TexBr/iStock via Getty Images

Note : All amounts discussed are in Canadian Dollars

When we last covered Pembina Pipeline Corporation (NYSE:PBA) on a standalone basis, we gave it a rare buy rating. This was despite expectations of very little growth from the midstream company. Specifically, we said,

Investors looking for steady income here will definitely get it, and we are forecasting at least one dividend bump this year. Although, we would be careful not to expect fireworks on the EBITDA as PBA has prudently maintained (as shown above) very little commodity price exposure. Its growth projects are more of a 2023-2024 story as well. So, the next two years should be just the same boring, steady cash flow, story. We are still maintaining a “buy” here, but the stock has obviously been flying, and investors should look to get in on a pullback.

We even reiterated a buy rating as PBA tried to scoop up Inter Pipeline Ltd. (OTCPK:IPPLF) which was ultimately picked up by Brookfield Infrastructure Partners (BIP) (BIPC). Investors did get a mild pullback after that and have been amply rewarded for staying long this opportunity.

Returns Since Published Article (Seeking Alpha)

With commodities hitting multi-year highs, investors are, of course, curious as to whether this is just the start or the end of the trend. We look at that in the context of investing in PBA.

2022 Guidance & Valuation

PBA expected 2022 adjusted EBITDA to be close to $3.50 billion. This will be a small increase from the $3.43 billion seen in 2021 and a considerable improvement over the $3.28 billion in 2020. Thanks to higher levels of maintenance capital expenditures primarily due to deferral of the same in 2020, adjusted funds from operations (AFFO) will come in about 4% lower. PBA has maintained very little commodity price exposure through all these and has already hedged half of its 2022 frac-spread exposure based on the last update. This limits any upside but also gives a high degree of confidence in the numbers.

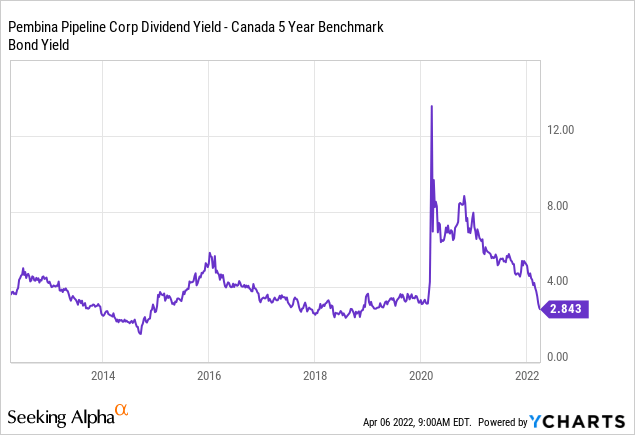

The firm now trades at 12.0X EV to EBITDA with a 10% AFFO yield and an exceptionally well covered 5.5% dividend yield. One way we like to look at this is to compare the dividend yield on the stalwart to the 5-year Government of Canada bond yield. With the rather rapid rise in those Treasury bond yields, coupled with the rise in PBA share price, we are seeing the spread compress down quite significantly.

You can see in the chart above that this is getting near trough levels but the wild card remains the extent to which Bank of Canada can tighten before breaking the economy. All three valuation metrics are now in the upper 20% of readings and that is an indicator of at least fair value if not froth. That still does not lead us to a sell rating. There is still room for some valuation expansion here as the world figures out the value of Canadian oil and gas and PBA starts getting due credit for managing a full self-funded growth plan. So while the shares are no longer compelling, we are only moving this to a hold/neutral rating. We still think, two years out, PBA outperforms the broader indices.

Preferred Shares

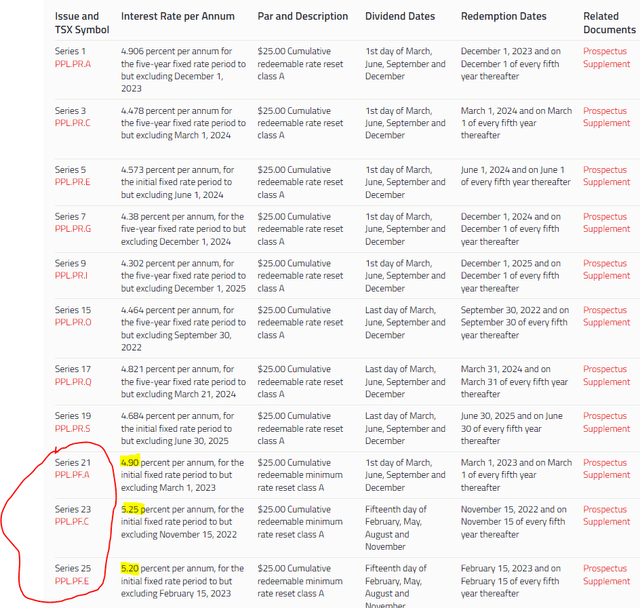

We have dived into the PBA TSX listed preferred shares on more than one occasion. They have often had the safest high-quality yields that we could find, and today is no different. PBA has 11 different preferred shares with different conditions, and covering all of them is beyond the scope of the article. We will highlight the ones we like though and explain the rationale.

Pembina Preferred Shares (Pembina)

The 3 highlighted above are unique in that they all have a floor rate. So 4.9%, 5.25% and 5.2% is the minimum they can pay out. They all are also due for reset rather soon with PFL.PF.C coming up in November. The reset conditions are defined as the following for the PFL.PF.C

The Annual Fixed Dividend Rate for the ensuing Subsequent Fixed Rate Period will be determined by the Company on the Fixed Rate Calculation Date (as defined herein) and will be equal to the sum of the Government of Canada Yield (as defined herein) on the Fixed Rate Calculation Date plus 3.65%, provided that, in any event, such rate shall not be less than 5.25%.

Source: Pembina

With those shares trading slightly under par (after stripping out 24 cents of accrued dividends), they become an interesting income bet. The current reset rate is 6.19% (2.54% 5-Year GOC Yield + 3.65%). This is an excellent yield for a 5-year “bond-like” security. We say “bond-like” as the floor interest rate protects against deflationary outcomes down the line and the upper end will reset alongside the 5-year Government of Canada bond yield. Of course, the higher interest rates move between now and November, the more likely it is that PBA decides to call these. Even in that case, they become exceptional cash-like parking vehicles.

PPL.PF.A and PPL.PF.E have lower spreads (3.26% and 3.51%, respectively) and lower fixed yields (see above). They are interesting in their own right and pricing distortions might make one of these more appealing over the PPL.PF.C. All three though give the option of good income alongside capital protection. They are also convertible into floating rate preferred shares (details in the linked prospectuses), so there remains another option of hedging your interest rate exposure.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment