As the global pandemic continuous to rage across the US, investors are now trying to determine which stocks to invest in after the large drop across the board. Shifting through the market for proper investments involves trying to imagine what a post-COVID world would look like and trying to ascertain whether a company’s business would thrive in such an environment. One company that seems poised to do well in a scenario of extended social distancing is Peloton Interactive (NASDAQ:PTON).

Social distancing could change the fitness industry forever

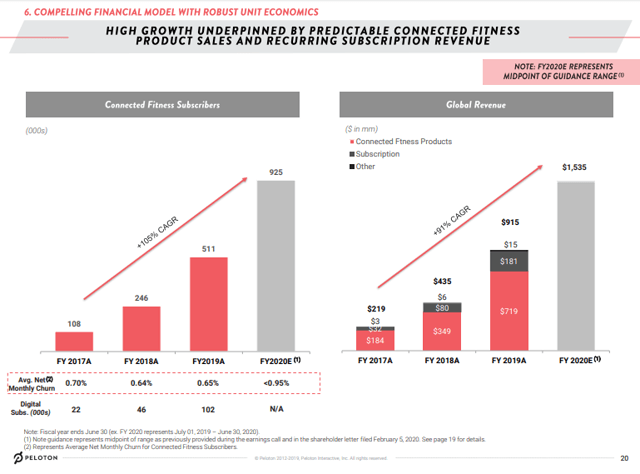

As mentioned in my previous article, there is a scenario being discussed in a post-COVID world where the economy restarts but social distancing guidelines remain in place for the foreseeable future. This bodes ill for the gym and the group exercise industry, which groups together many people sweating bodily fluids all within a small contained space. The current way gyms operate makes them a hotbed for viruses. I believe as people become more aware of this fact, there would be a shift away from physical gyms into a more home workout style setup. You can already see this play out a bit with the emerging popularity of home video-style workouts as people are locked in quarantine. One such company that could take advantage of this shift in consumer preference is Peloton. Peloton bills itself as the “largest interactive fitness platform in the world”, and looking at its end year 2019 metrics, its results are rather impressive as the company boasts around 2 million members and a 93% subscriber retention rate. The company has an almost cult-like following, not unlike the popular boutique fitness gym, SoulCycle.

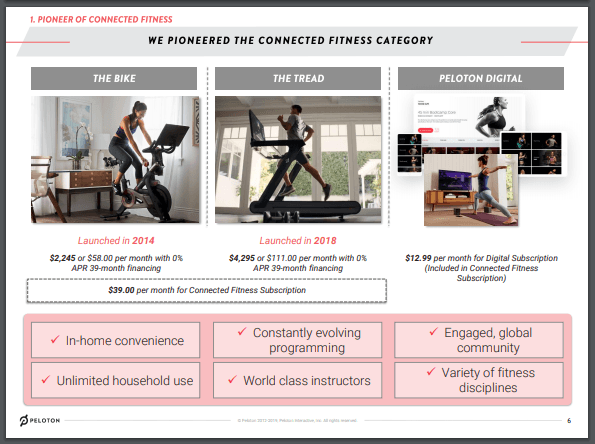

Source: Investor presentation

At its core, the company has a relatively simple business model. It sells premium fitness equipment, the more popular one being the stationary bike, but the company has a treadmill as well, along with a digital subscription of exercise classes. The bike or treadmill comes with a large Wi-Fi enabled screen that allows you to follow along and/or have limited interactions with other subscribers in a “live” class. Hence, the “platform” moniker used in Peloton’s advertising. In normal times, this type of home workout is a compelling alternative to going to the gym. The advantages of home workouts are only magnified in a post-COVID world as people become more concerned about viruses and start re-evaluating their gym/workout habits.

Belt-tightening may prevent widespread use

One main argument against the widespread adoption of Peloton bikes is simple economics. The average Peloton bike is pretty expensive as the low-end model could retail for as much as $2,300. Coupled with a $39 monthly subscription, that quickly becomes an expensive proposition. Despite gyms and fitness classes being closed and home workouts gaining in popularity for fitness buffs, the complete shutdown of the economy means people won’t necessarily have the disposable income for an expensive luxury purchase like a Peloton bike.

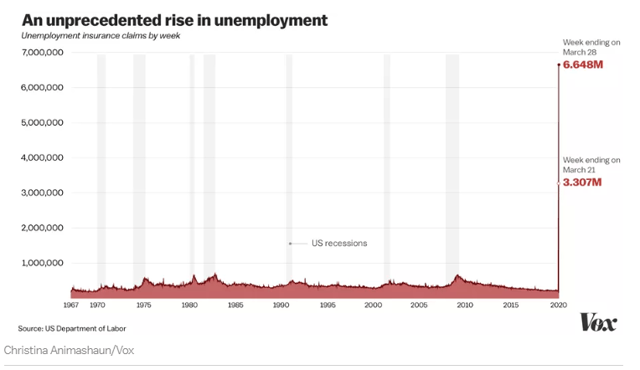

Source: Investor presentation

In the US, an estimated 6.6 million people filed for unemployment. This is a staggeringly high number. For reference, only 665,000 people filed for jobless claims during the 2008/ 2009 great recession. With the economy predicted to be weaker in the weeks or months to come, I believe that new Peloton bike sales (and by extension, Peloton revenue and income) would be a lot weaker as consumers cut on luxury items and discretionary spending. The existence of cheaper alternatives to Peloton would only be more attractive when times are tough. You can even get a simple bike plus an alternative online spin class or even YouTube (NASDAQ:GOOG) (NASDAQ:GOOGL), then you can be on your way. Furthermore, traditional gyms like Planet Fitness (NYSE:PLNT) and SoulCycle are jumping on the online bandwagon, given that their physical locations are closed, thus making the space even more crowded.

Valuation

This leads to a discussion on Peloton’s valuation. Even pre-COVID, the company was trading at an expensive valuation as the market priced it like a growth stock. Post-COVID, Peloton stock price has fallen around 22 percent from its highs, a fair bit but not as much as some other stocks in the market, and the stock price certainly does not reflect the tough times ahead for the company.

The market seems to believe that Peloton as a gym alternative justifies its high valuation while ignoring the incoming contraction of customer discretionary spending and the emergence of cheaper alternatives. Currently, Peloton has a market cap of 7.7 billion against TTM revenue of 1.2 billion, implying a Price/Sales ratio of about 6.4. This ratio is similar to that of a technology company, not a luxury good retailer and implies that the company will continue to grow at a rapid rate. I believe the high price point and the tough employment situation coming from the pandemic makes the company’s assumed growth difficult to achieve.

I believe the high growth rate is unlikely to continue.

The share price of Peloton, which assumes a high rate of growth is only valid in a scenario where we would make a V-shape recovery coming out of the COVID pandemic. Even then, within this V-shape scenario, it assumes consumers’ habits would have permanently changed (as opposed to consumers wanting to get out of the house as much as possible). A scenario with extended social distancing, which would seem great for Peloton, also comes with limited economic growth and spending power. Given that Peloton is disadvantaged in whichever outcome occurs leads me to believe that its expensive valuation is not justified. The stock is an avoid for me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment