The Pender Growth Fund gives Canadians access to difficult to reach markets ronniechua

I like funds that do something different. It doesn’t have to execute perfectly. Just don’t be another high-yield fund or large-cap value fund. We already have too many of those. True diversification requires investments that are substantially different from each other. Investments which have low correlation returns will reduce risk and provide smoother portfolio returns.

The Pender Growth Fund (TSXV:PTF:CA) fits into the ‘something different‘ category for Canadian Investors.

- What drives the Pender Growth Fund?

- Why were prices so volatile over the past 12 months?

- Is the Pender Growth Fund a good investment going forward?

What Drives the Pender Growth Fund?

The Pender Growth Fund is a closed-end fund that invests in both public and private companies. Their focus is primarily on the information technology and telecommunications sectors with a preference for Canadian companies. They tend to invest in very small and illiquid firms. Because of this, a long-term holding period is vital if you are looking to invest. It can take years between when a fund takes an early position and when the underlying company goes public, whereby the fund is able to cash in.

The Pender Growth Fund gives the average investor access to the private markets in Canada. This is something different.

(Please note that all dollar amounts in the article will be listed in CAD.)

Price Volatility of Pender Growth Fund

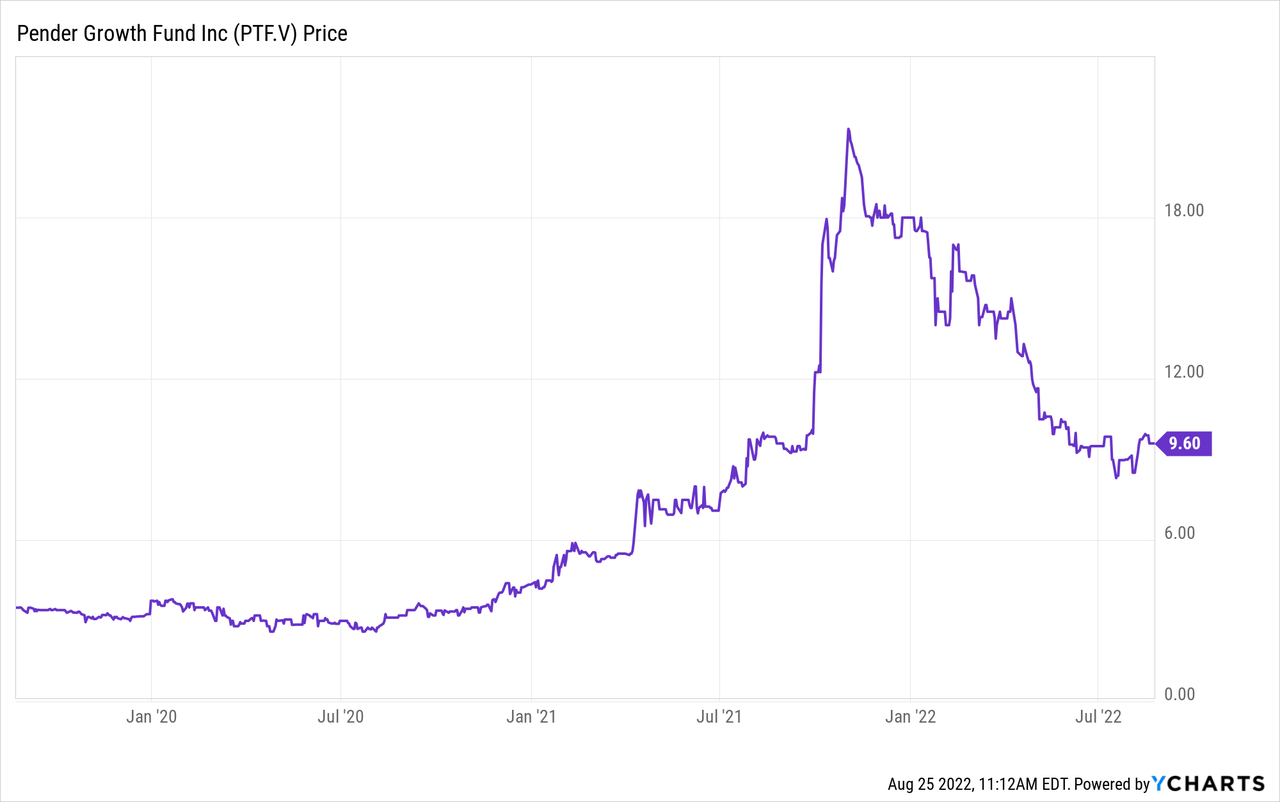

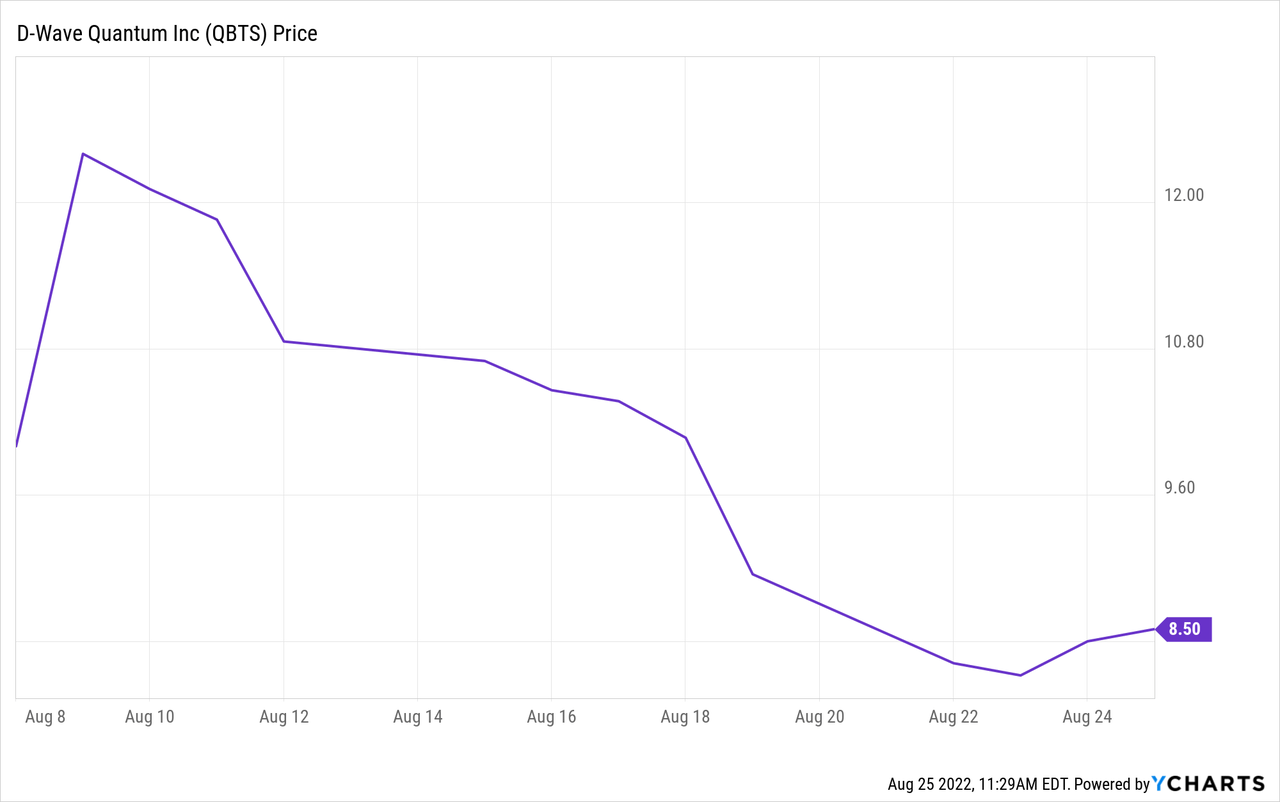

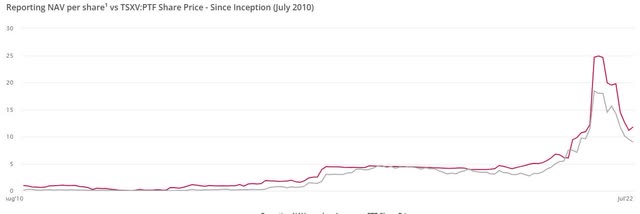

The first thing I noticed when considering the Pender Growth Fund was the huge run-up in price followed by a substantial drawdown. What happened? A chart like this can scare off a potential investor.

- 2021 – Price went up 313.8%

- 2022 (YTD) – Price went down 46.67%

The huge loss in 2022 is primarily related to concentration risk in one specific publicly traded company, Copperleaf (CPLF:CA). How did this happen when Pender Growth is supposed to be diversified across a multitude of small private companies in addition to public ones?

Pender Growth and Copperleaf

It took me a while to sort through all the filings, but basically, this is the story. The Pender company also ran a different fund called the Working Opportunity Fund which dates back to the early 1990s. It was a “Venture Series” fund. WOF was eventually spun-off into a separate fund called the Pender Private Investments in 2021. The reason for this was to provide an exit for some of the long-term shareholders as well as to adjust the structure of the fund to more accurately reflect what it was.

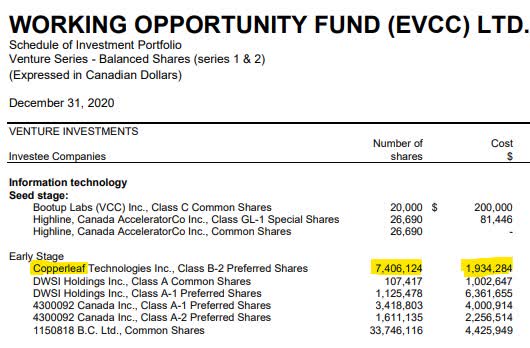

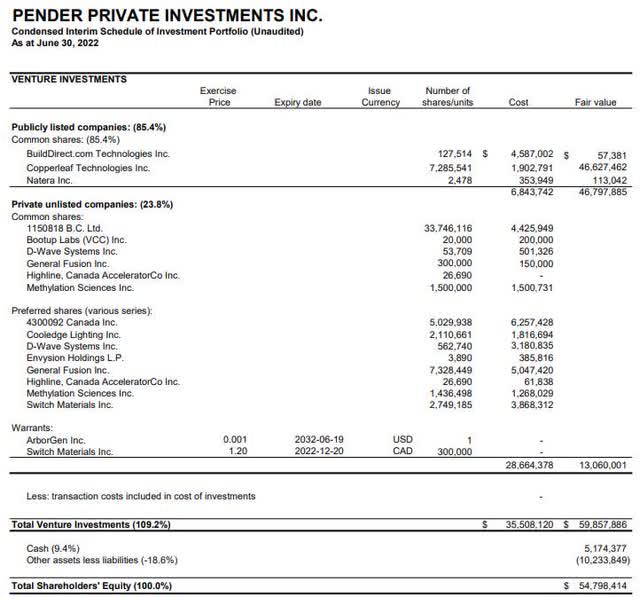

Inside the former Working Opportunity Fund, and now the Pender Private Investments fund was a whole lot of shares in a private firm (at the time) called Copperleaf. As in more than 7.4 million shares. It looks like the cost was a little over 26 cents – which is a great price.

pendergrowthfund.com

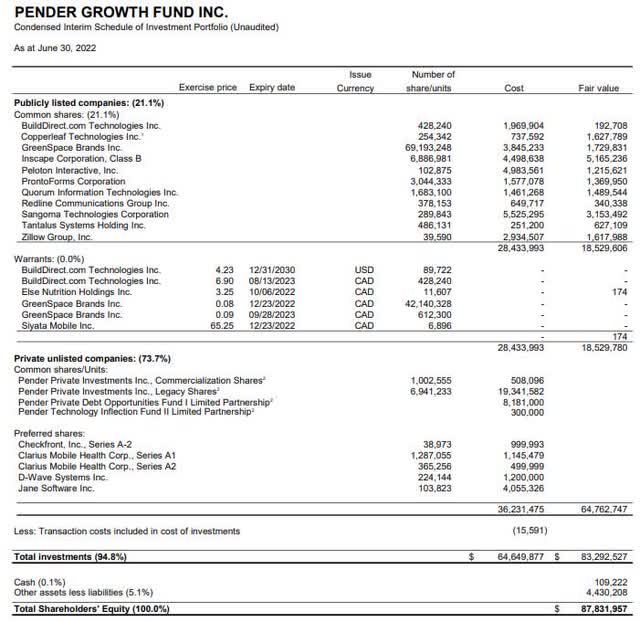

Pender Private Investments is now 97-98% owned by Pender Growth. The mother company, Pender Growth, has only a small stake in Copperleaf. But combined with the Private Investment arm of the company, the stake is quite large. Just how large did it get?

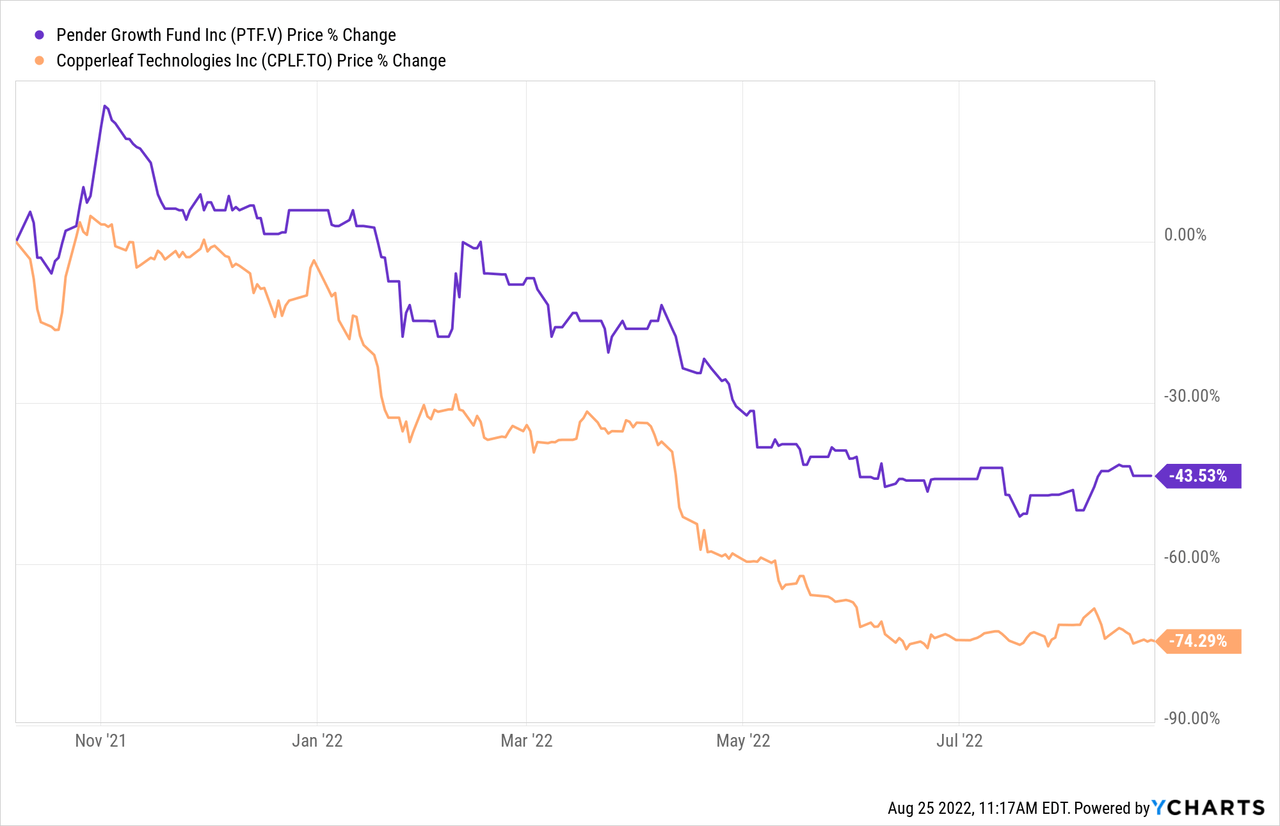

Copperleaf went public on the Toronto Stock Exchange in October 2021. And this is where things went wild. The IPO was supposed to be in the $11-13 range, but due to high interest, it was underwritten at $15 per share. Shortly after listing, the share price of Copperleaf rose to over $25. Because Pender Growth had such a massive share in Copperleaf, their fund skyrocketed. As of December 2021, 92% of the company’s total equity was tied up in Copperleaf. At this point, Pender Growth would virtually mirror Copperleaf’s price volatility. At least at first until Pender Growth could lower their exposure to Copperleaf.

But why not quickly sell-off some shares at a huge profit and re-invest elsewhere? The common shares of Copperleaf were subject to a 180-day lock-up period. If they could have reduced their massive position, I am sure they would have. And over the next 6-months, the share price of Copperleaf fell dramatically as you can see in the chart above.

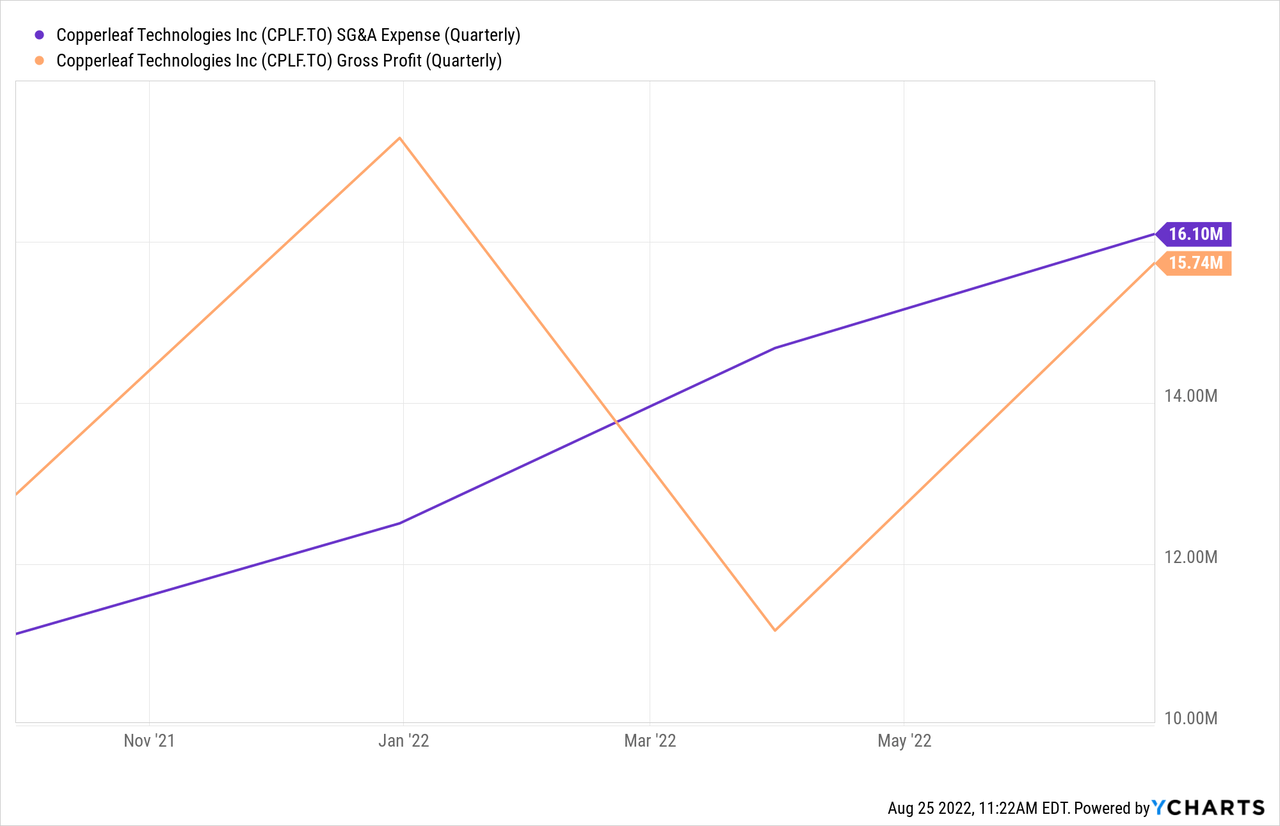

I won’t deep dive into Copperleaf as that’s the topic for another article and likely another author closer to the situation. But they are an early-stage growth company that creates analytics for large firms. They are not profitable and are trying to increase recurring subscription revenue. This is very capital intensive. Not only are they paying a lot in R&D but also with marketing. Below is a chart of SG&A versus gross profit.

Smaller, non-profitable companies carry higher risks and typically experience higher volatility. Their sky-high valuation as a unicorn may have been a remnant of the ‘pandemic pricing’ for tech companies that experienced a major decline in 2022.

Before I get into whether Pender Growth is a good investment today, we need to talk about their fee structure.

Pender Growth Fund Fee Structure

The fee structure of Pender Growth is more like a hedge fund and less like a mutual fund.

- 2.50% per annum on first $15m

- 1.75% per annum thereafter

- 20% performance fee of net gains after 6% hurdle rate

If you are looking for a low-cost ETF, this fund isn’t for you. If you are looking for a fund with some big potential and are willing to hold for years at a time, then read the next section.

Is the Pender Growth Fund a Good Investment Going Forward?

The fund is still very concentrated and I anticipate elevated volatility for a while. Volatility isn’t necessarily bad. Prices that go up fast are also considered volatile. But there could be more downside ahead considering the market conditions we are in.

Copperleaf continues to make up 53.9% of shareholder equity. That is very high. I would like to see that lower and I am sure it will be now that the lock-up period is over.

Pender Growth also has 548,427 shares of D-Wave which completed a SPAC deal and was merged with DPCM Capital to trade under the QBTS (QBTS) symbol. In less than 3 weeks the share price experienced a 22% drawdown from its peak.

With total shareholder equity sitting at $87.8 million as of June 30, 2022, the stake in D-Wave works out to a little over $6 million CAD which is roughly 7% of the overall equity.

But it is early days for D-Wave. As I said, this isn’t some short-term holding. If you invest, you should be prepared to hold for years.

What are the historical NAV returns like? Below are some of the figures for annualized performance ending on July 31, 2022:

- 10-year holding = 57% annualized return

- 5-year holding = 20.8% annualized return

- 3-year holding = 44.1% annualized return

Discrepancy Between NAV and Price = Risk-Based Explanation

Please note that the market price is well below the Net Asset Value.

- On July 29th the price was $9 per share while the NAV was $11.78 per share.

This represents a 23.5% discount. Why are investors pricing in such a hefty discount?

There has always been a discount to NAV with the fund as the chart shows below.

Because the fund deals with small, illiquid and private companies, this leaves a larger degree of uncertainty with the true net asset value and shareholder equity. The more uncertainty shareholders have the bigger the discrepancy is to be expected. Because of this, investors demand a bigger discount on the calculated value of such companies. Furthermore, you have to account for volatility. A small private firm can go belly-up. That elevated risk needs to be taken into account. As well, they only calculate NAV monthly. The gap would likely be smaller if it was computed weekly.

On the other hand, the firm feels that some of the reason lies with the price paid to acquire Pender Private Investments. Please read the following statement from Pender Growth:

PTF acquired its share of PPI’s portfolio at a discount of 43.5% to fair value. Under IFRS, the gain on this acquisition at a discount, is treated as a deferred gain and total shareholders’ equity per share for financial reporting purposes excludes this deferred gain and the deferred gain will be recognized to the extent that it arises from a change in a factor (including time) that market participants would take into account when pricing the investment. The calculation of Reporting NAV does not include potential future taxes associated with unrealized capital gains and from time to time it may reflect valuation discounts that are more conservative than those permitted under IFRS.

The firm feels that the recent acquisition of Pender Private Investments is not being fully reflected because they purchased the assets at a discount. That gain is deferred under accounting standards.

The firm isn’t just saying that they think the gap between NAV and price is too wide, they are backing it up with share repurchases. For a couple of years, they have authorized the repurchase of up to 10% of the shares every year. The last 2 years they have filled this mandate. It remains to be seen how aggressive they will buy back this year.

Other Companies in Their Portfolio

Although Copperleaf currently makes up over 50% of the current portfolio, there are other companies that could also add value over time.

To drill a bit deeper, let’s have a look at what is contained in the Pender Private Investments fund for private companies.

To discuss the risks and potential rewards of each private and public company listed here is far beyond the scope of this article highlighting the overall fund. It would take an article 30x this length to scratch the surface. But I have provided you with many names of both their public and private investments so you can perform your own due diligence at the firm level.

Final Thoughts on Pender Growth and Risks

I give Pender Growth a buy rating. Why?

My buy rating is not based on my analysis of individual holdings. I am not an expert in analyzing private companies and knowing their current value. But then again, likely neither are you. And that is my point. Pender Growth has displayed some long-term proficiency in this regard as their high annual growth rate shows. The point of this article was to outline why the recent volatility. And now that their portfolio is showing a reduced concentration risk, I feel that they are entering buy territory again. And I am basing this on long-term management skill and proficiency which is proven with a long history of outperformance. I have no reason to believe that the recent portfolio imbalance negates that.

But it does carry significant risks. The biggest risk right now is their position in Copperleaf. If this concerns you, then wait until this makes up a much smaller weighting in the portfolio.

Normal risks to this type of fund are illiquidity of the underlying assets. Share price might be at a discount to NAV, and you may want to company, but that doesn’t mean that the firm is able to easily sell the underlying assets to achieve fair value. You must also pay the illiquidity premium.

There is volatility risk. A company that sells shares at 25 cents but then trades at $25 and then trades around $6 is going to affect the fund in no small way. You need to be prepared for this in funds that invest in private firms which could go up 100x but could also fall to zero.

Then there are the fees. They are in the realm of hedge funds rather than mutual funds or ETFs. This is not some low expense fund that you should invest in without serious consideration.

In what situations would I revoke my buy rating? Because the firm invests in small private companies it takes years to determine if they made a blunder and management messed up. That is why I try to look at long-term historical performance when determining manager skills. So if years down the road the fund continues to drop, then I would revoke my buy rating. If you invest in this fund – that’s the risk you assume. You plan to invest a small allocation for a good many years just to find out if the managers are now washed up.

The other situation in which I would revoke my buy rating is if the company continues to be overweight in Copperleaf. I would hope that they will sell shares at a good price and reinvest that profit elsewhere. Even at $6, they are up a huge amount from the pennies they paid. If Copperleaf prices go up and Pender Growth doesn’t aggressively sell, I would be concerned. Although I believe that managers should have a few high conviction stock picks, I also believe that they need to diversify so that what happened over the past 12 months doesn’t happen again. Temporarily things can get out of line but the firm should attempt to restore a balance as soon as possible.

Overall, I give the Pender Growth Fund a buy rating provided you understand the risks and you allocate accordingly.

Be the first to comment