – PET financials (PET investor presentation)

Growth Remains Strong But Fully Valued

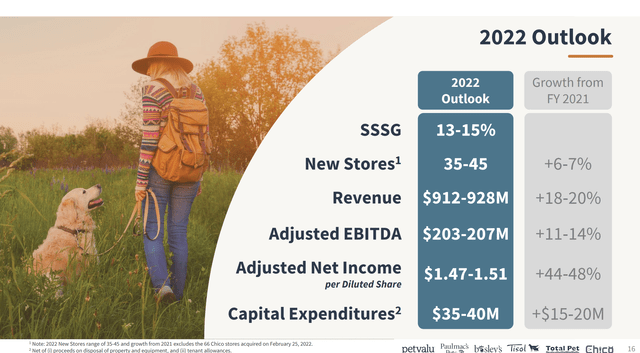

For 2022, management is guiding to a slightly higher growth rate from recent trends, with 13-15% SSSG and 35-45 new stores (5.5-7.0% of the year-end 2021 store count of 633). Adjusted EBITDA is expected to be ~$205 million and adjusted EPS is expected to be ~$1.49 (Figure 7).

Figure 7 – PET 2022 guidance (PET investor presentation)

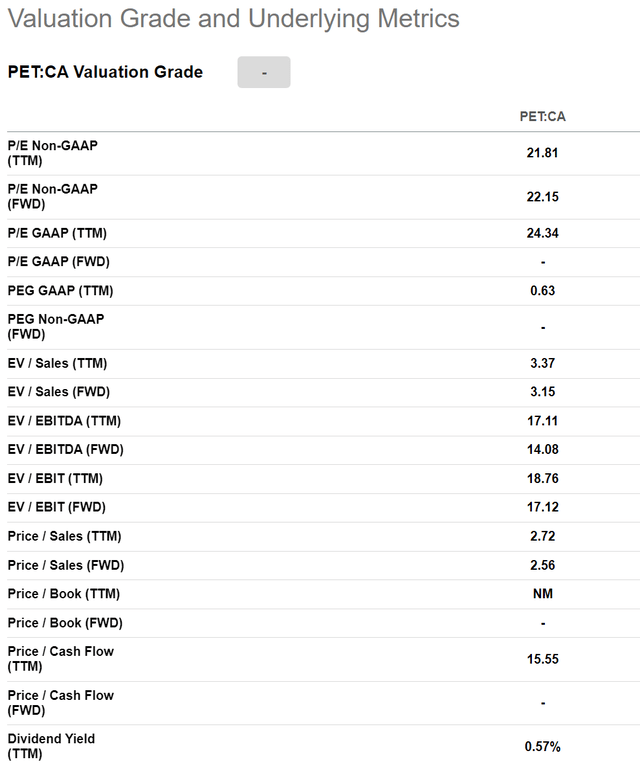

Based on management’s guidance, Pet Valu is currently trading at 22.8x Fwd P/E and 14.2x Fwd EV/EBITDA. On consensus analyst estimates (7 Bay Street analysts cover PET), Pet Valu is trading at 22.2x Fwd P/E and 14.1x Fwd EV/EBITDA (Figure 8).

Figure 8 – PET valuation (Seeking Alpha)

As a point of reference, Petco (WOOF), the 2nd largest specialty pet retailer in the U.S. currently trades at 18.8x Fwd P/E and 11.6x Fwd EV/EBITDA. Loblaw (OTCPK:LBLCF) (L:CA), a Canadian retail conglomerate, trades at 20.9x Fwd P/E and 8.9x Fwd EV/EBITDA.

So while Pet Valu’s revenue and earnings growth remains strong, it appears to be fully valued by the market.

Technicals

Pet Valu IPO’d in June 2021 at $20 / share, and has been trading in a wide $28-36 range for the past year and a half, despite strong fundamental momentum (Figure 9). This is most likely because of valuation concerns towards the top of the range. At $28 / share, Pet Valu would be trading at ~18.7 Fwd P/E, which would screen attractive relative to peers, given its higher growth rate.

Figure 9 – PET sideways trading range (Author created with price chart from stockcharts.com)

Risks

Competition

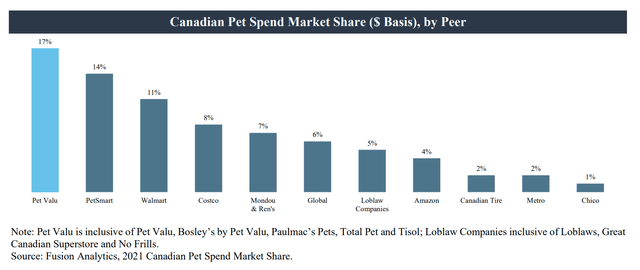

As we can see from Pet Valu’s margins and earnings, the Canadian Pet Industry is highly lucrative, and hence it is no surprise that it is highly competitive as well. While Pet Valu is the largest specialty pet retailer with 17% market share, PetSmart, the Private-Equity owned U.S. chain, is not far behind at 14%. Furthermore, pet food and supplies are sold in all major retailers and grocery stores, so Pet Valu faces competition from Walmart (WMT), Costco (COST), and Loblaw, just to name a few.

Figure 10 – Canadian pet market share (PET Prospectus)

Inflation

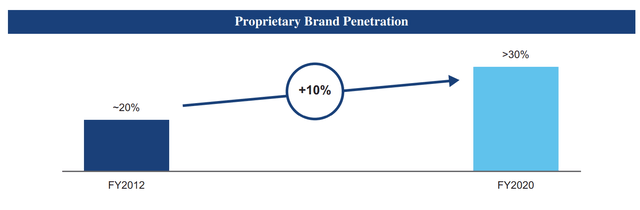

Soaring inflation may cause consumers to shift their spending patterns to value retailers such as Walmart and discount store brands for pet foods and supplies. For Pet Valu, this might actually be an opportunity, as private label penetration remains relatively low in Pet Valu stores at 30%, especially in the recently acquired ‘Chico’ chain of pet stores in Quebec.

Figure 11 – PET private label penetration (PET prospectus)

Pet Abandonment

Finally, there is a risk that the surge in pet adoption during the COVID-19 pandemic (a study by Purina in June 2021 found that 3.7 million Canadians newly adopted a pet during the pandemic) may actually reverse in the coming quarters as companies mandate workers to be physically back in the office, leading to increasing rates of pet abandonment and reduced spending.

Conclusion

Pet Valu is a leading specialty pet retailer in Canada, with 17% market share. The Pet Industry is relatively recession resistant, as ~60% of the spend is on consumables like food and litter. Pet Valu has benefited from the increased spending on pets by delivering 15%+ revenue growth CAGR in the past few years. However, shares are fully valued for now. I would be interested in accumulating shares towards the lower end of its trading range ~$28 / share.

Be the first to comment