da-kuk/E+ via Getty Images

Almost three months ago, I stated that Permian Basin Royalty Trust (NYSE:PBT) had become less attractive due to its steep rally, which had resulted in a 10-year low distribution yield. Since my article, the stock has rallied 30% and thus it has more than tripled in the last 12 months thanks to the rally of the prices of oil and gas to 13-year highs. The rally of these prices has resulted primarily from the sanctions of western countries on Russia in response to its invasion in Ukraine. As there are no signs of an end to the ongoing war, the trust is likely to continue thriving until at least the end of the year. However, due to the extreme cyclicality of the prices of oil and gas, PBT has significant downside risk from a long-term point of view.

Business overview

Permian Basin Royalty Trust has royalty interests in some oil and gas properties in Texas. PBT has two key differences from the well-known oil majors, such as Exxon Mobil (XOM) and Chevron (CVX). First of all, it has static assets, i.e., it cannot add new properties to its asset base. In addition, the well-known oil majors generate a meaningful portion of their earnings from their downstream assets whereas PBT is a pure upstream player. As a result, PBT is much more sensitive to the cycles of the prices of oil and gas than the oil majors.

The current conditions of the energy market are ideal for PBT. Due to the sanctions of the U.S. and Europe on Russia, the global oil and gas markets have greatly tightened this year. To be sure, before its invasion in Ukraine, Russia was producing approximately 10% of global oil output and 30% of natural gas consumed in Europe. Due to the sanctions imposed on Russia, the prices of oil and gas have rallied to 13-year highs lately. As these sanctions are not likely to be withdrawn anytime soon, the prices of oil and gas will probably remain high in the short run.

Moreover, Saudi Arabia, which is the only major oil producer that can significantly boost its output, is refusing to increase its production in order to keep oil prices at excessive levels. Another tailwind for the price of oil is the depressed level of total investment in new oil fields in the last two years due to the pandemic and the fears of oil producers that their investments may prove uneconomical due to the secular shift of most countries from fossil fuels to clean energy sources. Overall, the current business landscape could not have been more favorable for oil and gas producers, including PBT.

However, investors should never forget the dramatic cyclicality of the energy market. Due to the 13-year high prices of oil and gas prevailing right now, most countries are doing their best to shift from fossil fuels to renewable energy sources and simultaneously reduce their dependence on Russia. The secular shift from fossil fuels to clean energy sources, which has accelerated since the onset of the coronavirus crisis, is running at full speed right now. The impact of the numerous renewable energy projects that are under development will become visible within the next 2-4 years. Whenever the market focuses on the impact of these projects, the prices of oil and gas are likely to plunge from their current multi-year highs.

As the net income and the distributions of PBT are closely tied to the prices of oil and gas, the trust is likely to be severely hurt whenever the next downturn of the energy market shows up. If the shift from fossil fuels to clean energy sources causes a downturn in the oil industry, the unitholders of PBT will incur a double hit; a steep decrease in distributions and a plunge of the stock price.

Distribution

A key characteristic of PBT is the fact that it cannot add new properties to its asset portfolio. Consequently, the trust suffers from the natural decline of its fields in the long run. On the bright side, its proved oil and gas reserves jumped nearly 50% last year. However, the steep increase resulted primarily from the rally of the prices of oil and gas, which rendered a great portion of previously uneconomical reserves profitable. Therefore, it is prudent for investors to expect a steep decrease of economical reserves whenever commodity prices revert towards normal levels and the natural decline of reserves to persist in the long run.

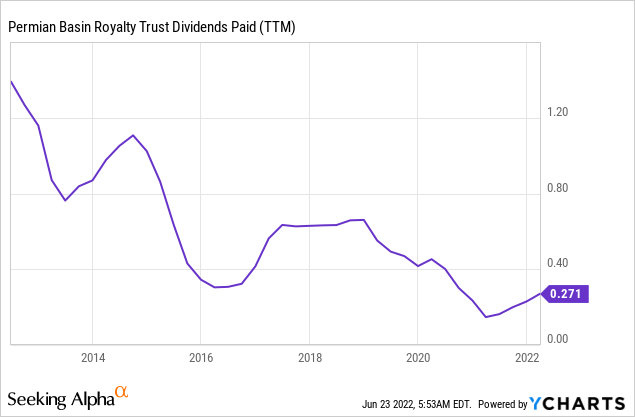

The impact of the natural decline of production on the performance of PBT is clearly reflected in its distribution record. As shown in the chart below, the distribution of PBT has dramatically decreased over the last decade, from $1.16 in 2012 to $0.27 in the last 12 months.

A small part of this decrease has been caused by a decline in the prices of oil and gas but still the average prices of these commodities in the last 12 months have been remarkably high. To cut a long story short, investors should pay attention to the risk that results from the inevitable decay of production of PBT.

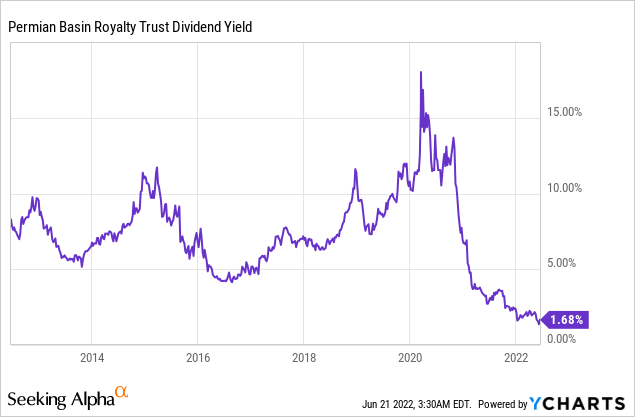

Moreover, despite the impressive rally of the prices of oil and gas this year, PBT if currently offering a distribution yield of only 1.7%, which is a 10-year low for the trust.

On the bright side, the above yield is based on the distributions of the last 12 months. If the distributions of only the last six months are used, the annualized yield of PBT becomes 2.7%. Nevertheless, this yield is still too low for a trust. Given the 10-year low yield of PBT and the strong long-term headwind from the natural decline of its reserves, the trust is not attractive from a long-term perspective.

Upside Risk

If the sanctions of western countries on Russia perpetuate and global economy does not decelerate, as currently expected, the prices of oil and gas will probably remain high beyond this year. Moreover, if the numerous renewable energy projects that are under development take years to come online, the prices of oil and gas may remain high for years. PBT will greatly benefit in such a scenario.

Nevertheless, as multi-decade experience has shown, the oil and gas industry is highly cyclical and prices have not remained extremely high or extremely low for many years. Instead, their cycles have been short in duration most of the time. Therefore, it is prudent to keep conservative long-term expectations for commodity prices and the stock of PBT.

Final Thoughts

PBT is thriving right now thanks to the sanctions of western countries on Russia, which have led the prices of oil and gas to skyrocket to 13-year highs. As these sanctions are not likely to be removed anytime soon, PBT is likely to continue thriving until at least the end of this year. On the other hand, due to the excessive commodity prices prevailing this year, most countries are doing their best to accelerate their transition from fossil fuels to renewable energy sources. To this end, a record number of renewable energy projects is currently under development. As soon as the market shifts its focus on these projects, PBT will probably decline significantly from its current 10-year high stock price.

Be the first to comment