JHVEPhoto/iStock Editorial via Getty Images

By Brian Nelson, CFA

When one thinks of PepsiCo (NASDAQ:PEP), the thoughts that come to mind are a refreshing drink that is an alternative to Coca-Cola (KO). But PepsiCo is far more than just a soft drink maker. The company has 20+, billion-dollar brands spanning its namesake to Quaker to Aquafina to Doritos to Brisk and beyond. PepsiCo is truly a powerhouse when it comes to brand awareness, and consumers keep coming back for more. We think PepsiCo has carved out a nice economic moat around its business.

PepsiCo’s first-quarter 2022 results, released April 26, showed that organic performance was solid. The company posted impressive 13.7% organic revenue growth in the period, and while the company came up short of leveraging that into a stronger earnings advance than the top line pace, core constant currency EPS still came in 7% higher than the year-ago period. Earnings growth that has trailed top-line performance has become a common theme among food and beverage stocks–and among the consumer staples sector more generally–so PepsiCo’s first-quarter 2022 performance was about as expected, in our view.

Also, similar to other consumer staples entities, PepsiCo raised its outlook for full-year organic growth to 8%, but it held the line with respect to full-year core EPS expansion at 8%. Management blamed “higher than expected input cost inflation for the balance of 2022” as the primary reason for reiterating, not raising, its bottom line guidance, and we would not be surprised if PepsiCo achieves its top line performance due to pricing initiatives but falls somewhat short of whisper numbers on the bottom line through the course of its fiscal year. We think this may happen to many food and beverage stocks in the coming quarters, which is why we remain cautious on the consumer staples (VDC) sector.

Regardless, investors continue to like the shareholder-friendly nature of the PepsiCo management team, and we do, too. For 2022, management expects to return $7.7 billion in cash to shareholders comprised of $6.2 billion in dividends and the balance in share repurchases. We think the market may still be bidding up shares of PepsiCo a bit too much though, as our fair value estimate stands at $148 per share (shares of PepsiCo are trading at $162 each at the time of this writing). Investors, nonetheless, are getting paid an attractive ~2.9% dividend yield to hold strong through the current uncertain environment characterized by hefty input cost inflation.

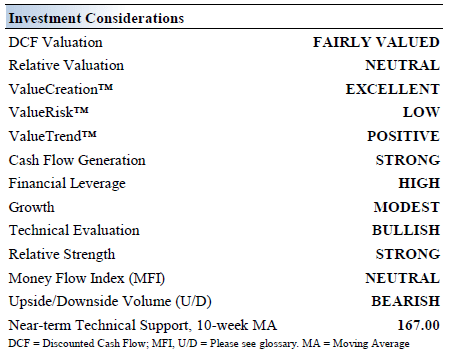

PepsiCo‘s Investment Considerations

Image source: Valuentum. The key investment considerations we consider with respect to PepsiCo. (Image source: Valuentum)

PepsiCo is a global food/beverage company with a plethora of respected brands. Its portfolio includes the namesake Pepsi, Mountain Dew, Gatorade, Lay’s, Doritos, Cheetos, Tostitos, Ruffles, Quaker oatmeal, and Cap’n Crunch, among others. North America accounts for ~60% of its sales. The company was founded in 1898 and is headquartered in New York.

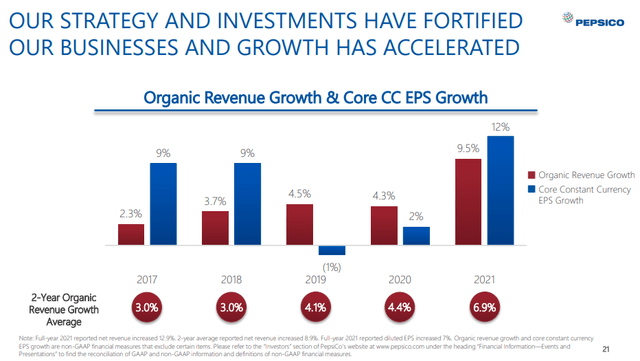

PepsiCo generates a little over half of its revenues from snacks and little under half of its revenues from beverages. The firm expects the total addressable market for beverages and convenient food will grow by mid-single-digits over the long haul. It pegs its share of the ~$573 billion global convenience foods market at 8% and its share of the ~$579 billion global beverages market at 9%. There’s a lot of room for further growth, and organic revenue expansion has been stellar the past several years, averaging in the 3-7% range.

PepsiCo’s organic revenue growth has been solid the past several years. (Image Source: PepsiCo (CAGNY, 2022))

We’re huge fans of Pepsi’s brand portfolio, but competition remains fierce. Coca-Cola is its primary beverage competitor, while food and beverage rivals include Nestlé (OTCPK:NSRGY), Danone (OTCQX:DANOY), Kellogg (K), General Mills (GIS), and Mondelēz (MDLZ). There’s also white label competition, and off brands that are looking to capture share as stretched consumers may balk at price increases. Nonetheless, PepsiCo has a scale advantage in North America that will help it navigate the current uncertain environment, as it seeks to leverage growth in its 20+ global brands that each bring in $1 billion or more in sales annually.

PepsiCo aims to generate long-term organic revenue growth of 4%-6% annually, aided by its marketing initiatives. Investments in automation and the digitization of its supply chain and selling operations are expected to help expand the company’s core operating margin over the coming years. Long-term targets also include core operating margin expansion of 20-30 basis points yearly, but that may be tough to achieve in the current inflationary environment where many food and beverage companies may struggle.

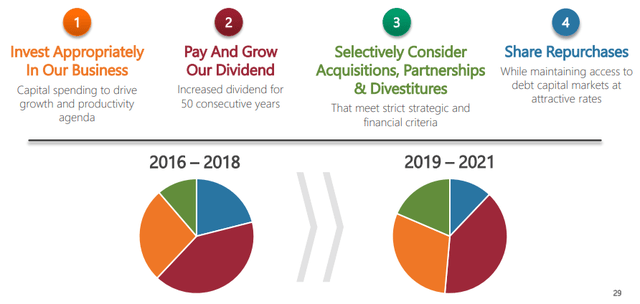

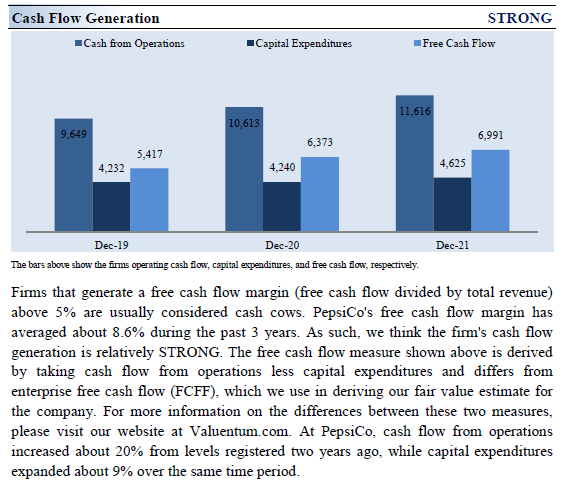

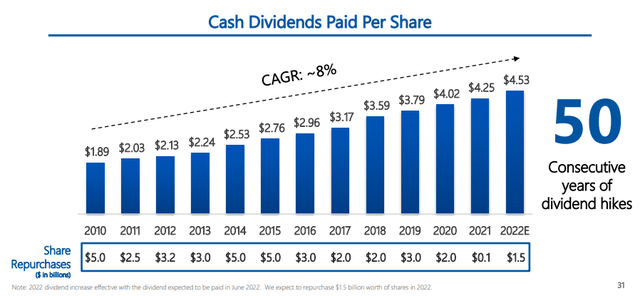

PepsiCo is a Dividend Aristocrat that has increased its payout over the past ~50 consecutive years. The company has grown its payout at an 8% compound annual growth rate since 2010, while repurchasing shares along the way. Its free cash flow generating abilities are impressive, though its net debt load is rather large. PepsiCo returns cash to shareholders via sizable share buyback programs, so it still retains the financial flexibility to slow repurchases to pare down its debt load if it so chooses.

PepsiCo is very shareholder friendly and has increased its dividend in each of the past 50 years. (Image Source: PepsiCo (CAGNY, 2022))

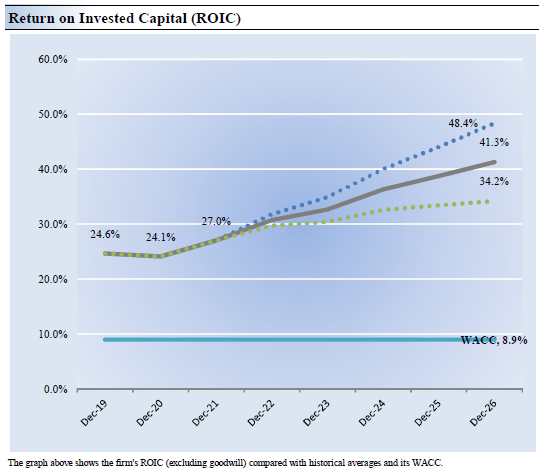

PepsiCo’s Economic Profit Analysis

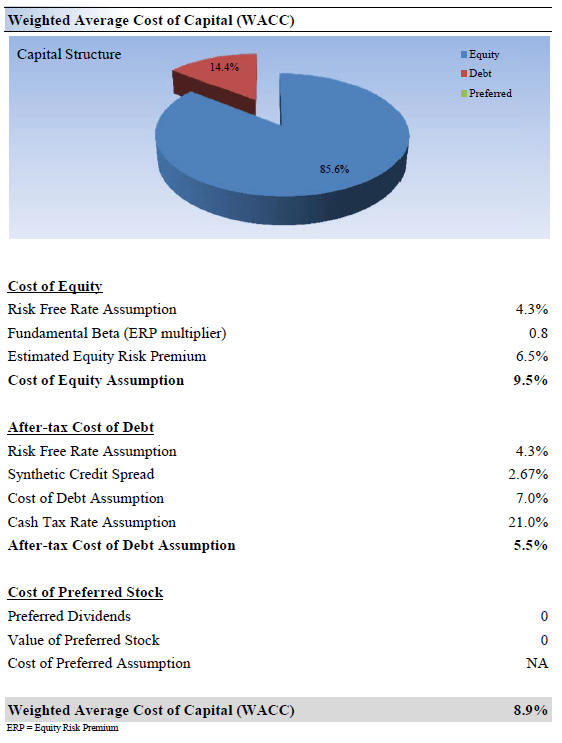

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. PepsiCo’s 3-year historical return on invested capital (without goodwill) is 25.3%, which is above the estimate of its cost of capital of 8.9%.

As such, we assign PepsiCo a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

Image source: Valuentum. We expect PepsiCo to continue to generate value for shareholders. (Image source: Valuentum) Image source: Valuentum. How we calculate PepsiCo’s weighted average cost of capital. (Image source: Valuentum)

PepsiCo’s Cash Flow and Valuation Analysis

Image source: Valuentum. PepsiCo is a solid free cash flow generator. (Image source: Valuentum)

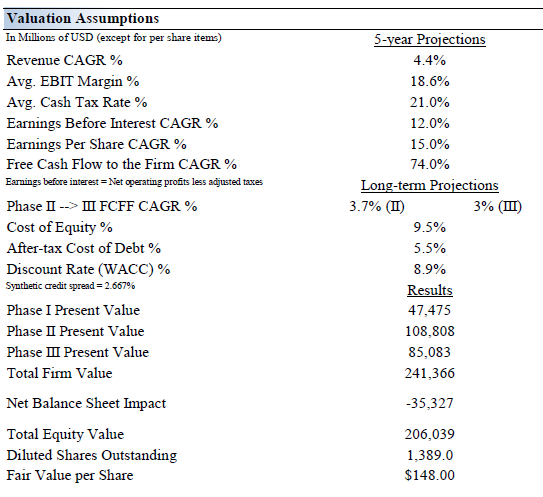

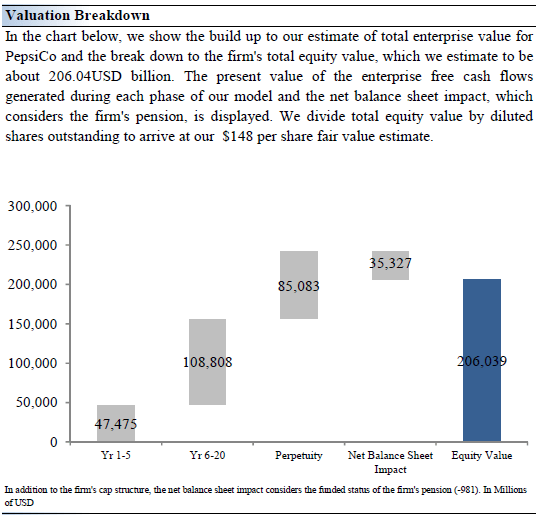

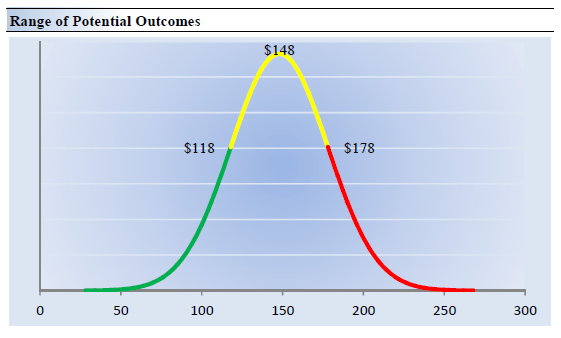

We think PepsiCo is worth $148 per share with a fair value range of $118- $178 per share. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them. Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance.

Our valuation model reflects a compound annual revenue growth rate of 4.4% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 7.1%. Our model reflects a 5-year projected average operating margin of 18.6%, which is above PepsiCo’s trailing 3-year average.

Beyond year 5, we assume free cash flow will grow at an annual rate of 3.7% for the next 15 years and 3% in perpetuity. For PepsiCo, we use a 8.9% weighted average cost of capital to discount future free cash flows.

Image source: Valuentum. A summary of the key assumptions behind our DCF-derived fair value estimate. (Image source: Valuentum.) Image source: Valuentum. The duration of the value composition of PepsiCo’s equity value. (Image source: Valuentum)

PepsiCo’s Margin of Safety Analysis

Image source: Valuentum. How we derive the fair value estimate range for PepsiCo. (Image source: Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm’s fair value at about $148 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for PepsiCo. We think the firm is attractive below $118 per share (the green line), but quite expensive above $178 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

PepsiCo has increased its dividend at a robust pace during the past decade. (Image Source: PepsiCo (CAGNY, 2022))

It is hard not to like the reliability of Pepsi’s business model, and such stability drives its impressively consistent free cash flow generating ability. PepsiCo is a Dividend Aristocrat that has increased its dividend for ~50 consecutive years, and we are expecting the streak to continue, though at a slower pace than in the recent past. The company expects that both the global beverage and global snack markets will grow by mid-single-digits annually in the medium-term, and the company’s international growth runway is immense. PepsiCo is digitizing its supply chain and investing in automation to boost its operational efficiency and improve its cost structure.

Pepsi’s fundamental strength is hard to poke holes in, and the firm’s strength in North America is augmented by its exposure to potentially higher-growth emerging markets, though higher volatility in the latter is not uncommon. The company’s large net debt load weighs negatively on its Dividend Cushion ratio (0.8), though Pepsi’s ability to generate sizable free cash flows in almost any operating environment continues to impress. PepsiCo historically has spent considerable sums buying back its stock which competes for capital against its dividend obligations. All things considered, investors can expect PepsiCo to continue returning copious amounts of cash to shareholders. Though shares may struggle through 2022, its ~2.9% dividend yield is hard to pass up.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment